|

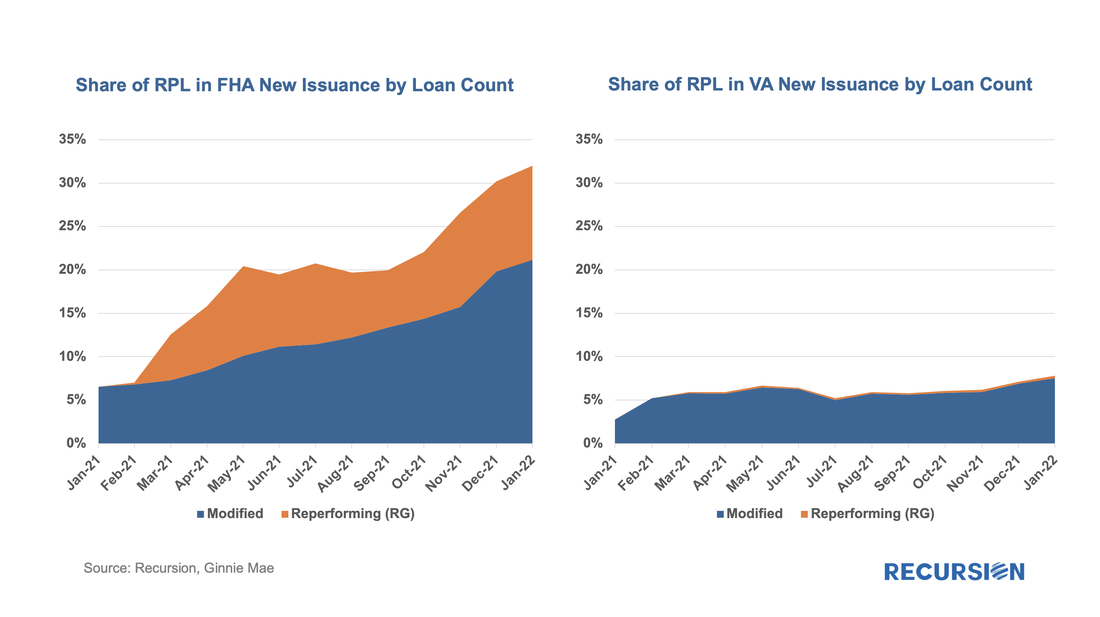

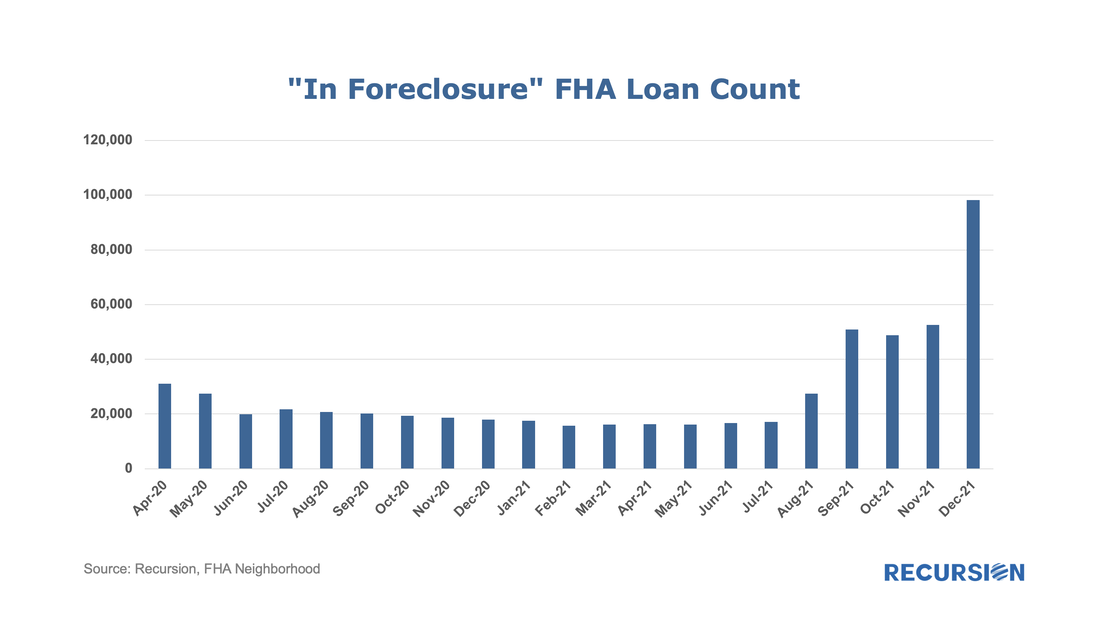

In a fine recent paper, the Federal Reserve Bank of Philadelphia “highlights the immediacy of the challenges facing mortgage servicers and policymakers” that arise from the resolution of mortgage forbearance and delinquencies[1]. As of the time of writing, the Philly Fed stated that “some 2.73 million mortgages are either in forbearance or past due; about 0.78 million of those are in Coronavirus Aid, Relief, and Economic Security (CARES) Act forbearance plans”. In addition, “about 47 percent of loans in forbearance will expire in the first quarter of 2022; another 42 percent will expire in the second quarter”. They go on to discuss recent trends and provide data on income and demographics of these borrowers. The point of this brief article is to look at secondary market indicators to shed additional light on these issues. The note is broken into two parts, the first looks at Government programs, notably FHA and VA, while the second looks at the GSEs. The various agencies are working hard to keep borrowers in their houses through various modification programs. The secondary market data helps to shed light on the progress made along these lines. Most of the indicators provided are related to modifications, or potential modifications. In addition, FHA revitalized a less used method: partial claim to help the borrowers during this difficult time. Modified loans or loans obtained a partial claim are allowed to be re-delivered to Ginnie Mae pools. While modified loans are allowed to be delivered to multi-issuer pools which are TBA eligible, loans with partial claim can only be delivered to a Customized pool type “C-RG”. Nonetheless, we saw a pickup of both since early 2021 in FHA and VA programs, but dramatically so for FHA. As The cumulative number of loans issued in Ginnie Mae pools from FHA programs over the period January 2021-January 2022 for MOD and RG loans was 225,000 and 137,000 respectively. The same data for the VA program was 82,000 and 2,300 respectively. It's important to note that while loans in RG and MOD loans are performing when redelivered to Ginnie Mae pools. However their future performance is highly uncertain as we have never seen how large numbers of loans exiting forbearance perform in different economic scenarios. Previously, borrowers with modified loans tended to be much less resilient than those with other loans in a downturn. Finally, there is the question of the number of loans that have been bought out of pools that are awaiting disposition. The pool data won’t help here so another source must be found. In the case of FHA this comes in the form of the FHA Neighborhood Watch Data. This dataset covers every loan in the program, and contains a column called “In Foreclosure” which can mean both in that state but also loans that are bought out of pools that have lost protections and whose fate has yet to be determined. With forbearance running out for an increasing number of borrowers, this category is picking up. The growing numbers here serve to underscore the point made by the Philadelphia Fed regarding “the challenges facing servicers and policymakers”. Next, we will look at the state of expiring forbearance programs in the conventional market. Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed