|

One of our ongoing themes is that pervasive structural change implies that traditional relationships between measures of market performance and economic fundamentals cannot be relied on to be stable over time. As a result, a broader view across markets is called for. Below see 90+Day delinquency rates as reported by the Federal Reserve Bank of New York’s Household Debt and Credit Report:[1] There are quite a few points to take away from this chart. Note the peaks around the time of the Global Financial Crisis (2009-2010) and the onset of the Covid Crisis (2020-2021). These correspond well with comparable spikes in the unemployment rate (10% in October 2009 and 14.8% in April 2020). But the composition is quite different. During the GFC mortgage, DQs spiked very much higher for mortgages than those for car loans, while the pattern was reversed during Covid. This can reflect differences in policy between the two periods (mortgage forbearance in 2021 but not 2011), but also, this likely reflects consumer’s views on the value of paying off different types of debt. In 2010, house prices were plummeting, so incentives to pay towards an underwater mortgage were low, but they needed their cars to get to their jobs, so they continued to pay off their auto loans. During the more recent Covid crisis period, homeowners in distress had access to forbearance programs. This brings us to the more recent period. We see that delinquency rates across products started to rise in late 2022 across debt classes. Of note is the sharp increase in 90-day DQs for credit cards from 7.7% in Q4 2022 to 10.7%, above the Covid crisis peak of 10.0% in 2021Q1 and the highest reached since 10.9% in Q2 2012. Car loan DQs rose modestly from 3.7% to 4.4% over this period, while mortgage DQs inched slightly higher from 0.4% to 0.6%. The superior performance in mortgages is no doubt due to the post-Covid surge in house prices, which has created a powerful incentive for homeowners to stay current on their mortgages. But the interesting observation is that these increases occurred even though the unemployment rate has remained less than or equal to 4.0% for the past 18 months. Clearly there is a class of distressed borrowers out there in this relatively strong labor market. Since the NY Fed data contains no detail at all in terms of these borrowers, we take a deep dive into mortgage delinquencies based on agency disclosures. We start by looking at total delinquencies of the total books of business for the GSEs and FHA: It's interesting to note that the trend in all cases is flat-to-down, in contrast to the slight rise in the NY Fed data[2]. There are many possible explanations for this, including that our data do not contain VA or non-QM loans, and that the NY Fed data is based on a 5% sample while ours covers the entire universe of outstanding mortgages in the GSE and FHA programs[3]. For our purposes, the most interesting program is FHA since these borrowers tend to have lower incomes, lower credit scores, and less experience managing debt compared to other mortgage holders, implying that they have relatively higher vulnerability to adverse economic conditions[4]. The thing is, as mentioned earlier, conditions are not that adverse. To find trends in distress in the FHA program we look at modified loans as these started out as loans that were determined to be unsustainable to begin with. In fact, performance here has deteriorated on trend over the past couple of years: The 90-day DQ rate for these loans almost doubled from 4.1% in February 2022 to 8.0% in March 2023 and has been in a volatile but flat trend since that time. We look for fundamental trends to scale this trend, in general, from labor market indicators, which we feel is the key driver of mortgage performance. There are many such candidates, but here we look at the Kansas City Federal Reserve Labor Market Condition Indicators (LMCI)[5]. These indicators consist of 24 distinct labor market variables. The indicator we use is the LMCI Level of Activity index. It is scaled so that a number above zero indicates a stronger level of activity than the long-term average. In the chart above, we invert this indicator so as to see the correlation with rising distress in FHA modified loans. It seems that modified loans are sensitive to deceleration in labor market activity. We can dig deeper into this phenomenon by breaking the data down into different categories: Here, we break the FHA universe into four categories: ET loans, mods ex ET, RG and other purposes. ET is extended term, which are generally 40-year mortgages. RG is Reperforming, which is not a mod but a loan leaving forbearance with a partial claim. All four categories exhibit quite different behaviors with ET loans displaying sharply worse performance than the other categories. It’s important to note that the ET share is quite small but growing: The above chart points out that while looking at DQ charts is informative, they can be somewhat misleading in situations where programs have been around for different lengths of time. One way to get around this is to look at particular cohorts. Below find DQ’s for the 2022-2024 cohort: It’s interesting to note here the stability in the Mod ex-ET and other categories. Growing distress is visible for the newer RG and ET programs, although the DQ rates for both peaked earlier this year. Finally, another way of looking at distress over time in a consistent pattern across programs is via Early Payment Defaults (EPDs). These are the share of loans that experience two or more months of missed payments in the first six months after origination: EPDs jumped with the onset of Covid but quickly fell back after forbearance and other policy programs were instituted. More recently, we can see distress in the various mod programs while loans in the Other category exhibit little such behavior. This difference is interesting because the incentive to pay for more recently-originated mortgages is very much less than those prior to 2021 given the recent jump in home prices. To conclude, examining the behavior of nonpayment of debt is a very complex task, which varies by loan class, and subclass. It depends on the financial health of borrowers, and the state of the economy, particularly with respect to labor markets. It is important to avoid making broad statements about trends in DQs without taking these factors into consideration. Finally, we do not see broad signs of distress in consumer debt markets (particularly credit cards) spilling over to mortgages, except possibly in the most distressed cohorts. We conclude that mortgages are not yet a source of general financial concern, but the situation needs to be closely monitored, particularly within the most distressed category of borrowers. [1] https://www.newyorkfed.org/microeconomics/hhdc

[2] This contradicts a widespread view that FHA loan performance has deteriorated in recent quarters. In fact, the 30-day DQ rate for FHA has been in an upward trend over the past two and a half years. (To as high as 6.5% recently, according to FHA Loan Performance Trends Report). Most of these however, cure before hitting the 90-day threshold. [3] See New York Fed Household Debt And Credit Report (https://www.newyorkfed.org/microeconomics/hhdc), p44, paragraph 1. [4] For 2023 issued GSE and FHA loans (disclosed by Agencies), the WA credit score is 754 vs. 676; while the share of first-time home buyer of purchase loans is 46.5% vs. 75.0%. In addition, according to HMDA 2023, the WA borrower’s income is $301k for conventional loans and $112K for FHA loans. [5] https://www.kansascityfed.org/data-and-trends/labor-market-conditions-indicators/ In a recent post, we reviewed the market for mortgages with down payment assistance features[1]. We noted that our loan-level data for FHA showed a rate that was about half of that reported by the FHA Portfolio Snapshot database.

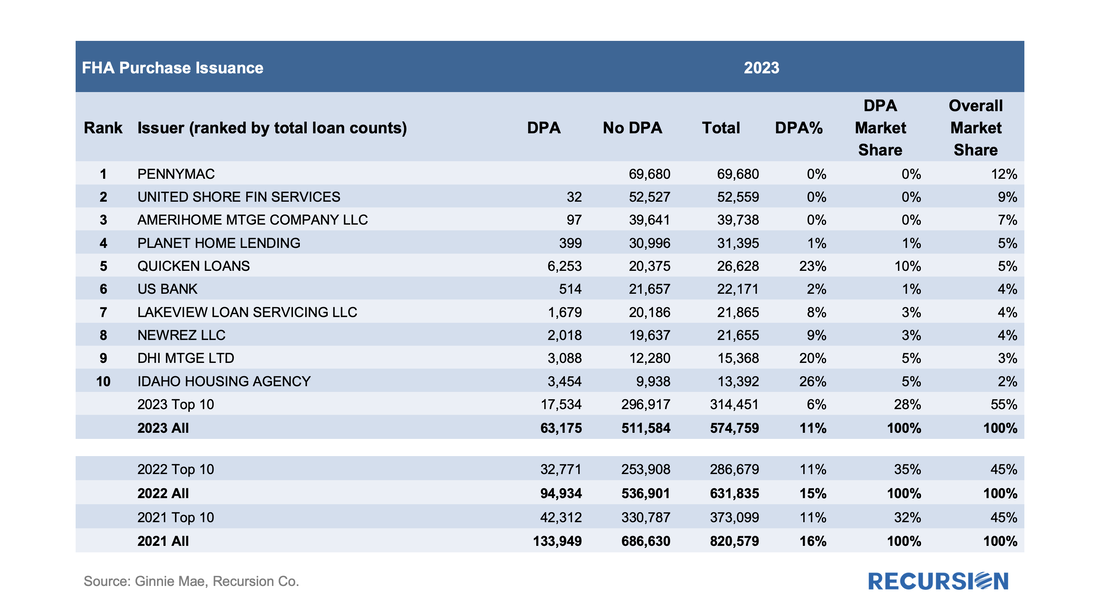

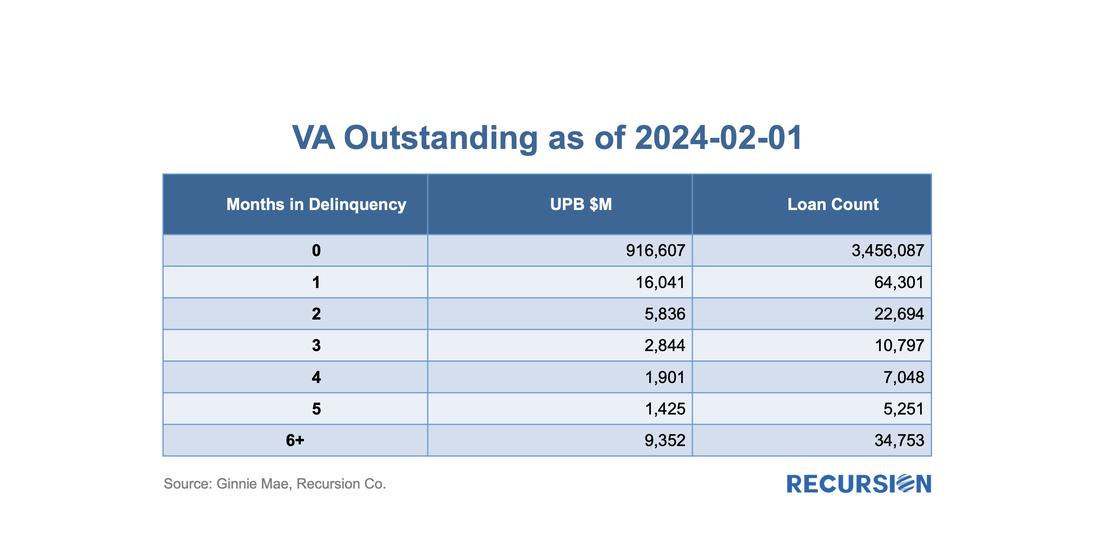

Since the agency disclosures are at the loan level, we use this dataset to do a deep dive into which servicers are most active with this product and what loan performance looks like across institutions. Unlike the previous note, which covered all deliveries, here we focus on the market for new purchase mortgages. Below find a table of the DPA usage for the top ten FHA purchase mortgage issuers in 2023, along with summary statistics for 2022 and 2021: On November 30, 2023, the Veterans Administration (VA) announced a new home retention program called the VA Servicing Purchase (VASP) program as an option for borrowers who cannot be assisted through other home retention options[1]. As the program will not be rolled out until March 2024, VA has strongly encouraged a foreclosure moratorium on all VA-guaranteed loans through May 31, 2024. Under this program, VA will exercise its statutory option to purchase the loan from the servicer and VA will hold the loan in VA's own loan portfolio[2]. The servicer will prepare a modification of the loan to increase affordability for the Veteran.

As the vast majority of VA mortgages are securitized in Ginnie Mae pools, let’s first take a look at the outstanding balance and loan count of VA loans using data disclosed by Ginnie Mae: Since the end of last year, the Government Sponsored Enterprises have released so-called “Social Score” Indexes that are made to appeal to ESG investors. Both Fannie Mae and Freddie Mac produce scores at the pool level based on a variety of social metrics. The following methodology summary comes from Fannie Mae[1] (Freddie Mac has adopted the same methodology as Fannie Mae’s):

With all eyes on the turmoil in the banking sector, it’s good to see that policymakers continue to innovate to help borrowers. Earlier this month, HUD published Mortgagee Letter 2023-06 “Establishment of the 40-Year Loan Modification Loss Mitigation Option”, which establishes the 40-year standalone Loan Modification into FHA’s COVID-19 Loss Mitigation policies[1]. The standalone 40-yr mod is scheduled to be implemented by May 8. This follows the establishment of a 40-yr modification with a partial claim in April 2022[2]. The introduction of standalone 40-yr mods reminded us that we haven’t focused on the progress of the 40-year mod with a partial claim identified by pool prefix “ET”. Below find a chart of issuance by program:

In recent posts, we introduced the phrase “Mortgage Winter” to describe the current environment where high-interest rates and elevated home prices lead to a severe drop in transaction volumes[1]. Subsequently, we looked at the impact of this situation on individual market participants[2]. The bulk of market participants across the mortgage ecosystem is experiencing year/year revenue declines of two-thirds or more. These entities are having to adjust their business models to this situation and develop strategies to navigate the uncertain environment ahead.

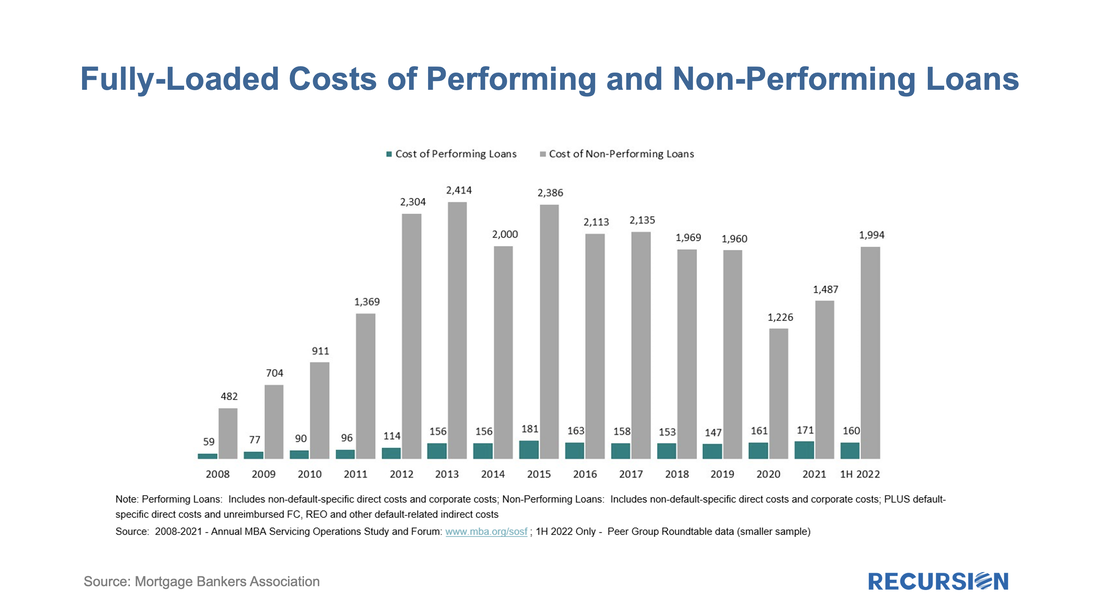

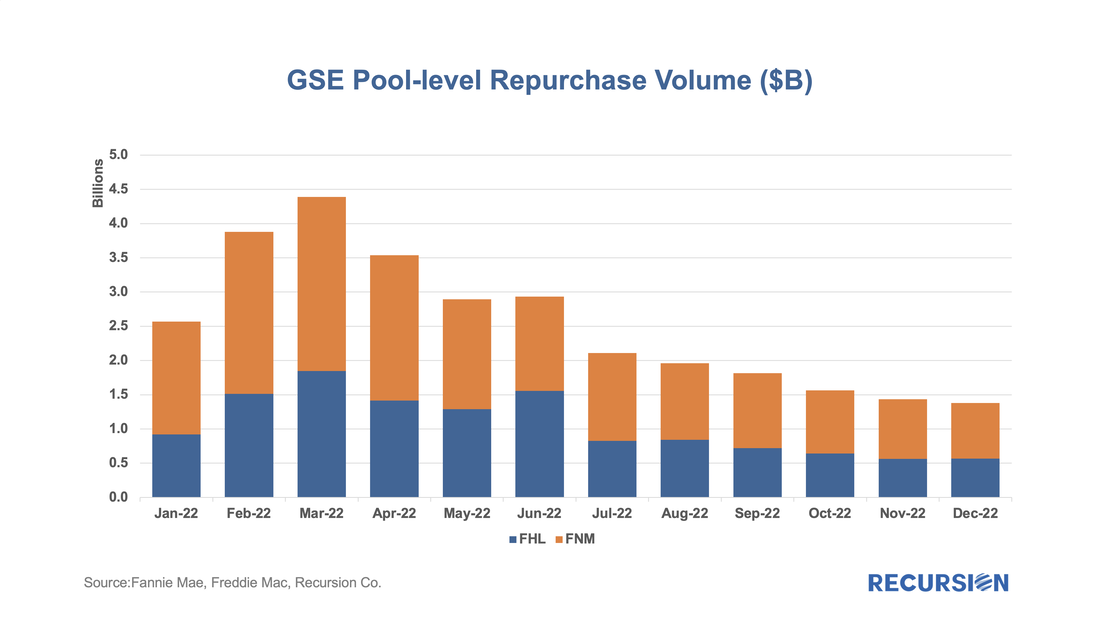

Spring will come, but whether the ensuing rebound will be sufficient to return the sector to a state of financial health is a question that remains far from assured. There is also another factor to consider besides revenue, and that is the potential for increased servicing costs associated with delinquent borrowers. Growing concerns about a looming recession combined with increasing signs of distress in Government mortgage programs, particularly FHA, are leading many market participants to step up their focus on GSE buyouts. These found a recent peak last winter as forbearance programs unwound and have been in a generally declining trend since that time.

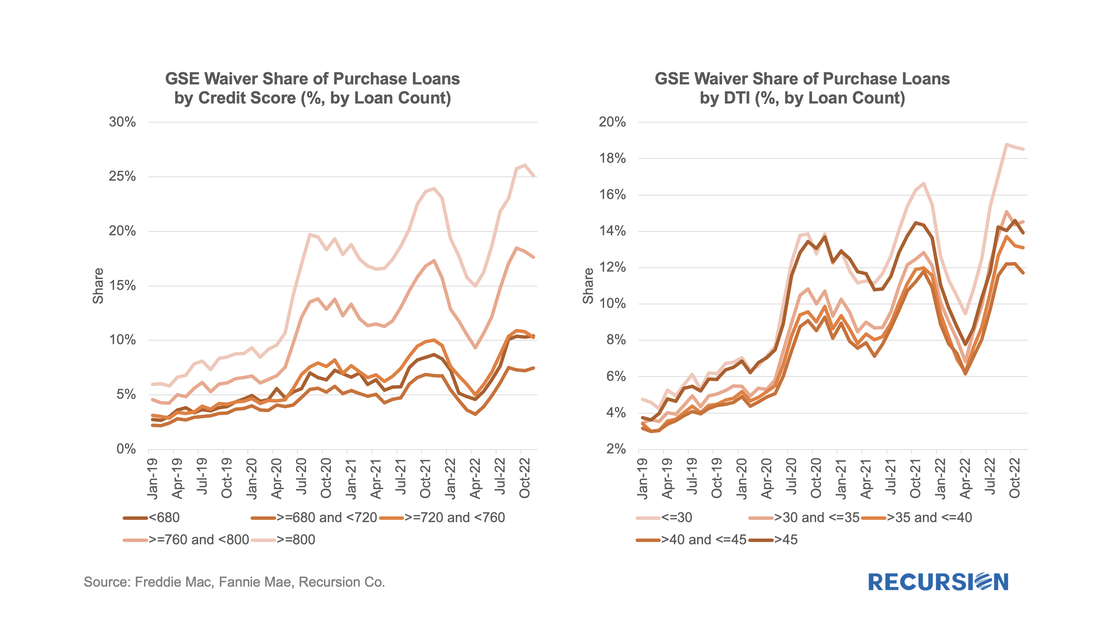

For some time, we have been following the trends in appraisal waiver usage for loans delivered to the GSEs[1]. Now it’s interesting to revisit these trends in the wake of the recent sharp volatility in economic and market conditions. Appraisal waiver usage by originators is one of a number of decisions that reflect the risk appetite of loan-producing firms. All else being equal, a waiver serves to reduce costs, and potentially volumes, at a cost of increased uncertainty about a property’s valuation. As the mortgage market is currently dominated by purchase mortgages in this high interest rate environment, we limit our analysis to this loan purpose.

The risk aspect can be clearly seen by the tendency for waivers to be more widely available for borrowers with strong credit profiles: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed