|

In a recent post[1], we spoke about how the current market environment of high interest and home prices is leading to downward pressure on both supply and demand in the housing market, a situation we call "Mortgage Winter". While this environment is unlikely to result in a severe recession such as the Global Financial Crisis, there is the potential for broad fallout associated with distress in the lender and broker markets.

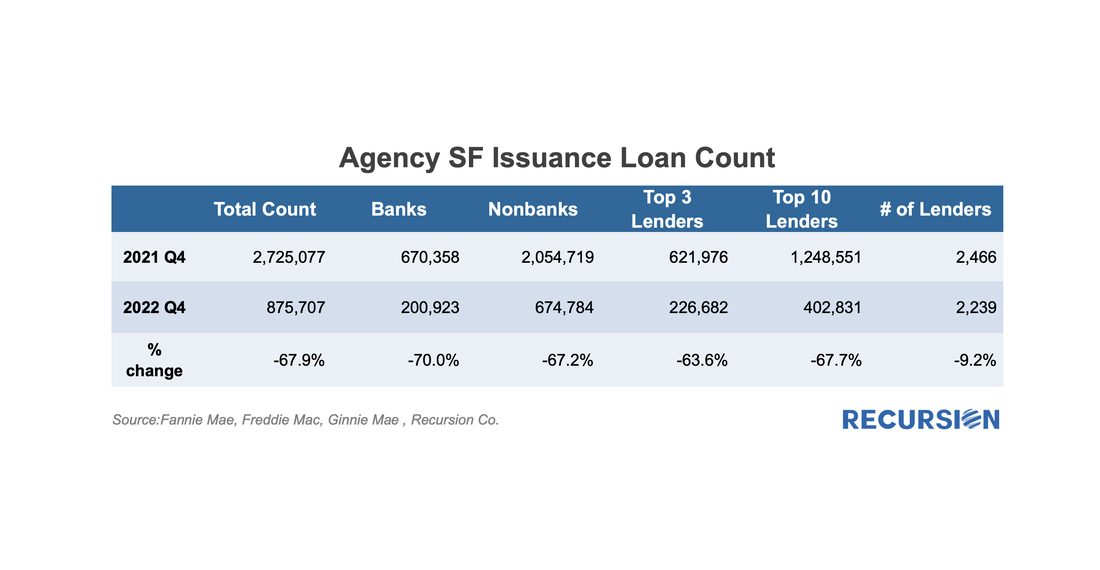

First, we look at the originations. The count of loans that were delivered to the three agencies dropped by 68% from Q4 2021 to Q4 2022: The rise in mortgage rates is having a profound impact on lender strategies in the mortgage market. These can be seen by looking at trends in the use of Third-Party Originators (TPOs). Some lenders, such as Quicken, traditionally work almost exclusively with loans originated in-house, while others, such as PennyMac, primarily accumulate and package loans produced by other lenders. Most larger institutions do some of both. The advantage of acquiring loans from a mortgage broker or correspondent in addition to origination is that the lender has flexibility regarding what method they use to turn volumes up and down to fit its strategy and market views. In both cases, there are costs to increasing and cutting capacity. As the market grows, bringing on new employees carries expenses such as training, while building trusted new external relationships can also be time-consuming. As markets contract, there are direct costs to layoffs, while unwinding networks can impact relationships that can be difficult to rebuild when the cycle turns. Of course, in a sufficiently bad market, the company may have no choice but to cut back.

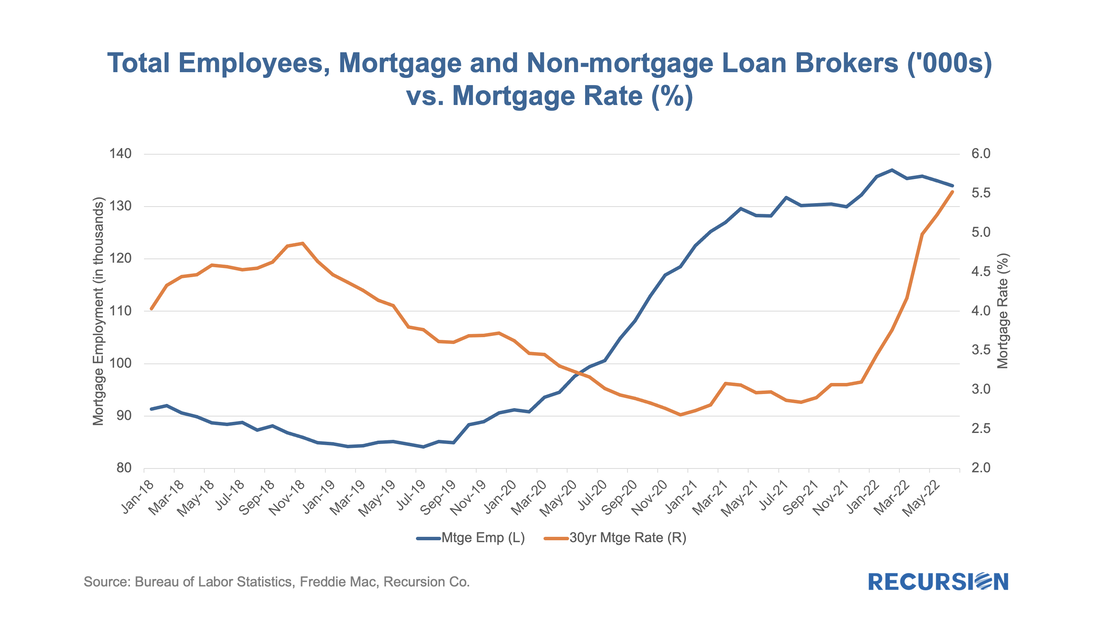

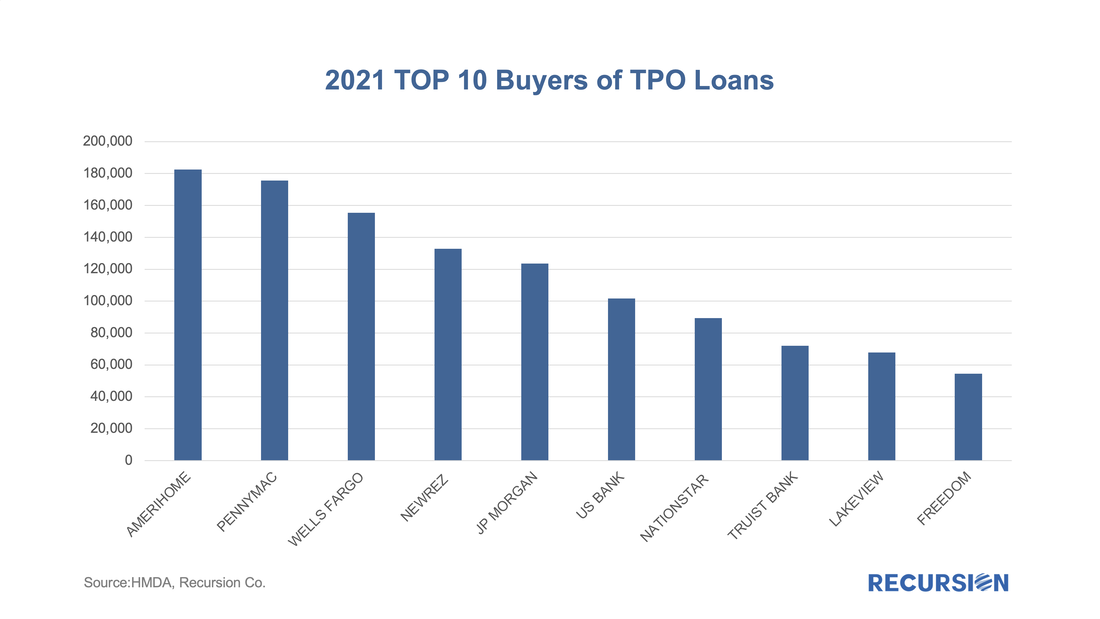

Recently there have been some high-profile announcements of layoffs across the mortgage lending space, but through the first half of 2022, the reported decline in employment has been modest. But employment tends to lag interest rates, so further declines cannot be ruled out. Usually, when we talk about financial institutions in our posts, we focus on sellers and/or servicers as we have a clear view from the Agency disclosures. An interesting distinction in this regard is to break down originations between those sourced through a retail channel within the lending institutions and those purchased from other lenders, known as third-party originations (TPOs). We are often asked the question in the case of TPO lending, where only sponsors of the mortgages are reported, who are the originators? This information is not reported in the agency loan-level disclosure. We can supplement this information by examining originators in the HMDA data by observing the fact a TPO (correspondent or broker) loan is often reported twice, one record reported by the originator and another reported by the sponsor. At Recursion, we conducted an exercise by matching the pairs together, and we were able to identify the counterparty pairs for about 50% of the mortgages marked as “purchased”, and also made this revealing data point to our HMDA Analyzer users.

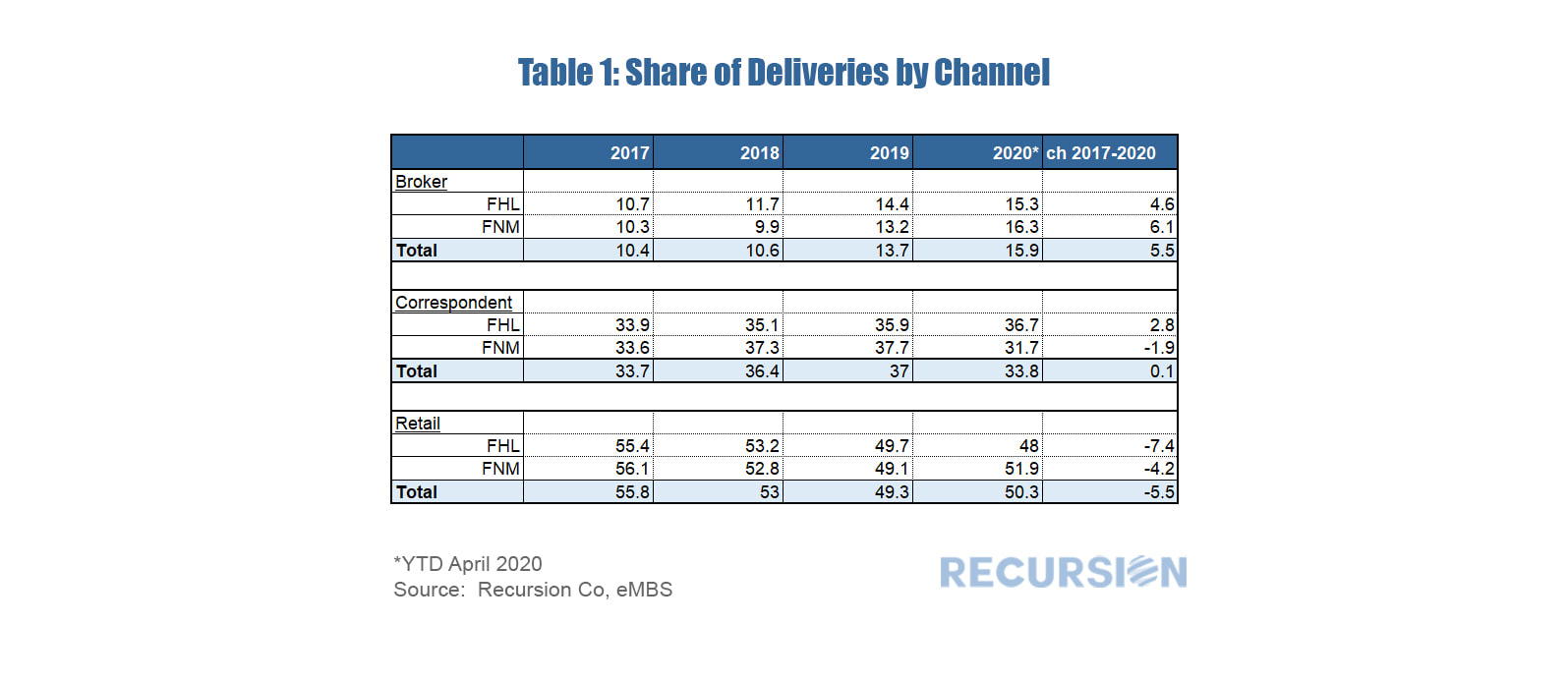

According to the 2021 HMDA preliminary release, about 2.65 million loans were purchased from other lenders that year, about 18% of all originations. Roughly half of these purchases were made by 10 institutions: Mortgage lenders obtain loans through three channels 1) The retail channel through which they originate loans, 2) The wholesale channel through which they purchase loans that are originated by other financial institutions, and 3) the broker channel through which they acquire loans that are originated by the lender through an independent mortgage banker not affiliated with the originating institution. Channels from outside the selling institution are called Third Party Originations or TPO’s. Every month Fannie Mae and Freddie Mac report the selling institution of every loan delivered to them, and the channel by which the loan was obtained. Over the last couple of years there has been a notable rise in the share of the broker channel. This note looks at recent trends and looks for market segments in which these are most pronounced, with an emphasis on the broker channel. Table 1 shows the market shares of sales to the GSE’s by channel.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed