|

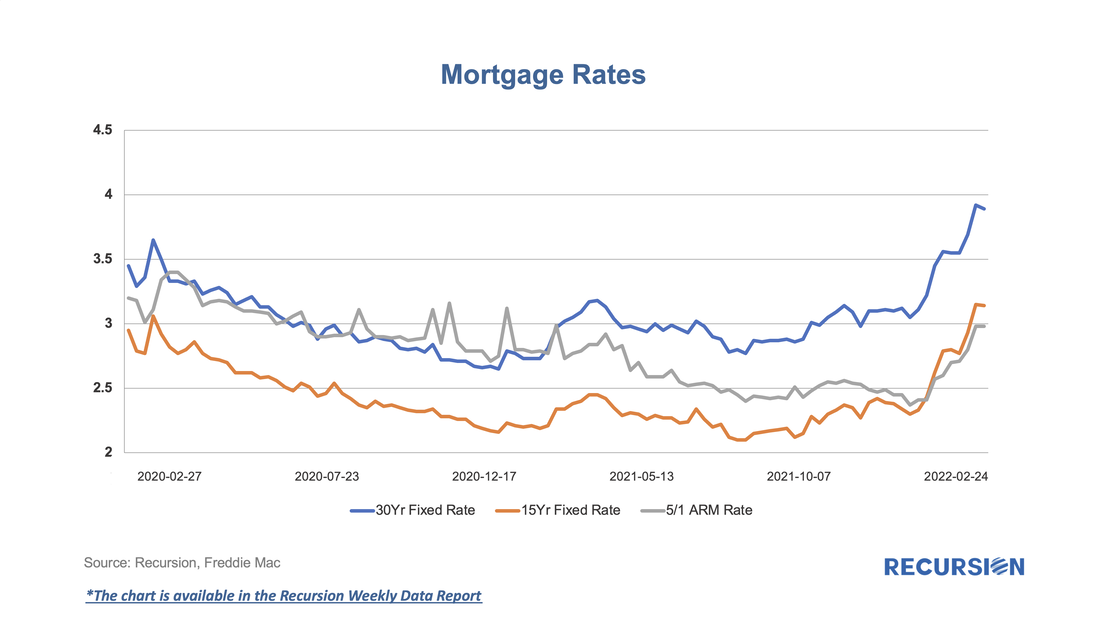

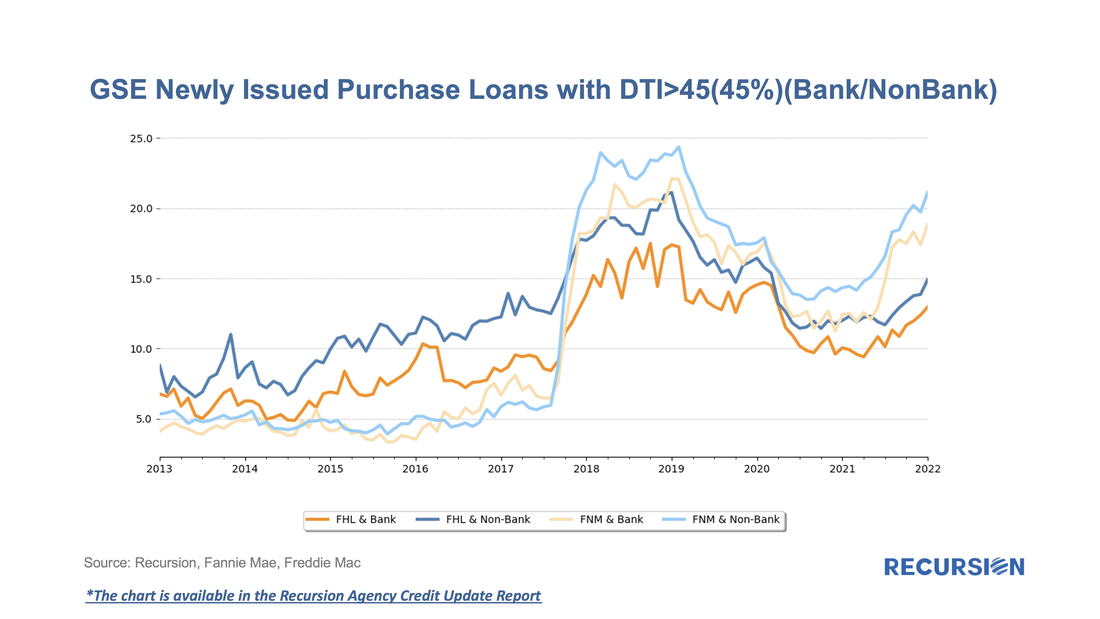

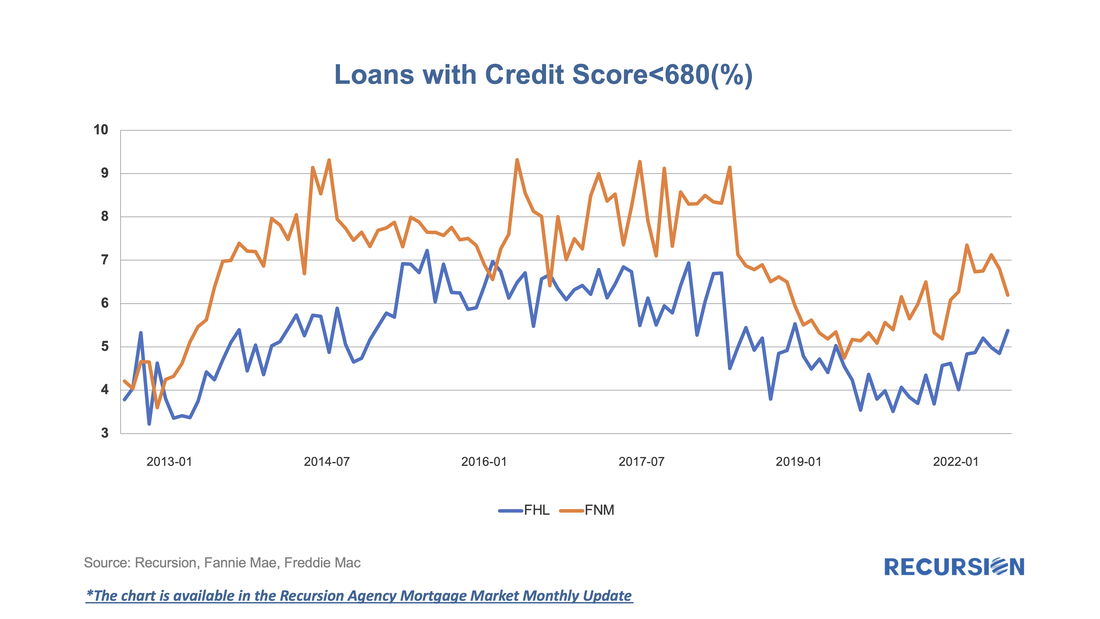

As mortgage rates have moved up recently, we have observed some changing trends in underwriting characteristics associated with GSE new issuance. According to Freddie Mac, the US weekly average 30-year fixed mortgage rate stood at 3.89% as of Feb 24, 2022, which is about a 1.3% increase since the record low level of 2.65% was reached on Jan 7, 2021. As mortgage rates decline, originators become capacity constrained and allocate credit to the highest-quality borrowers. Similarly, to keep lending pipelines full, originators are likely to loosen up their underwriting standards when rates rise. After declining in recent years when interest rates were low, GSE new issuance purchase loans with DTI over 45 started to increase again in the second half of 2021, especially for Fannie Mae, as mortgage rates began to rise. Nonbanks have historically been more active in lending to higher DTI borrowers, but recently the gap between banks and nonbanks has narrowed. We have observed similar trends in credit scores. After the decline in the shares of low credit score borrowers in 2019 and 2020, sellers have recently been delivering an increasing share of loans with credit score less than 680 to the GSEs. We observe these trends by tracking our monthly data reports. If you are interested in the outlook for mortgage market developments, reach out to [email protected] and subscribe to Recursion Reports!

In a recent post, we discussed the utility of secondary market indicators to track the progression of loans that are coming out of forbearance in Government programs[1]. This short note looks at this progression in the conforming loan market.

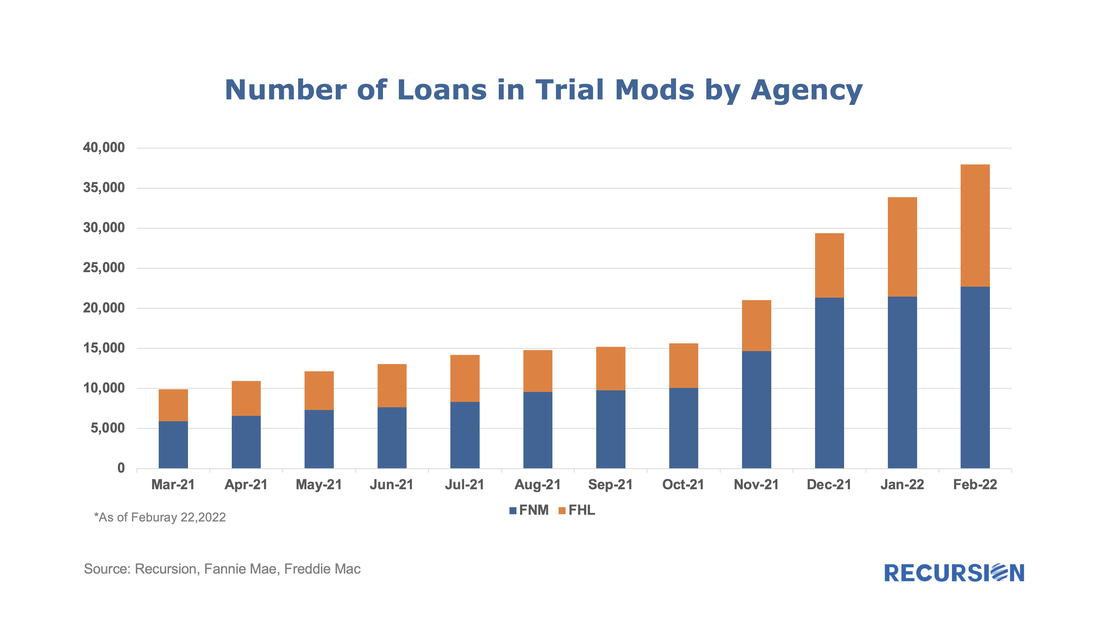

For the Ginnie Mae programs, issuers may buy loans out of pools after they are delinquent more than 90 days and begin a workout process that culminates in one of the options, including loan modification. The situation is quite a bit different for Fannie Mae and Freddie Mac. The main distinction is that on January 1, 2021, the GSEs extended their timeline for buying loans out of pools to 24 consecutive months of missed payments[2]. As the Covid-19 pandemic began in March 2020, we expect to see buyouts being extended as much as to April and May this year. However, we can obtain a view on future loan modifications through the trial mod flag in the borrower assistance plan field in the monthly disclosures the GSEs started to release in March, 2021. In order to obtain a permanent modification, borrowers must first successfully complete a three-month trial modification plan[3]. Below find the progression in the number of loans in such plans since March 2021: In a fine recent paper, the Federal Reserve Bank of Philadelphia “highlights the immediacy of the challenges facing mortgage servicers and policymakers” that arise from the resolution of mortgage forbearance and delinquencies[1]. As of the time of writing, the Philly Fed stated that “some 2.73 million mortgages are either in forbearance or past due; about 0.78 million of those are in Coronavirus Aid, Relief, and Economic Security (CARES) Act forbearance plans”. In addition, “about 47 percent of loans in forbearance will expire in the first quarter of 2022; another 42 percent will expire in the second quarter”. They go on to discuss recent trends and provide data on income and demographics of these borrowers.

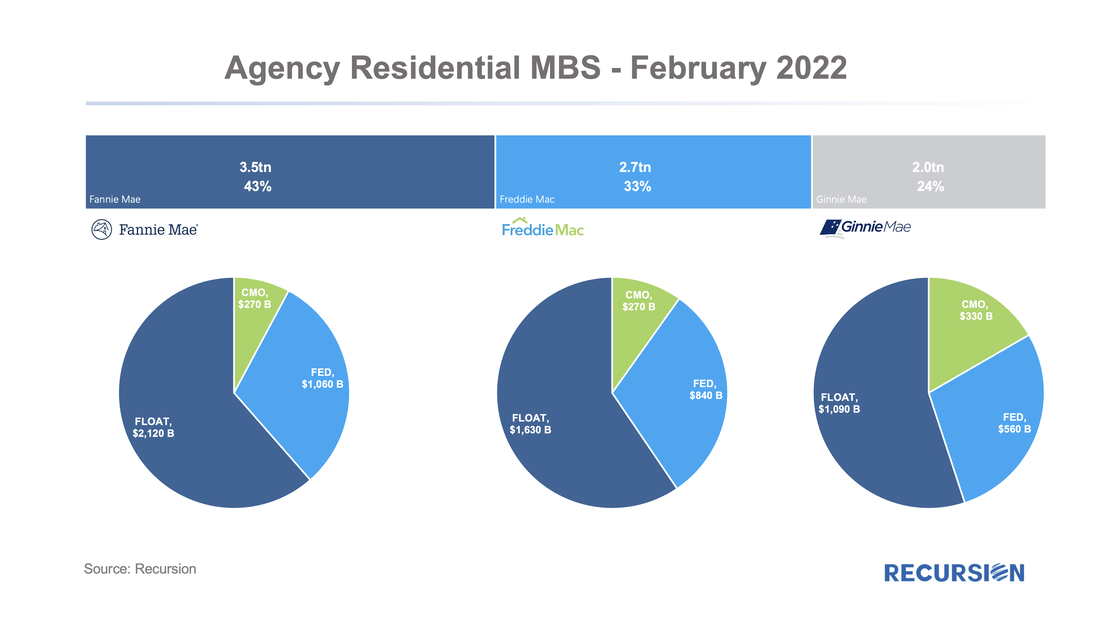

The point of this brief article is to look at secondary market indicators to shed additional light on these issues. The note is broken into two parts, the first looks at Government programs, notably FHA and VA, while the second looks at the GSEs. The Agency residential MBS market is over $8.3tn in February 2022 and is the second most liquid fixed income market after Treasuries.

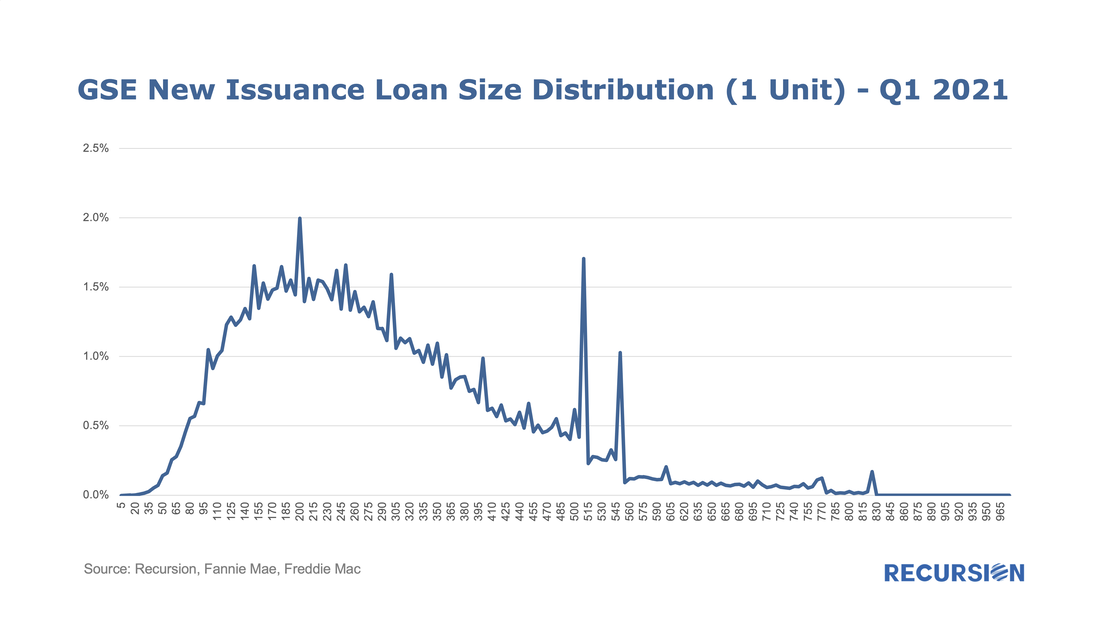

The market shares of the three agencies are: 1. Fannie Mae 3.5tn, ($1.060B in Fed Portfolio, $2,120B in Pools, $270Bin CMOs) 2. Freddie Mac 2.7tn ($840B in Fed Portfolio, $1,630B in Pools, $270B in CMOs) 3. Ginnie Mae 2.0tn ($560B in Fed Portfolio, $1,090B in Pools, $330B in CMOs) On December 30, 2021, FHFA announced that the baseline conventional loan limit for 2022 would rise by $98, 950 to $647,200.[1] The new ceiling for high-cost areas is set at 150% of the baseline limit or $970,800. Since loan limits apply when they are delivered to the agencies, not when they are originated[2], it would be of interest to look at the pace at which loans reaching to the new limit are delivered at the start of the year.

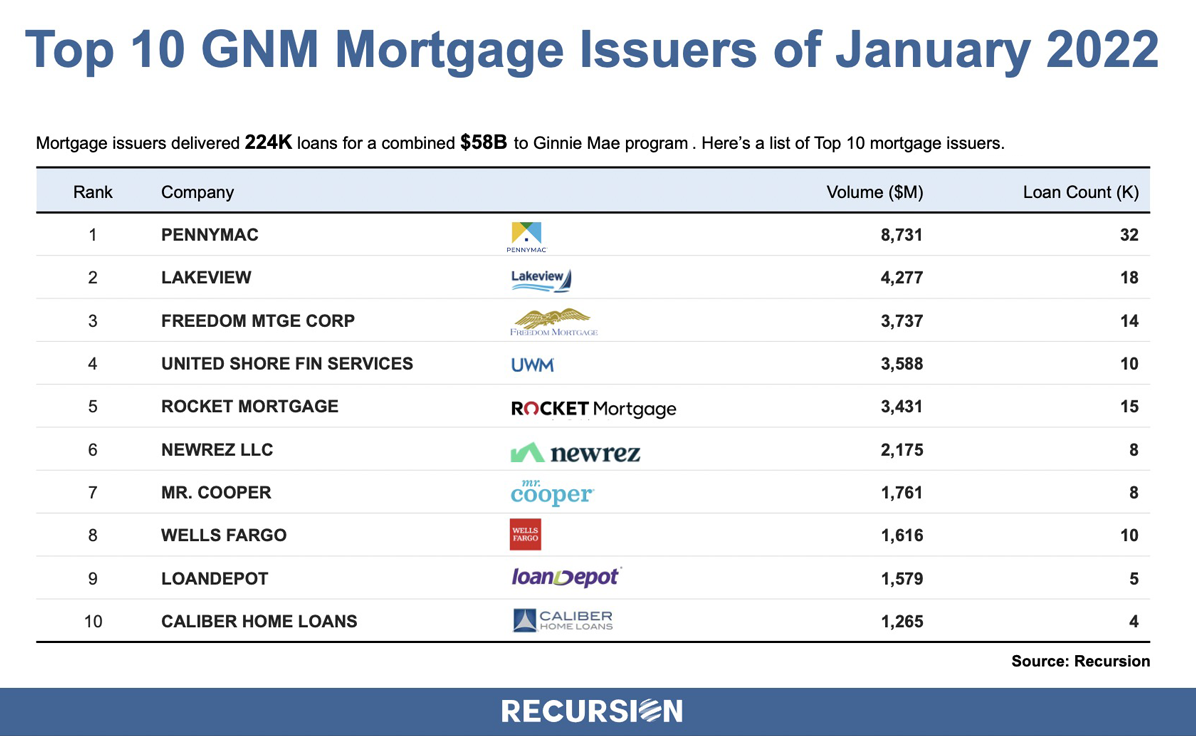

The chart below shows the distribution of mortgages delivered to the GSE’s in Q1 2021 by loan size($K). Recursion released the roaster of TOP 10 GNM issuers and GSE lenders of January 2022.

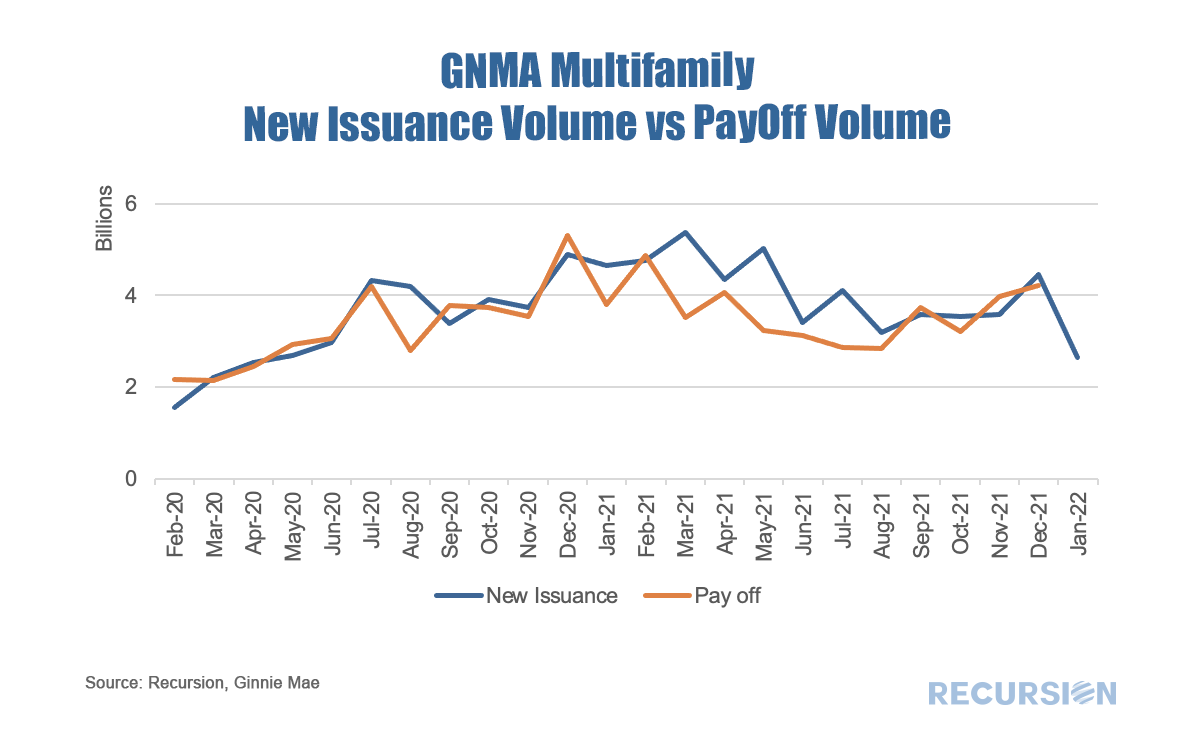

With home prices and interest rates on the rise, policy focus becomes more clearly fixed on the subject of affordability. This is particularly true for renter households, which tend to have lower incomes than is the case for homeowning households. As a result, Recursion is in the process of upgrading its capabilities in this area, through its Multifamily Analyzer. A recent upgrade is the addition of payoff volumes for GNM multifamily programs, in addition to the new issuance volumes already in place. This provides a sense of how much of the total volume is due to expiring loans, and how much to new activity.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed