|

In a recent post, we posed the question: as the Fed’s portfolio shrinks, who will buy[1]? In this report, we dig a bit deeper and look at the differential market impacts based on whether the loans on the balance sheet roll off (as in, for example, a refinance transaction) or are sold off.

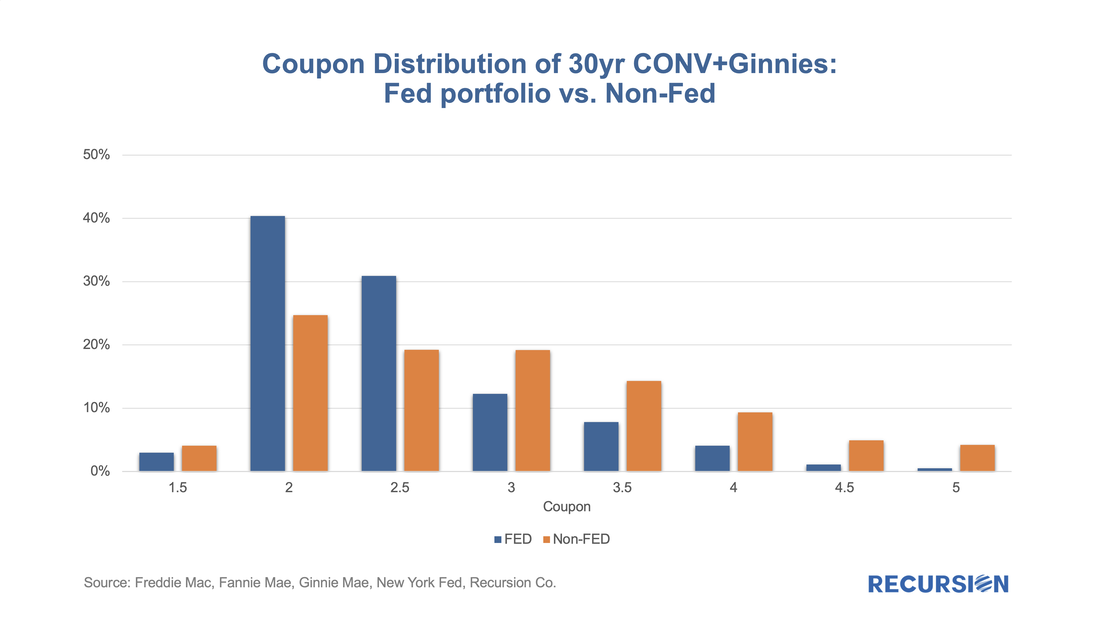

In the first case, we assume that a mortgage in a pool the Fed holds is extinguished, and a new mortgage is created through a refinance transaction, or via a home sale followed by the purchase of a new home financed by a new purchase mortgage, or through a buyout that generates a new modified loan. This case describes the situation described in the earlier post: a mortgage on the Fed’s balance sheet disappears, and some other investor has to pick up the new loan. The question here is how much higher the yield on the new pools has to be to attract sufficient demand from private investors. These new loans tend to have characteristics that investors find attractive, including a coupon which is near the most liquid part of the market (the current coupon). The second case is quite different. In this instance, the question is how much higher the yield has to be (lower price) for the existing mortgages being sold to find buyers, not for a new mortgage with the most desirable characteristics. In this case, it’s not just a matter of who has the capacity to increase their holdings, but how much additional yield investors will be required for characteristics that are less than pristine. These are challenging issues that we can’t offer precise solutions to, but one way to approach the issue is to see how different the Fed’s portfolio looks from those held in the private sector. To conduct this exercise, we look at two characteristics. The first is the coupon distribution of what the Fed holds vs. the portfolios held by private investors. This rather technical exercise can be conducted by supplementing the data provided in the Agency disclosures contained in our Pool-level Analyzer with the central bank’s holdings provided by the New York Fed[2]. In fact, the distinction is quite notable for 30-year fixed-rate mortgage pools: In recent posts, we’ve been tracking the progress of loans coming out of forbearance into various pool types such as Reperforming (RG), Extended Term (ET) and, even Private Label pools[1]. A different perspective can be obtained by looking at the disposition of loans with partial claims. Recall that a partial claim occurs when a borrower with missed payments can resume making payments but does not have the resources to increase payments to compensate for the balance missed. In general, the missed payments are placed into a subordinate lien that comes due when the mortgage is extinguished. It is important to note that a partial claim is not a modification, and a loan with a partial claim does not have to be in a forbearance program.

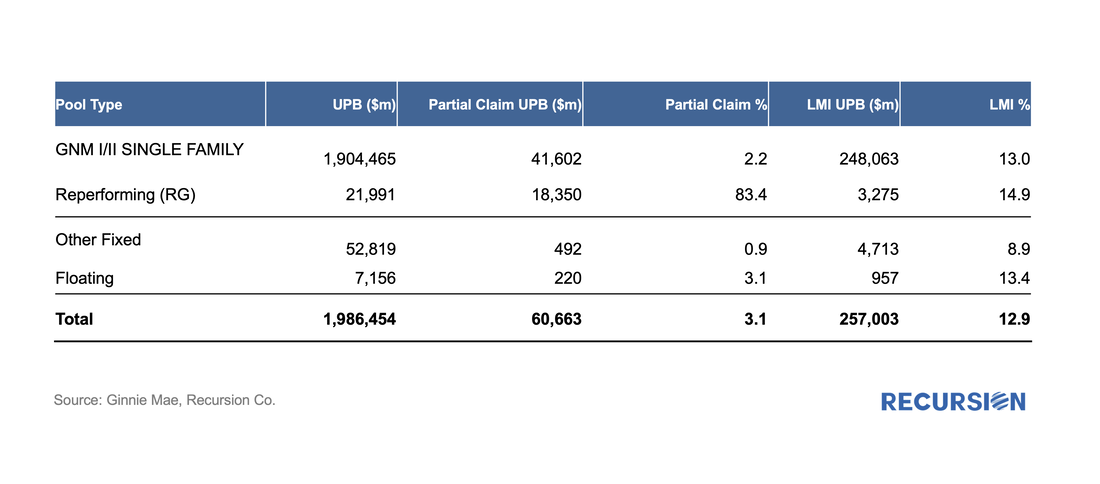

Recently, Ginnie Mae announced that they would disclose the share of loans in pools with partial claims[2]. Below find a summary table of these results reported first ever as of April, 2022 With the 30-year mortgage rate surging to a 13-year high near 5 ¼% and the FHFA purchase-only house price index at a record-high 19.42% in February (edging out the prior record of 19.39% in July 2021), we are in an unprecedented environment in the mortgage market. As such, it makes sense to update our analysis of the trend in issuance updated through April. Of particular interest in this regard are the FHA and VA programs.

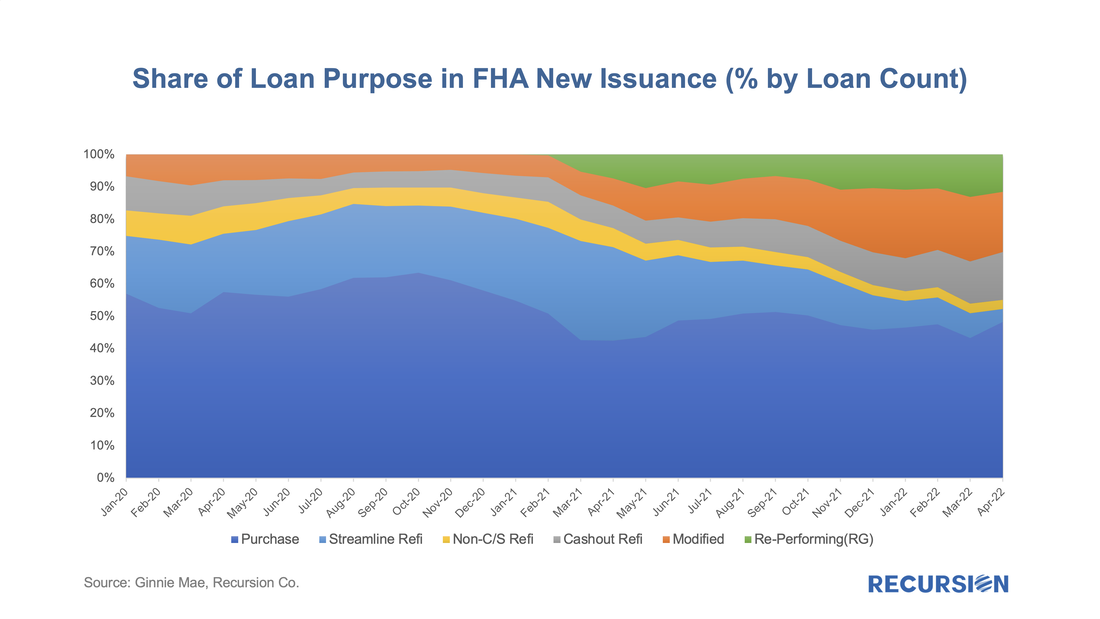

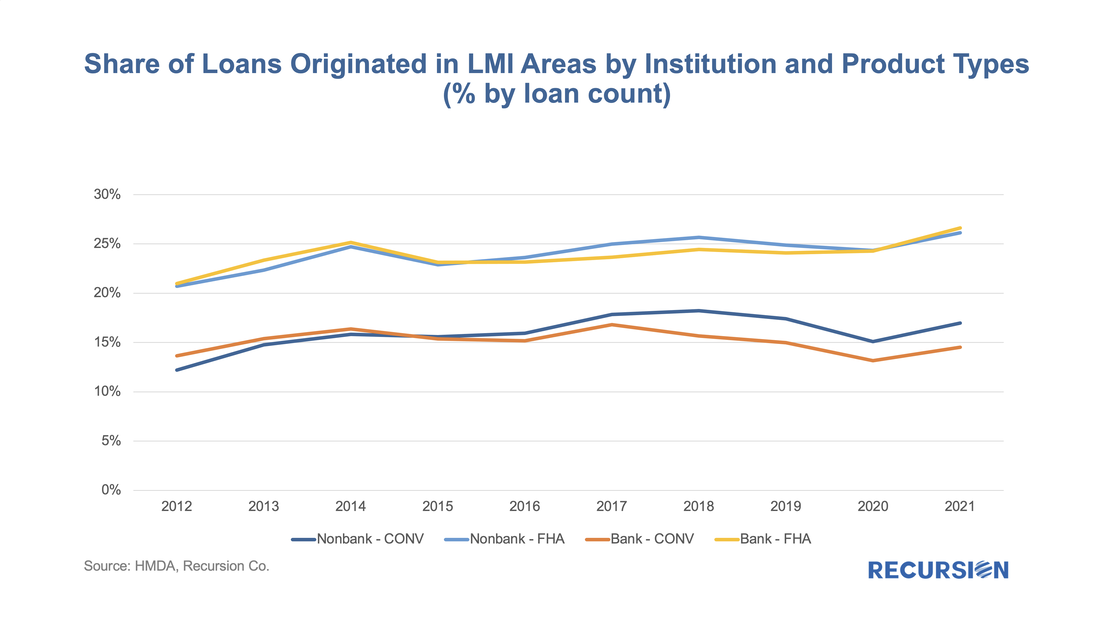

Let’s start by looking at FHA. By loan count, there were 107,500 FHA loans issued in GNM pools in April, with a decline of over 1/3 from the same month a year earlier. One special interest is the evolution of the share of issuance by loan purpose: In a recent post[1], we discussed findings obtained with the recent release of 2021 HMDA data. Among other things, we looked at the share of mortgage originations by income group and product type. In this note, we look at the difference in lending patterns between the banks and nonbanks.

The incentive behind this approach is policy driven. There is a long history of measures taken to encourage lenders and builders to foster economic development in low-income areas via the housing market. For example, the Community Reinvestment Act (CRA) stipulates that a bank’s performance with regards to compliance of their regulatory requirements depends in part on: “the geographic distribution of loans—that is, the proportion of the bank's total loans made within its assessment area; how these loans are distributed among low-, moderate-, middle-, and upper income locations[2]” To assess this issue, we assign a flag to each of the census tracts designated by HUD as having a greater than 51% share of households with incomes in the Low-to-Moderate (LMI) range in the larger MSA the tract is part of[3], which are called LMI area by HUD, or “low income” tracts by FHFA. Below find a chart of the 10-year trend in the share of loans originated in this category by institution type for conventional and FHA loans: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed