Tracking the Disposition of GSE Loans in Forbearance: Borrower Assistant Plan Transitioning3/15/2022

In a recent post, we mentioned that the 24-month timeline for the purchase of delinquent loans out of pools implied that this activity would not pick up until April 2020[1]. However, some leading indicator of loan disposition was available through the release of trial modification data in the Borrower Assistance Plan (BAP) field released in the monthly Agency disclosures. Once loans have completed three months of successful payments in this plan, they are eligible to be purchased out for the commencement of a permanent modification, and eventual resecuritization.

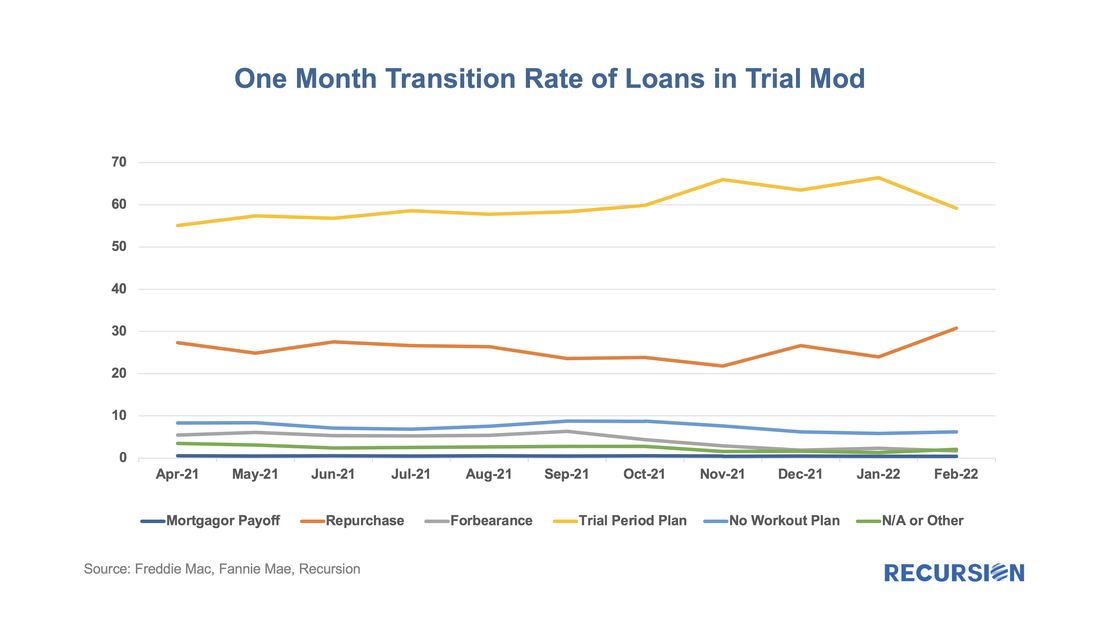

A loan in trial modification plan (trial mod) can transit into the following state the next month:

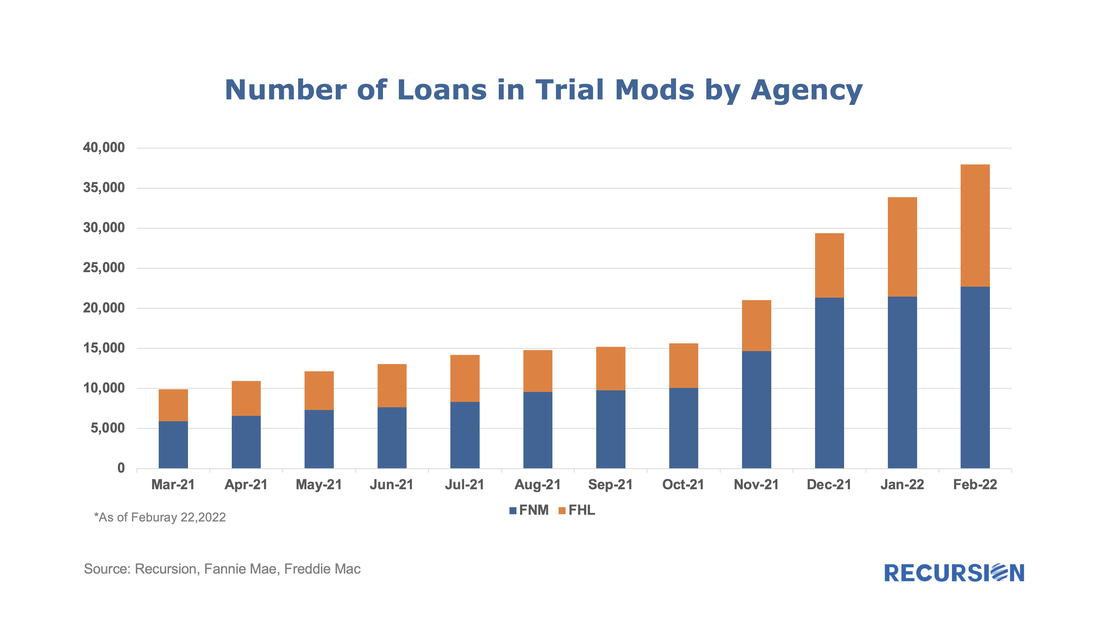

The number of loans in these programs continues to grow, standing at 37,957 in February 2022, with a balance of about $8.3 billion, up from 9,911 and $2.1 billion in March 2021. The evolution of the disposition of loans is shown in the following chart: In a recent post, we discussed the utility of secondary market indicators to track the progression of loans that are coming out of forbearance in Government programs[1]. This short note looks at this progression in the conforming loan market.

For the Ginnie Mae programs, issuers may buy loans out of pools after they are delinquent more than 90 days and begin a workout process that culminates in one of the options, including loan modification. The situation is quite a bit different for Fannie Mae and Freddie Mac. The main distinction is that on January 1, 2021, the GSEs extended their timeline for buying loans out of pools to 24 consecutive months of missed payments[2]. As the Covid-19 pandemic began in March 2020, we expect to see buyouts being extended as much as to April and May this year. However, we can obtain a view on future loan modifications through the trial mod flag in the borrower assistance plan field in the monthly disclosures the GSEs started to release in March, 2021. In order to obtain a permanent modification, borrowers must first successfully complete a three-month trial modification plan[3]. Below find the progression in the number of loans in such plans since March 2021: In a fine recent paper, the Federal Reserve Bank of Philadelphia “highlights the immediacy of the challenges facing mortgage servicers and policymakers” that arise from the resolution of mortgage forbearance and delinquencies[1]. As of the time of writing, the Philly Fed stated that “some 2.73 million mortgages are either in forbearance or past due; about 0.78 million of those are in Coronavirus Aid, Relief, and Economic Security (CARES) Act forbearance plans”. In addition, “about 47 percent of loans in forbearance will expire in the first quarter of 2022; another 42 percent will expire in the second quarter”. They go on to discuss recent trends and provide data on income and demographics of these borrowers.

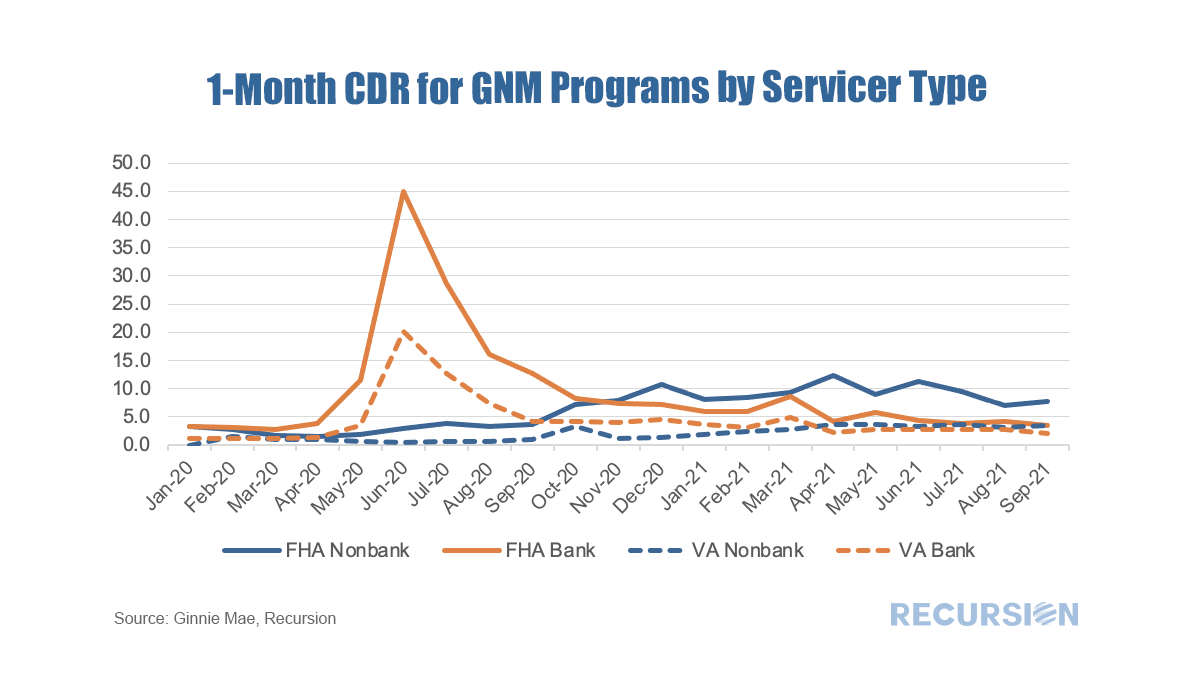

The point of this brief article is to look at secondary market indicators to shed additional light on these issues. The note is broken into two parts, the first looks at Government programs, notably FHA and VA, while the second looks at the GSEs. Episode 10 of Ginnie Mae’s “Capital Markets Live” podcast is titled “Using Data to Understand the First-Time Home Buyer” and featured Recursion’s Founder and CEO Li Chang explaining how the company’s advanced data and tools can be leveraged to demonstrate Ginnie Mae’s important role in serving this important borrower segment. Chief Research Officer Richard Koss further discussed how fundamental factors such as a shortage of supply are supporting the housing market and how Ginnie Mae’s modification programs designed to help families stay in their homes are minimizing disruptions associated with the expiration of forbearance. As we approach year-end and the beginning of the process of phasing out forbearance programs, the natural question market participants are asking is which indicators should they be watching to gain a sense of the mortgage landscape in 2022. Along these lines, there is a significant difference between the Ginnie Mae programs and the GSE’s. In particular, for conforming loans, it is the Agencies themselves that buy nonperforming loans out of pools, while for FHA and VA, this function is performed by servicers. As the timeframe for buyouts on the part of the GSE’s was extended to 24 months earlier this year, we won’t see much activity prior to April 2022 on this front[1]. So in this post, we focus on the Ginnie Mae programs.

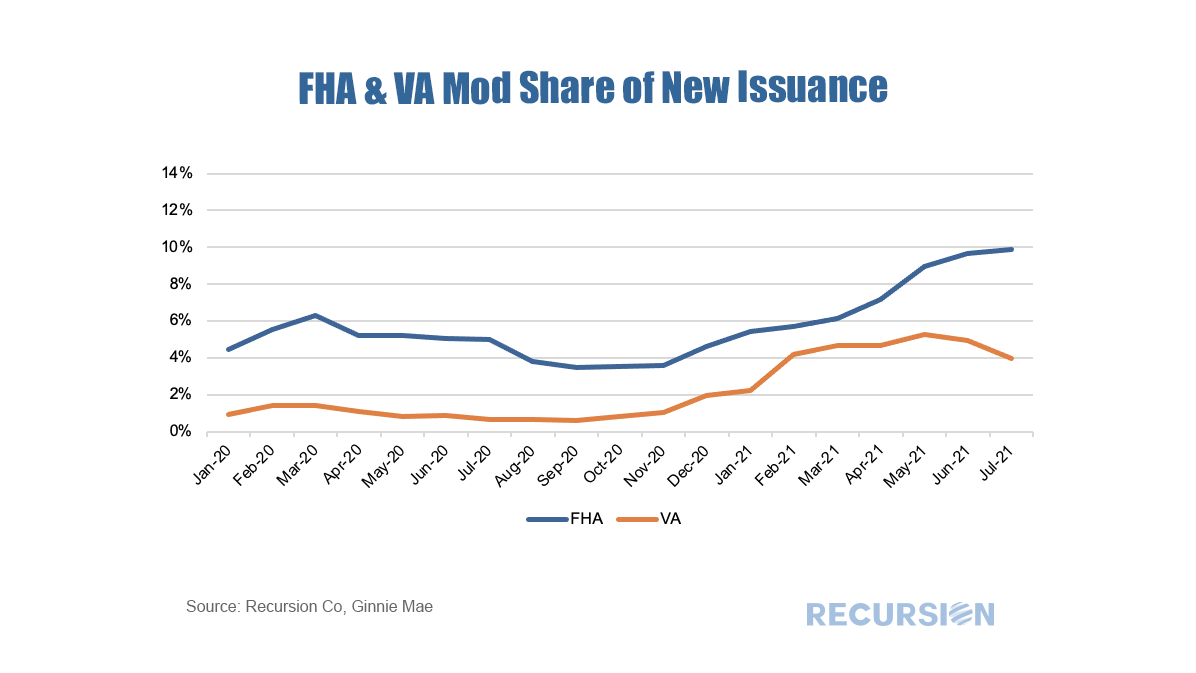

As we have written previously, it is challenging to follow the path of a loan once it has been purchased out of a pool. At the aggregate level, we can view the activity of individual lenders using the FHA Neighborhood Watch data[2]. In terms of the process, a nonperforming loan is bought out of a pool, and one of three actions can be taken. First, the borrower can be taken into foreclosure. Second, the borrower can become current and roll the unpaid balance into a second lien, in a process known as a partial claim. Third, the borrower can accept a loan modification. In terms of the scale of buyouts, after an early spurt of activity in 2020 on the part of some parties, notably banks, the involuntary prepayment rate, measured by CDR(constant default rate), has settled down in recent months. FHA nonbank servicers have been more active in this space than other categories over the past year. As forbearance plans begin to expire towards the end of the year, these numbers may start to rise. One of the many recurring themes of these posts is that the shock of the Covid-19 Pandemic and subsequent policy response has resulted in structural changes in behavior that cause loan performance metrics to shift compared to the pre-crisis world. An interesting example of this can be found in the performance of modified loans in Ginnie Mae programs.

Modified loans in these programs are those that have been purchased out of pools by servicers that are past due that subsequently have features such as rate and term adjusted in order to bring households back to a current status. These are then often resecuritized into a new GNM pool.

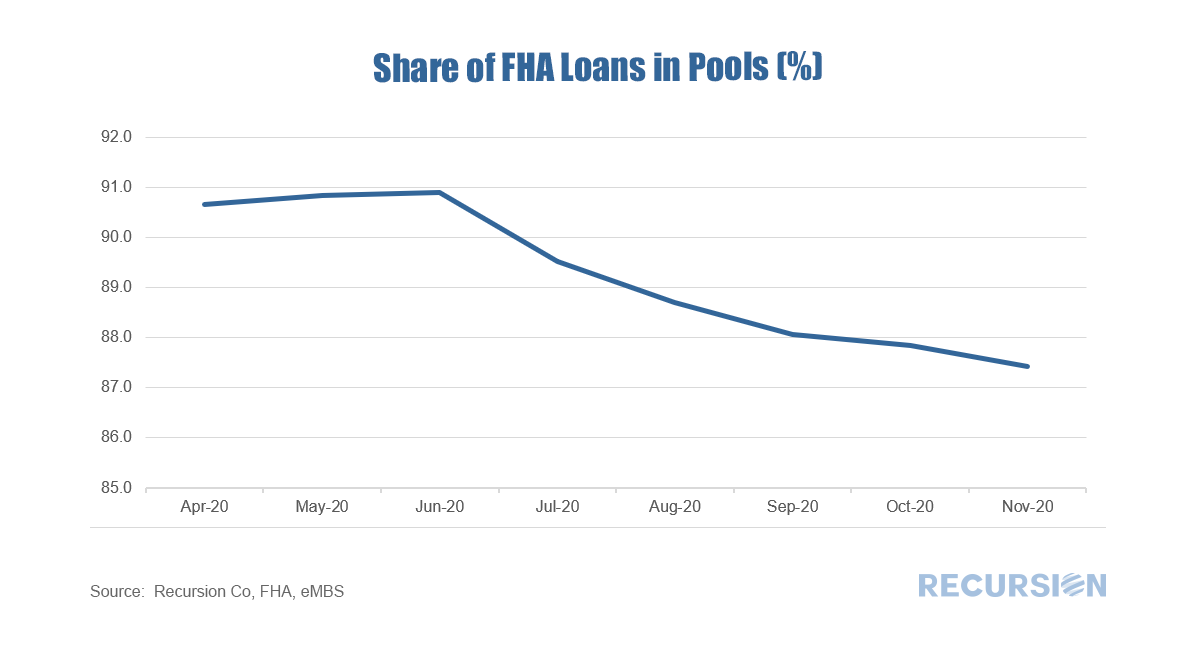

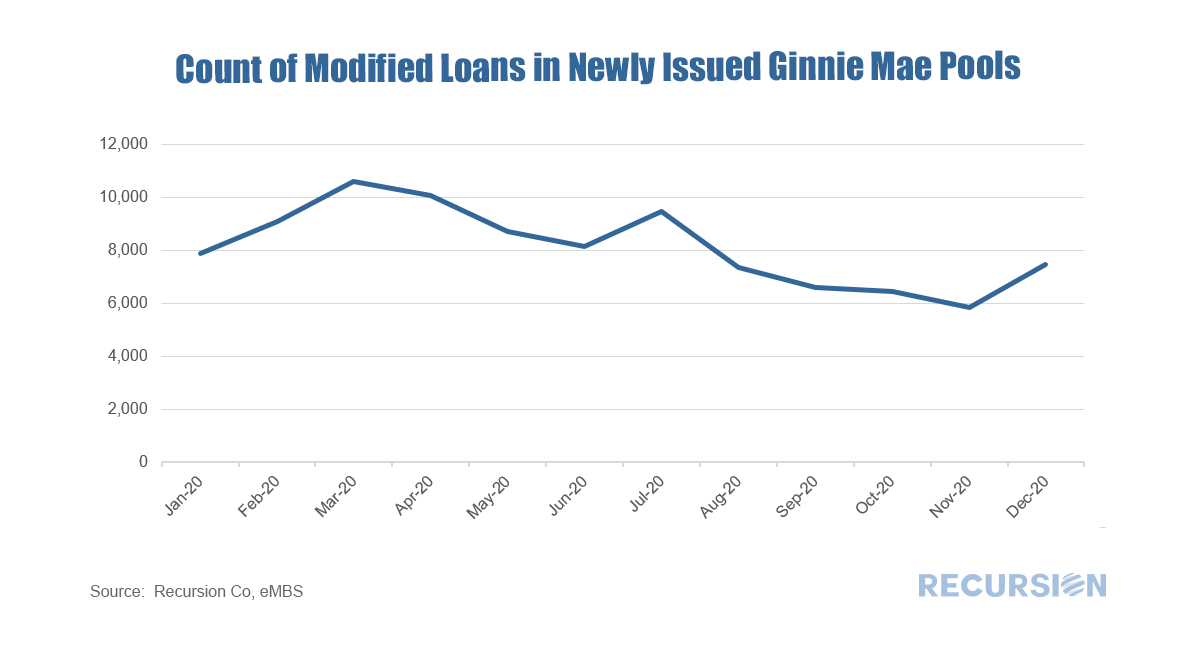

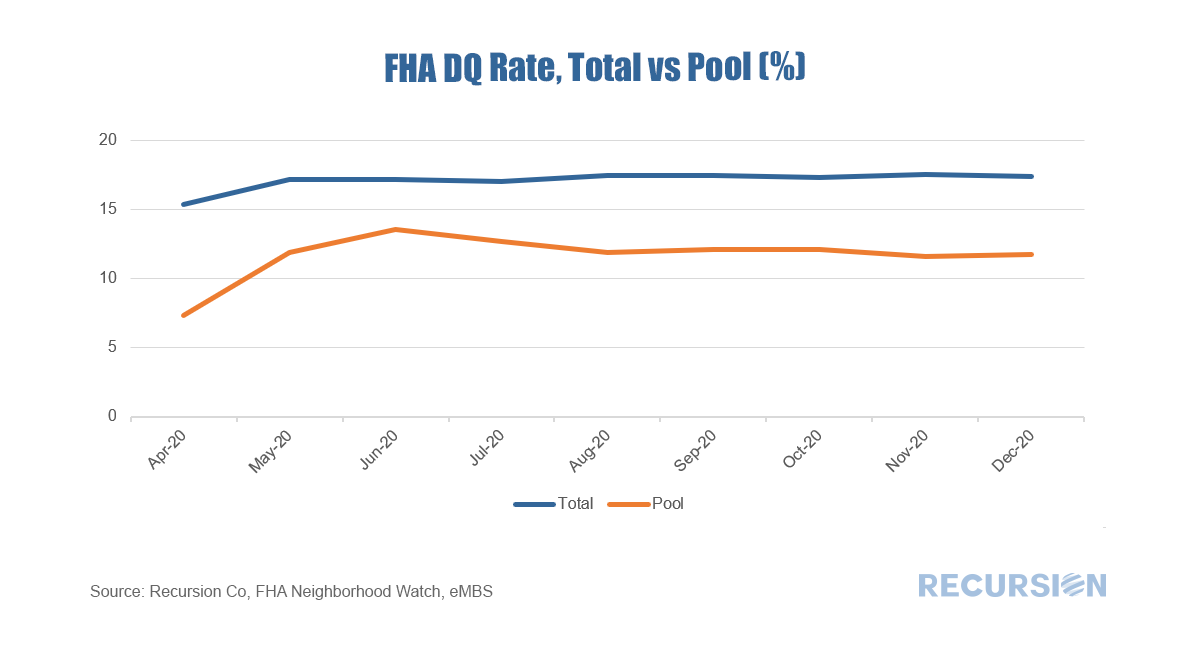

In a recent post, we discussed the application of the FHA Neighborhood Watch dataset to understanding the market landscape for this program[1]. Peering a bit deeper, more insights can be obtained. We just updated this dataset through December so it is an opportune time to take a look at FHA loan performance. First, the share of FHA loans in pools [2]continued to decline at the end of the year: The loans in pools fell by about 60,000 in December while the total fell by 40,000 implying that perhaps 20,000 loans were purchased out of pools, and presumably modified as foreclosures are currently forbidden. Interestingly, the number of loans in pools new issuance with mods rose for the first time since July: It shows even though most of the loans are expected to be cured by partial claims, modification remains a tool to work out delinquent loans. We will have separate pieces focusing on partial claims in future posts. Now what about delinquencies? What is the delinquency rate[3] of loans in the FHA program? As servicers may buy serious delinquent loans out of pools, and banks tend to hold conventional loans not FHA loans on their balance sheet, the overall FHA delinquency rate reported by FHA Neighborhood Watch data is generally higher than that for loans in pools. When COVID-19 first struck last spring, the 30-day delinquency rate spiked, narrowing the gap with the total figure, but many of these cured as labor markets recovered. More recently, lenders have picked up the pace of purchasing delinquent loans out of pools, as they have the financial incentive to modify the loans to allow the borrowers to become current and then resecuritize them. A key question for 2021 is when forbearance programs expire, how many borrowers will be able to work with lenders to keep their homes, and how many will lose them? Stay tuned. [1] https://www.recursionco.com/blog/fha-buyouts-and-loan-counts

[2] “In pools” means the loans were securitized by Ginnie Mae issuers [3] The delinquency rates are calculated using the delinquent loan counts divided by total loan counts As we head into 2021, an ongoing issue is the disposition of loans in forbearance. The Cares Act allows for borrowers negatively impacted by the Covid-19 pandemic to obtain forbearance up to 1 year[1]. This will begin to expire in Spring 2021, although an extension is possible as the new Administration takes over in January. A key point is that forbearance is not forgiveness. The mortgage agencies have provided options for borrowers who become current after forbearance, so they don’t have to make a lump-sum payment for missed principle and interest.

FHA has designated its policy regarding the disposition of suspended payment amounts as COVID-19 National Emergency Standalone Partial Claims[2](COVID Partial Claim). “The COVID Partial Claim puts all suspended mortgage payment amounts owed into a junior lien, which is only repaid when the homeowner sells the home, refinances the mortgage, or the mortgage is otherwise extinguished.” |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed