|

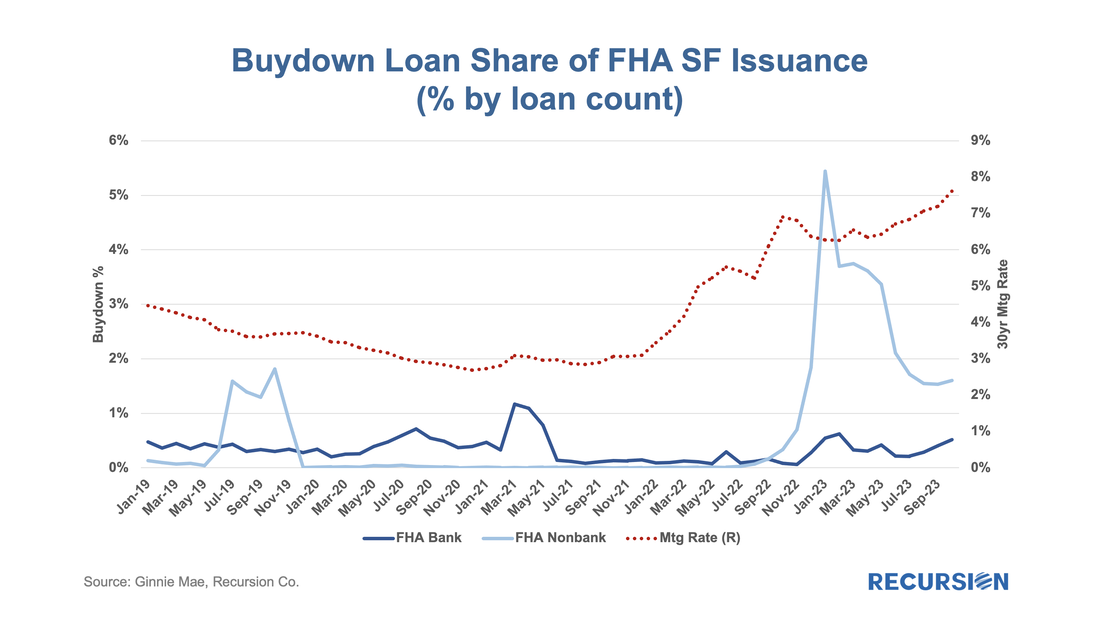

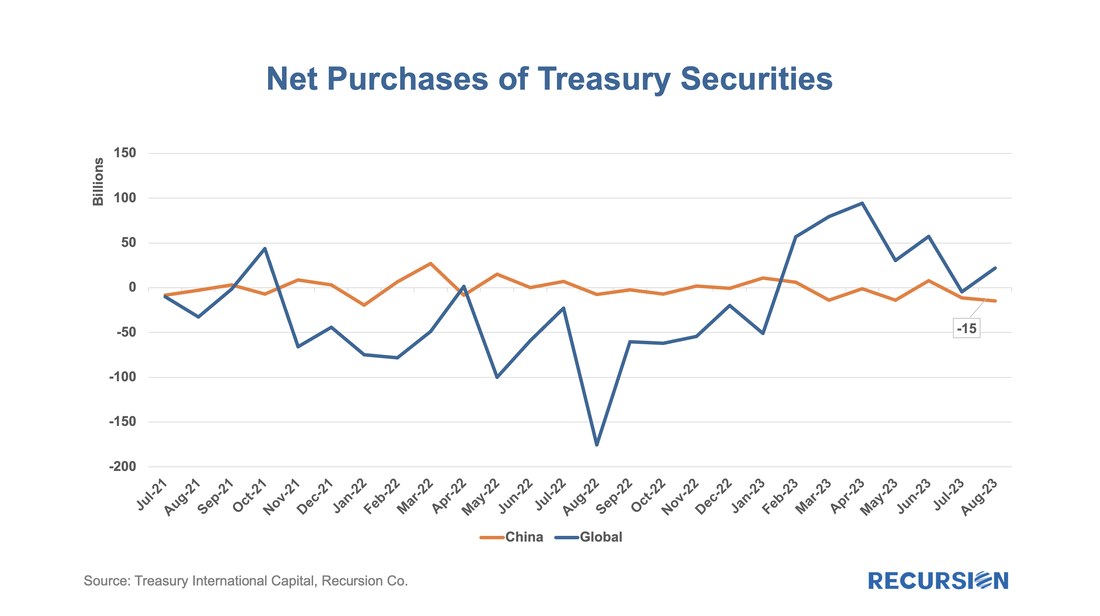

The recent release of pool-level buydown data led us to write a note contrasting the use of this product across Agencies, including Ginnie Mae[1]. In the process of writing this, we discovered that FHA, unlike the GSEs, also provides loan-level data for buydowns. This allowed us to run an analysis showing loan performance as measured by EPDs was better for FHA loans with buydowns than without, reflecting increased lender caution in using buydowns, which, on average, had higher credit scores than those without. The availability of loan-level data for FHA on this topic provides us with an opportunity to conduct an additional informative analysis specific to this program, which we document here. To start, let’s look at the share of the market with buydowns: ...... ...... ...... To read the full article, please send an email to [email protected] One of the key changes that has been underway in the policy environment over the last decade or so is the linking of economic and foreign policies. Trade policies in the form of tariffs or product bans have increasingly become part of the foreign policy toolkit. The most extreme case, of course, is the sanctions placed on Russia’s dollar assets by the US government following the invasion of Ukraine[1]. It’s natural to wonder if these developments could lead to changes in the foreign appetite for US financial assets. Recently, these concerns rose following reports of three consecutive months of declines in US Treasuries[2].

These are complex issues that matter to investors in US assets, so it’s worth looking into. Our Macro Analyzer provides a view into the main source of international financial flows, the Treasury International Capital (TIC) System[3]. Indeed, the data show sales of Treasury securities of almost $15 billion out of China in August, the biggest such figure since January 2022: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed