Tracking the Disposition of GSE Loans in Forbearance: Borrower Assistant Plan Transitioning3/15/2022

In a recent post, we mentioned that the 24-month timeline for the purchase of delinquent loans out of pools implied that this activity would not pick up until April 2020[1]. However, some leading indicator of loan disposition was available through the release of trial modification data in the Borrower Assistance Plan (BAP) field released in the monthly Agency disclosures. Once loans have completed three months of successful payments in this plan, they are eligible to be purchased out for the commencement of a permanent modification, and eventual resecuritization. A loan in trial modification plan (trial mod) can transit into the following state the next month:

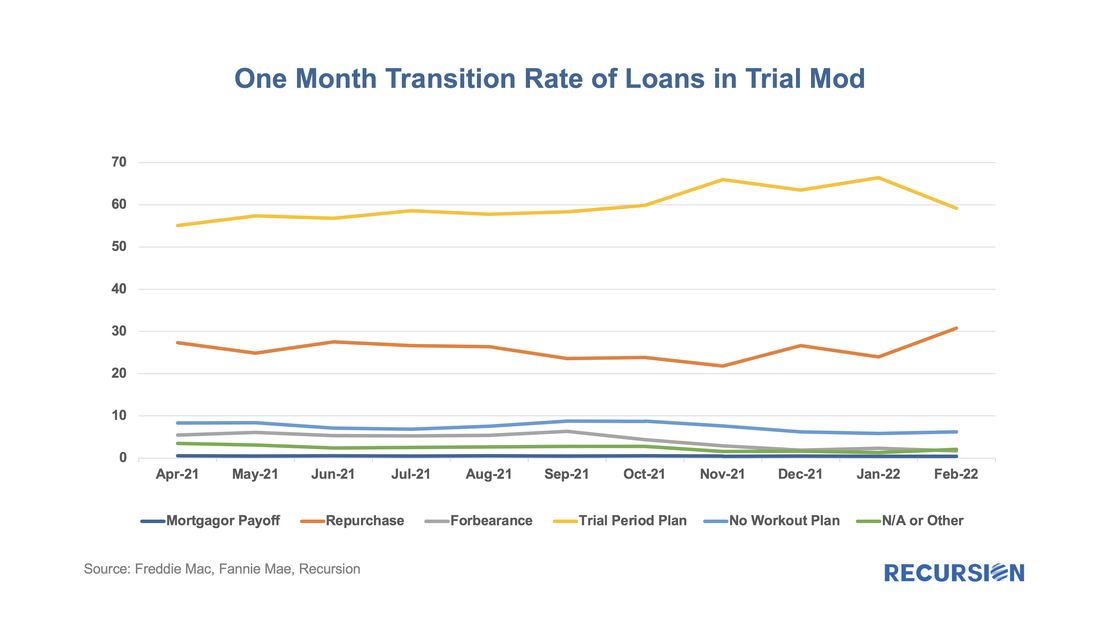

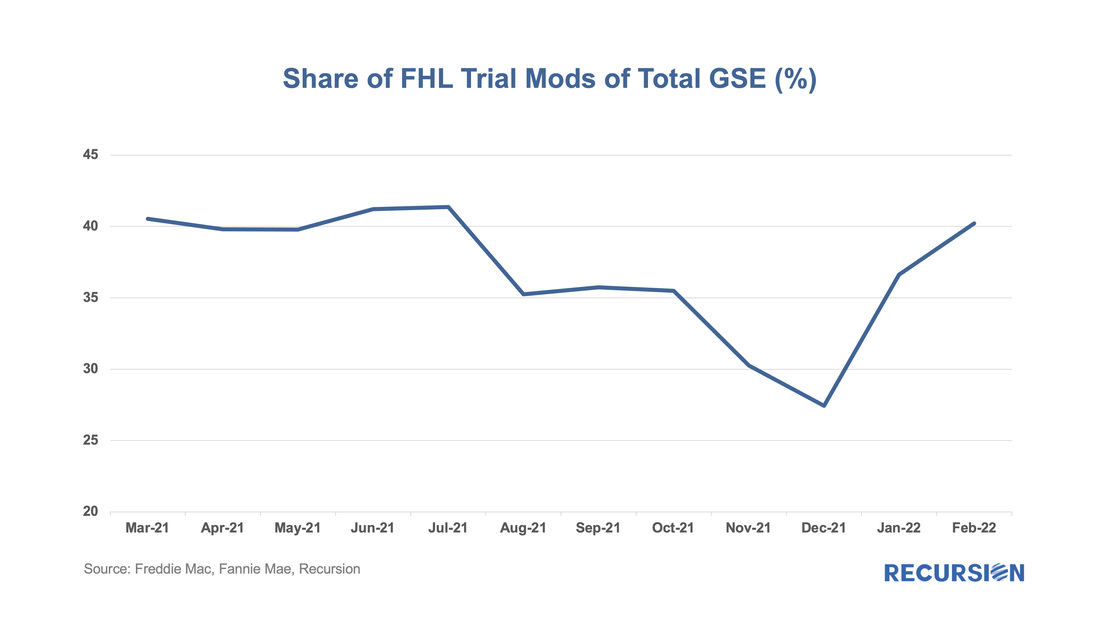

The number of loans in these programs continues to grow, standing at 37,957 in February 2022, with a balance of about $8.3 billion, up from 9,911 and $2.1 billion in March 2021. The evolution of the disposition of loans is shown in the following chart: From April to October 2021, the share of loans that stayed in a trial mod grew modestly from 55%-60%, before sharply rising in November to 66%, due to more loans entering trial mod plan the very first month. Over the same period, the share of repurchases was steady near 26%, then dipped to 20% in November, but recently reached 31% as more loans in temporary mod programs graduate to permanent status. Few trial mods, so far, are failing to achieve their goals as the share going back to a state of forbearance has dipped from 6.3% last September to 1.7% in February 2022. A further interesting question is whether the patterns described above vary between Fannie Mae and Freddie Mac. First, Freddie Mac’s share of all GSE loans in trial mods has lagged that of Fannie Mae, falling sharply from 40% in the first half of last year down to 27% in December 2021 before rebounding sharply back to 40% in February 2020. Note that 40% is very close to Freddie Mac’s share in the GSE market. As more loans in trial mods get bought out of pools, involuntary prepayments will rise, leading to higher overall CPRs. The dynamic between the GSEs is interesting, and it will be interesting to see any pricing distinction develops in UMBS pools with different Agency shares. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed