|

The cherry blossoms are blooming, which means it’s time for the HMDA preliminary data set to be released. The dataset provides a social underpinning to the nation’s mortgage market and enhances our understanding of the behavior of borrowers and lenders. The 2022 dataset has been particularly eagerly awaited, as we get our view on the new world of high inflation and mortgage rates for the first time in decades. We start with origination volumes and get not just confirmation of the onset of mortgage winter, but some breakdown of its characteristics.

With all eyes on the turmoil in the banking sector, it’s good to see that policymakers continue to innovate to help borrowers. Earlier this month, HUD published Mortgagee Letter 2023-06 “Establishment of the 40-Year Loan Modification Loss Mitigation Option”, which establishes the 40-year standalone Loan Modification into FHA’s COVID-19 Loss Mitigation policies[1]. The standalone 40-yr mod is scheduled to be implemented by May 8. This follows the establishment of a 40-yr modification with a partial claim in April 2022[2]. The introduction of standalone 40-yr mods reminded us that we haven’t focused on the progress of the 40-year mod with a partial claim identified by pool prefix “ET”. Below find a chart of issuance by program:

In a recent story about the impact of the recent banking turmoil, National Mortgage News cited Recursion data in noting that both UBS and Credit Suisse have little direct tie to mortgage lending in the US. In the same story, Recursion Chief Research Officer Richard Koss was cited as saying that a hard landing in the economy related to bank issues could lead to cost pressure on servicers.

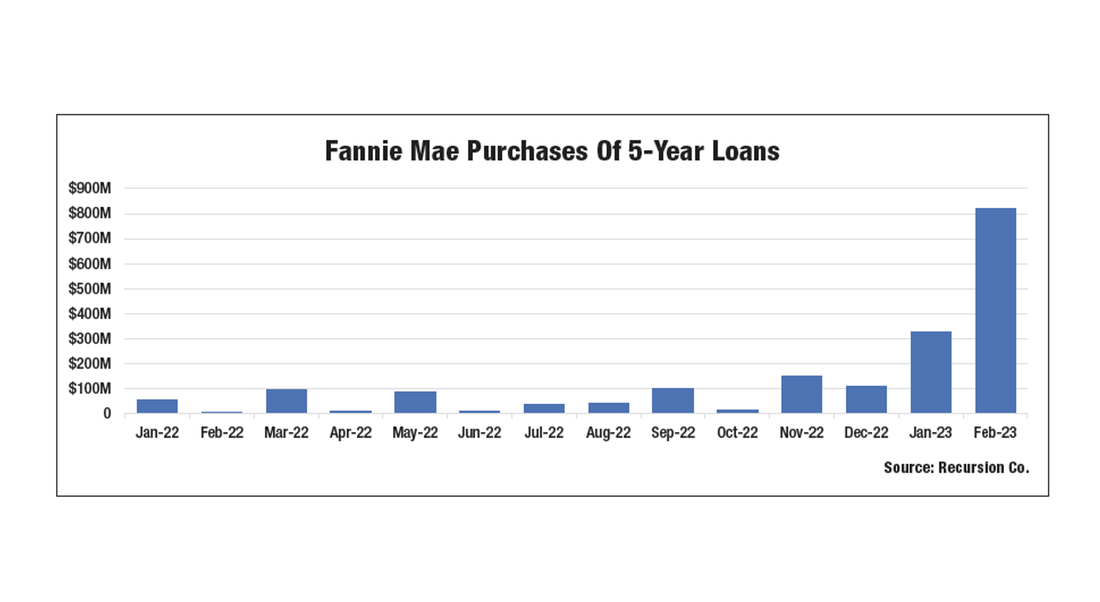

The article can be found on the National Mortgage News website (paywall). The Commercial Mortgage Alert recent article “Agencies Open to Five-Year Loans” [1] cites Recursion data to document a recent surge in five-year commercial mortgages on the part of Fannie Mae and Freddie Mac. Market conditions are supporting the change in the profile of demand for Agency mortgages.

Introducing the Recursion Agency Multifamily Dataset Part 2: Outstanding Balance Benchmarking3/20/2023

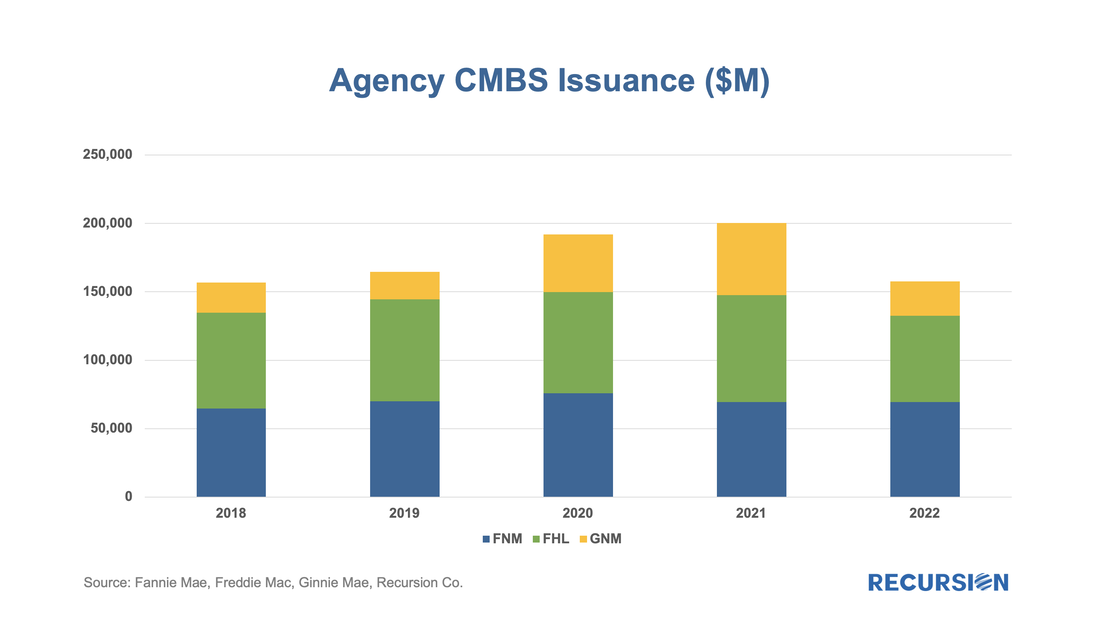

In a recent post, we introduced the Recursion Agency Multifamily Dataset, a complete accounting of multifamily loans securitized in Agency pools, going back to 2009. We provided a breakdown of issuance for the total market and by agency in that post. A natural question that arises is how can we benchmark our new dataset? In this case, we look at outstanding balance rather than issuance volume. The Agencies provide quarterly data on total outstanding balances on their web sites. When we compare this to our own data, we get this:  To read the full article, please send an email to [email protected] Over the past 18 months, Recursion has undertaken an extensive effort to aggregate multifamily loans and properties across all three Agencies by Deal Type. The data is complete back to 2009 for all three Agencies and somewhat longer for individual deal types. This allows us to aggregate the loans to the pool and then CMO levels for in-depth analysis. An innovation is that we have tied the loans to the property level, giving us the ability to perform analyses on a wide variety of topics, including ESG considerations and much more[1]. For this note, we will provide a basic overview of the dataset. Here is the topmost view from the Agency level: To read the full article, please send an email to [email protected] On February 9, Ginnie Mae announced a new Low-Moderate Income Borrower (LMBI) disclosure[1] “in response to investor interest in having greater transparency into Ginnie Mae mortgages in pools, in particular as part of meeting Environmental, Social, and Governance (ESG) investment mandates”.

“The new disclosures capture the number of underlying loans made to LMI borrowers, the percentage of LMI loan count of total loan count, the unpaid principal balance (UPB) of LMI loans in the mortgage-backed security (MBS), and the percentage of LMI UPB of total MBS UPB.” “LMI households are classified according to the Federal Financial Institutions Examination Council (FFIEC) Median Family Income Report Tables[2] corresponding with the time of loan origination. These disclosures are being provided at the aggregate pool level for Federal Housing Administration (FHA) and U.S. Department of Veterans Affairs (VA) loans originated beginning in 2012.” In other words, grist for the Recursion mill. First, we look at the share of Ginnie vintage 2012 and later pools that consist of loans for which more than 50% are LMBI borrowers: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed