|

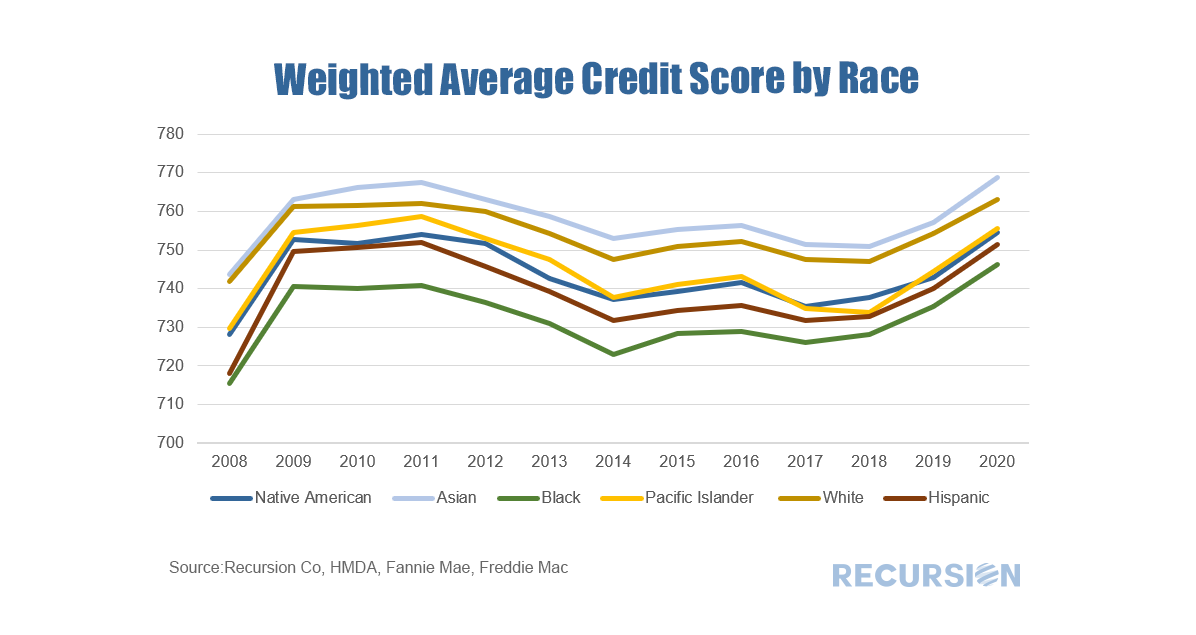

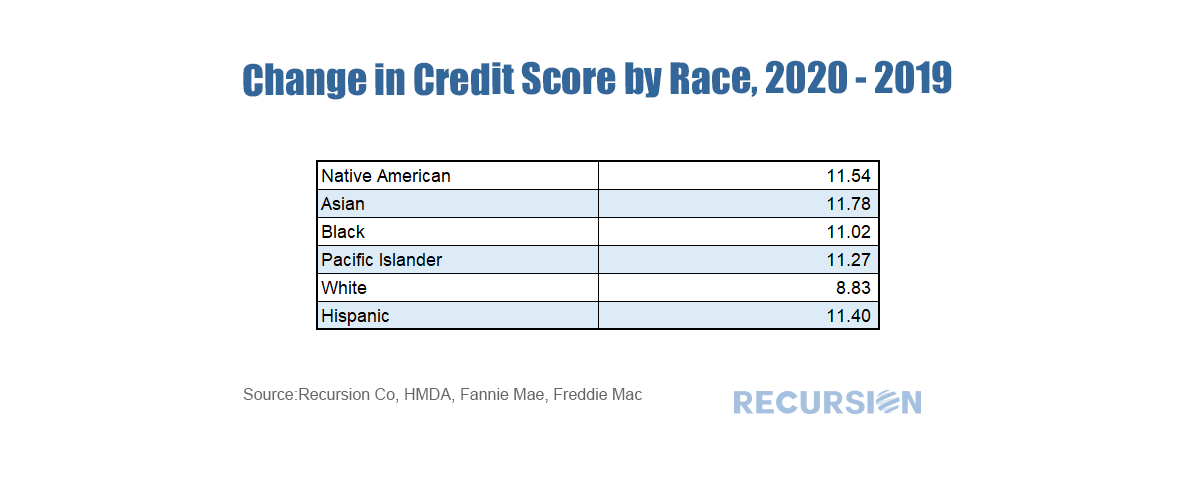

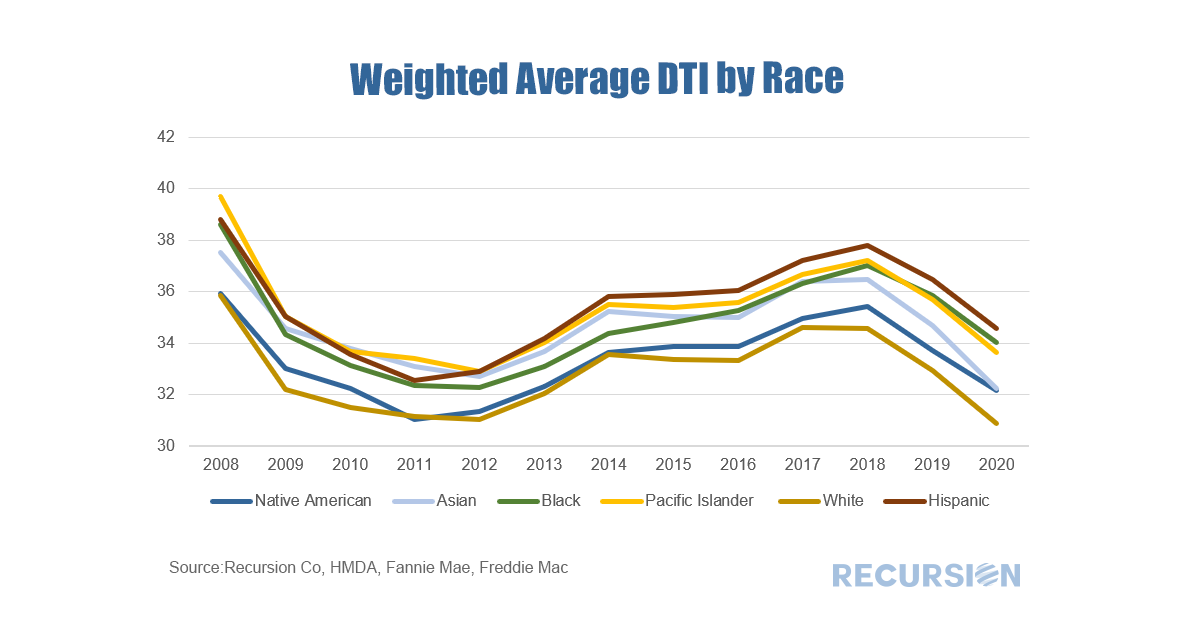

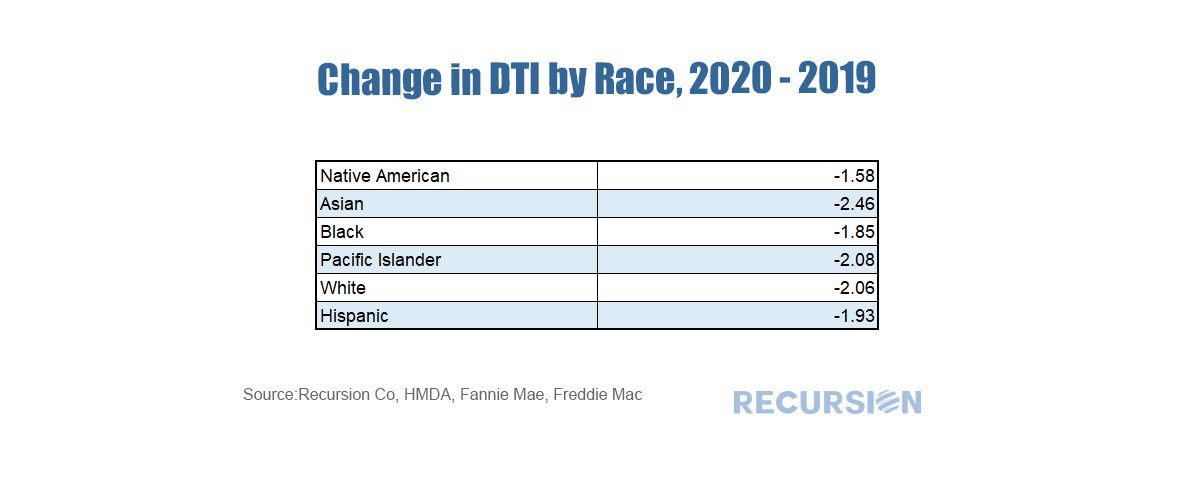

While market commentary is focused on developments such as inflation and house price increases, the key housing policy issues in the post-Covid world are financial inclusion and climate change. Our agency loan-level data provide us with many insights into market trends, but these do not contain demographic or geological details that are necessary to perform in-depth analysis in these areas. On the topic of financial inclusion, the key supplemental data set is the Home Mortgage Disclosure Act (HMDA) dataset, an annual disclosure made by lenders in support of fair lending. HMDA data contains relevant data points such as income, gender, and race. Any assessment of fair lending practices requires an analysis of how these factors influence the availability of credit. To accomplish this, Recursion has applied a proprietary matching algorithm to create a robust dataset consisting of loans with both underwriting and demographic characteristics. Over the period 2008 – 2020 the data set consists of about 20 million loans. Below finds a chart of average credit scores by race (as measured by race of the first borrower) over the 2008 – 2020 period from this matched data set: Over time we have seen credit conditions “tighten” when interest rates fall and profit-maximizing lenders allocate capital starting with the highest credit quality borrowers. For example, when the 30-year mortgage rate hit a record low in 2020, credit scores reached to new cycle highs across racial categories. Of interest is the differential between the magnitude of the increase by race: Of note is the smaller magnitude of credit score hikes for white borrowers in 2020 compared to 2019 across racial categories. Of course, financial inclusion can be measured across a variety of characteristics and below finds a similar chart for debt-to-income for borrowers by race: For this measure, tighter policy implies a lower DTI and we see this once again across all racial categories. However, the pattern for the magnitude of the tightening for this category is a bit different as the smallest degree of tightening experienced by this measure between 2019 and 2020 was for Native American and Black borrowers. The analysis of policies designed to enhance credit inclusion requires a nuanced understanding of financial markets and cultural norms. A key to developing these skills is robust data derived from the most up-to-date big data techniques.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed