|

On January 27 2022, HousingWire published an article called “GSEs’ cash window loses some luster” that talks about how large nonbanks have increasingly moved to using swap transactions with the Enterprises. Recursion data is used throughout and Recursion’s Chief Research Officer Richard Koss is quoted regarding the fact that only Freddie Mac provides full disclosure of the loans delivered through the cash window while Fannie Mae’s data in this regard is incomplete.

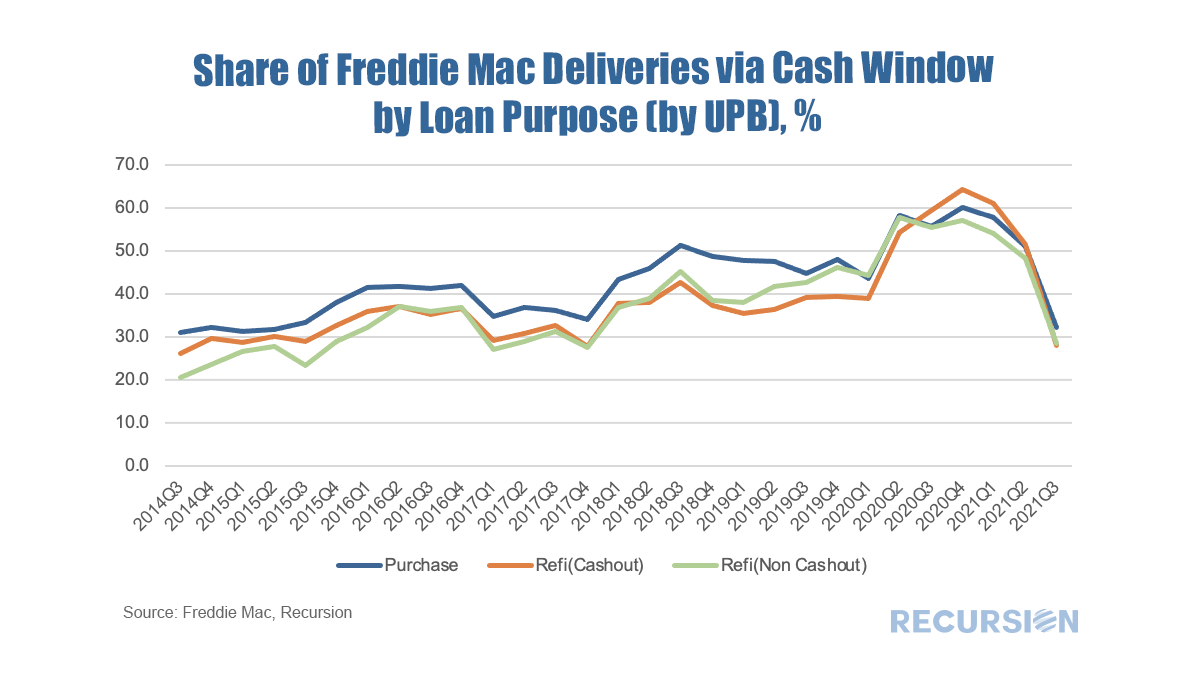

In a recent post, we discussed the market impact that arose from the imposition, and subsequent reversal, of limits on deliveries of NOO (non owner-occupied) residences, as well as on deliveries via the cash window, to the GSEs[1]. In summary, it discussed how the imposition of limits resulted in declines in the share of the NOO categories in the summer, with some rebound in evidence in Q3 when these were rescinded.

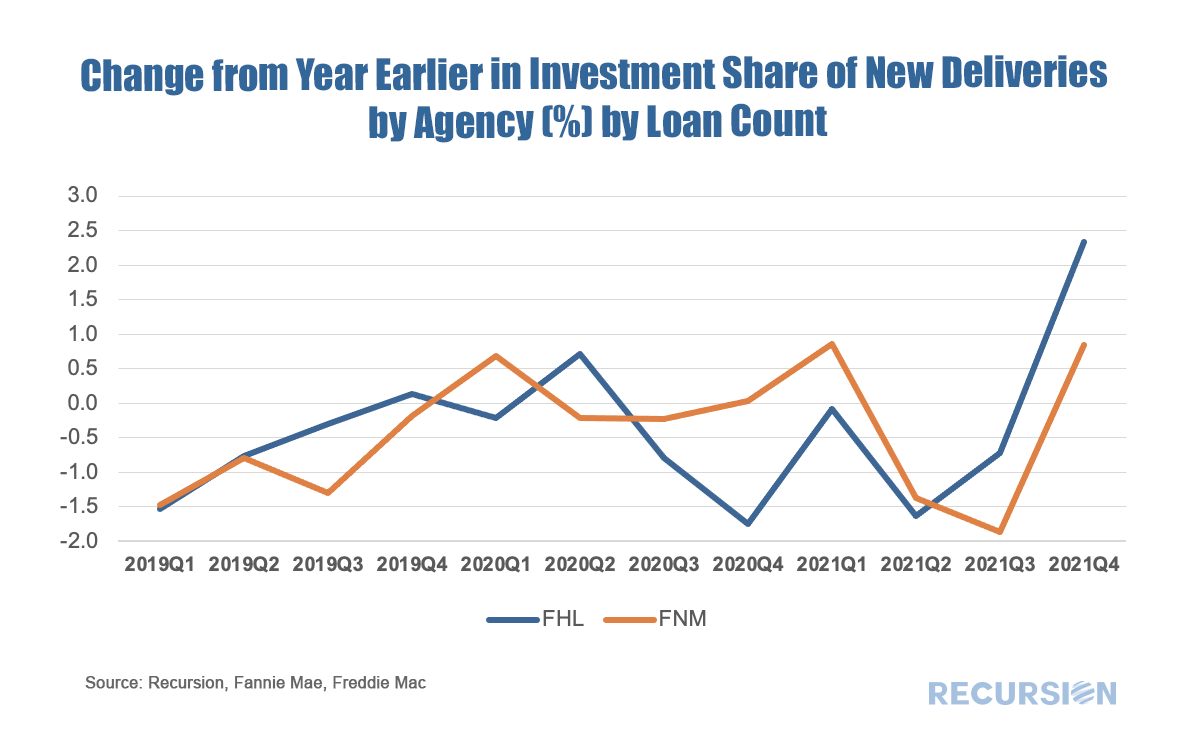

In this exercise, we look at the change in the share of purchase mortgage deliveries to both Enterprises from the same quarter in the prior year. This is done to eliminate the seasonal pattern that is in evidence in these shares that derive from the fact that owner-occupied purchases tend to have a strong seasonal pattern (peak in the spring) while the NOO categories do not. If the suspension of the constraints in September 2021 were binding, we would expect to see a jump in the share in the NOO categories in Q4. This is certainly the case for investment properties: In a recent post[1], we looked at the share of the use of the cash window for bank and nonbank sellers. We found a reversal in the long-term upward trend in this share this year, correlated with the imposition of FHFA imposed lender-level caps on the use of the cash window. We next turn to performance.

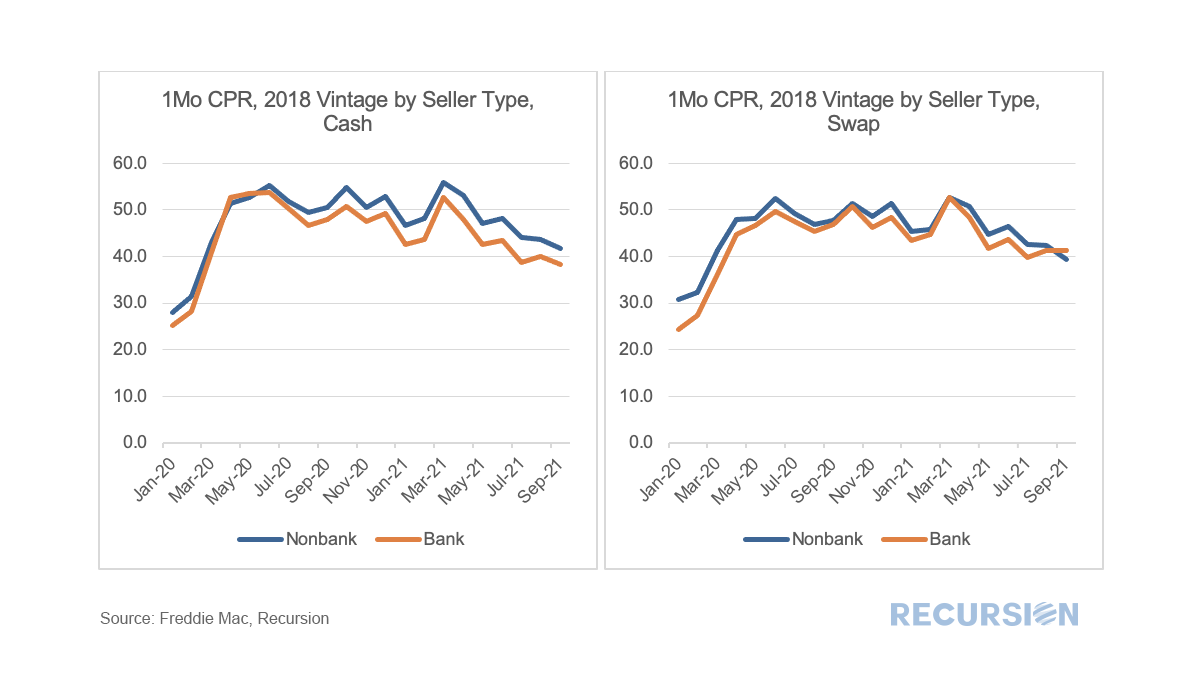

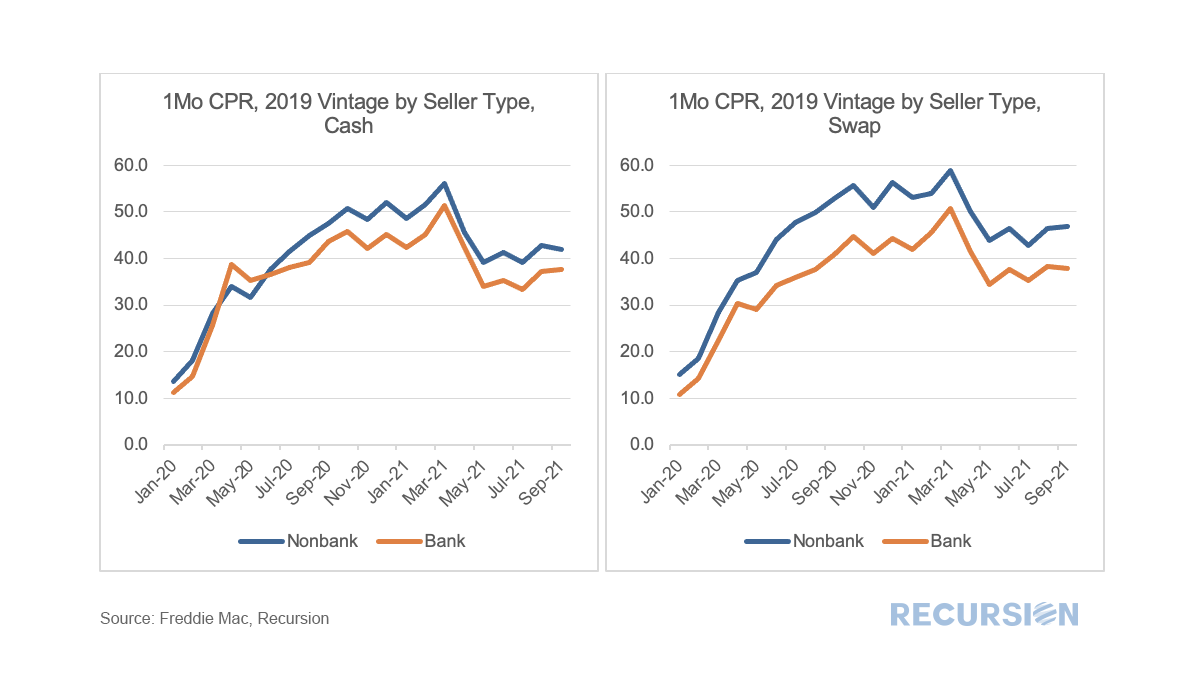

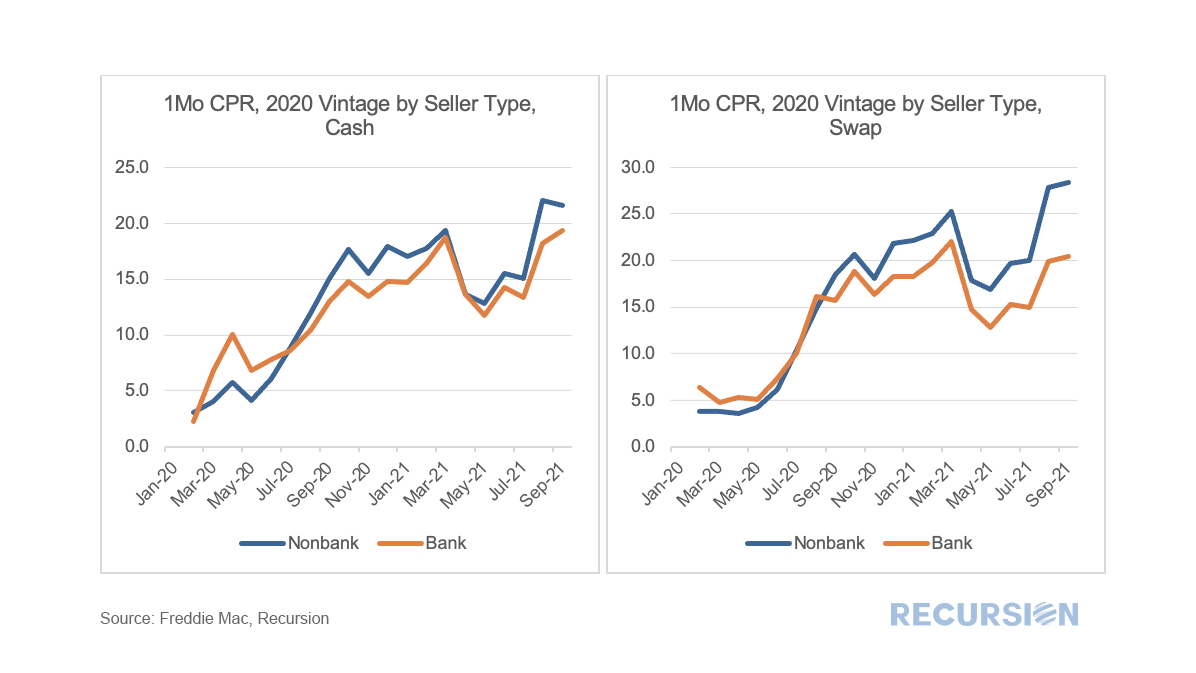

We look below at prepayment speeds for the 2018, 2019 and 2020 cohorts broken down by bank and nonbank sellers. It’s always interesting to look at the underlying dynamics within the mortgage market to get a deeper handle on the forces behind recent trends and to gain insights into the market impact of policy changes. This time we will look at a breakdown of the market between the cash window and swaps. Simply, in a swaps transaction the lender sends loans to one of the Enterprises, Fannie Mae or Freddie Mac, and in return obtains a security which it can keep as an investment (mostly in the case of banks) or else sell into the market (both banks and nonbanks). The alternative is to sell the loans directly to the Agencies for cash. This is important to nonbanks in particular as this cash is used as a funding source for running their businesses.

As it turns out, neither GSE reports the path by which a loan is obtained in their loan-level disclosures. However, in the case of Freddie Mac, cash loans are placed in their own pools with distinct prefixes. As a result we can unpack these pools and perform a matching exercise with the loan tape and assign these accordingly. This allows us to perform queries on this characteristic across our loan-level querying tool Cohort Analyzer. Below find the share of deliveries made to Freddie Mac from the Cash Window by loan purpose. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed