|

One of our ongoing themes is that pervasive structural change implies that traditional relationships between measures of market performance and economic fundamentals cannot be relied on to be stable over time. As a result, a broader view across markets is called for. Below see 90+Day delinquency rates as reported by the Federal Reserve Bank of New York’s Household Debt and Credit Report:[1] There are quite a few points to take away from this chart. Note the peaks around the time of the Global Financial Crisis (2009-2010) and the onset of the Covid Crisis (2020-2021). These correspond well with comparable spikes in the unemployment rate (10% in October 2009 and 14.8% in April 2020). But the composition is quite different. During the GFC mortgage, DQs spiked very much higher for mortgages than those for car loans, while the pattern was reversed during Covid. This can reflect differences in policy between the two periods (mortgage forbearance in 2021 but not 2011), but also, this likely reflects consumer’s views on the value of paying off different types of debt. In 2010, house prices were plummeting, so incentives to pay towards an underwater mortgage were low, but they needed their cars to get to their jobs, so they continued to pay off their auto loans. During the more recent Covid crisis period, homeowners in distress had access to forbearance programs. This brings us to the more recent period. We see that delinquency rates across products started to rise in late 2022 across debt classes. Of note is the sharp increase in 90-day DQs for credit cards from 7.7% in Q4 2022 to 10.7%, above the Covid crisis peak of 10.0% in 2021Q1 and the highest reached since 10.9% in Q2 2012. Car loan DQs rose modestly from 3.7% to 4.4% over this period, while mortgage DQs inched slightly higher from 0.4% to 0.6%. The superior performance in mortgages is no doubt due to the post-Covid surge in house prices, which has created a powerful incentive for homeowners to stay current on their mortgages. But the interesting observation is that these increases occurred even though the unemployment rate has remained less than or equal to 4.0% for the past 18 months. Clearly there is a class of distressed borrowers out there in this relatively strong labor market. Since the NY Fed data contains no detail at all in terms of these borrowers, we take a deep dive into mortgage delinquencies based on agency disclosures. We start by looking at total delinquencies of the total books of business for the GSEs and FHA: It's interesting to note that the trend in all cases is flat-to-down, in contrast to the slight rise in the NY Fed data[2]. There are many possible explanations for this, including that our data do not contain VA or non-QM loans, and that the NY Fed data is based on a 5% sample while ours covers the entire universe of outstanding mortgages in the GSE and FHA programs[3]. For our purposes, the most interesting program is FHA since these borrowers tend to have lower incomes, lower credit scores, and less experience managing debt compared to other mortgage holders, implying that they have relatively higher vulnerability to adverse economic conditions[4]. The thing is, as mentioned earlier, conditions are not that adverse. To find trends in distress in the FHA program we look at modified loans as these started out as loans that were determined to be unsustainable to begin with. In fact, performance here has deteriorated on trend over the past couple of years: The 90-day DQ rate for these loans almost doubled from 4.1% in February 2022 to 8.0% in March 2023 and has been in a volatile but flat trend since that time. We look for fundamental trends to scale this trend, in general, from labor market indicators, which we feel is the key driver of mortgage performance. There are many such candidates, but here we look at the Kansas City Federal Reserve Labor Market Condition Indicators (LMCI)[5]. These indicators consist of 24 distinct labor market variables. The indicator we use is the LMCI Level of Activity index. It is scaled so that a number above zero indicates a stronger level of activity than the long-term average. In the chart above, we invert this indicator so as to see the correlation with rising distress in FHA modified loans. It seems that modified loans are sensitive to deceleration in labor market activity. We can dig deeper into this phenomenon by breaking the data down into different categories: Here, we break the FHA universe into four categories: ET loans, mods ex ET, RG and other purposes. ET is extended term, which are generally 40-year mortgages. RG is Reperforming, which is not a mod but a loan leaving forbearance with a partial claim. All four categories exhibit quite different behaviors with ET loans displaying sharply worse performance than the other categories. It’s important to note that the ET share is quite small but growing: The above chart points out that while looking at DQ charts is informative, they can be somewhat misleading in situations where programs have been around for different lengths of time. One way to get around this is to look at particular cohorts. Below find DQ’s for the 2022-2024 cohort: It’s interesting to note here the stability in the Mod ex-ET and other categories. Growing distress is visible for the newer RG and ET programs, although the DQ rates for both peaked earlier this year. Finally, another way of looking at distress over time in a consistent pattern across programs is via Early Payment Defaults (EPDs). These are the share of loans that experience two or more months of missed payments in the first six months after origination: EPDs jumped with the onset of Covid but quickly fell back after forbearance and other policy programs were instituted. More recently, we can see distress in the various mod programs while loans in the Other category exhibit little such behavior. This difference is interesting because the incentive to pay for more recently-originated mortgages is very much less than those prior to 2021 given the recent jump in home prices. To conclude, examining the behavior of nonpayment of debt is a very complex task, which varies by loan class, and subclass. It depends on the financial health of borrowers, and the state of the economy, particularly with respect to labor markets. It is important to avoid making broad statements about trends in DQs without taking these factors into consideration. Finally, we do not see broad signs of distress in consumer debt markets (particularly credit cards) spilling over to mortgages, except possibly in the most distressed cohorts. We conclude that mortgages are not yet a source of general financial concern, but the situation needs to be closely monitored, particularly within the most distressed category of borrowers. [1] https://www.newyorkfed.org/microeconomics/hhdc

[2] This contradicts a widespread view that FHA loan performance has deteriorated in recent quarters. In fact, the 30-day DQ rate for FHA has been in an upward trend over the past two and a half years. (To as high as 6.5% recently, according to FHA Loan Performance Trends Report). Most of these however, cure before hitting the 90-day threshold. [3] See New York Fed Household Debt And Credit Report (https://www.newyorkfed.org/microeconomics/hhdc), p44, paragraph 1. [4] For 2023 issued GSE and FHA loans (disclosed by Agencies), the WA credit score is 754 vs. 676; while the share of first-time home buyer of purchase loans is 46.5% vs. 75.0%. In addition, according to HMDA 2023, the WA borrower’s income is $301k for conventional loans and $112K for FHA loans. [5] https://www.kansascityfed.org/data-and-trends/labor-market-conditions-indicators/ In a recent post, we noted that delinquency rates for two classes of FHA modified loans were rising faster than for the general population, namely reperforming (RG) and extended term (ET) loans[1]. In this post, we dig down into details to get a closer view of the behavior of lenders in these categories.

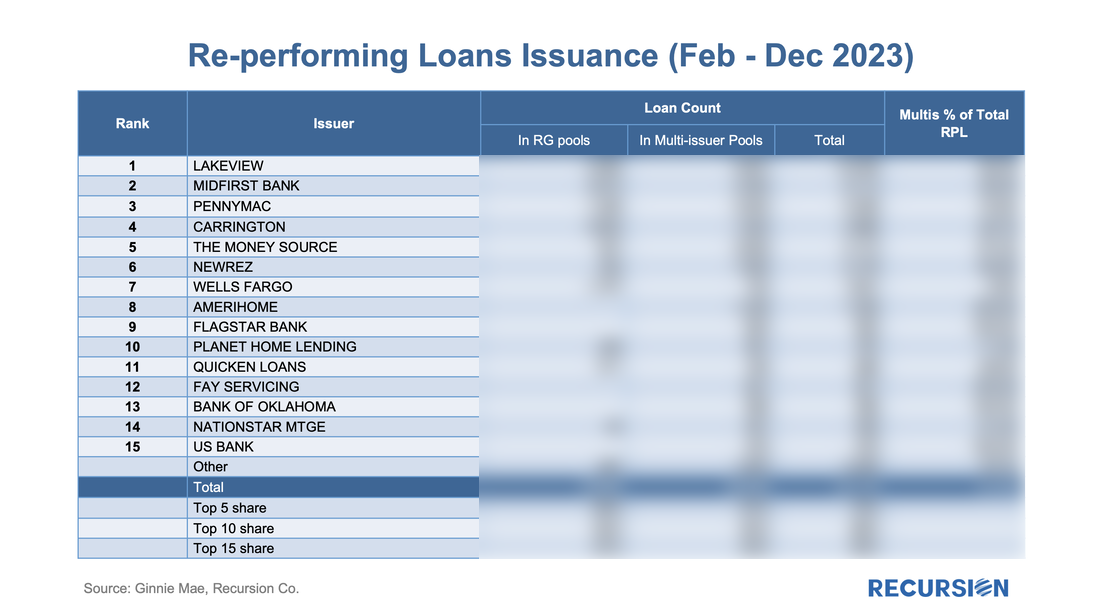

We start with RG loans. As noted in the previous blog, the program was launched in January 2021, allowing borrowers who had outstanding unpaid balances from the Covid period but six consecutive months of payments to roll the balances into a “partial claim” due when the loan is extinguished. At that time, a new “RG” custom pool category was formed to issue these mortgages. Starting in February 2023, the seasoning period was reduced from six to three months and these loans became eligible to be issued in Ginnie Mae multi-issuer pools. The share of these loans in multi-issuer pools reached over 2/3 at the end of 2023. Delinquency rates are modestly higher for RG loans in multi-issuer pools relative to RG pools even though they are relatively new. One topic that comes up is which servicers are most involved in this loan type and how much variation in behavior can be seen across these institutions. Below find the list of the top 15 institutions issuing RG loans and the distribution of each by pool type Analyzing trends in market performance requires two things, 1) a lot of data, and, 2) a deep understanding of the structure of markets. We recently came across a good example of this with relative delinquency rates between GNM and GSE pools[1]. In this post, we look at the dynamics of the two categories of reperforming mortgage loans.

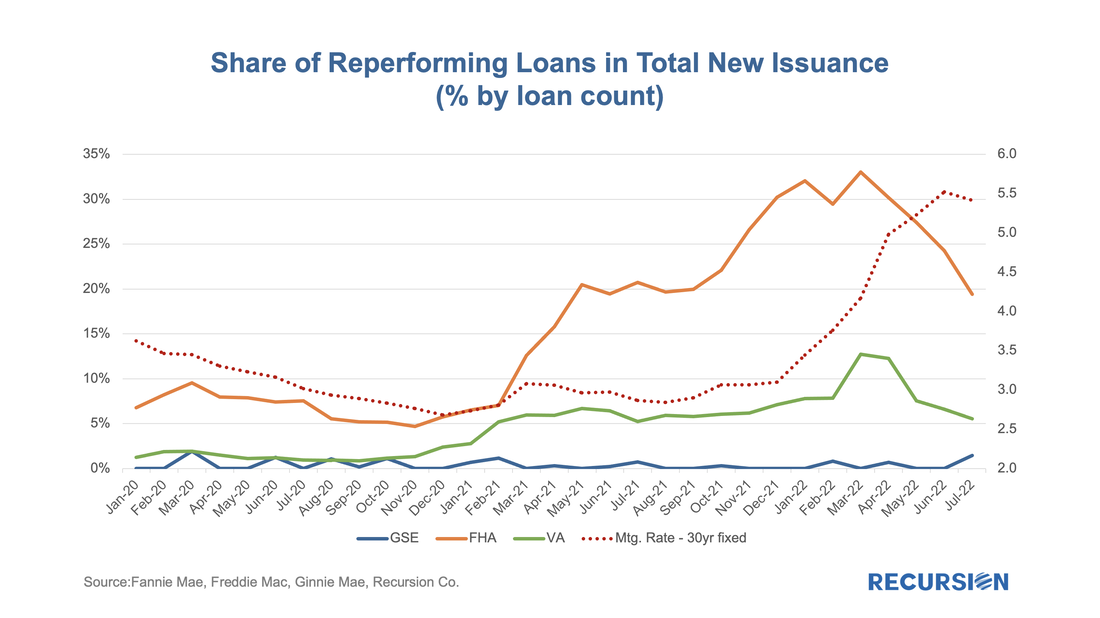

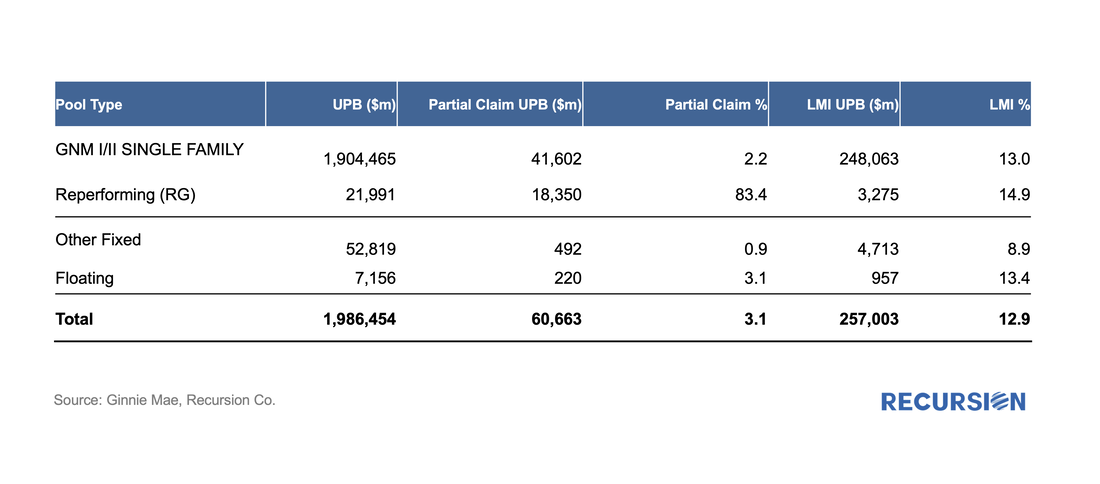

Investors have spent many years building models of prepayment speeds for mortgage pools based on a variety of characteristics such as loan size and underwriting characteristics. However, institutional factors can come into play as well. One that comes to mind is the difference in program structure between conventional and government loans. For the conforming market, the issuer is a GSE, while for government programs, it is the servicer. In both categories, when a loan becomes seriously delinquent, it can be bought out of the pool at par, amounting to a prepayment. The difference is that for the case of conforming loans, it is the quasi-public GSEs that perform this function, while for government programs, the decision is up to private sector entities. In the first case, there are overarching policy goals that weigh on decisions about the disposition of loans in delinquency, while in the second case, these decisions are based on financial considerations. One way to test this is to look at buyouts over the interest rate cycle. Below find a chart containing the shares of reperforming loans in new issuance for FHA, VA and the GSEs. These are loans that have been previously bought out of pools and then reissued into new pools. There can be a substantial lag between the buyout and re-issuance. In recent posts, we’ve been tracking the progress of loans coming out of forbearance into various pool types such as Reperforming (RG), Extended Term (ET) and, even Private Label pools[1]. A different perspective can be obtained by looking at the disposition of loans with partial claims. Recall that a partial claim occurs when a borrower with missed payments can resume making payments but does not have the resources to increase payments to compensate for the balance missed. In general, the missed payments are placed into a subordinate lien that comes due when the mortgage is extinguished. It is important to note that a partial claim is not a modification, and a loan with a partial claim does not have to be in a forbearance program.

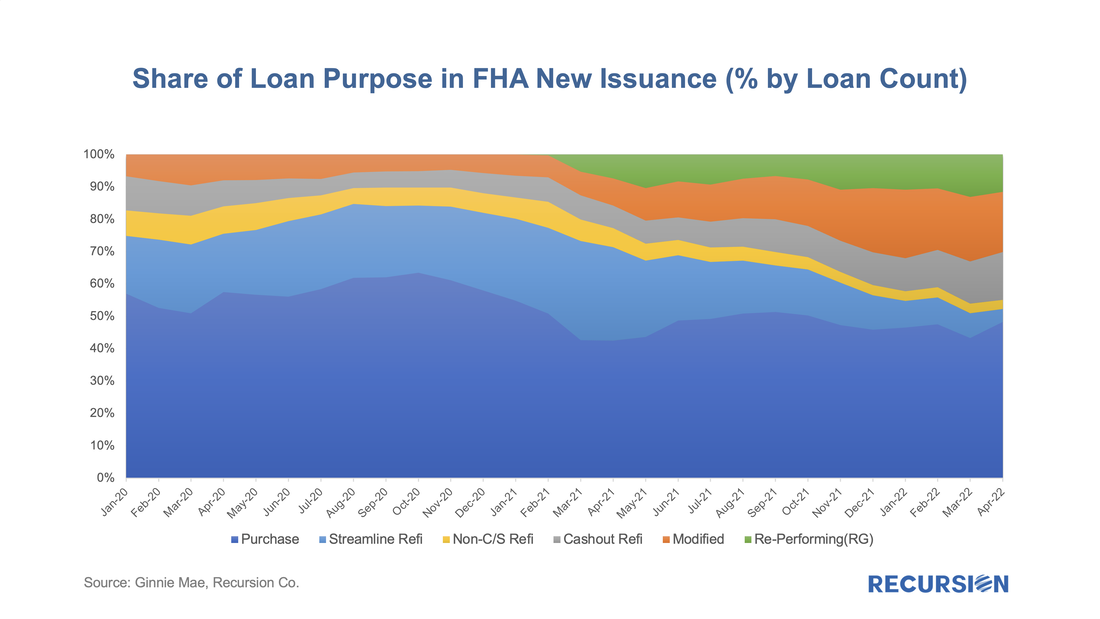

Recently, Ginnie Mae announced that they would disclose the share of loans in pools with partial claims[2]. Below find a summary table of these results reported first ever as of April, 2022 With the 30-year mortgage rate surging to a 13-year high near 5 ¼% and the FHFA purchase-only house price index at a record-high 19.42% in February (edging out the prior record of 19.39% in July 2021), we are in an unprecedented environment in the mortgage market. As such, it makes sense to update our analysis of the trend in issuance updated through April. Of particular interest in this regard are the FHA and VA programs.

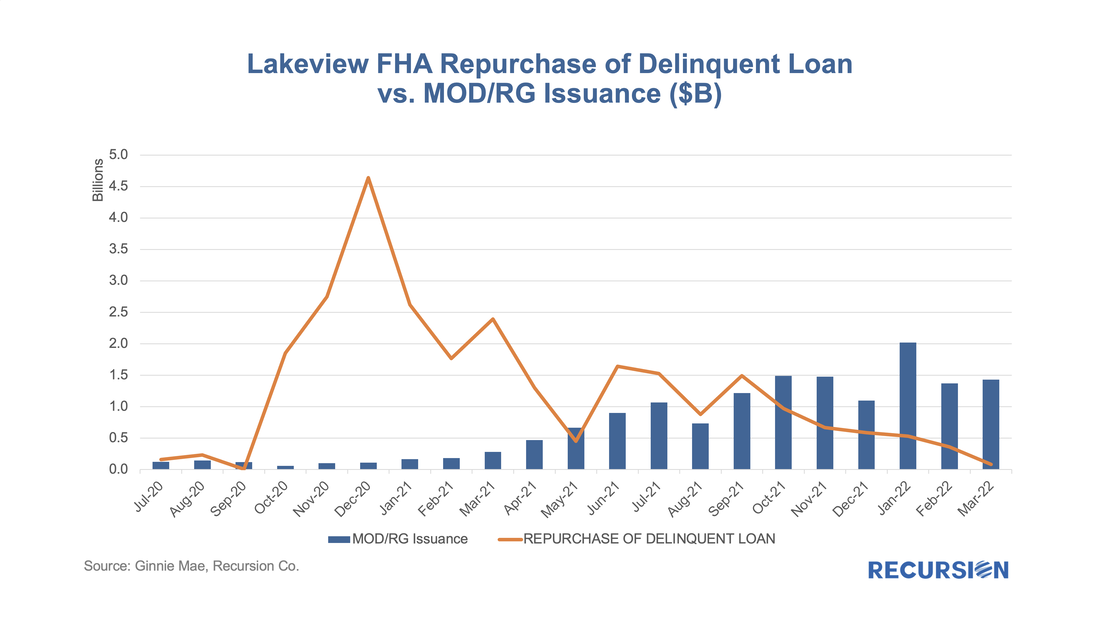

Let’s start by looking at FHA. By loan count, there were 107,500 FHA loans issued in GNM pools in April, with a decline of over 1/3 from the same month a year earlier. One special interest is the evolution of the share of issuance by loan purpose: In a recent post[1], we discussed the disposition of loans that are exiting forbearance programs. In the Ginnie Mae programs, many loans bought out of pools have received modifications or other workouts, and then redelivered to Ginnie Mae pools. However, we have historically observed that there are more loans bought out than re-delivered, even considering the time needed for the workout. As it turns out, there are other market-based outlets for these loans, which is more evident at the issuer level than in aggregate.

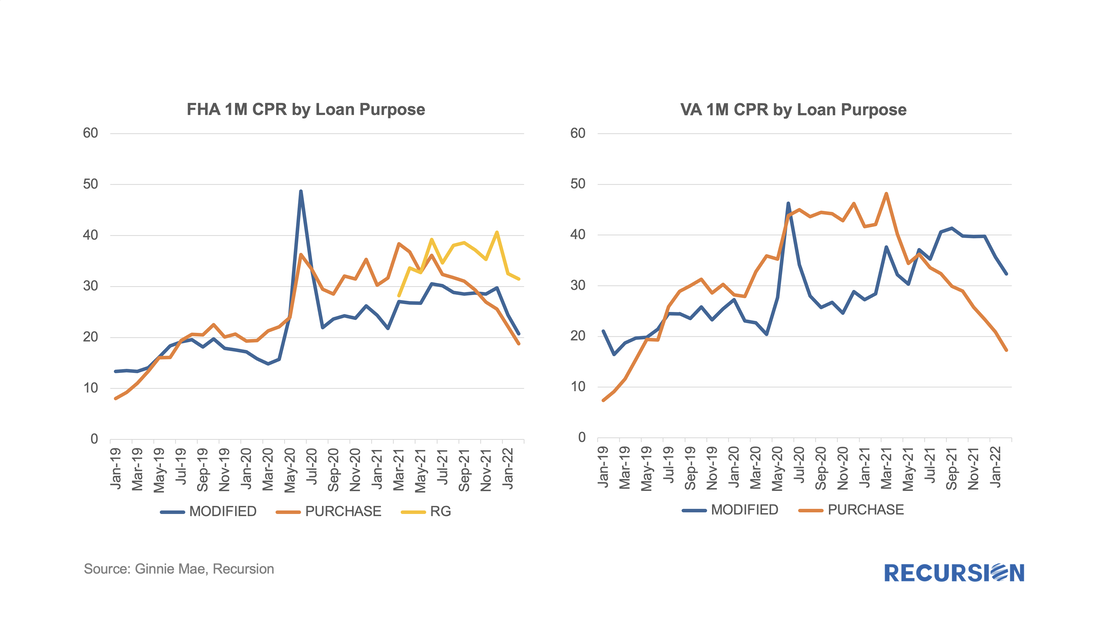

Below find a chart of buyout and securitization activities within Ginnie Mae program for Lakeview, the third-largest Ginnie Mae servicer as of April 2022. With the expiration of forbearance programs underway, there is an interesting question about how loans exiting these programs will perform once they are resecuritized. For Ginnie Mae programs, these are either loans that exit forbearance with a partial claim or receive a permanent mod under the various waterfall options in the FHA or VA programs. In our previous blogs[1], we have noted MOD and RG loans are becoming a significant portion of loans delivered to newly issued Ginnie Mae pools.

In a fine recent paper, the Federal Reserve Bank of Philadelphia “highlights the immediacy of the challenges facing mortgage servicers and policymakers” that arise from the resolution of mortgage forbearance and delinquencies[1]. As of the time of writing, the Philly Fed stated that “some 2.73 million mortgages are either in forbearance or past due; about 0.78 million of those are in Coronavirus Aid, Relief, and Economic Security (CARES) Act forbearance plans”. In addition, “about 47 percent of loans in forbearance will expire in the first quarter of 2022; another 42 percent will expire in the second quarter”. They go on to discuss recent trends and provide data on income and demographics of these borrowers.

The point of this brief article is to look at secondary market indicators to shed additional light on these issues. The note is broken into two parts, the first looks at Government programs, notably FHA and VA, while the second looks at the GSEs. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed