|

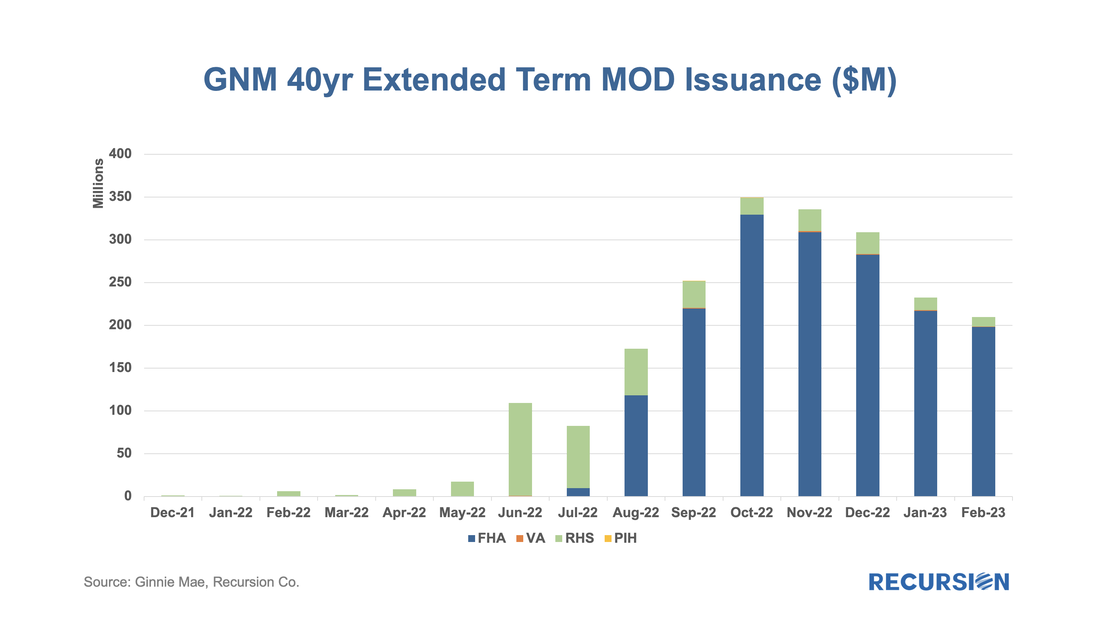

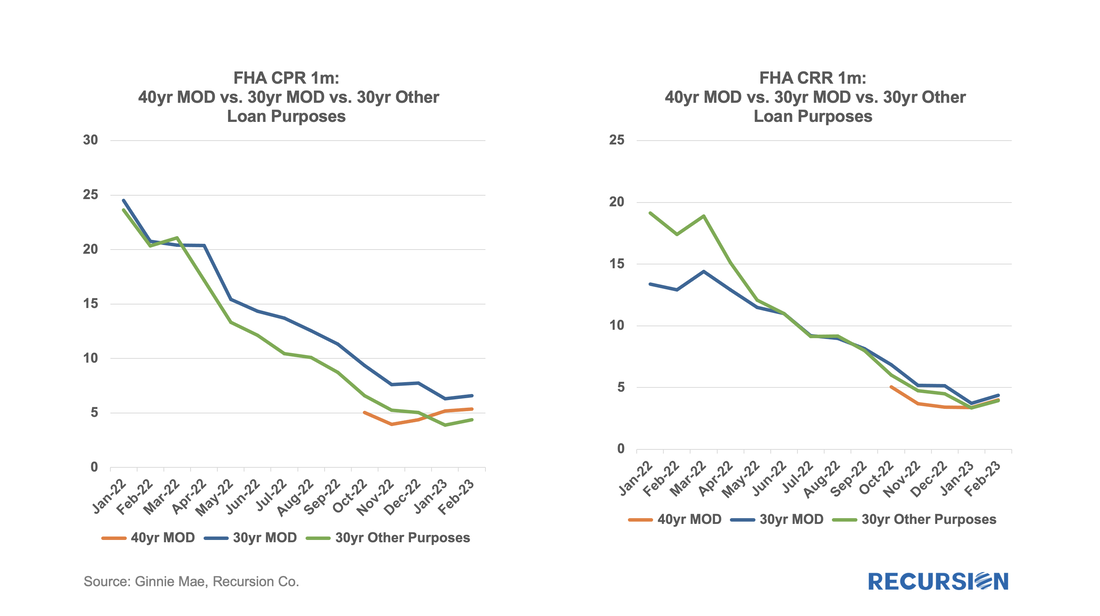

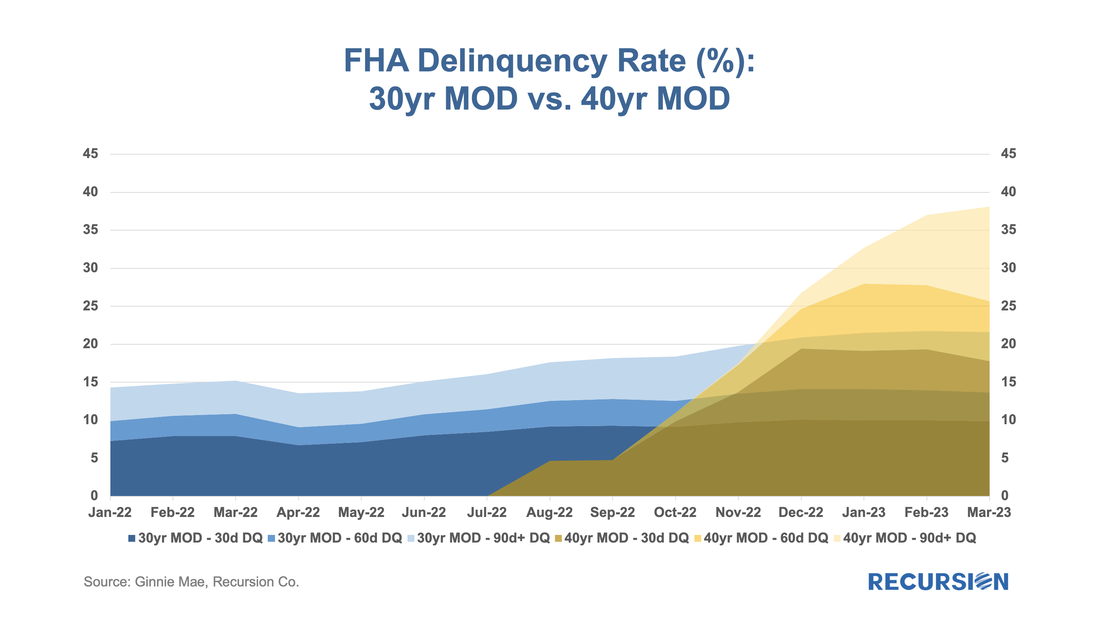

With all eyes on the turmoil in the banking sector, it’s good to see that policymakers continue to innovate to help borrowers. Earlier this month, HUD published Mortgagee Letter 2023-06 “Establishment of the 40-Year Loan Modification Loss Mitigation Option”, which establishes the 40-year standalone Loan Modification into FHA’s COVID-19 Loss Mitigation policies[1]. The standalone 40-yr mod is scheduled to be implemented by May 8. This follows the establishment of a 40-yr modification with a partial claim in April 2022[2]. The introduction of standalone 40-yr mods reminded us that we haven’t focused on the progress of the 40-year mod with a partial claim identified by pool prefix “ET”. Below find a chart of issuance by program: The program was led by loans produced by the Rural Housing Service, but since the Fall of 2022, it has been dominated by FHA loans. Issuance peaked in October and has more recently tailed off, in line with the pattern of declining buyouts we observed last year. The use of term extensions has become an increasing portion of the toolkit that policymakers have at their disposal to help forestall foreclosures in a high interest rate environment. Prior to 2022, interest rate mods were the most common vehicle, but during 2022 this became impossible as current mortgage rates climbed higher than virtually all outstanding loans. A natural question in benchmarking the program is to compare the performance of the new 40-year mods with their 30-year counterparts for FHA loans: Here is the comparison for speeds: Interestingly, the new 40-year mod has recently prepaid (measured by 1 month CPR) slower than 30-year mods, but faster than 30-year mortgages with other purposes. However, after adjusting for mandatory buyouts, we can see that in the past couple of months, voluntary prepays (measured by 1 month CRR) have converged over pool types. We can conclude here the faster overall prepayment for 40-year mods is driven by involuntary prepayment. The corresponding chart for delinquencies is here: Here we see that 40-year mods DQs picked up quite quickly from the outset of the program, with total DQs reaching 38% compared to 22% for 30-year mods. So there is some cost associated with the new program. Going forward, learnings from these experiences will certainly inform future policies. The effectiveness of these programs is dependent to a large degree on the environment, which is at present increasingly challenging to borrowers and policymakers alike. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed