|

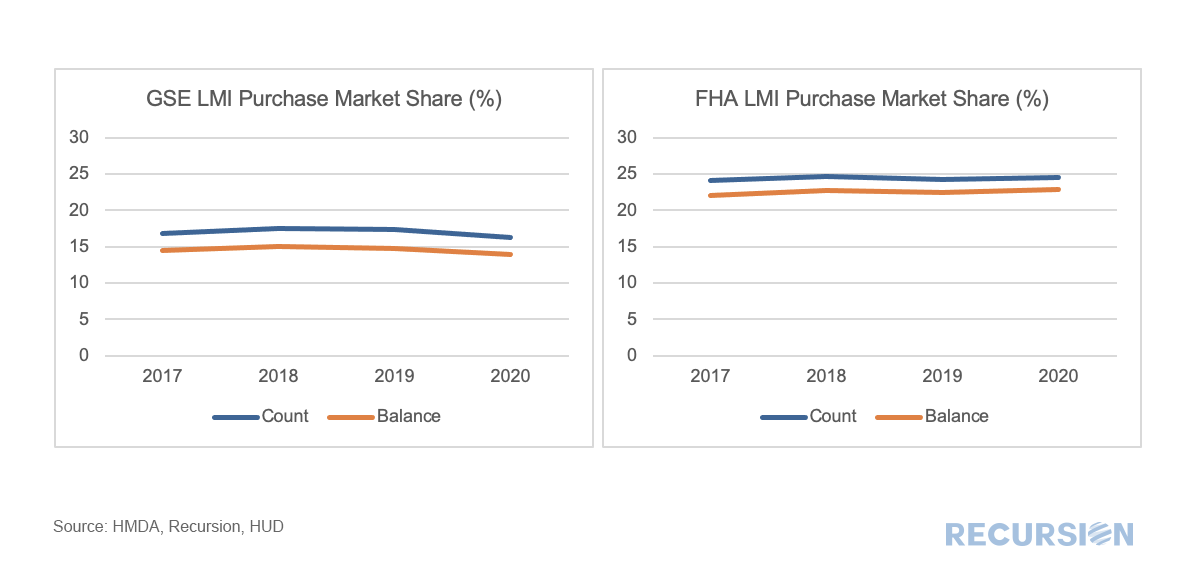

In a recent post[1], we looked at the declining FHA share of the purchase mortgage market relative to the GSE’s across a variety of price points. Another way to look at this question is by a geographic breakdown focusing on those census tracts with a Low-Moderate Income (no greater than 80% of area median income) population greater than 51% (we will call these LMI areas)[2].

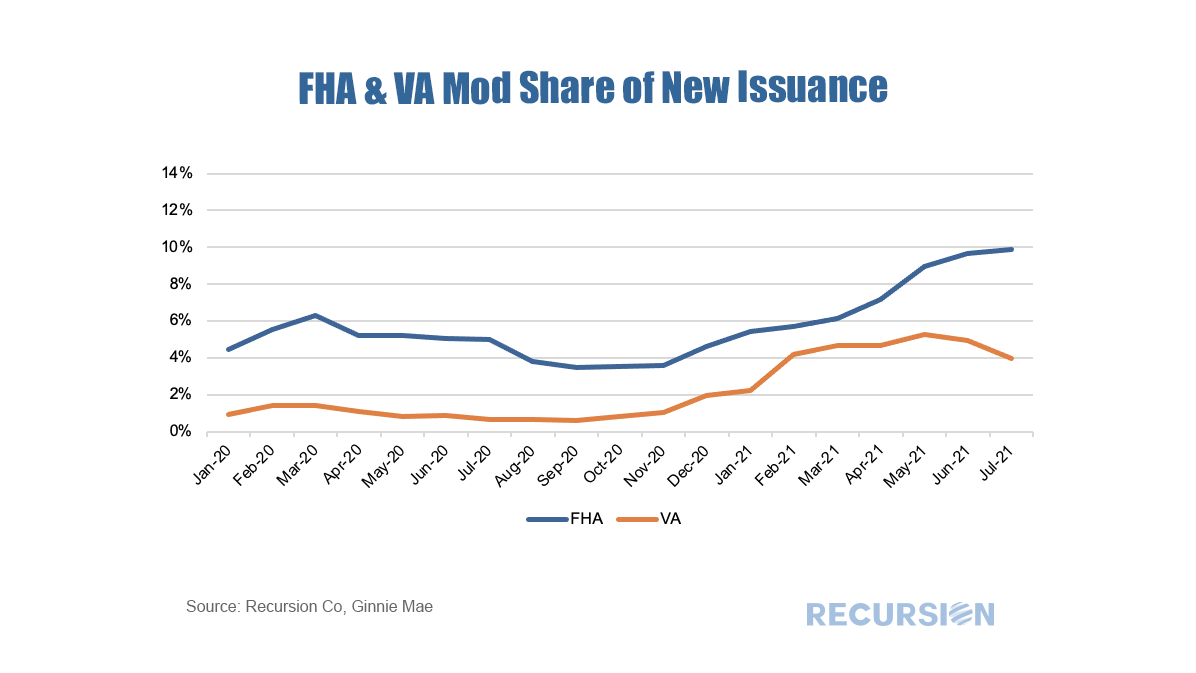

To address this issue, we utilize the HMDA dataset, and then apply the LMI information to compute shares of originated purchase loans delivered to FHA vs GSE. This is done on both a loan count and loan balance basis. One of the many recurring themes of these posts is that the shock of the Covid-19 Pandemic and subsequent policy response has resulted in structural changes in behavior that cause loan performance metrics to shift compared to the pre-crisis world. An interesting example of this can be found in the performance of modified loans in Ginnie Mae programs.

Modified loans in these programs are those that have been purchased out of pools by servicers that are past due that subsequently have features such as rate and term adjusted in order to bring households back to a current status. These are then often resecuritized into a new GNM pool.

Recursion Co’s Chief Research Officer Gives the Food for Thought Lecture Series at Columbia SIPA8/19/2021

Food for Thought is a speaker series that discuss the Covid-19 crisis and social justice reform at the Columbia University School of International and Public Affairs (SIPA). Our Chief Research Office Richard Koss will give a talk at this forum on Wednesday, September 22 at 12PM EST about housing policy changes during the Covid-19 Pandemic.

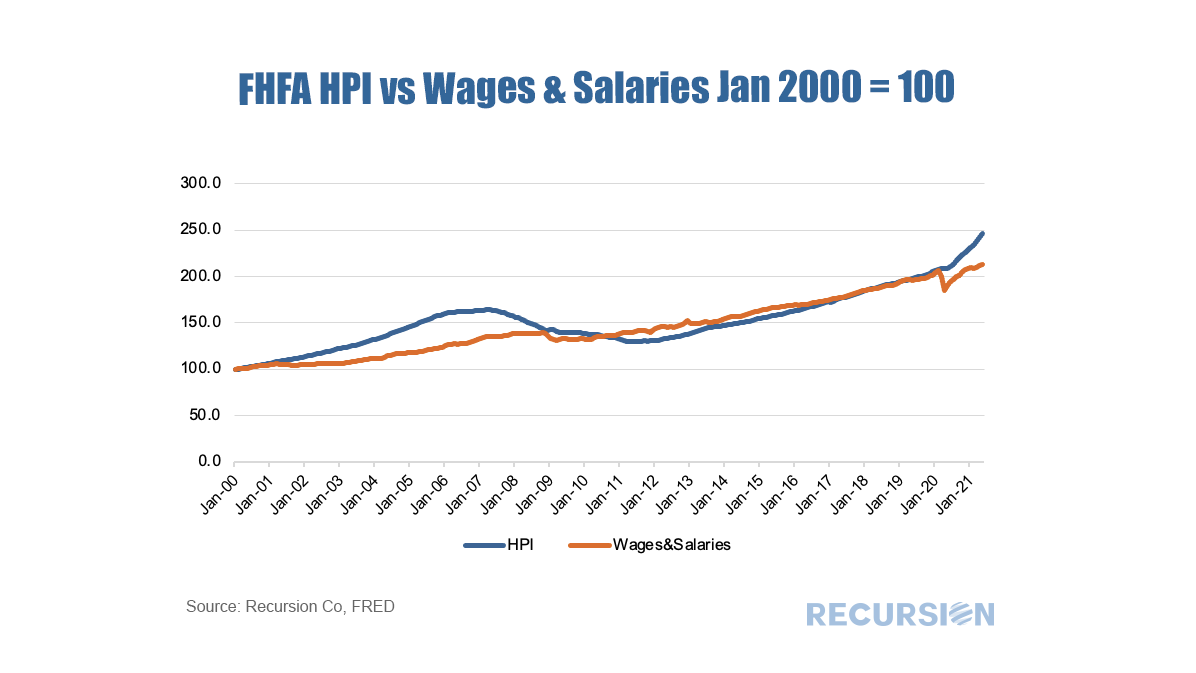

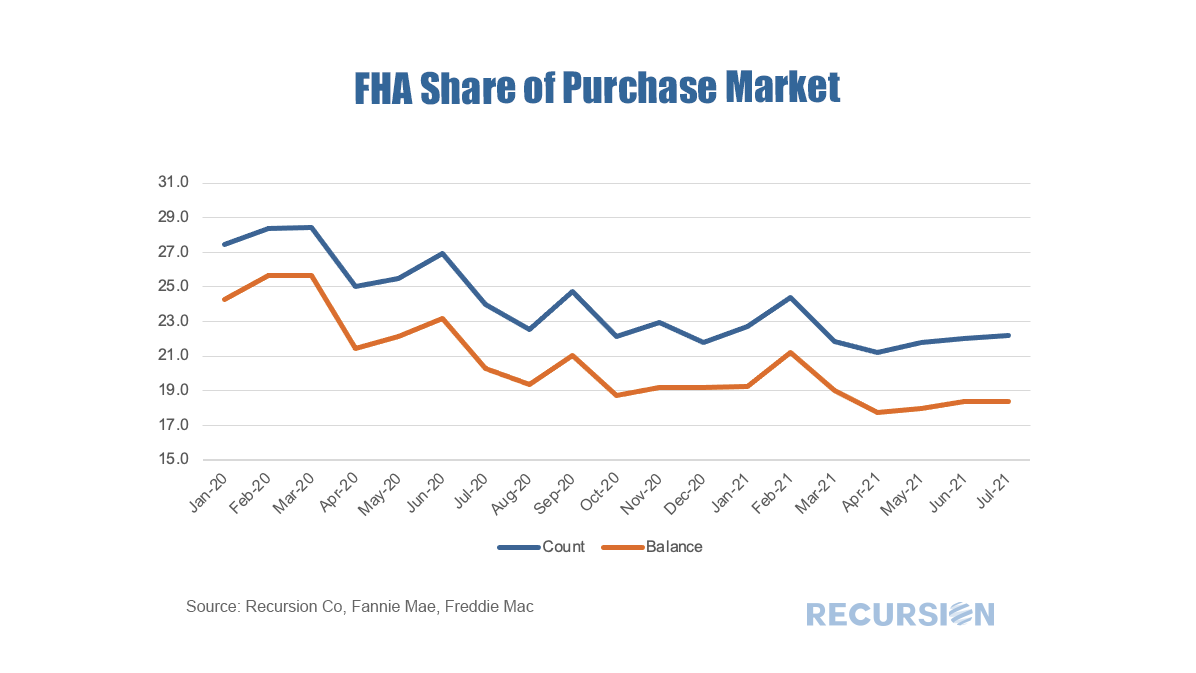

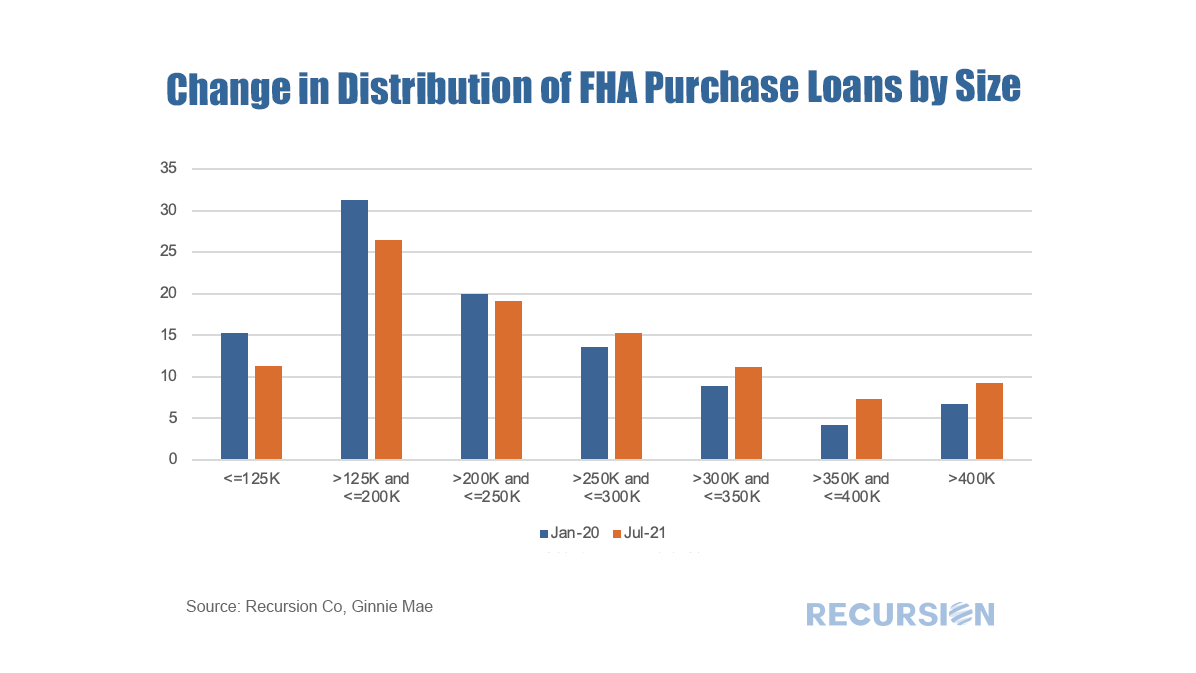

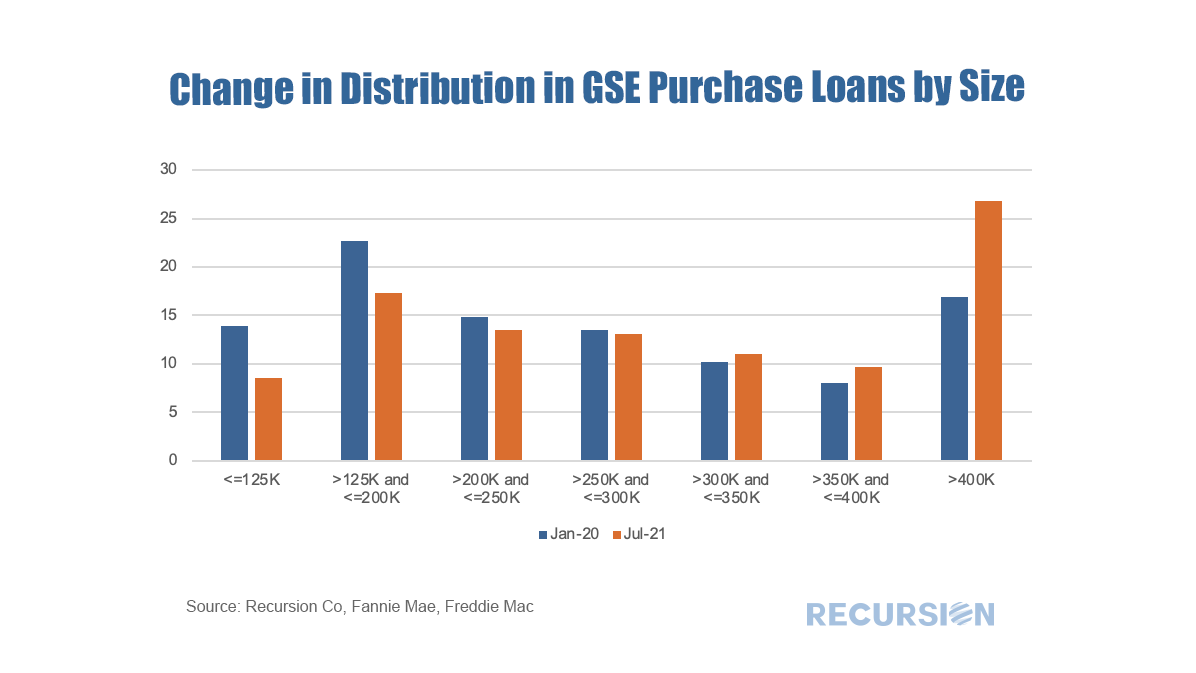

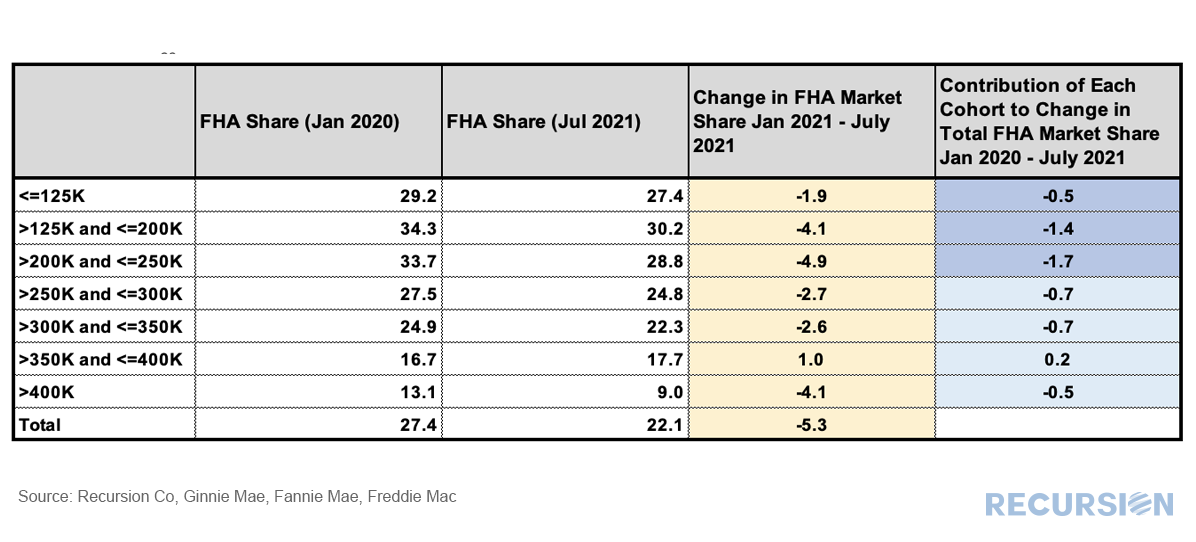

“The onset of the Covid-19 Pandemic represents a massive shock impacting all sectors of the global economy. It has been particularly felt in the real estate sector as households reconsider their work/living arrangements and adjust their lives accordingly. It has also greatly exacerbated the trend towards wealth inequality. The new Biden Administration and other government agencies, notably the Federal Reserve, are engaging in innovative policy making to improve the functioning of the economy, expand access to credit and provide affordable rental housing to low-income households. What are the barriers to success facing these programs and what more needs to be done?” Read More The recent unprecedented surge in home prices to a record 18% jump on a year-year basis as measured by the FHFA purchase-only index brings affordability front and center to the current housing policy debates. In May 2021, indexed home prices stood 15.5% above indexed aggregate earned income, a bit less than half of the peak house price overvaluation of 29.0% reached in December 2005, just before the onset of the Global Financial Crisis. The topic of affordability is very broad, and will be the subject of much further commentary, but in this post we look briefly at this topic through the distribution of the purchase mortgage market across securitization agencies, notably FHA and the GSE’s. Looking at the distribution between the GSEs and FHA is informative in this issue because the FHA program is aimed at low-income borrowers. According to 2020 HMDA data, the weighted average household income for FHA borrowers of purchase mortgages was $85K while for those in conforming mortgages the figure was $228K. Since the onset of the Covid-19 pandemic in early 2020, the share of FHA purchase mortgages of the total[1] delivered to agency pools as been in general decline, on both a loan count and outstanding balance basis: With a base consisting of relatively lower-income borrowers, it makes sense that the borrowers in this program are struggling to qualify for loans in a skyrocketing market. To check this out, we calculate the change in the distribution of loans between FHA and the GSE programs by original loan sizes: Intuitively, larger loans comprise a greater share of the distribution of purchase loans in both programs between January 2020 and July 2021. Over this period, FHA lost a bit over 5% in market share to the GSE’s in this category. The change in share by loan size bucket and the contribution of each of these to the total loss in share is given below: In fact, it turns out that about three quarters of the loss in FHA’s purchase market share comes from losses in loan sizes less than $250,000. Further analysis is needed to look at the fundamental and structural factors that are behind this result. [1] In this case we view the total as FHA + GSE

MSCI has just released a report “Managing Against MBS Indexes: A Duration Perspective[1]” that details the reasons that the MBS Index duration extended dramatically even though the 30-year mortgage rate was little changed over the period from June 2020 – June 2021. Six main factors are examined in the article to have impacts on MBS index duration. One of the main factors, the distribution of coupon drift due to record refinance activity, was documented using Recursion data. Support of cutting-edge research is one of our proudest activities. To learn more contact us at [email protected]. Read More |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed