|

Recursion’s team of 3 led by Chief Executive Officer Li Chang, joined by Kathy Ma and Tianci Zhu, successfully completed the NYCRIN Virtual Innovation Corps Program sponsored by the National Science Foundation.

The curriculum of this program encourages entrepreneurs to get out of the building and talk in person to their targeted market regarding their unmet needs. Recursion’s team completed a great number of interviews during the 8-week program and collected detailed feedback from our current and potential customers. Recursion is always actively developing our products and focusing on providing our customers effective solutions to meet their daily needs. Congratulations Li, Kathy and Tianci! As we head into 2021, an ongoing issue is the disposition of loans in forbearance. The Cares Act allows for borrowers negatively impacted by the Covid-19 pandemic to obtain forbearance up to 1 year[1]. This will begin to expire in Spring 2021, although an extension is possible as the new Administration takes over in January. A key point is that forbearance is not forgiveness. The mortgage agencies have provided options for borrowers who become current after forbearance, so they don’t have to make a lump-sum payment for missed principle and interest.

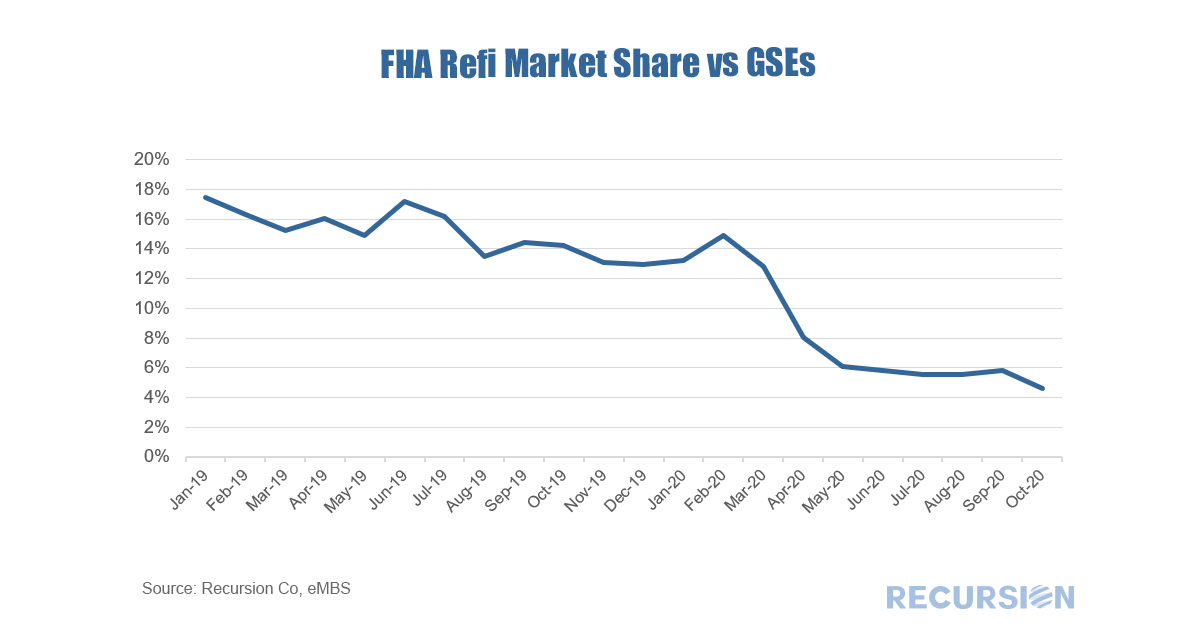

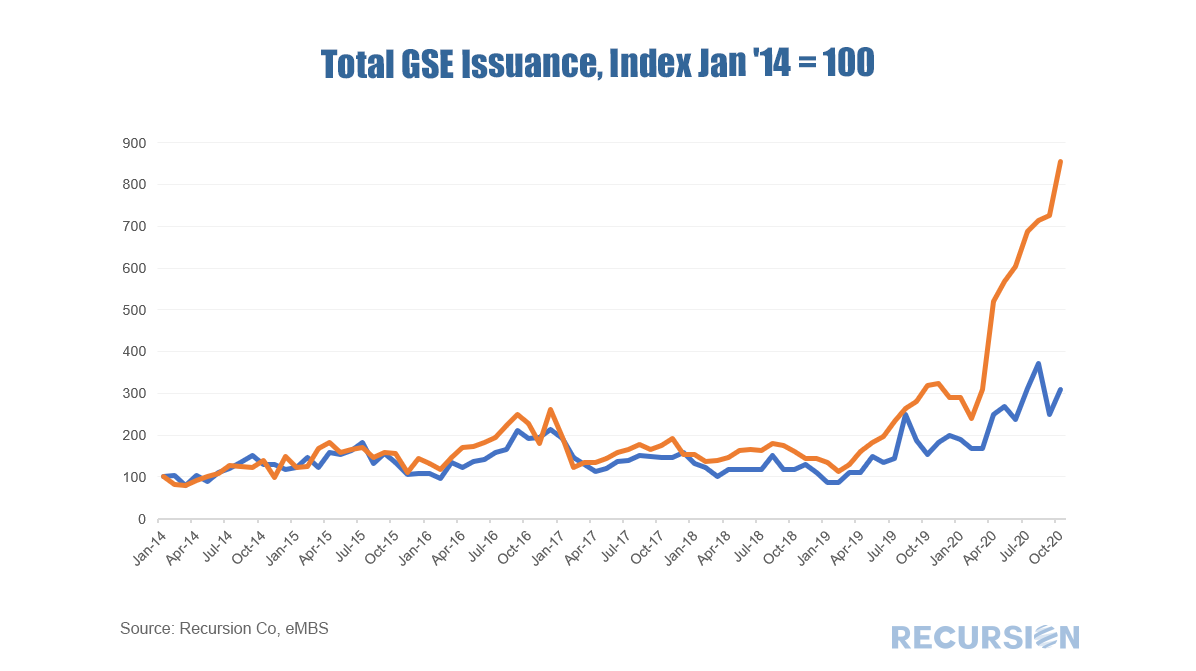

FHA has designated its policy regarding the disposition of suspended payment amounts as COVID-19 National Emergency Standalone Partial Claims[2](COVID Partial Claim). “The COVID Partial Claim puts all suspended mortgage payment amounts owed into a junior lien, which is only repaid when the homeowner sells the home, refinances the mortgage, or the mortgage is otherwise extinguished.” In a recent post we noted the recent striking rise in the GSE refinance share and commented that the rate of this activity in GNM programs, while still rising, has lagged[1]. This seems to be related to the tendency of capacity constrained lenders to provide credit to the highest quality borrowers, and to a looming 0.5% fee hike on GSE refinance deliveries scheduled for December 1.

Focusing on FHA alone, the share of refinance loans compared to those delivered to the GSE’s has plummeted in recent months: Recursion Chief Executive Officer on Podcast Regarding Mortgage Big Data “Democratization”11/23/2020

Our Chief Executive Officer, Li Chang, was invited by the Finding Genius Podcast to talk about the concept of “data democratization” in the mortgage big data space. Li shared how her career path and work experience led her to start Recursion Co. She also described how Recursion rearranges and normalizes “messy” data into business insights, what achievements Recursion has attained, and what types of customers Recursion is seeking currently. Source: Finding Genius Podcast

Unlike the situation during the Global Financial Crisis, imbalances in the housing market are not the root cause of the Covid-19 economic downturn. Instead, housing is helping to pull the economy out of its pandemic-induced swoon. House price rises have accelerated, due both to low interest rates, as well as to household relocations away from high-density areas. This is leading to increased construction, and improved household balance sheets. Moreover, a surge in refinances improves household cash flow. How long can this trend continue?

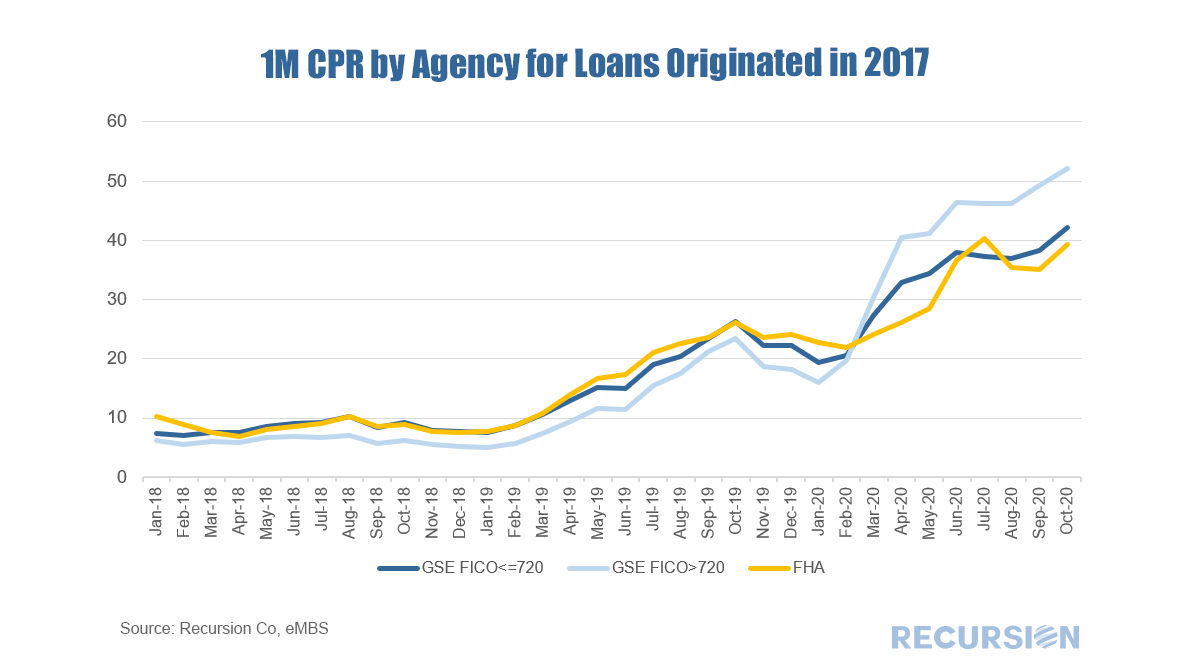

The answer to this question depends crucially on many varied policy settings that influence lender and borrower behavior. The chart below shows 1-month CPR for 30-yr MBS securities broken down between the 30-Year GSEs and 30-Year FHA for the 2017cohort. A number of fundamental and policy factors come into play. For some time, we have been writing about the surge in the share of nonbanks in mortgage underwriting and servicing[1]. We are just getting GSE data for October and the results are striking:

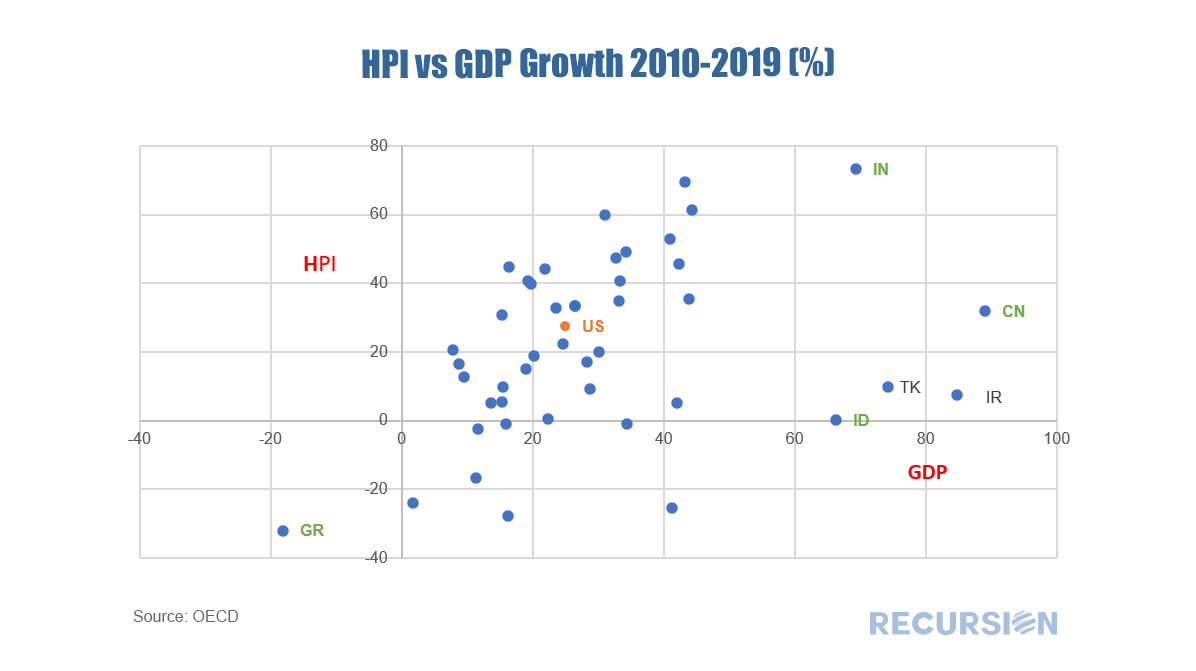

Our monitoring of the US housing and mortgage markets tends to focus on details obtained from a micro view of the market. This post takes a quite different perspective of treating the US as a single point across an international perspective. This is part of a long tradition in economics, including at the Federal Reserve[1], but is used infrequently as the market focus is generally directed more narrowly. But interesting patterns do emerge by stepping back and taking a big picture view.

For example, here is a scatter diagram of cumulative real house prices vs GDP from 2010-2019 for 45 countries using data from the OECD. Recursion’s Chief Executive Officer Li Chang and Chief Research Officer Richard Koss spoke at the Mortgage Servicing Rights Virtual Forum hosted by Information Management Network (IMN) on October 29th.

Recursion’s Chief Executive Officer Li Chang joined the Servicing In-House vs Outsource panel and discussed mortgage delinquency and servicing costs. The video can be access through https://vimeo.com/473559723 Chief Research Officer Richard Koss joined the Modeling and Stress Tests panel, and discussed the impact of forbearance in these areas. The video can be access through https://vimeo.com/473622572 |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed