|

As we careen towards 2021, it’s getting to be time to look down from the top of the roller coaster towards the abyss below. The view is extremely hazy, but fortunately we have big data tools at our disposal to help clarify things. In mortgage space the single main question is what’s going to happen when forbearance expires. This program was designed to run out after a year, and that will be coming up starting next spring. If you are in forbearance and your time runs out, you have three choices:

Like all things related to mortgages, this is far more complicated than it appears. According to the Mortgage Bankers Association, 5.9% of mortgages are in a forbearance program[1]. The NY Fed tells us that outstanding mortgages amount to about $10 trillion.[2] So large numbers are involved. The main market focus is on the distribution of outcomes when forbearance ends. This depends on a number of factors including the strength of the economy and the effectiveness of public health policy, as well as the financial condition of mortgage lenders and servicers. None of these are easy to predict. Our Chief Research Officer, Richard Koss, was invited by the Urban Innovation Working Group of the School of International and Public Affairs (SIPA) at Columbia University to discuss post-COVID affordable housing. This event was organized as part of UN-Habitat’s Urban October initiative. Richard talked about recent trends in the housing market and the impact on low income groups.

Besides his work at Recursion Co, Richard also serves as Adjunct Professor at Columbia SIPA. The panel discussion can be found at: https://www.youtube.com/watch?feature=youtu.be&v=HX56vC_QLrI&app=desktop Recursion’s Chief Executive Officer Li Chang and Chief Research Officer Richard Koss will speak at the Mortgage Servicing Rights Virtual Forum hosted by Information Management Network (IMN) on October 29th. The forum will cover new market paradigms developed during the Covid pandemic and their impact on the mortgage market. Recursion’s Chief Executive Officer Li Chang will discuss mortgage delinquency and servicing costs, while our Chief Research Officer Richard Koss will discuss the impact of forbearance on modeling and stress tests. More Information can be found at https://www.imn.org/virtual-events/conference/Mortgage-Servicing-Rights-Virtual-Forum/Description.html Our Chief Research Officer, Richard Koss, was invited by the Finding Genius Podcast to analyze the pandemic’s impact on the housing finance system. Richard describes how Recursion data sheds light on new developments and shares his insights on how the cyclical and structural elements of the housing market respond to the pandemic, and the outlook for the housing market over the next six months. Source: Finding Genius Podcast

The millennial generation has reached peak home buying age, covering a range of about 25-40 years old. Just this year this cohort at 72.1 million passed the baby boom generation in sheer size[1] although this is a bit less than the 78.8 million peak reached by boomers in the late 90’s[2]. Millennial presence or lack of it in the housing market has been the subject of voluminous commentary, ranging from extreme optimism derived from the magnitude of the population bulge to caution related to affordability and impediments to building savings stemming from student loan debt[3] and high rental and child care costs[4]. What can big data tell us about this?

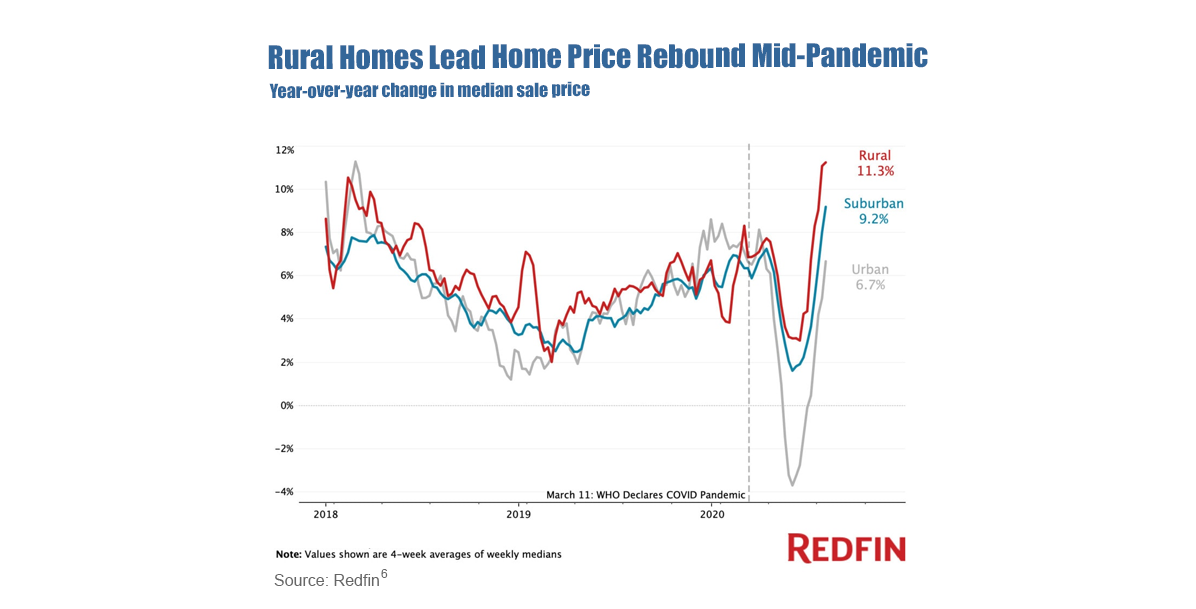

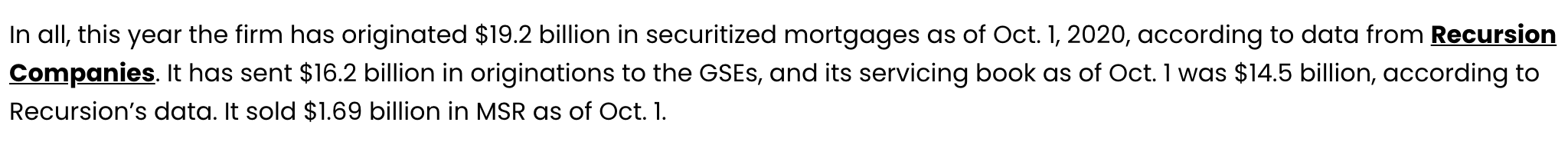

A 2018 study by the Federal Reserve showed that Millennials had lower incomes and assets and higher debt than previous cohorts at a similar age[5]. Our data sets can provide some useful, but far from conclusive, insights into these trends since the onset of the Covid-19 pandemic. Covid-19 is both a cyclical and structural shock. On the cyclical side mortgage rates have fallen to record lows as the Federal Reserve responded quickly and decisively to the health crisis. On the structural side, residents of urban areas have picked up and fled to less dense locations, resulting in a sharp increase in house prices nationally. According to Redfin these price gains have been led by those in rural and suburban areas, rendering these areas less affordable, while urban areas remain out of reach for most. Recursion data was quoted in the October 13, 2020 HousingWire article on Finance of America’s IPO plan. Recursion Data was used to demonstrate the magnitude of Finance of America’s agency mortgage securitization, the size of its servicing book and its most recent MSR transactions. Source: HousingWire This article is accessible through the link below:

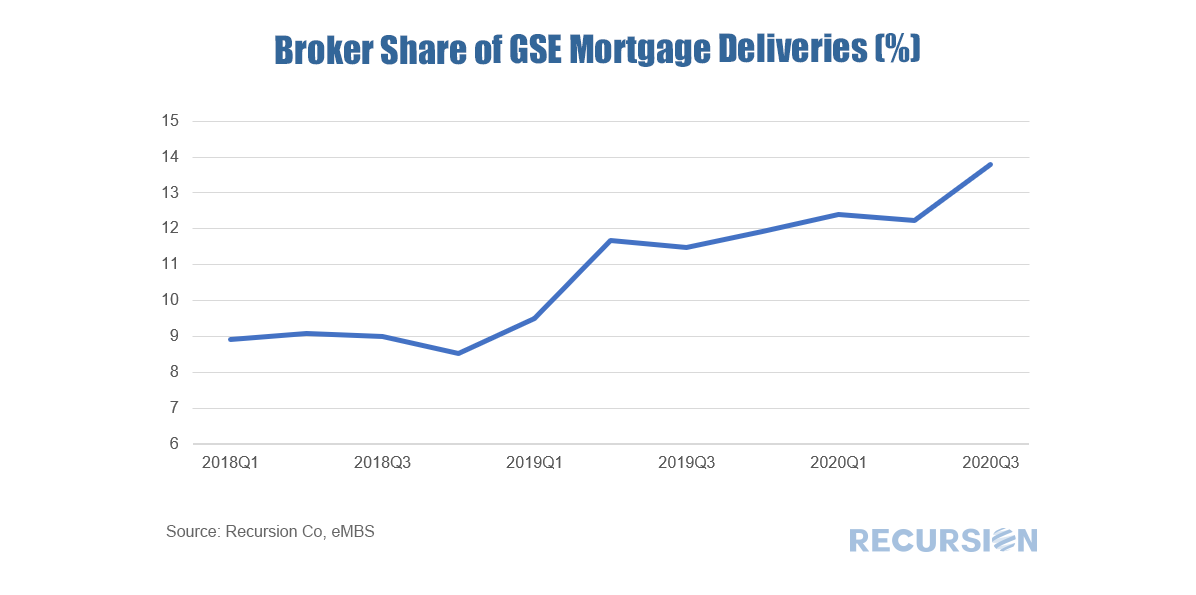

https://www.housingwire.com/articles/blackstone-owned-lender-and-servicer-finance-of-america-to-go-public/ We have posted numerous blogs about how Covid-19 has served to accelerate structural change in the mortgage market, particularly in the growing share of nonbank mortgage sales to the GSE’s[1]. It’s natural in such an environment to look at deliveries by channel. As has been widely noted in the industry, the broker channel enjoyed a considerable increase in market share over the 2018-2019 period, as the broker community became better organized[2]. Has this trend continued with the onset of the Covid-19 crisis?

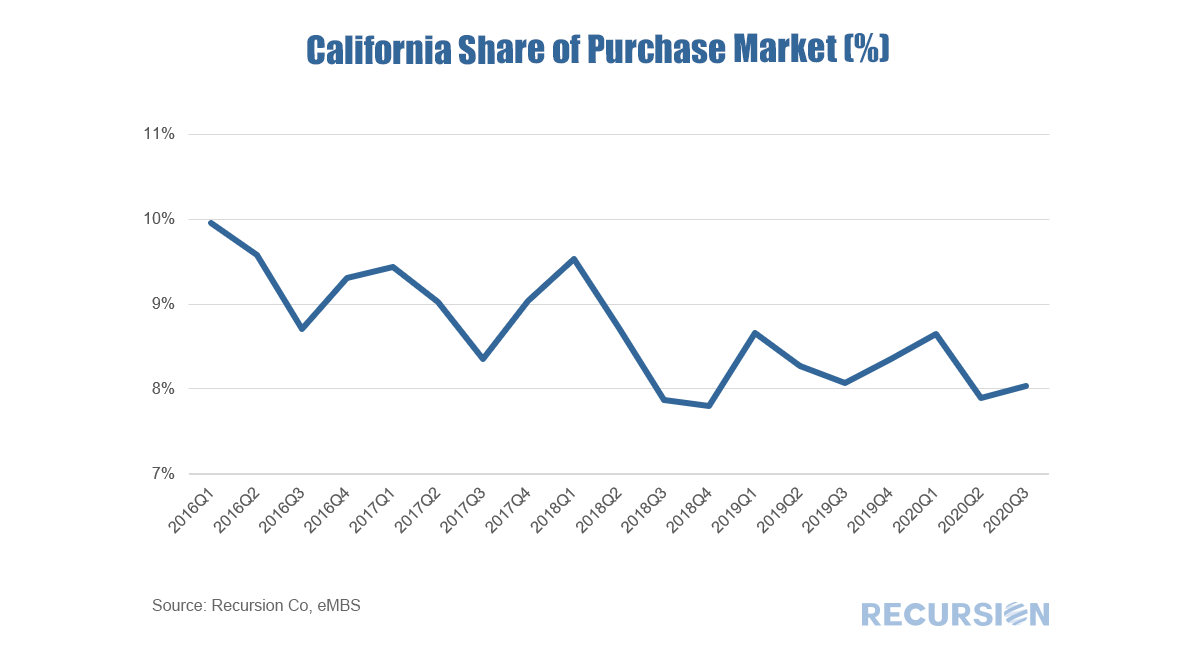

One of our ongoing themes in this blog is that we are entering a period of unremitting structural change. We’ve noted previously that the combination of Covid-19 and technological innovation is leading to a surge in the nonbank share of purchase mortgages to the GSE’s[1]. Of course, there are others, notably climate change. As the technology leader among states and also the one suffering severe damage from wildfires, California is at the nexus of these transformations.

A survey conducted by the University of California at Berkeley in 2019 revealed that more than half of the residents of the state had given “some” or “serious” thought to leaving the state[2]. Has this in fact occurred? Such a desire may be offset by the traditional role of the state in attracting immigrants and young people looking for careers in technology and media. One way to look at this is to pull data for the count of new purchase mortgages sold to the GSEs in the state as a share of the US total: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed