|

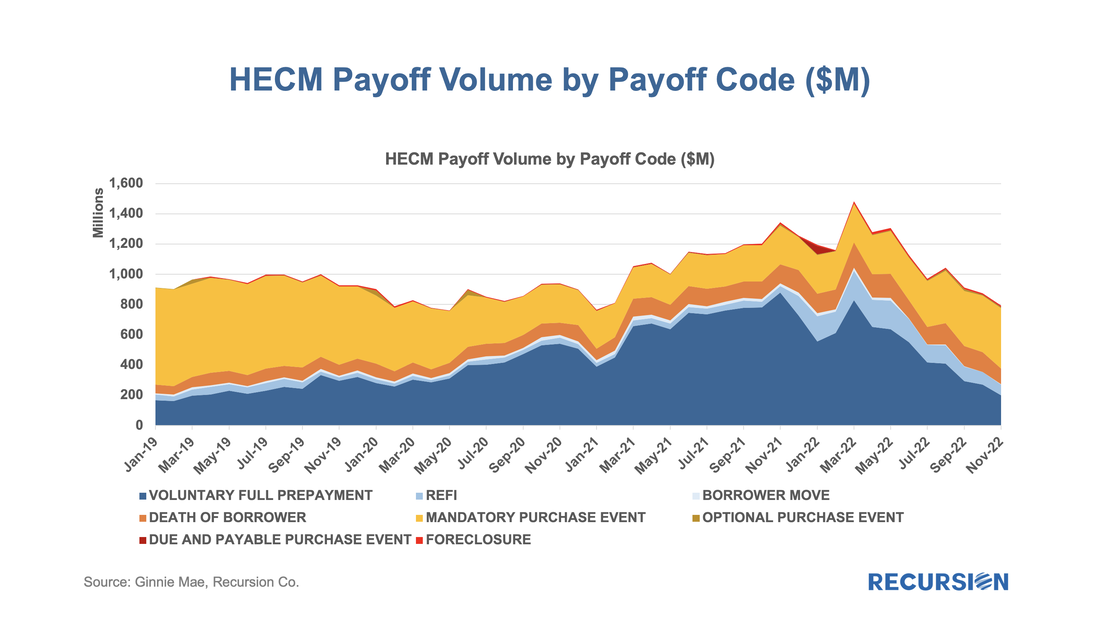

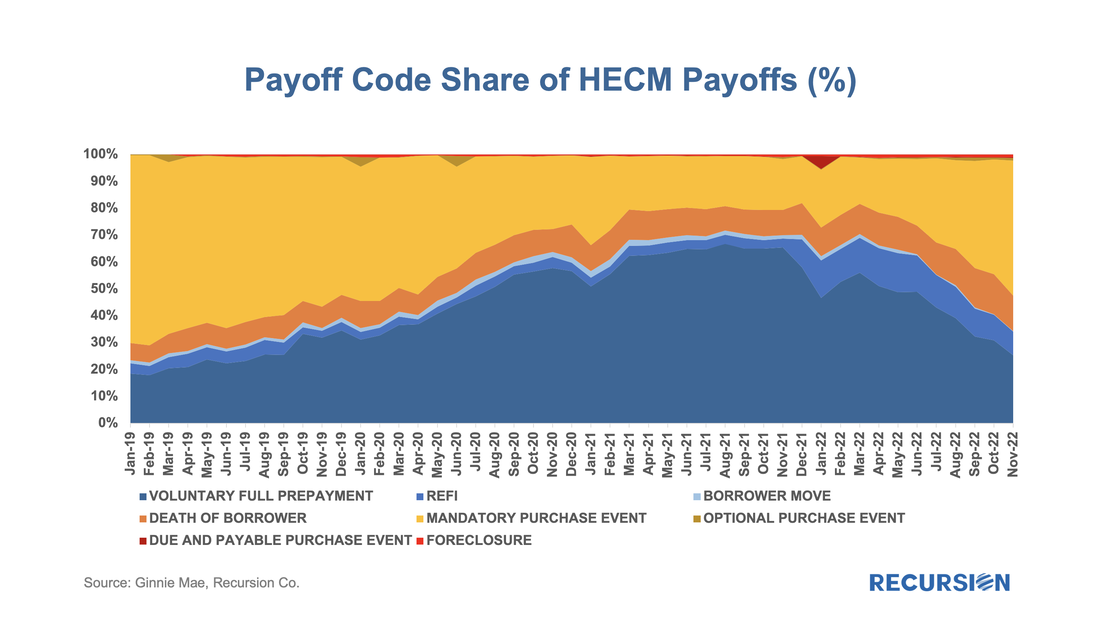

As the economy slows and the impact of inflation weighs on many households, we have noted signs of distress in mortgage performance in parts of the market despite the resilience observed in the labor market[1]. Another corner of the market that is drawing attention is reverse mortgages. The metric used to assess performance in this space is the number of mandatory purchase events. Unlike the situation in the forward mortgage market, these occur not when the borrower faces financial distress[2], but when the servicer is compelled to purchase a loan out of a pool once the balance reaches 98% of a pre-set amount -- the “Maximum Claim Amount (MCA)”[3]. This amount is capped so as to reduce the risk of the loan amount surpassing the valuation of the collateral. The fundamental factor driving this event is interest rates as HECMs are floating-rate loans, and a higher rate brings the loan balance up faster.

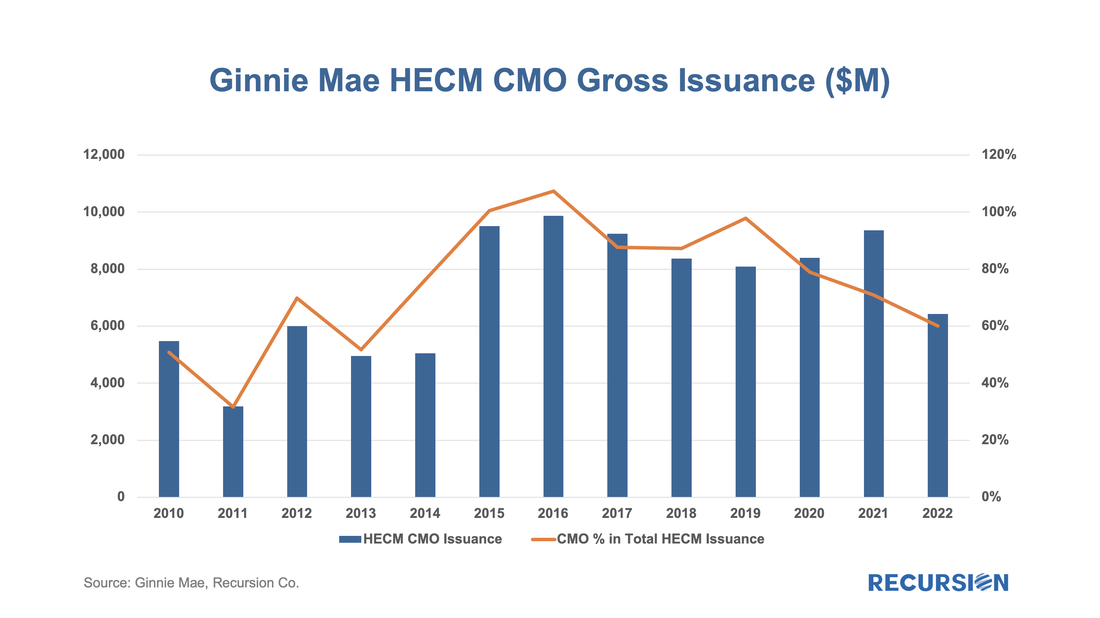

Recursion’s HECM Analyzer tool allows us to quantify the number of prepayments that are due to this factor, both in absolute dollar amount and as a share of total prepayments. Following the recent publication report of our CMO league tables[1], our next look at the structured mortgage product market is with HECMs. This is a very specialized product, but it offers distinct investment opportunities for investors to benefit from fundamental analysis of the unique characteristics of these "reverse mortgages". As the number of outstanding loans in this class is very much less than that of "forward" mortgages, it stands to reason that many HECMs would be packaged into CMOs to enhance diversification, and indeed that is the case:

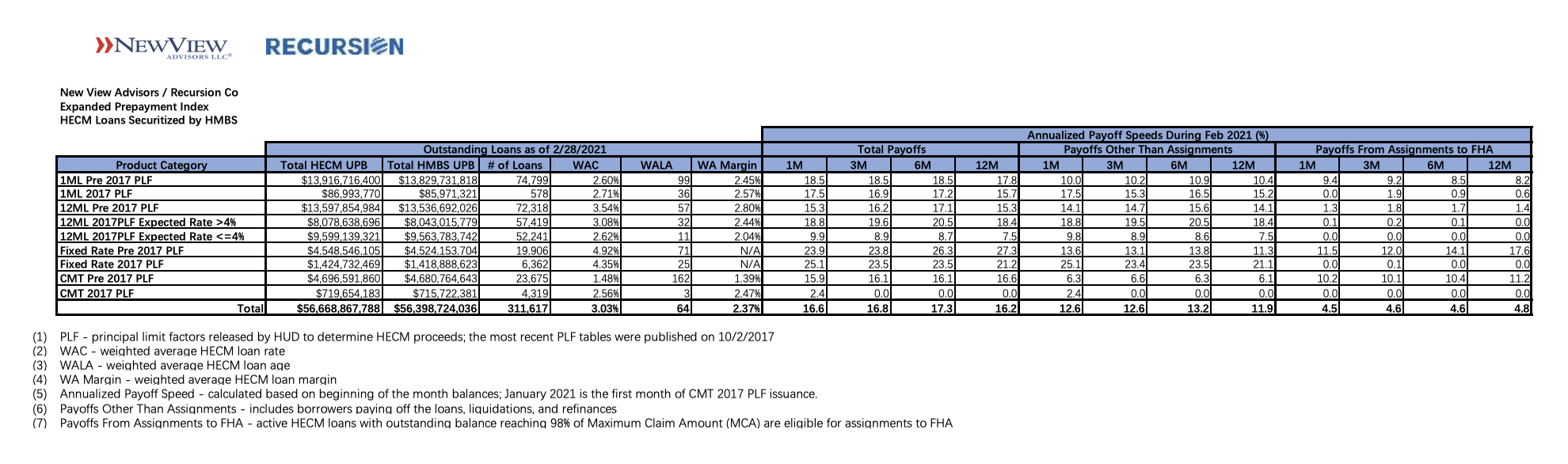

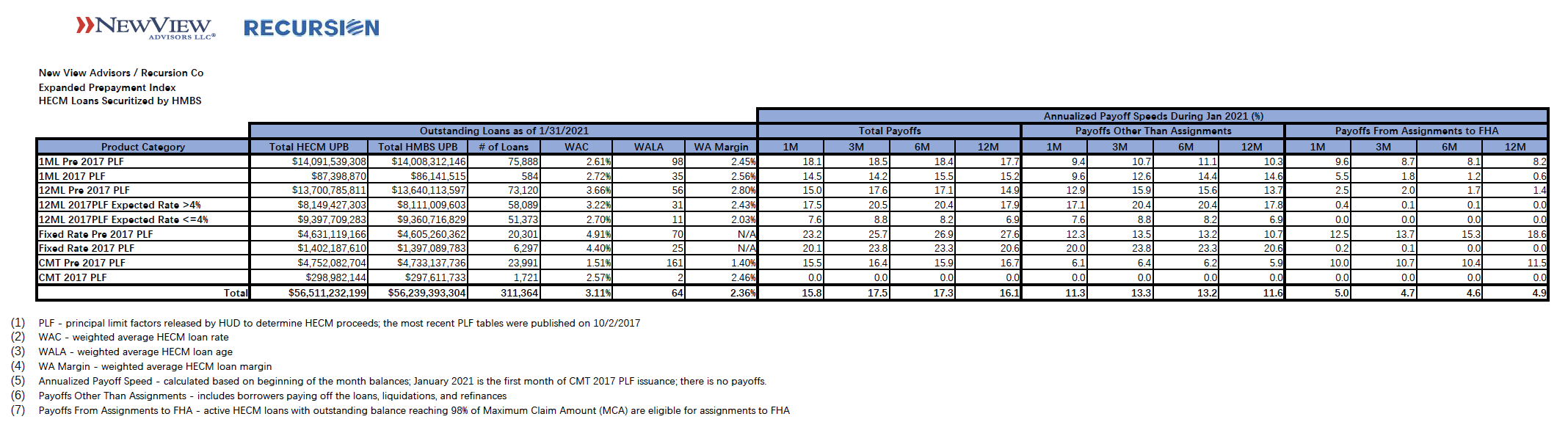

Recursion and New View Advisors February 2021 expanded HECM reverse mortgage prepayment indices can be found here: New View Advisors Recursion Cohort Speeds 02_2021. The indices are derived from underlying HECM data in HMBS made public by Ginnie Mae, as well as private sources. This new expanded set of prepayment data is calculated using dollar principal balance, not unit count.

The enhanced data set shows current trends in prepayment activity by product type and Principal Limit Factors (PLFs), and for current 12-month LIBOR PLFs by Expected Rate. HECM loans with higher Expected Rates originated in the year or so prior to the precipitous fall in interest rates brought on by the pandemic are experiencing higher prepayment rates. Therefore, we segregate indices for recent production 12-month LIBOR PLFs into Expected Rates greater than 4% and Expected Rates less than or equal to 4%. Prepayment speeds are expressed as annualized percentages in three categories: Total Payoffs, Payoffs Other Than Assignments, and Payoffs from Assignment. For each category, we calculate the 1-month, 3-month, 6-month and 12-month CPR, or annual rate of prepayment. For HMBS pools backed by adjustable rate HECMs using the Constant Maturity Treasury (CMT) index, prepayment speeds will begin to populate as more of these HMBS are issued. Just under $300 million of CMT HMBS are currently outstanding: other than some highly seasoned tail pools, none have been outstanding more than one month. Please contact us if you’re interested in customized stratification of HECM prepayment speeds by vintage, Expected Rate, Weighted Average Loan Age, or other tailored output. New View Advisors and Recursion are introducing a set of expanded HECM reverse mortgage prepayment indices, which can be found here: New View Advisors Recursion Cohort Speeds 01_2021. The indices are derived from underlying HECM data in HMBS made public by Ginnie Mae, as well as private sources. This new expanded set of prepayment data is calculated using dollar principal balance, not unit count. Data presented are for HECMs outstanding as of January 31, 2021, representing 311,364 loans totaling $56.5 billion. Future updates of the indices will be available after the 6th business day of each month.

A reverse mortgage is a mortgage loan backed by a residential property, that allows the borrower to access the unencumbered equity in their home without making monthly payments. The loans are usually offered to senior homeowners. Currently, FHA has endorsed reverse mortgage loans an outstanding balance of 54 billion USD and these are securitized in Ginnie Mae’s HECM pools. This program is available for people age 62 and over.

There are many differences between reverse mortgages and regular (forward) mortgages, particularly that the balance of reverse mortgages tends to grow over time as interest accrues and sometimes payments are made to the homeowner. But in both cases investors face prepayment risk. The HECM loan tape disclosed monthly by Ginnie Mae provides data by many characteristics, including reason for prepayment and the age of the borrower. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed