|

While surging house prices continue to be the focus of market participants, the rental market is increasingly attracting the attention of policymakers, both because of the impact on inflation[1] and the importance of this market for the economic wellbeing of lower-income households[2]. In both cases, there is a widespread consensus regarding the need for new supply to ameliorate these problems. There are many factors that come into play regarding the construction of new rental units, including the availability of private and public sources of credit.

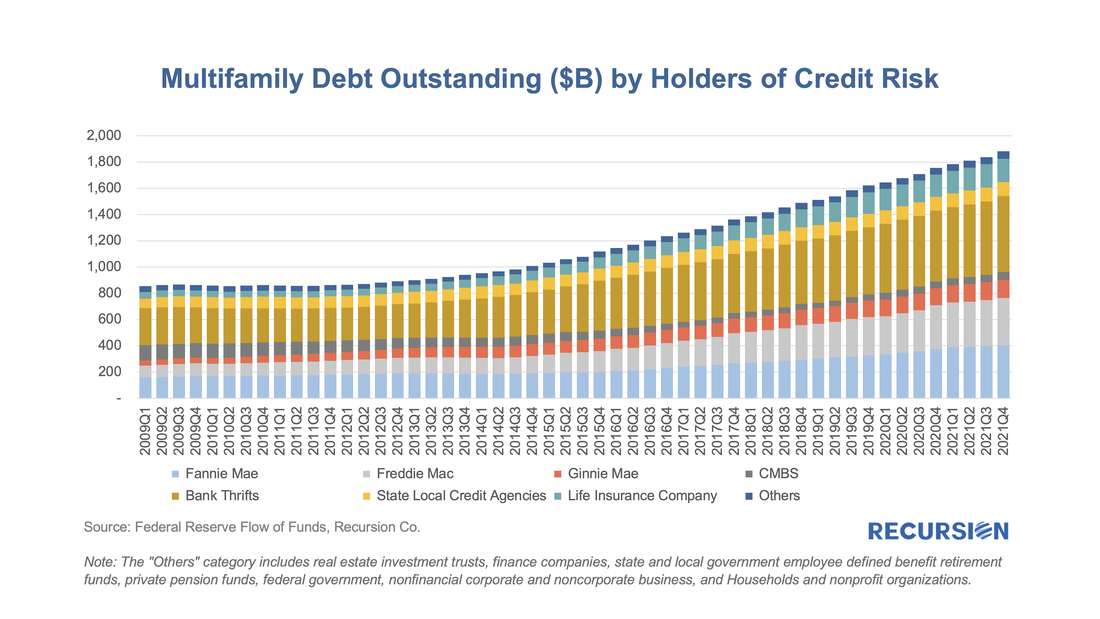

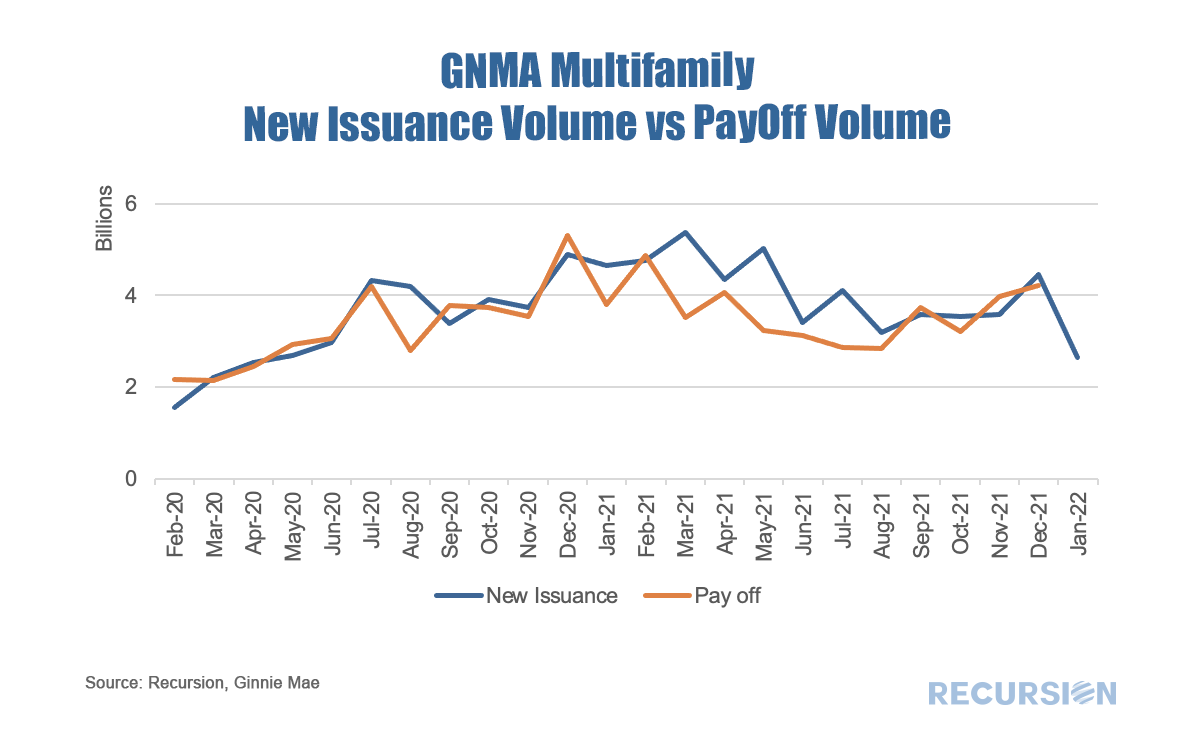

As part of its quarterly release of the "Financial Accounts of the United States"[3], the Federal Reserve publishes data that allows us to break down the trend in total multifamily lending into major categories of credit risk holders: With home prices and interest rates on the rise, policy focus becomes more clearly fixed on the subject of affordability. This is particularly true for renter households, which tend to have lower incomes than is the case for homeowning households. As a result, Recursion is in the process of upgrading its capabilities in this area, through its Multifamily Analyzer. A recent upgrade is the addition of payoff volumes for GNM multifamily programs, in addition to the new issuance volumes already in place. This provides a sense of how much of the total volume is due to expiring loans, and how much to new activity.

During the 2008 global financial crisis, the agency multifamily CMBS (commercial mortgage backed securities) and the RMBS (residential mortgage backed securities) markets performed differently as measured by delinquency rates. For example, at the peak of the financial crisis in Feb. 2010, single family Fannie Mae loans had a 90+ day delinquency rate of 5.6% in Feb. 2010, compared with their multifamily 60+ day delinquency rate of just 0.8% in Jun. 2010. However, the historical performance cannot guarantee the same relationship will hold during the current Coronavirus pandemic. The huge surge in unemployment currently being experienced will fall equally on renters and homeowners alike. The CARES act provides forbearance to households with mortgages, but there is no such broad program for renters[1].

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed