|

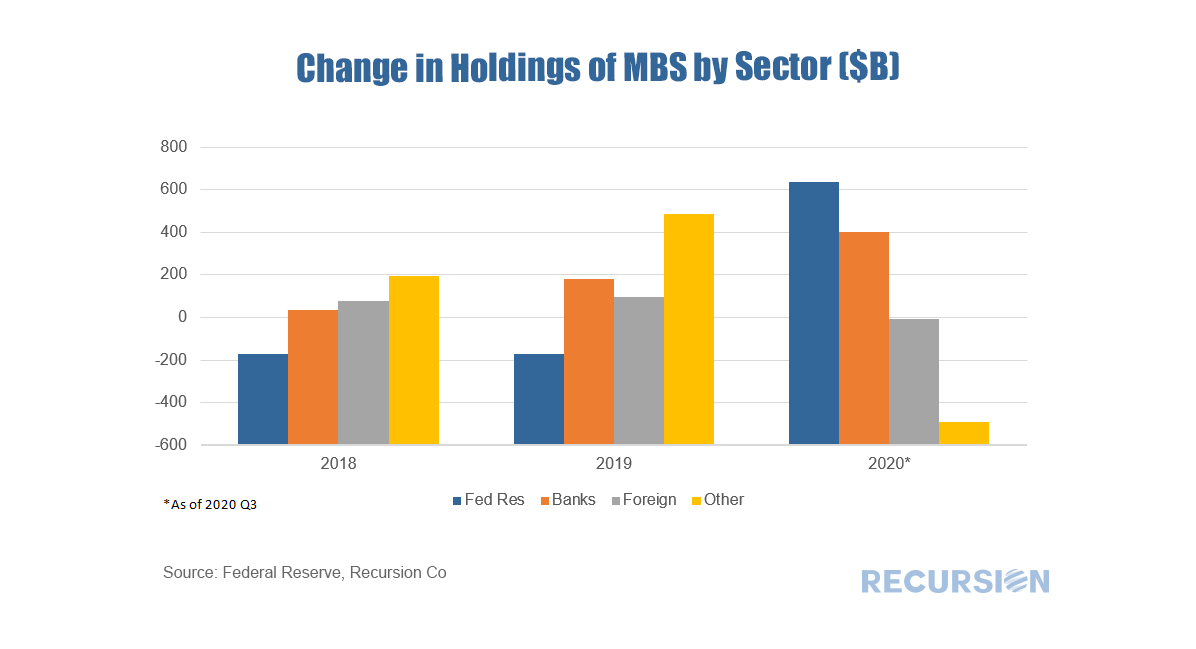

Updates of the Federal Reserve Financial Accounts (Z.1) data[1] always provide food for big-picture thoughts and the recent release of Q32020 data is no exception. Here is a look at the recent trend in holdings of MBS by sector:

Recursion Co’s Chief Executive Officer Gives the New Year Opening Talk to PyData Chicago Group12/30/2020

Recursion Co’s Chief Executive Officer Li Chang will give a talk sponsored by PyData Chicago Group, the educational arm of the NumFOCUS non-profit organization on January 21st. Li will introduce how Recursion applies big data technology on Amazon Cloud to drastically cut down data processing time, reduce users’ costs, and bring transparency to the financial markets.

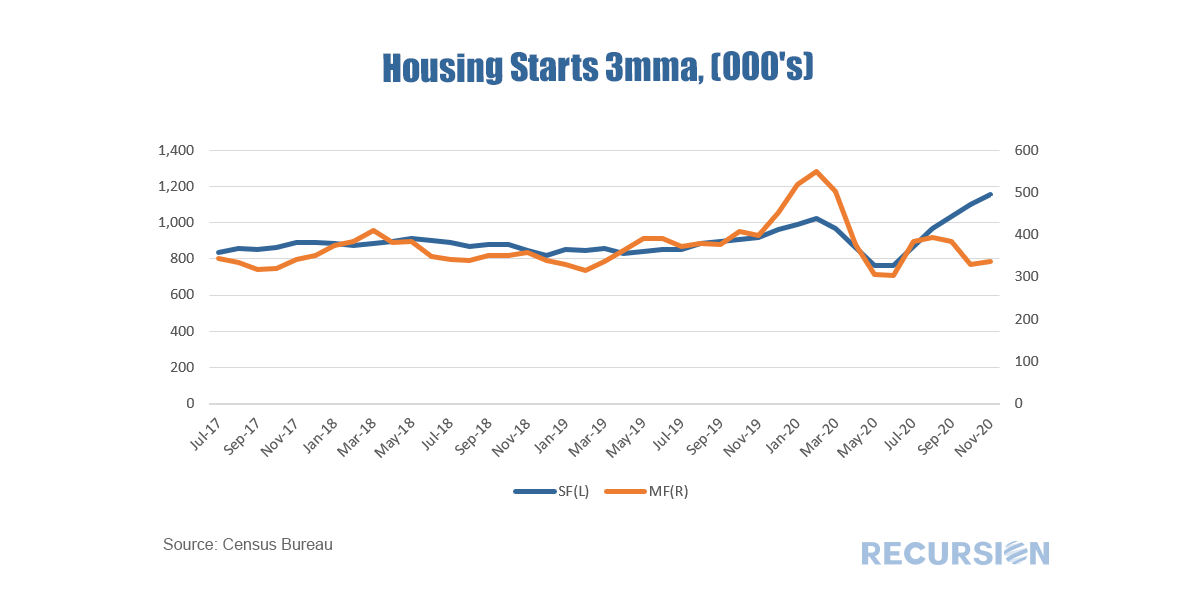

More details can be found at https://www.meetup.com/PyDataChi/events/275326825/ While the single-family housing market is booming, the trend in the multifamily market is much more nuanced. Over the 3 ½ year period from July 2017 to December 2020, new supply as measured by housing starts was in a steady-to-modestly rising trend. This changed with the onset of the Covid-19 pandemic:

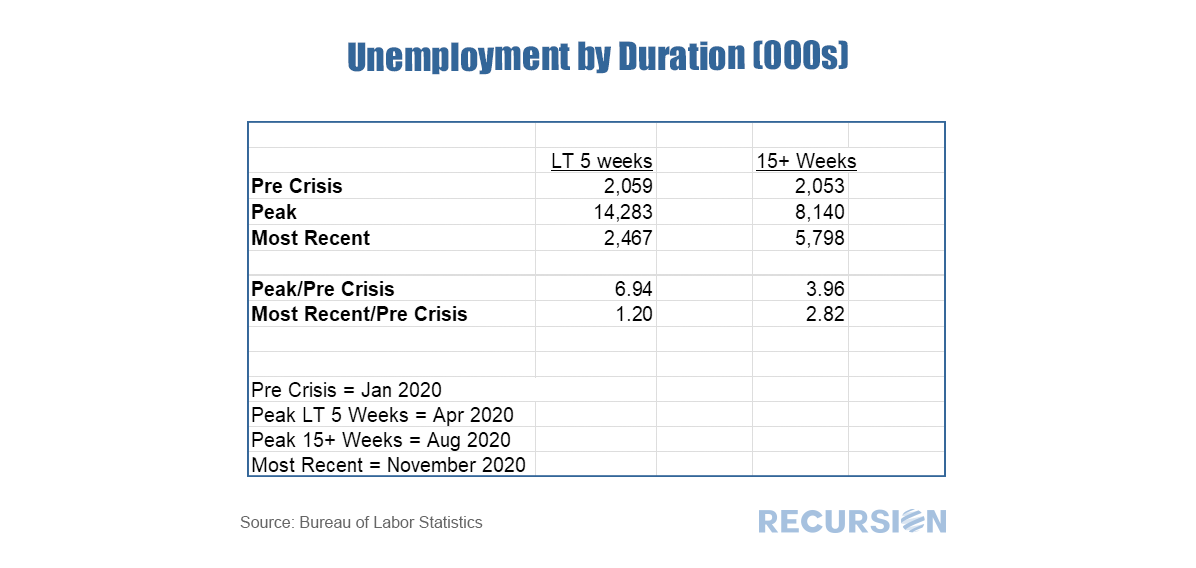

In prior posts, we have pointed out the tight relationship between unemployment and mortgage delinquency[1]. This note extends this analysis by looking at this relationship at particular durations.

Every month, the Bureau of Labor Statistics releases data on the “Duration of Unemployment”[2]. For example, below find a table containing data for the number of unemployed people in before, during and after the shock associated with the onset of the Covid-19 crisis by how long they have been unemployed. Recursion’s Chief Research Officer Richard Koss was interviewed by HousingWire about the role of policy intervention on the part of the Federal Reserve in supporting secondary market stability at the onset of the Covid-19 crisis. Mr. Koss commented on the market performance during pandemic and the Fed’s actions to stabilize the market. Source: HousingWire This full article is accessible through the link below:

https://www.housingwire.com/articles/the-secondary-market-comes-to-the-rescue-again/ Recursion’s Chief Research Officer Richard Koss joined the IMN China Securitization Virtual Series hosted by Information Management Network (IMN) on December 8th. Mr. Koss discussed the real estate markets outlook for US and China during the recovery from the pandemic in the session “Outlook for 2021: The Global Economy”.

The audio can be access through http://imn-audio.s3.amazonaws.com/ESB1940/China%20-%202021%20Outlook-compressed.MOV.mp4 Along with Richard, other Session speakers include:

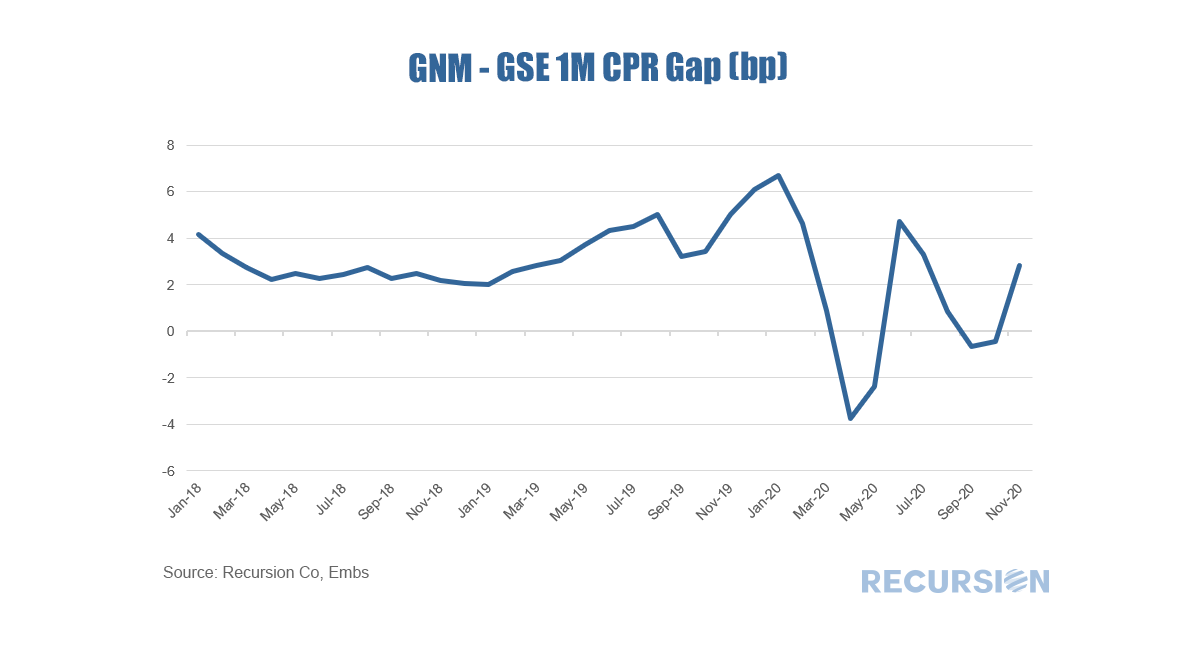

For some time, we have been talking about the key driver of mortgage performance is policy rather than fundamentals. This theme is certainly evident with the release of agency prepayment data for November[1]. The chart below chart displays the gap between the 1M prepayment speeds between Ginnie Mae and GSE securities:

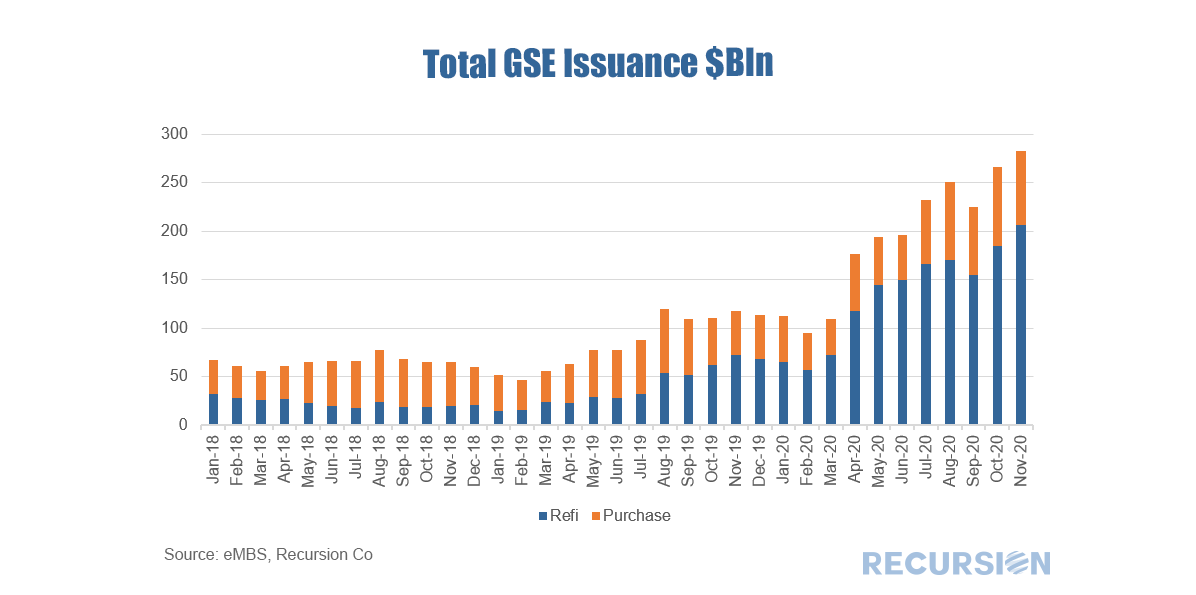

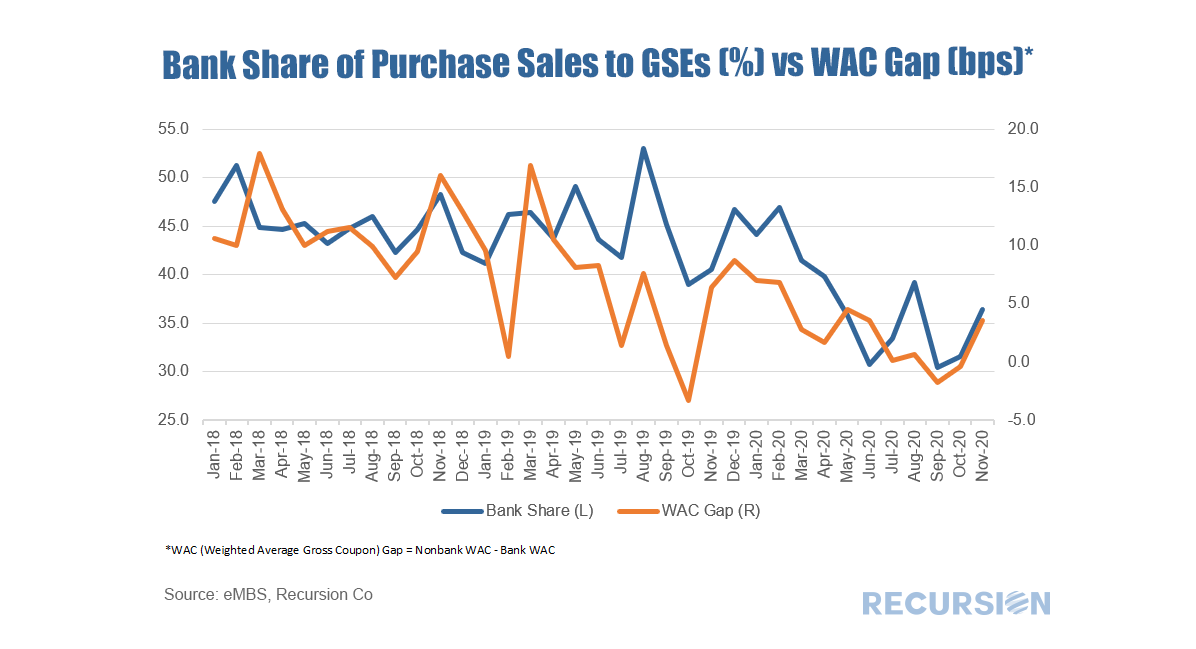

We received complete GSE data for November late last week and as always there is a lot to churn on. Another record high of issuance was achieved, although this was entirely due to a surge in refi deliveries (+$16 Bln from October) while purchase deliveries declined slightly (-$7 Bln). Lack of supply and softer seasonal demand appear to be weighing on purchase volumes. A long-term trend in these comments is the trend decline in the bank share of deliveries to the GSE’s[1]. We have commented that the Covid-19 pandemic has played to the natural technological advantage of nonbanks, while eroding the value of the bank branch networks, particularly for purchase mortgages. Interestingly, a little bit of a reverse trade can be seen the last couple of months, at least in purchase mortgages. The chart below looks at the bank share, graphed against the gap in the weighted average coupon between nonbanks and banks (“WAC Gap”). There is a distinct correlation between these two series, although considerable noise is also apparent. Many factors drive market share including underwriting characteristics and product types, but the basic relationship comes across. In November, the gap in the WAC between Nonbanks and Banks increased by almost 4 basis points from October, which was attained by a 3 bp drop in the nonbank WAC being exceeded by a 7 bp drop in that of banks. In a market measured in tens of billions, a single bp has significance. The question going forward is whether the decline in the rates of banks’ offerings is supported by efficiency enhancements or simply reflects reduced profitability. The answer to this is key in determining the question of their long-term role in this market. [1] See, for example: https://www.recursionco.com/blog/besieged-banks

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed