|

On June 5, Housing Wire published an article, “Analysis: Loan repurchase patterns at Fannie, Freddie are divergent” which discussed the declining rate of repurchases on the part of Fannie Mae and Freddie Mac. “A review of the same agency loan-level data by mortgage-analytics firm Recursion shows that Freddie Mac’s repurchase-loan count, as of the first quarter of 2022, stood at about 2,500 loans, compared to about 1,500 repurchased loans for Fannie Mae. As of the fourth quarter of last year, however, that gap had all but disappeared, with each agency repurchasing about 1,000 loans each. “[Freddie] has come way down [in its loan-repurchase count], and now they’re about the same [as Fannie], and that’s really interesting,” said Richard Koss, chief research officer at Recursion.” Recursion is always pleased to see its data utilized to shed light on important industry developments.

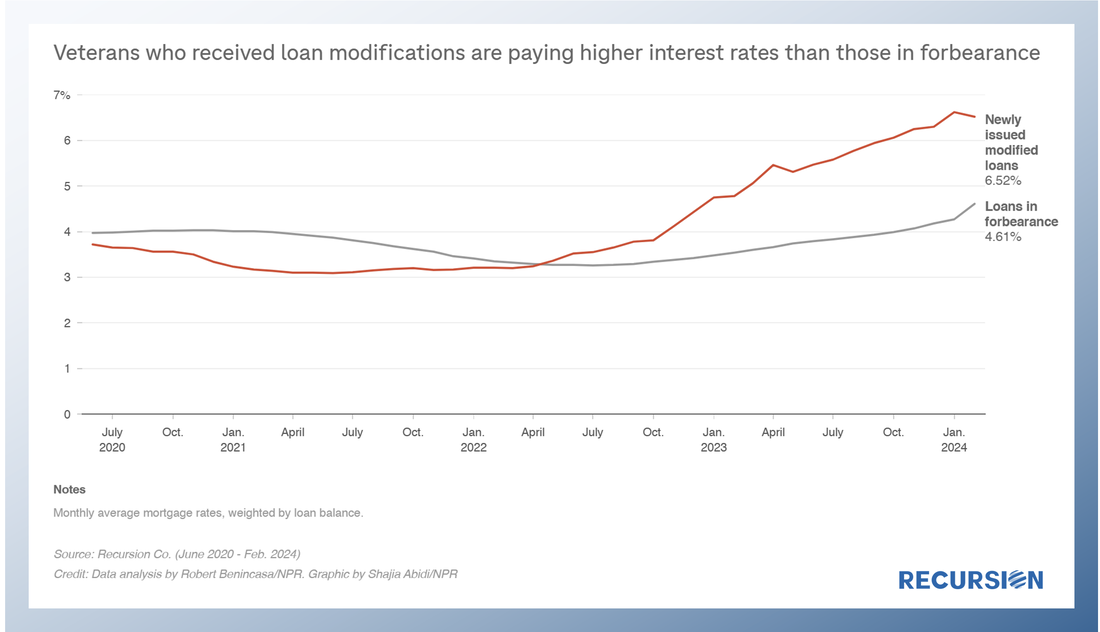

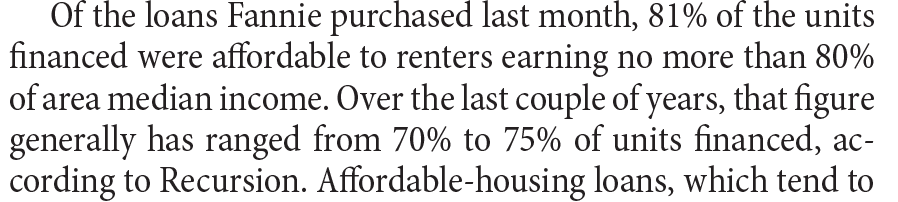

https://www.housingwire.com/articles/analysis-loan-repurchase-patterns-at-fannie-freddie-are-divergent/ (paywall) On May 14, 2024, National Mortgage News published an article, "How mortgage investments may evolve as bank share shrinks”[1] citing Recursion Chief Research Officer Richard Koss as saying that “the share of government-related transfers to nonbanks have been trending upward and have been particularly high recently”. Moreover, “Bank to nonbank trades have made up nearly 12% to almost 20% of transfers based on loan count in the past three quarters as compared to a range of around 4% to 17% in the 18-month period just prior, Recursion found in analyzing data from Ginnie Mae, Fannie Mae, and Freddie Mac. " Recursion is very pleased to be the leader in providing mortgage market data and analytics to the most influential industry professionals. Please reach out to find out how our team can help you grapple with today’s most pressing challenges in the mortgage space. On April 11, NPR cited Recursion data in a story about VA policies designed to assist distressed borrowers[1]. Last year, VA terminated its forbearance program, leaving borrowers vulnerable to foreclosure. In November, VA initiated a foreclosure moratorium, and on April 10, the Veterans Affairs Servicing Purchase (VASP) program was announced[2]. Recursion data was cited by the reporters to show that interest rates of newly modified VA mortgages are higher than those currently in the forbearance program. On February 16 Commercial Mortgage Alert published an article entitled “Fannie Focusing on Affordable Market”. In this article, they stated that “Fannie purchased $4.04 billion of multifamily mortgages in January, according to data from Recursion Co.” They go on to mention that “Of the loans Fannie purchased last month, 81% of the units financed were affordable to renters earning no more than 80% of area median income. Over the last couple of years, that figure generally has ranged from 70% to 75% of units financed, according to Recursion.” We are proud that our data is widely cited in issues of importance to the housing policy and finance communities.

Please reach out to [email protected] if you would like a copy of the article As part of its year-end market review, Housing Wire picked up Recursion’s theme of “Mortgage Winter”. On December 22, in an article entitled “‘Mortgage winter’ is expected to thaw a bit”, Recursion Chief Research Officer Richard Koss is extensively quoted. “Koss points to the huge volume of low-rate mortgages outstanding as the vexing problem the market faces. He said ‘I think a mortgage winter has frozen things hard and conditions are such that we can only expect a measurable improvement out past 2030.’ Recursion is proud to apply its advanced data and analytic tools to contribute to the ongoing dialogue about the market environment for the mortgage market.

Please reach out to [email protected] if you would like a copy of the article. On September 15, Recursion Data was cited in a story in Commercial Mortgage Alert that pointed out that Fannie Mae “has started to restrict the interest-only payment periods on debt backing properties built before 2000.” They cite Recursion data in pointing out that Fannie Mae purchased $4.2 bn in multifamily loans in August, bringing the year-to-date total to 35.3 billion, down 20% from the same period in 2022.

Recursion is pleased to provide excellent support to all participants in this crucial segment of the commercial real estate market. An article published in Commercial Mortgage Alert on June 9 stated that:“Fannie Mae will no longer offer 35-year amortization schedules on loans financing market-rate multifamily properties.”

They went on to state:“Loans with 35-year amortization schedules accounted for 26.5% of Fannie multifamily loans in May, the highest portion on record and up from 6.1% in the same month a year ago, according to data from Recursion Co., which has amortization data dating to 2016. The research firm also reported that Fannie notched $4.25 billion of multifamily business in May, down 14% from last year.” The new policy takes effect on June 12. Loans with 35-year schedules providing support to affordable projects will continue to be offered. Recursion is pleased to be the preferred source for mortgage data and analytics for key information providers in the mortgage market. On June 20th, MSCI Executive Director Yihai Yu published a report “Agency MBS Are Going Social”[1], describing the data disclosed by the GSEs in the social data space. He goes on to describe how the release of this data enhances their prepayment models. We are pleased to see that they cite Recursion data in their efforts. Recursion is devoted to providing its clients with cutting-edge analytic tools to access timely and clean mortgage data at a deep level of detail conduct research of great benefit to all the participants in the mortgage market. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed