|

In a recent post we discussed trends in the conforming purchase market by occupancy type[1]. In this note we look at performance metrics.

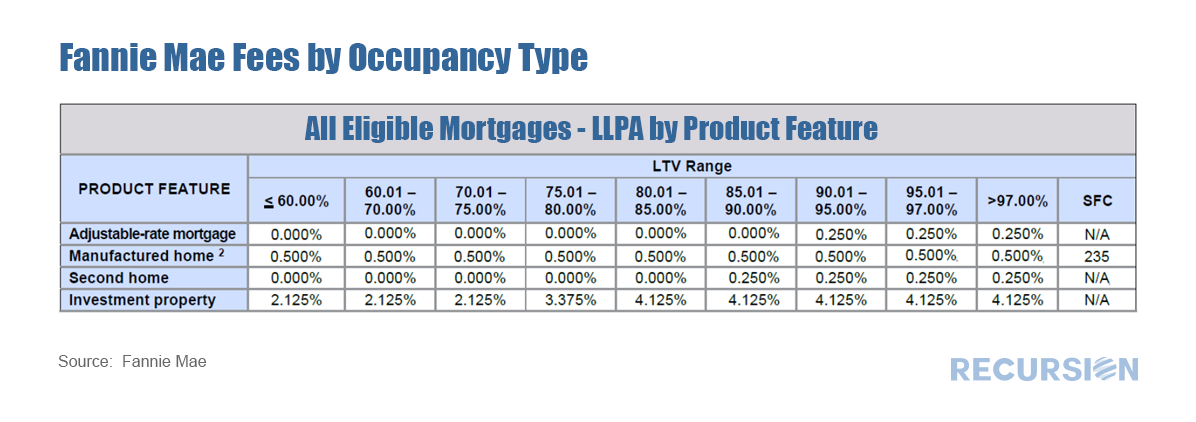

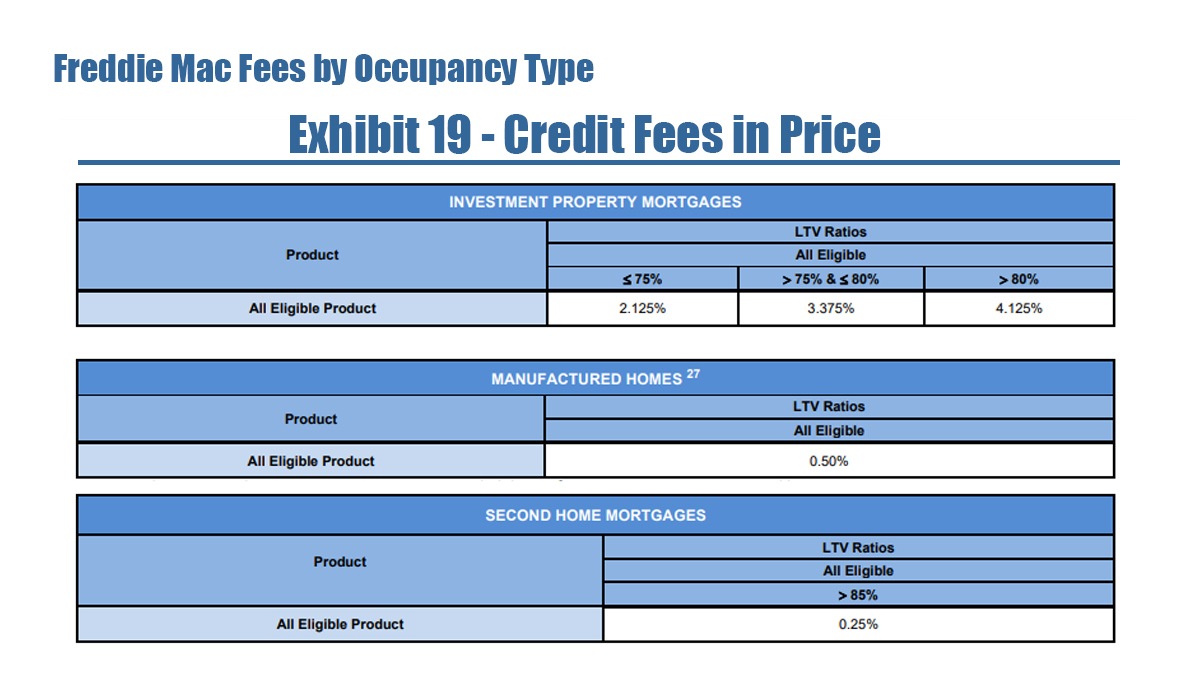

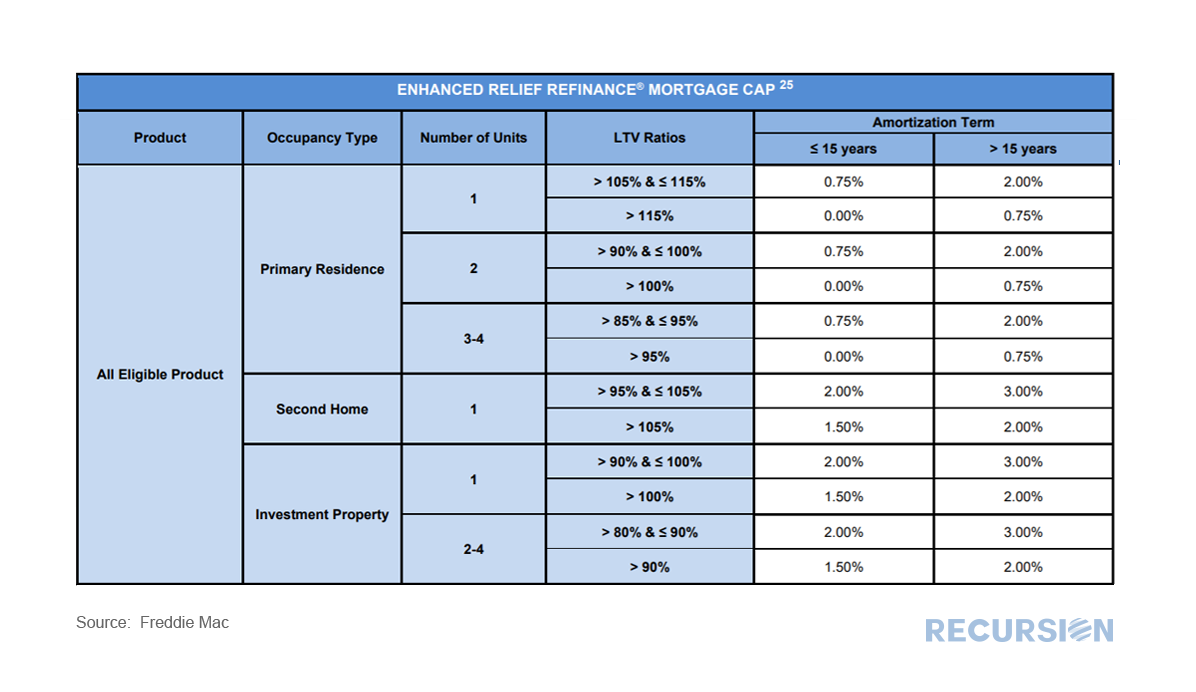

To begin, we look at prepayment speeds. It’s important to note that certain fees (which Fannie Mae calls LLPA’s[2] and Freddie Mac calls Credit Fees[3]) vary by occupancy type, particularly for those with high LTV’s. While market commentary is focused on developments such as inflation and house price increases, the key housing policy issues in the post-Covid world are financial inclusion and climate change. Our agency loan-level data provide us with many insights into market trends, but these do not contain demographic or geological details that are necessary to perform in-depth analysis in these areas.

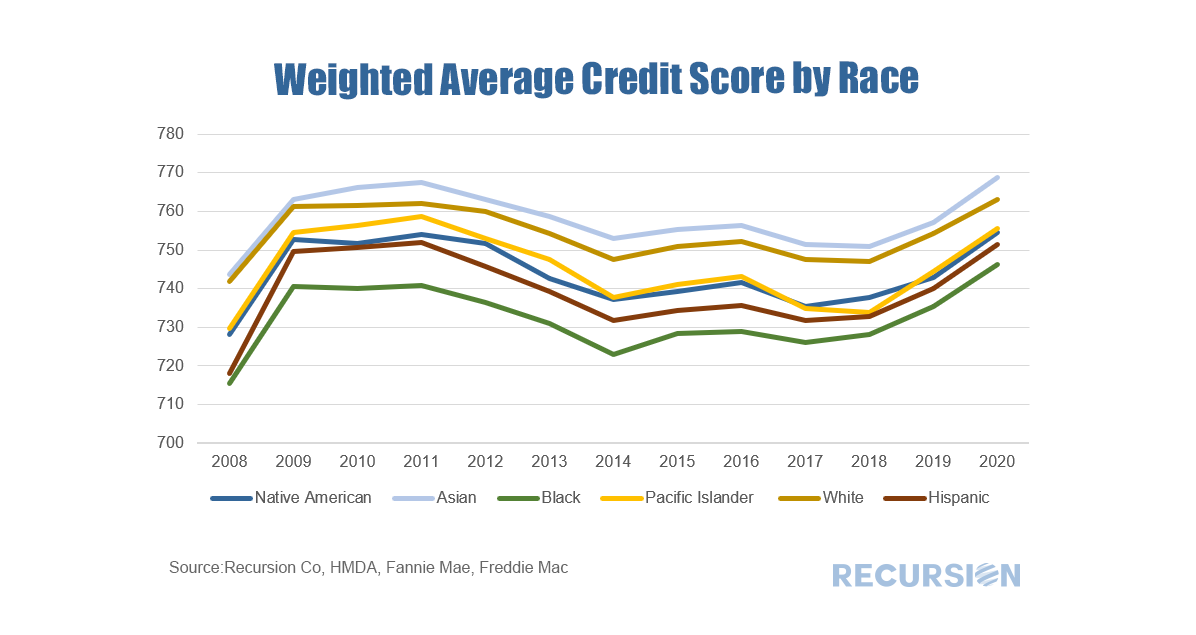

On the topic of financial inclusion, the key supplemental data set is the Home Mortgage Disclosure Act (HMDA) dataset, an annual disclosure made by lenders in support of fair lending. HMDA data contains relevant data points such as income, gender, and race. Any assessment of fair lending practices requires an analysis of how these factors influence the availability of credit. To accomplish this, Recursion has applied a proprietary matching algorithm to create a robust dataset consisting of loans with both underwriting and demographic characteristics. Over the period 2008 – 2020 the data set consists of about 20 million loans. Below finds a chart of average credit scores by race (as measured by race of the first borrower) over the 2008 – 2020 period from this matched data set: Recursion’s Chief Research Officer Richard Koss published an article in Housing Wire Magazine on agency mortgage forbearance and the capital markets. When the CARES act was originally passed on March 27, 2020, there were notable concerns that these measures would merely postpone an inevitable correction in the housing market once the programs expired. However, home price appreciation came to the rescue. But the mortgage market continues to face the prospect of involuntary buyouts of loans from agency pools. Check out the details at:

https://www.housingwire.com/articles/the-end-of-forbearance-and-the-capital-markets/ With house prices soaring to new highs on the back of pandemic-related household relocations and sub 3% mortgage rates, the natural question is how far these trends can continue. While we have no crystal ball for calling market tops and bottoms, we feel we can gain some insight into market dynamics by looking into the composition of demand.

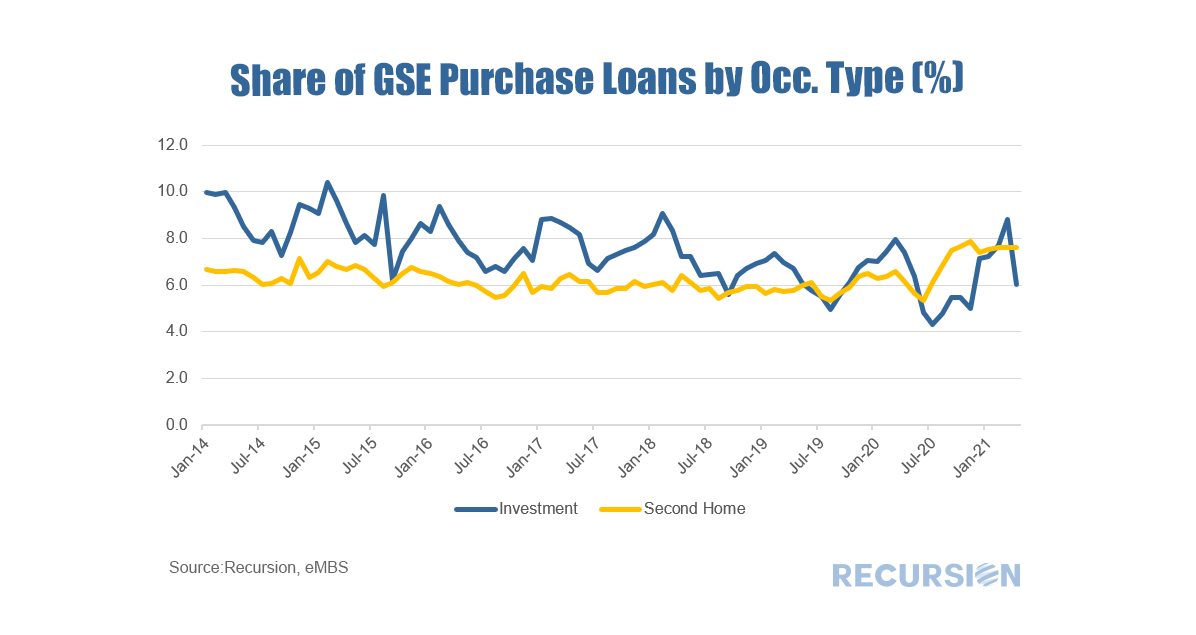

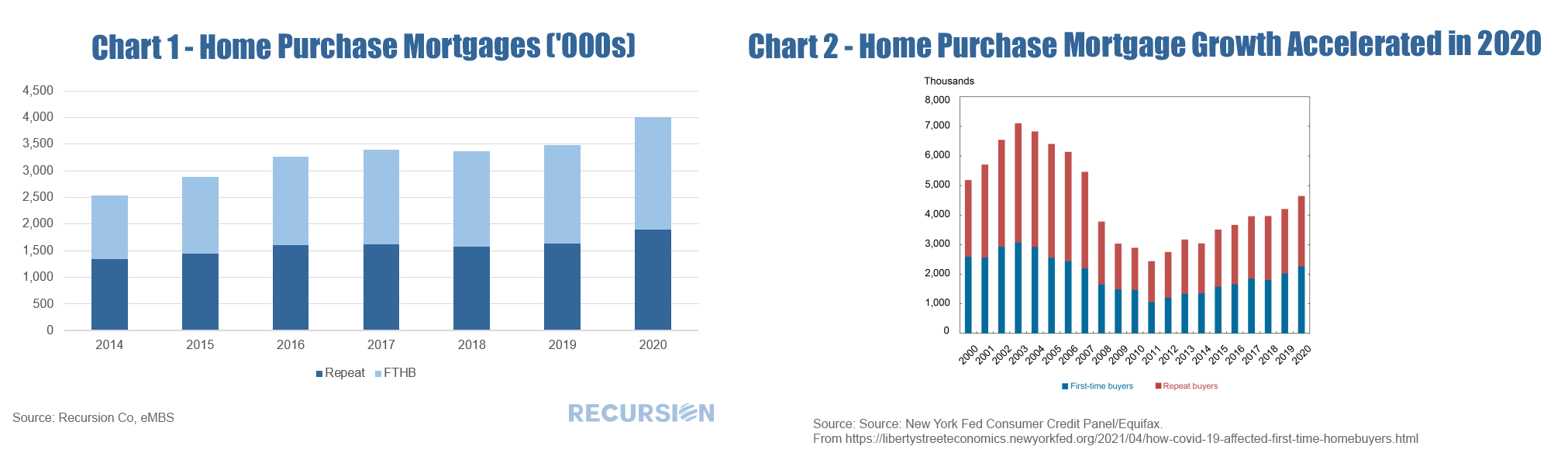

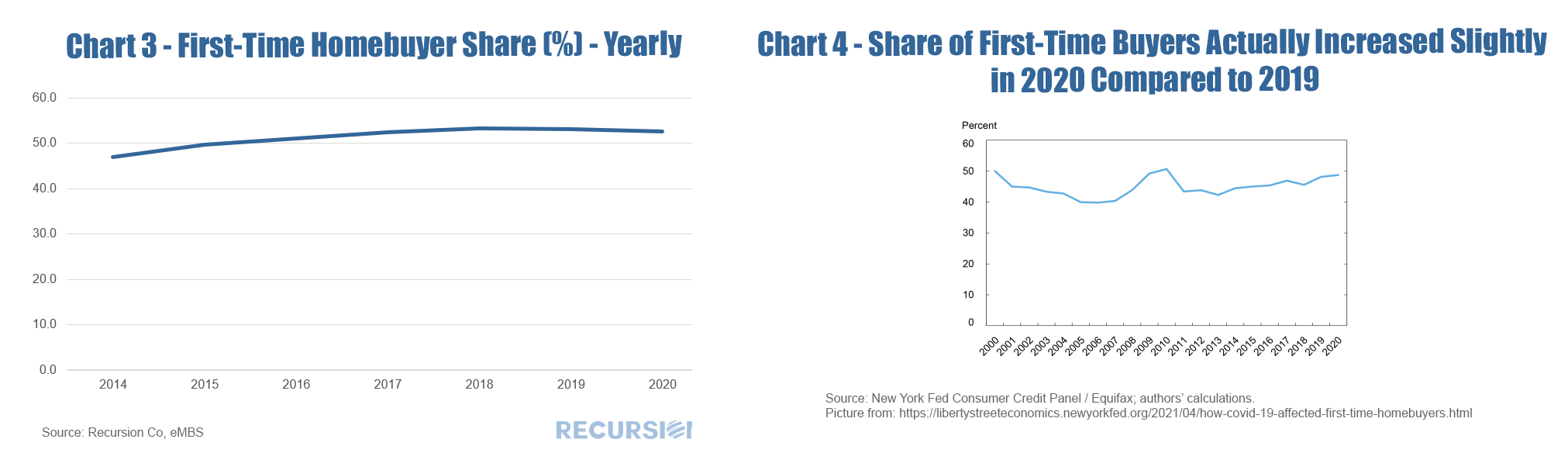

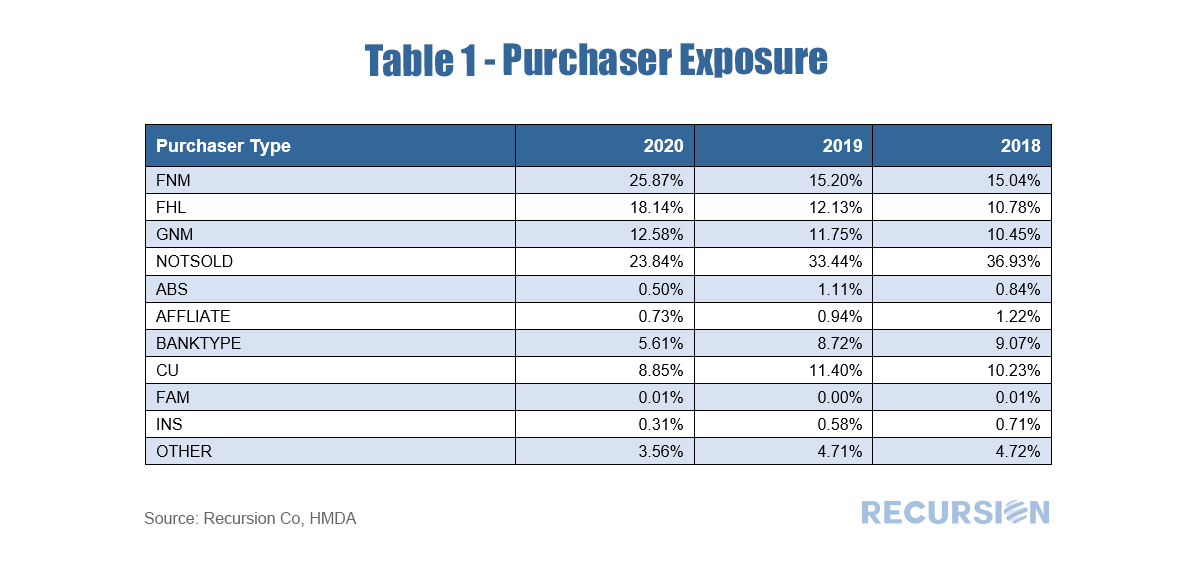

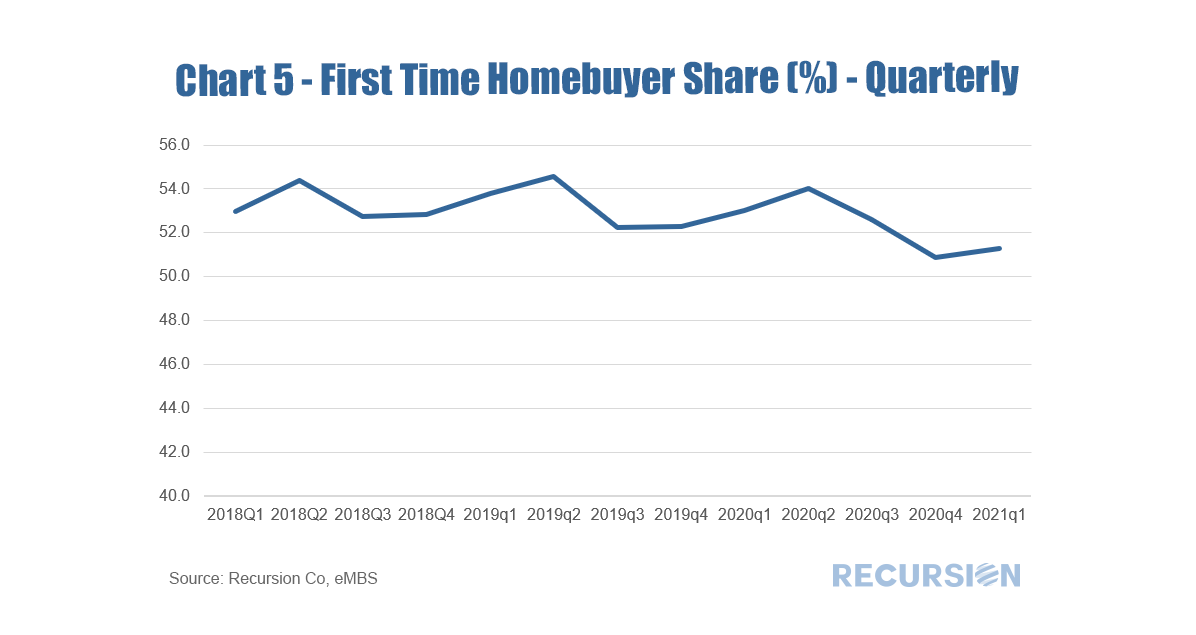

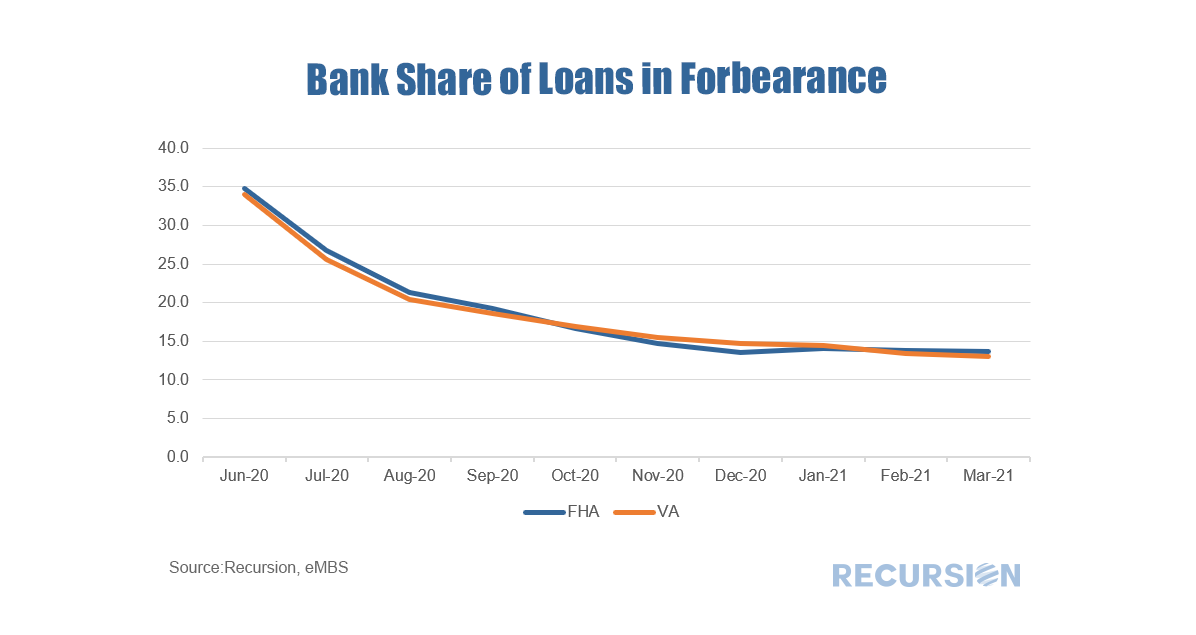

The GSE’s provide us with the ability to peer into this composition through the “Occupancy Type” flag, which consists of three types: owner-occupied, second homes and investor properties. Here we look at the share of all purchase mortgages from the last two types: Recently, researchers at the Federal Reserve published a blog about trends in first time home buyers (FTHB)[1]. They utilize a dataset that is a 5% sample of credit files from a credit bureau. It appears from their analysis that there was a bit fewer than 5 million loans originated in 2020, so it would seem they are using a sample of around 250,000 loans. It is natural to ask how their measure of first-time home ownership compares with our calculation using Agency loan level delivery data consisting of over 4 million loans for that year. To start, we can look at the trend of purchase mortgage delivery for the past seven years: And second, we can compare estimates of first-time homeownership: There are several distinctions to be made between the two data sets that are worth pointing out. First, the loan level delivery data only goes back through 2014 on an annual basis. Second, the Agency delivery data does not include loans originated but held on investor balance sheets, including any non-QM loans. A third difference is that the Fed researchers consider FTHB to be the first-ever mortgage file for a household while the Agencies consider a household to be “first-time” if they have not owned a house in more than three years. The number of loans delivered to the Agencies in 2020 increased by considerably more (15.1%) in Chart 1 than that from the credit bureau (10.5%) in Chart 2, which does not reflect a difference in the growth in the total number of loans originated, but rather an increase in the share of originated loans delivered to the Agencies. During Covid, investors preferred to hold mortgages with insured credit risk. This can be seen in the sharp decline seen in the “not sold” category from the recent 2020 release of HMDA data. The share of FTHB in our data is slightly higher than in the Fed report, which may be due to a low FTHB share in segments such as Jumbos and non-QM loans not included in our datasets. But a key difference is that our FTHB share declined slightly in 2020 from the prior year (52.5% from 53.1%) while it rose slightly in the Credit Bureau data (48.8% from 48.2%). A rigorous attribution of the difference is beyond the scope of this note, but a few comments based on the composition of our delivery data can be made. First, in our data, the decline in the first-time homebuyer share can be attributed to a rise in the market share of conforming loans with lower FTHB shares at the expense of GNM loans with higher FTHB shares[2]. Second, our data comes in monthly so we can look a bit at the dynamics within the year: Interestingly, we show the FTHB share picked up in a normal seasonal pattern in 2020 Q2 and Q3, when the pandemic hit with full force. However, in Q4 the share declined to pre-pandemic levels, and rebounded only slightly in the first half of this year. It will be very interesting to monitor these trends going forward. In a recent post, we commented on the drop in the number of loans in forbearance in Ginnie Mae pools[1]. Because of the different capital strictures, it’s interesting to look at the breakdown between banks and nonbanks.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed