|

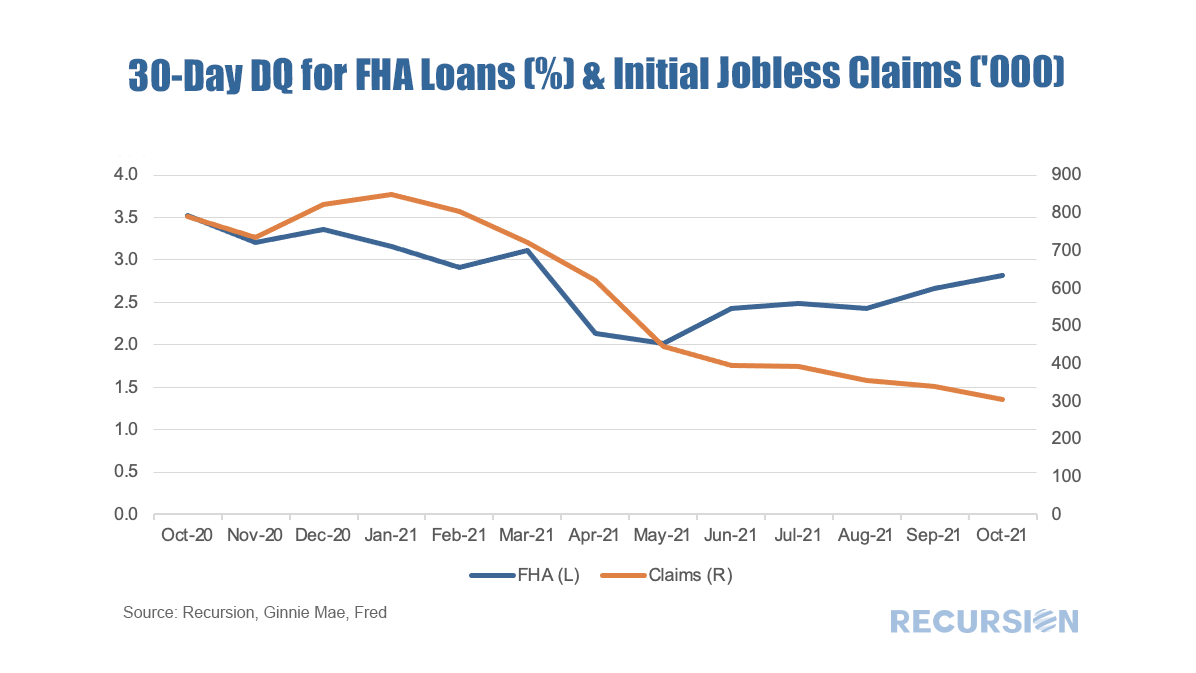

Received wisdom in the mortgage market holds that distress in the mortgage market eases as the labor market improves. While there is certainly some justification for this view, in fact there are many factors that drive performance so the direct correlation with the jobs market does not always hold.

Recursion is teaming up with Lincoln Institute of Land Policy and Rice University to work on the Underserved Mortgage Markets Coalition project and the Social Policy Analysis Capstone Course (“SOPA”).

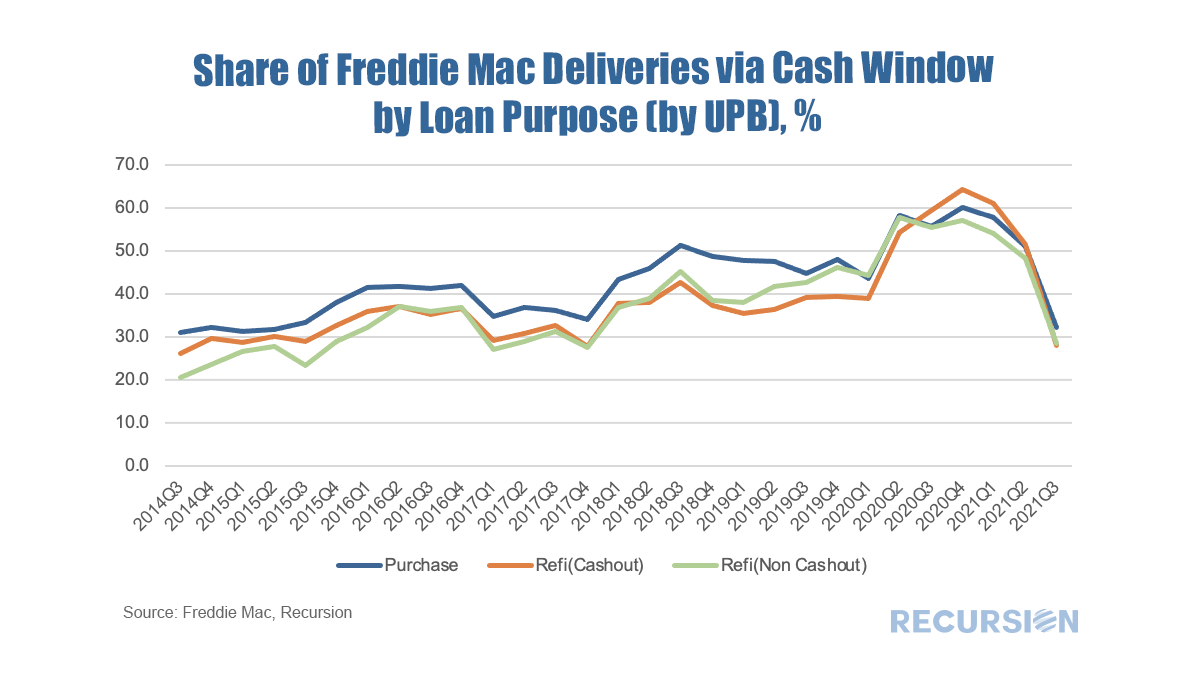

It’s always interesting to look at the underlying dynamics within the mortgage market to get a deeper handle on the forces behind recent trends and to gain insights into the market impact of policy changes. This time we will look at a breakdown of the market between the cash window and swaps. Simply, in a swaps transaction the lender sends loans to one of the Enterprises, Fannie Mae or Freddie Mac, and in return obtains a security which it can keep as an investment (mostly in the case of banks) or else sell into the market (both banks and nonbanks). The alternative is to sell the loans directly to the Agencies for cash. This is important to nonbanks in particular as this cash is used as a funding source for running their businesses.

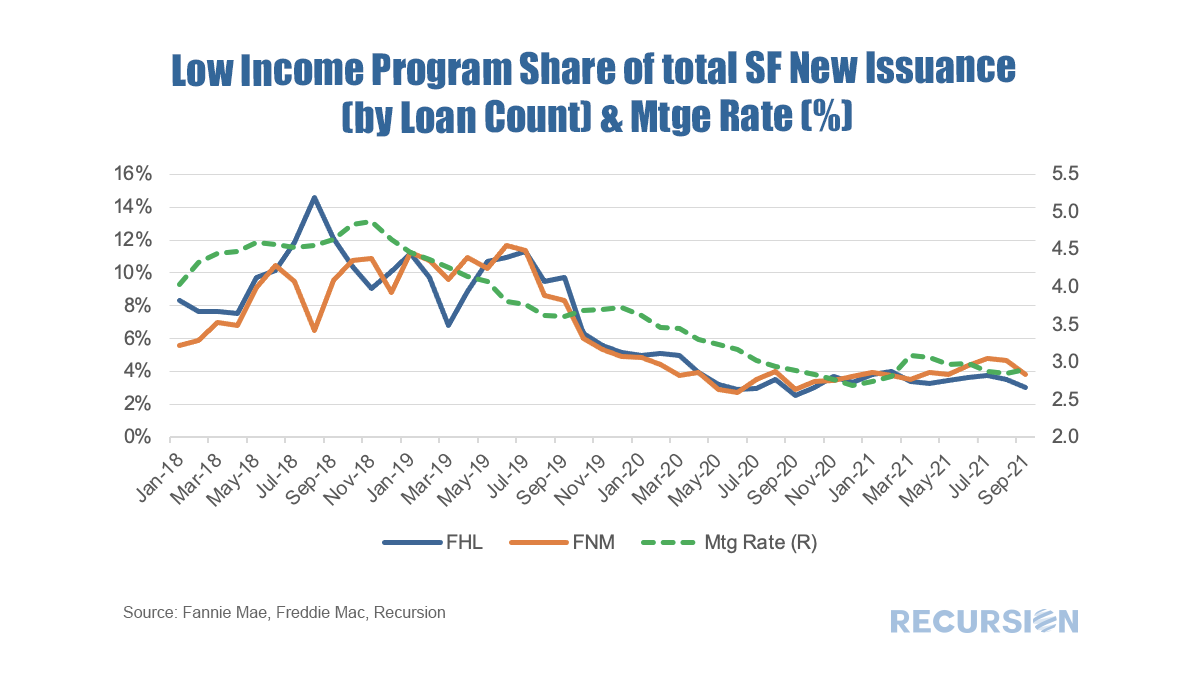

As it turns out, neither GSE reports the path by which a loan is obtained in their loan-level disclosures. However, in the case of Freddie Mac, cash loans are placed in their own pools with distinct prefixes. As a result we can unpack these pools and perform a matching exercise with the loan tape and assign these accordingly. This allows us to perform queries on this characteristic across our loan-level querying tool Cohort Analyzer. Below find the share of deliveries made to Freddie Mac from the Cash Window by loan purpose. Recently, the GSE’s Fannie Mae and Freddie Mac released loan-level data associated with their “Special Eligibility Programs” that look to extend credit to low-income borrowers. As housing policy is increasingly focused on providing this market segment access to this market segment, this data will prove useful to housing analysts looking to assess the effectiveness of these programs as well as to traders looking to understand the impact on the performance of MBS containing these loans.

Briefly, each agency has three programs. There are many differences in details between the programs.

As the refi programs are relatively new and volumes are small, in this post we focus on the first two. For convenience, we refer to the first as the “Low-Income Programs” and the second the “HFA Programs”. Below find the market share of Home Ready and Home Possible out of total volumes for their respective Agencies by loan count: Our Chief Research Office Richard Koss gave a speech at the forum Food for Thought on Wednesday, September 22 at Columbia University about housing policy changes during the Covid-19 Pandemic. Food for Thought is a speaker series that focuses on the Covid-19 crisis and social justice reform. Richard will discuss his paper about the policy response to the unexpected arrival of the global pandemic. His speech paper The New Housing Policy is available to download.

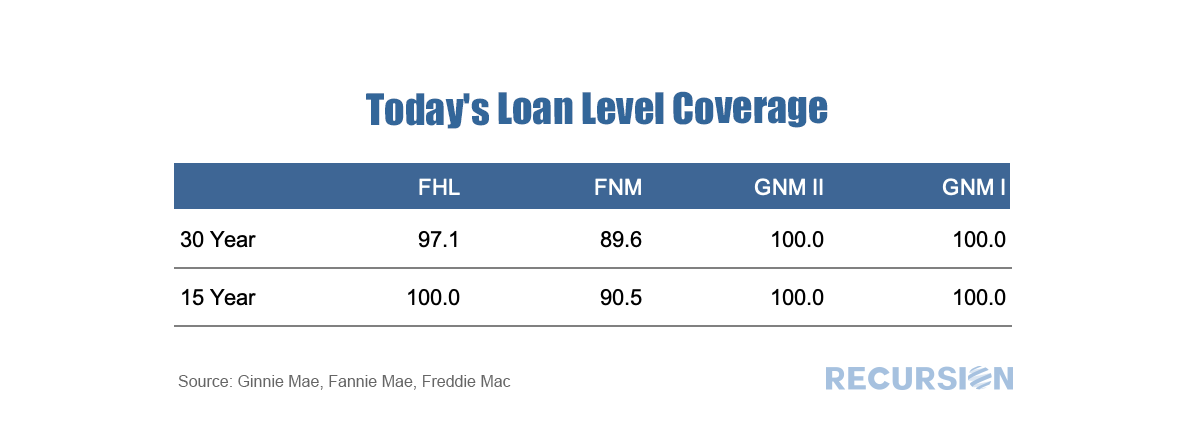

As we mentioned in our previous blogs, Recursion’s proprietary tools Cohort Analyzer, and Pool Level Analyzer can analyze FED and CMO portfolios recursively down to the “simple pool” level. There are a wide range of applications of these powerful tools. We previously demonstrated how to calculate FED portfolio and CMO lockup rates at the macro level. Another important application is to study the collateral of mortgage bonds directly at the loan level in order to support investor’s trading decisions. To read the full article, please send an email to [email protected]

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed