|

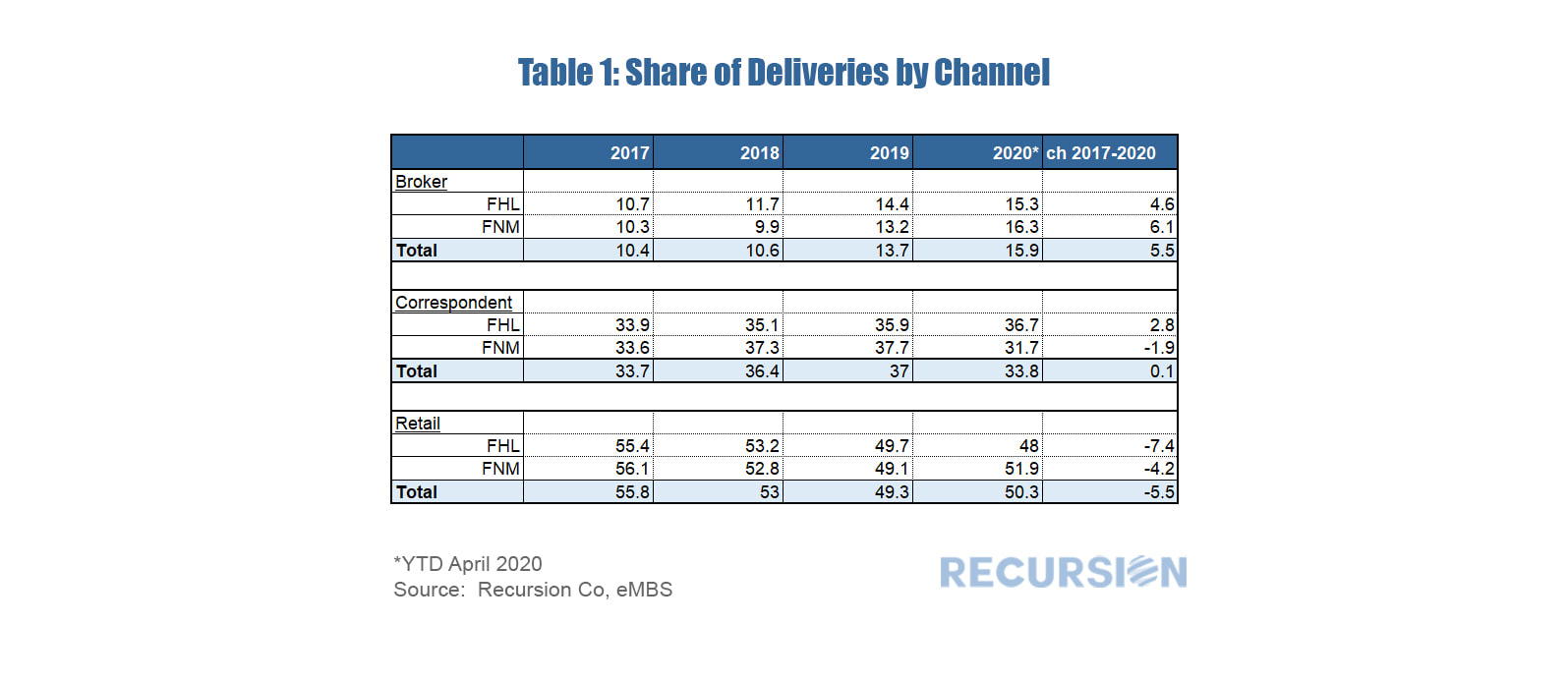

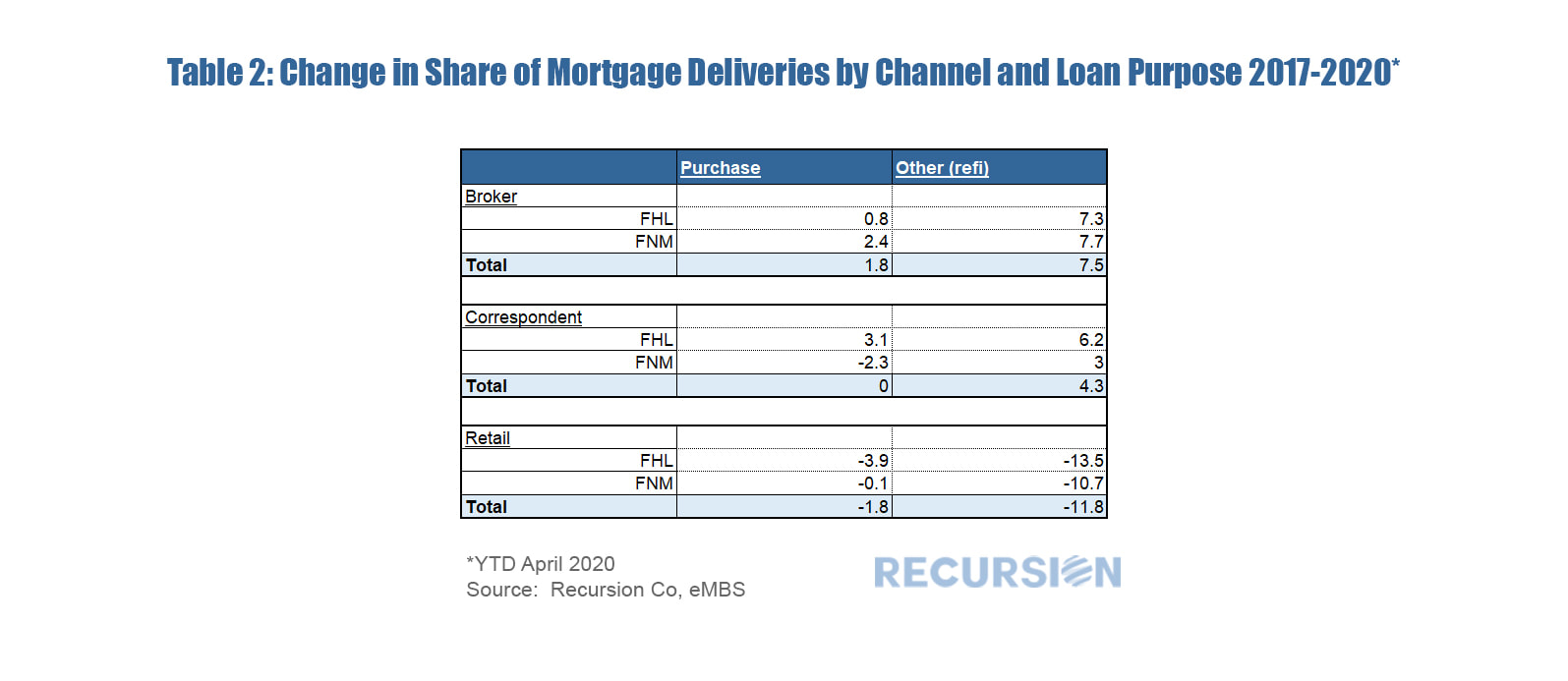

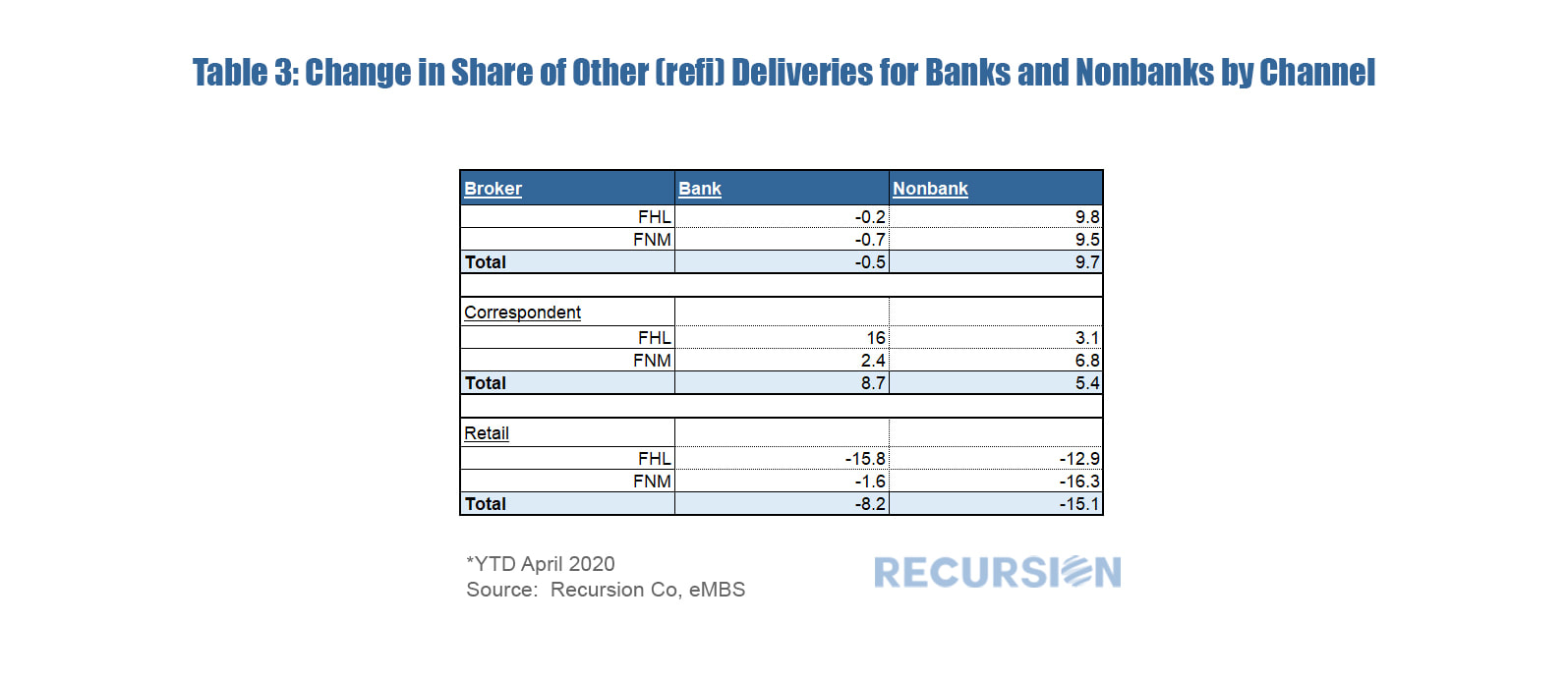

Mortgage lenders obtain loans through three channels 1) The retail channel through which they originate loans, 2) The wholesale channel through which they purchase loans that are originated by other financial institutions, and 3) the broker channel through which they acquire loans that are originated by the lender through an independent mortgage banker not affiliated with the originating institution. Channels from outside the selling institution are called Third Party Originations or TPO’s. Every month Fannie Mae and Freddie Mac report the selling institution of every loan delivered to them, and the channel by which the loan was obtained. Over the last couple of years there has been a notable rise in the share of the broker channel. This note looks at recent trends and looks for market segments in which these are most pronounced, with an emphasis on the broker channel. Table 1 shows the market shares of sales to the GSE’s by channel. It can be easily seen that the broker channel has gained about 5.5% in market share since 2017, virtually all at the expense of the retail channel. That is, financial institutions are increasingly relying on independent brokers to source new loan production at the expense of internal mortgage bankers. This is true for loans delivered to both Fannie Mae and Freddie Mac. It’s natural to ask what sorts of loans (by loan purpose) are being sourced this way. Table 2 looks at a breakdown in the change in share by purchase and other (largely refi) loans. It appears that the bulk of the gain of share of the broker channel is in the other (refi) category. Of these, the final breakdown we look at is between bank and nonbank sellers, and this is displayed in Table 3. The data displayed in Tables 1-3 reveal a material increase in the use of the broker channel on the part of financial institutions that sell loans to the GSE’s over the past several years. The market segment that has been most impacted is refinance loans delivered by nonbanks. This is intuitive as banks tend to have extensive branch networks that act as bases for mortgage production. Purchase loan production tends to be more personal than that for refinances, where borrowing costs are the main factor driving lender decisions. Nonbanks tend to leverage technology and lower regulatory costs to effectively compete in the refinance market. Much work remains to delve deeper into factors driving these trends. This can be done using big data tools to examine characteristics of millions of loans and thousands of lenders.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed