|

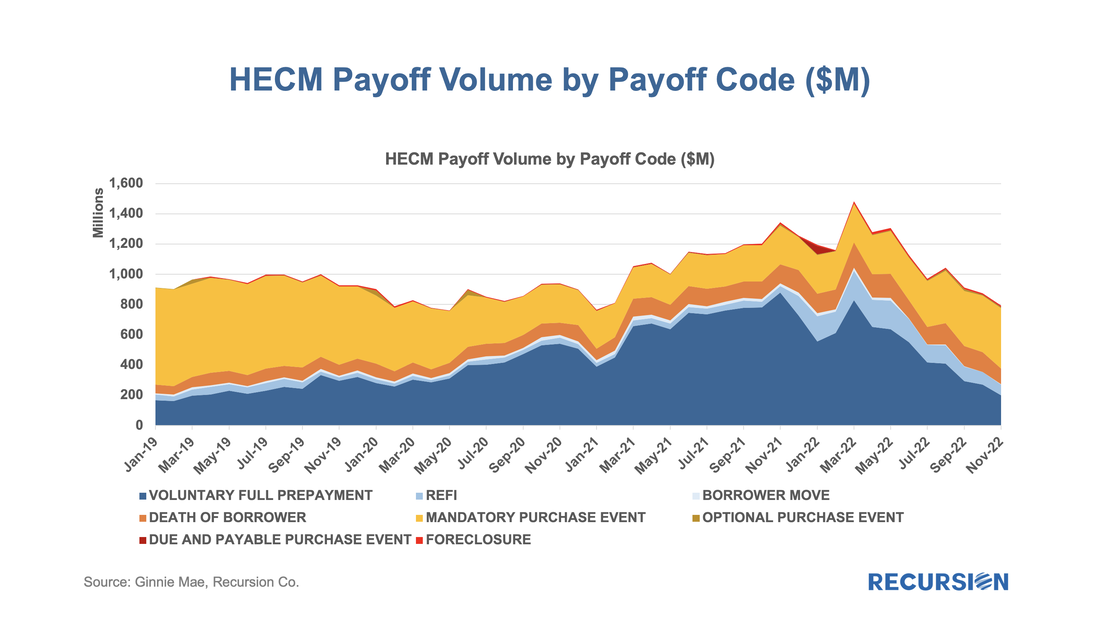

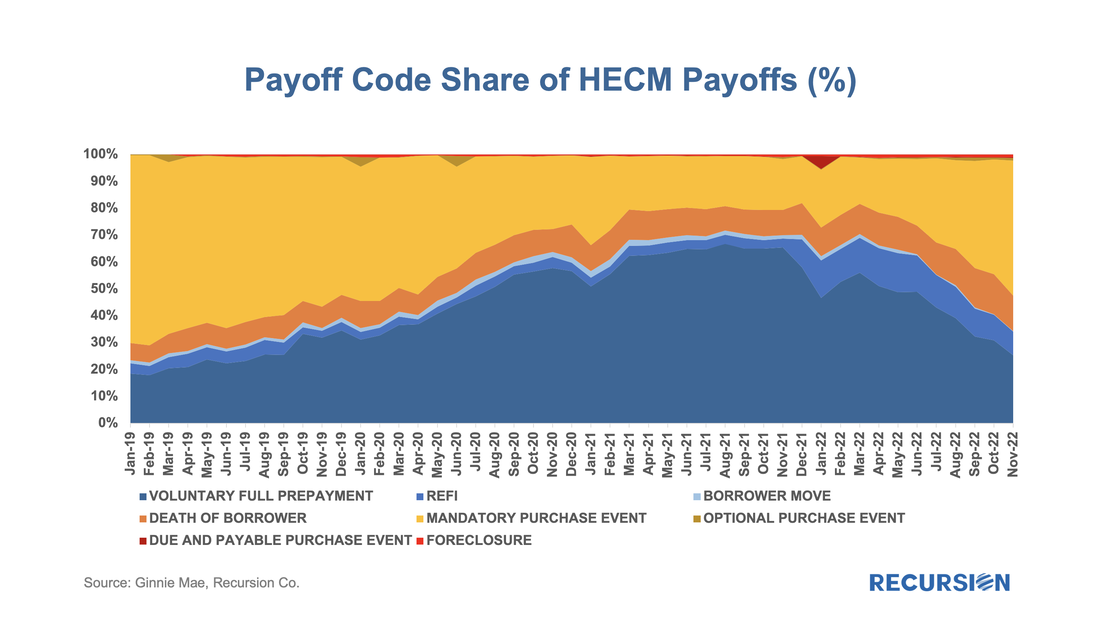

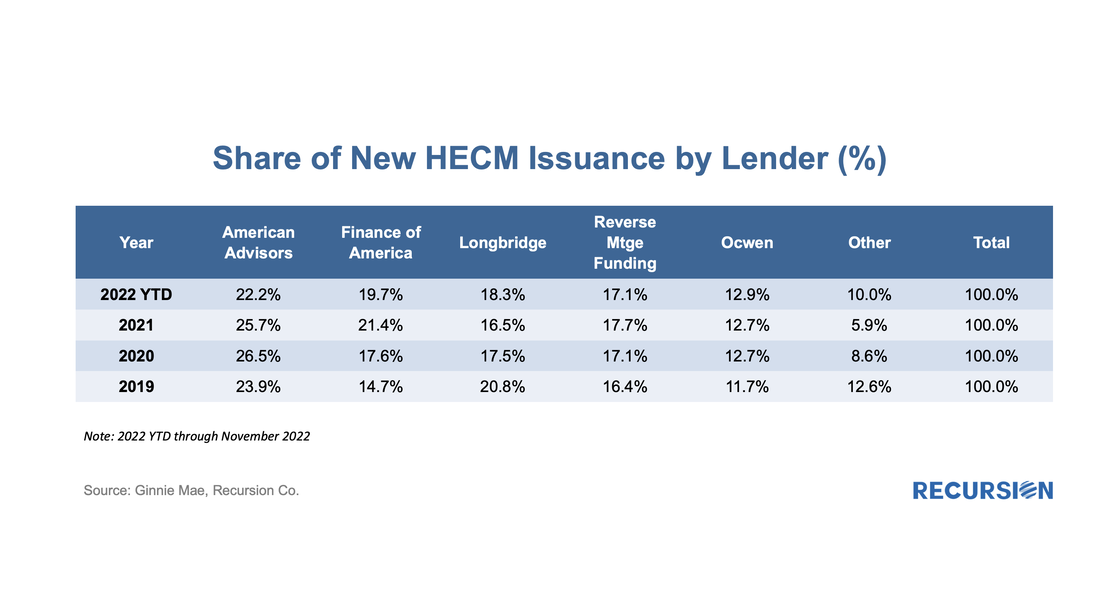

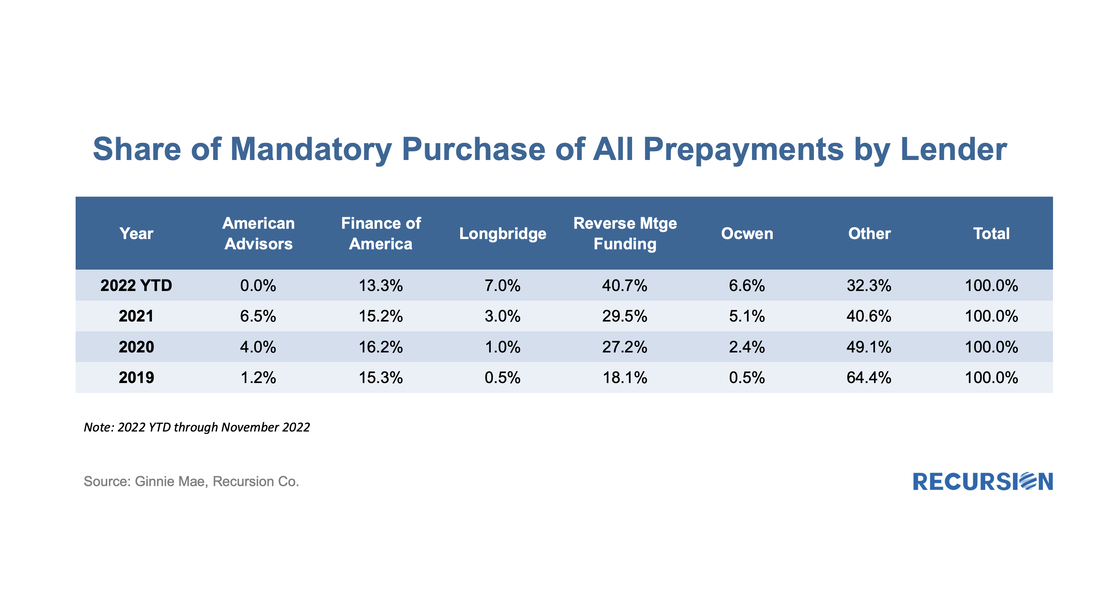

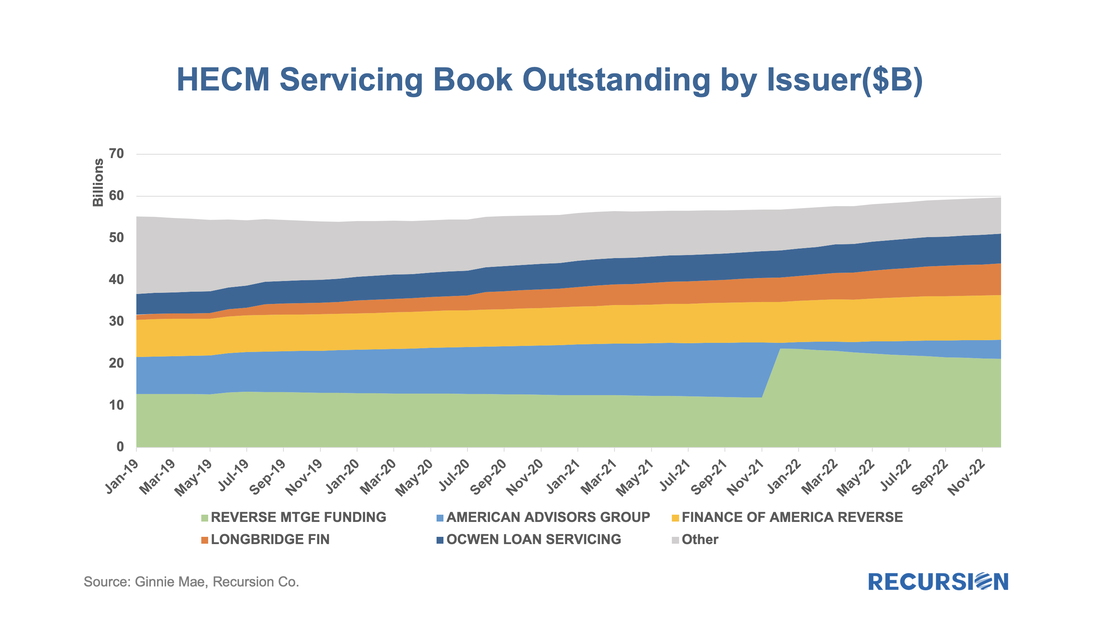

As the economy slows and the impact of inflation weighs on many households, we have noted signs of distress in mortgage performance in parts of the market despite the resilience observed in the labor market[1]. Another corner of the market that is drawing attention is reverse mortgages. The metric used to assess performance in this space is the number of mandatory purchase events. Unlike the situation in the forward mortgage market, these occur not when the borrower faces financial distress[2], but when the servicer is compelled to purchase a loan out of a pool once the balance reaches 98% of a pre-set amount -- the “Maximum Claim Amount (MCA)”[3]. This amount is capped so as to reduce the risk of the loan amount surpassing the valuation of the collateral. The fundamental factor driving this event is interest rates as HECMs are floating-rate loans, and a higher rate brings the loan balance up faster. Recursion’s HECM Analyzer tool allows us to quantify the number of prepayments that are due to this factor, both in absolute dollar amount and as a share of total prepayments. The aggregate amount of mandatory purchases rose by 57% over the past year ($255 million in November 2021 to $400 million a year later). This is because most reverse mortgages bear adjustable rates and interest is capitalized into outstanding principal. As rates increase, the monthly interest resets accordingly to a higher level, resulting in the outstanding balance reaching 98% of MCA much faster. The share of total prepayments derived from mandatory purchases is 50%, up from 19% a year earlier, but well below the 70% figure attained in early 2019. While these figures show growing strains in the overall HECM market, these are not necessarily distributed equally across all originators. Below finds the share of issuance for five large issuers annually back to 2019, as can be seen the top 5 HECM issuers dominate the market with 90% of HECM originations: Next, below find the shares of total mandatory purchases across these lenders for the past four years. The data shows that while the smaller issuers originate about only 10% or less of the new loans, their share of mandatory purchases in all prepayments is strikingly high. Some of these issuers (for example, Nationstar in 2014, and Quicken’s One Reverse Mortgagein 2020)[4] played big roles in the HECM space for a while but have exited the space, leaving only seasoned HECM loans in their portfolios. While some issuers looked to exit, others saw opportunity. The following area chart of HECM servicing book by issuer shows Reverse Mortgage Funding (RMF)’s HECM servicing portfolio doubled between Nov to Dec 2021, as it purchased loans from AAG’s book. One less obvious observation from our data is Reverse Mortgage Funding’s (RMF) share of mandatory purchase of prepayment jumped from 18.1% in 2021 to 40.7% this year. This is due to the fact that the AAG portfolio RMF took over is very seasoned and particularly vulnerable to mandatory purchases than were younger loans. Loans that are bought out of pools tend to be expensive to service, particularly as the assignment to FHA can take some time. As such, it might be anticipated that RMF would suffer some financial impact from this surge in share following the purchases, and in fact, the firm filed for Chapter 11 bankruptcy on November 30[5]. This exercise is a prime example of how big data tools can perform a useful function (in this case, financial forensic analysis) by tying in loan-level performance data by lender with fundamental factors. Both security investors and financial regulators can find their tasks made exceedingly more efficient by the application of these techniques. [1] A Quick Note on the GNM – GSE Early Delinquency Gap - RECURSION CO [2] HECM borrowers do face responsibilities to pay taxes and insurance and maintain their homes see: https://www.consumerfinance.gov/ask-cfpb/do-i-still-need-to-pay-my-property-taxes-and-home-insurance-with-a-reverse-mortgage-loan-en-235/ [3] The MCA limit will rise from $970,800 this year to $1,089,300 in 2023 see https://www.hud.gov/press/press_releases_media_advisories/HUD_No_22_244 [4] https://reversemortgagedaily.com/articles/quicken-halts-one-reverse-mortgage-operations-shifts-focus-to-rocket-mortgage/ [5] https://nationalmortgageprofessional.com/news/reverse-mortgage-funding-files-chapter-11-bankruptcy Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed