Tracking the Disposition of GSE Loans in Forbearance: Borrower Assistant Plan Transitioning3/15/2022

In a recent post, we mentioned that the 24-month timeline for the purchase of delinquent loans out of pools implied that this activity would not pick up until April 2020[1]. However, some leading indicator of loan disposition was available through the release of trial modification data in the Borrower Assistance Plan (BAP) field released in the monthly Agency disclosures. Once loans have completed three months of successful payments in this plan, they are eligible to be purchased out for the commencement of a permanent modification, and eventual resecuritization.

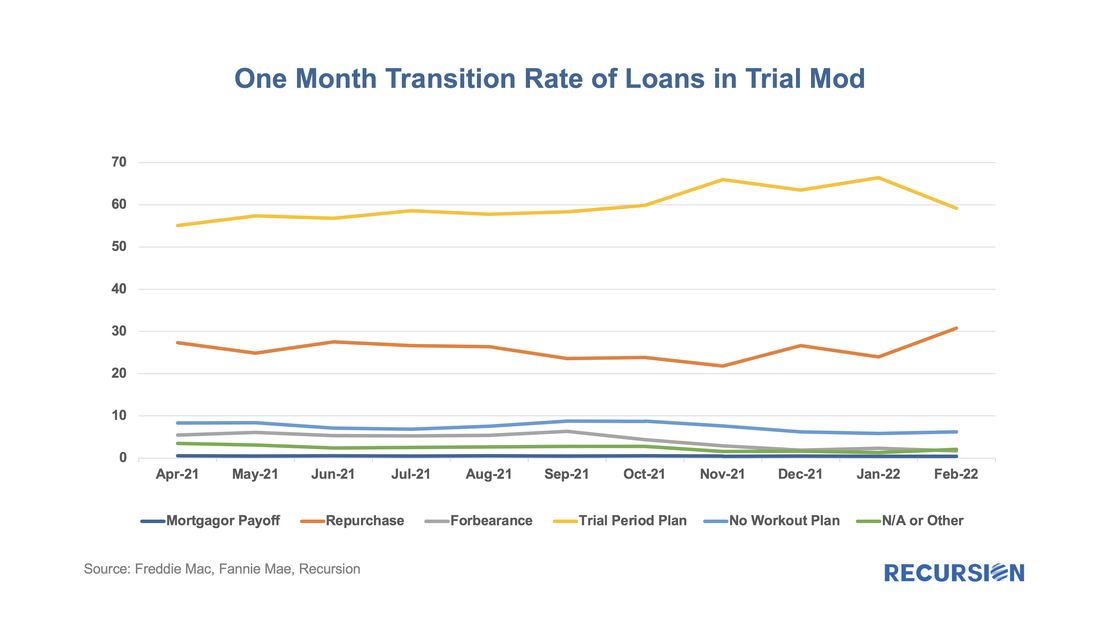

A loan in trial modification plan (trial mod) can transit into the following state the next month:

The number of loans in these programs continues to grow, standing at 37,957 in February 2022, with a balance of about $8.3 billion, up from 9,911 and $2.1 billion in March 2021. The evolution of the disposition of loans is shown in the following chart: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed