|

On September 15, Recursion Data was cited in a story in Commercial Mortgage Alert that pointed out that Fannie Mae “has started to restrict the interest-only payment periods on debt backing properties built before 2000.” They cite Recursion data in pointing out that Fannie Mae purchased $4.2 bn in multifamily loans in August, bringing the year-to-date total to 35.3 billion, down 20% from the same period in 2022.

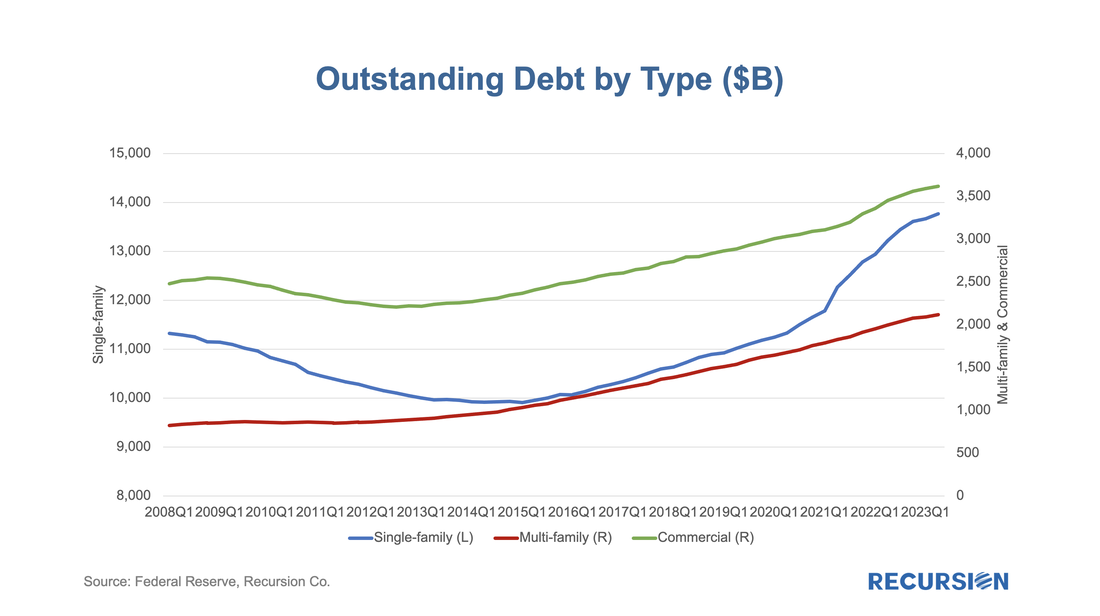

Recursion is pleased to provide excellent support to all participants in this crucial segment of the commercial real estate market. In a recent post, we discussed trends in the ownership of risk in the single family residential real estate market[1]. In this note, we round the picture out with an analysis of the commercial real estate market.

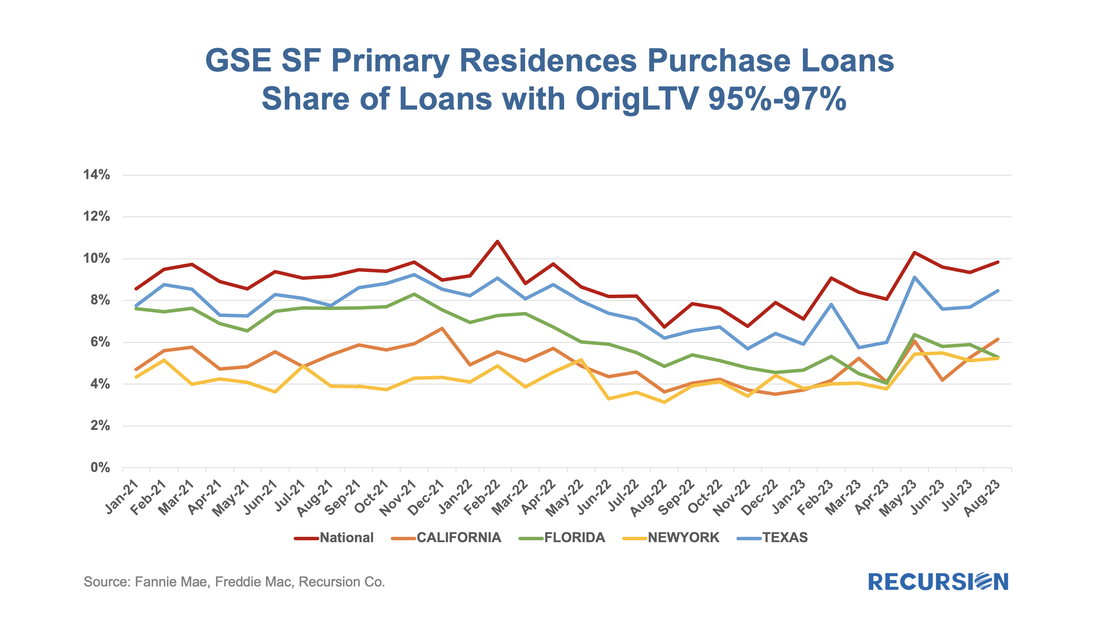

In recent posts, we discussed how some firms are implementing strategies to maintain origination volumes in Mortgage Winter. These include private securitizations and the use of buydowns. A more traditional approach would be direct market subsidies. The larger commercial banks have used various subsidy programs to assist low-income and first-time borrowers for some time, likely in compliance with their CRA obligations. More recently, some nonbanks have stepped up in this area, motivated by maintaining their volumes in a very challenging market. The ball got rolling back in April when United Wholesale Mortgage (UWM) launched its Conventional One Program, where a borrower with 50 or lower AMI who puts 1% down receives a 2% grant from the bank up to $4,000. In June, Rocket Loans instituted its One+ Program, offering a similar deal but for borrowers with AMI at 80 or lower. Not to be outdone, in July, UWB broadened its program to include borrowers at 80 AMI or less. To read the full article, please send an email to [email protected]

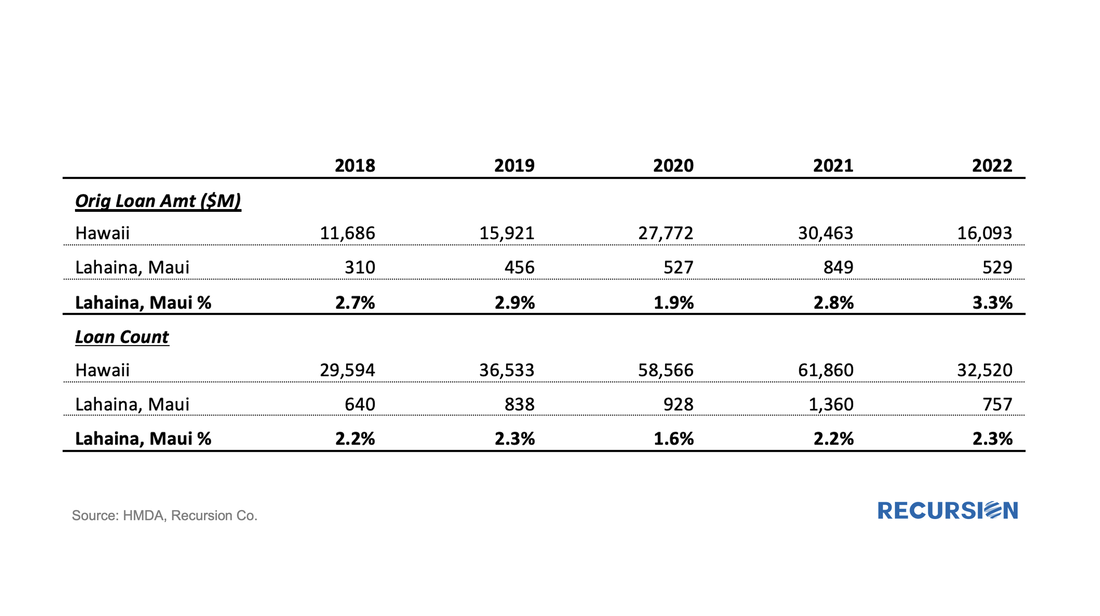

We get a lot of requests at Recursion, the bulk of which never make it to these posts, but one that struck home recently was from a regulator who asked what we know about Lahaina. Given the scope of this tragedy, we thought it worth the effort to talk about what we do and don’t have. Specific to that location, the answer is relatively limited. The Agency disclosure data is provided at the state level. The population of Lahaina was 12,700 as of the 2020 Census, out of a population of the Island (County) of Maui of 164,000 and 1.4 million for the state of Hawaii overall. So, this level of detail seems unlikely to be sufficiently granular to provide a basis for analysis. However, it seems we can take a bottom-up approach that may yield something of value. This would be based on the HMDA data.

HMDA data has the advantage of granularity down to the census tract level. Out of over 84,000 Census Tracts, we can identify 6 for Lahaina. We can then pull-down originations from HMDA: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed