|

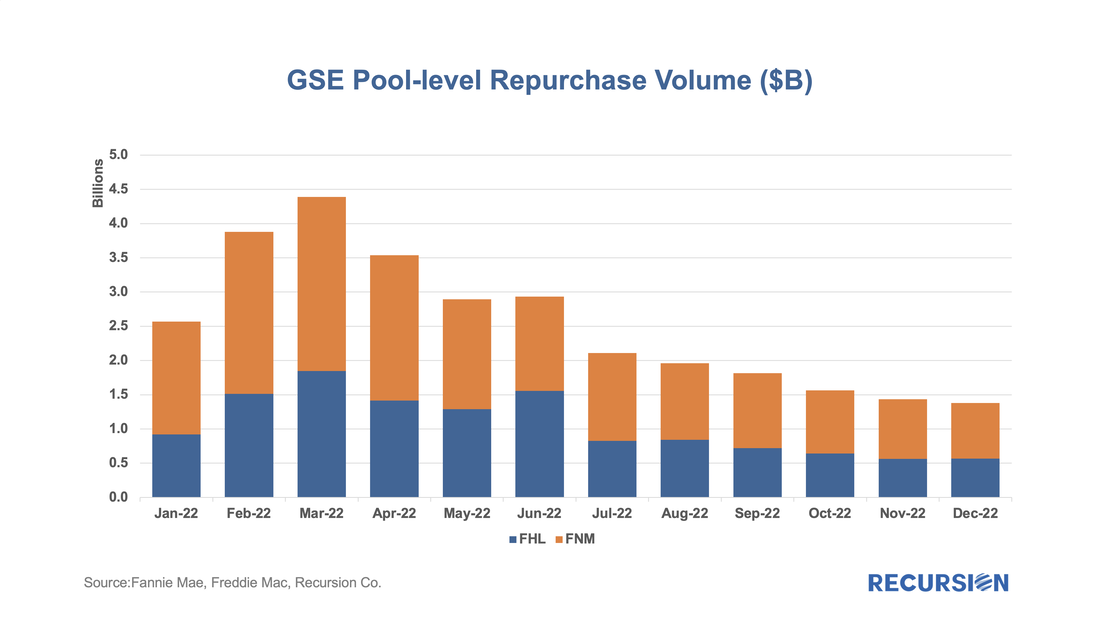

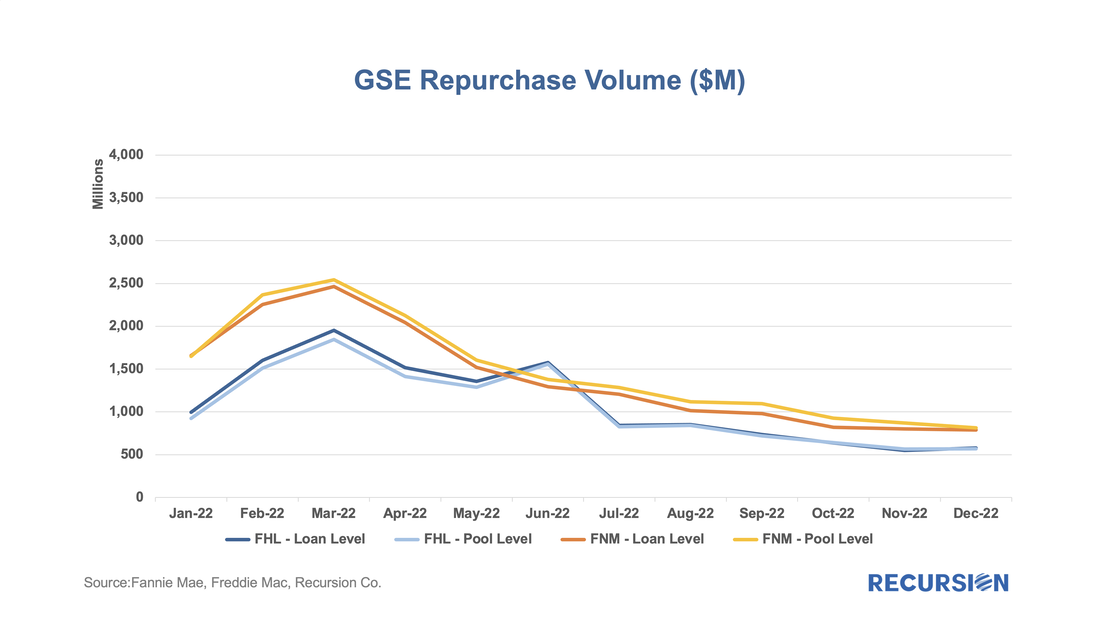

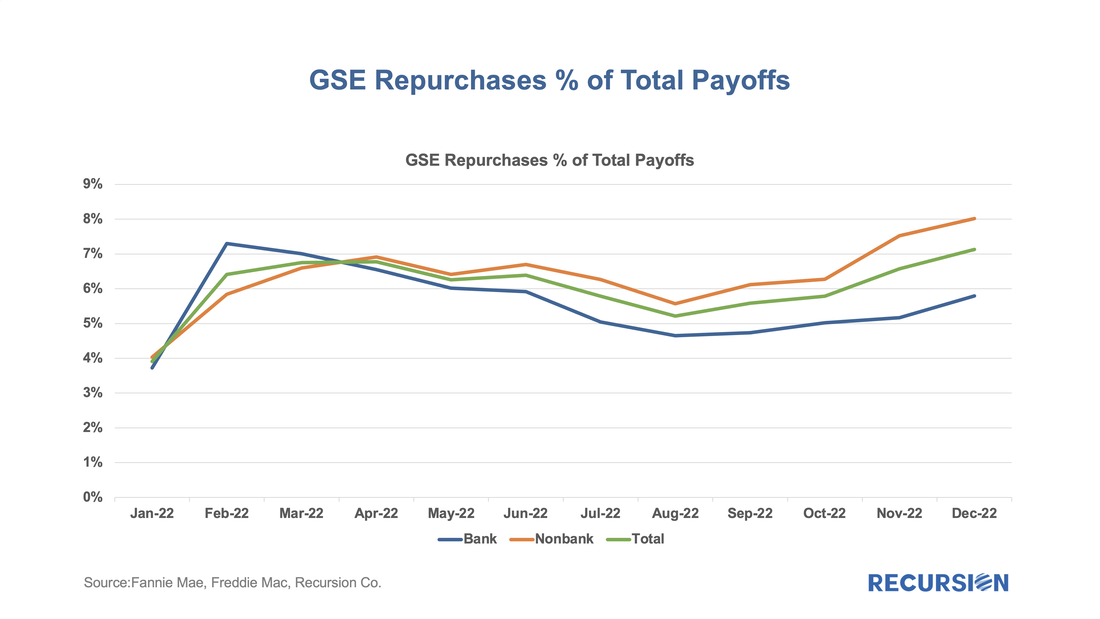

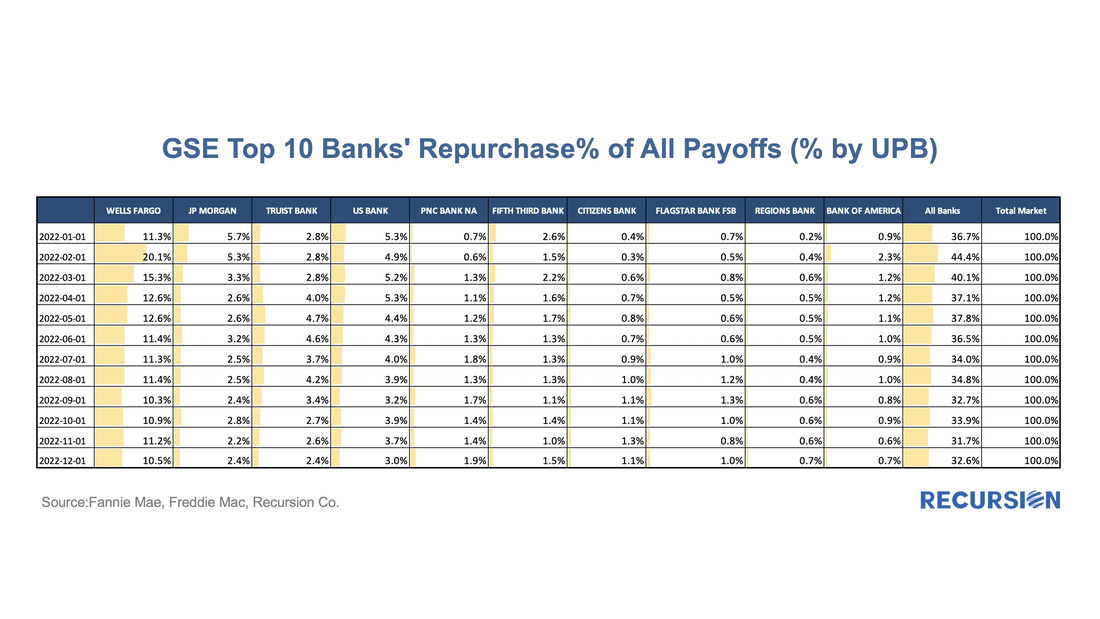

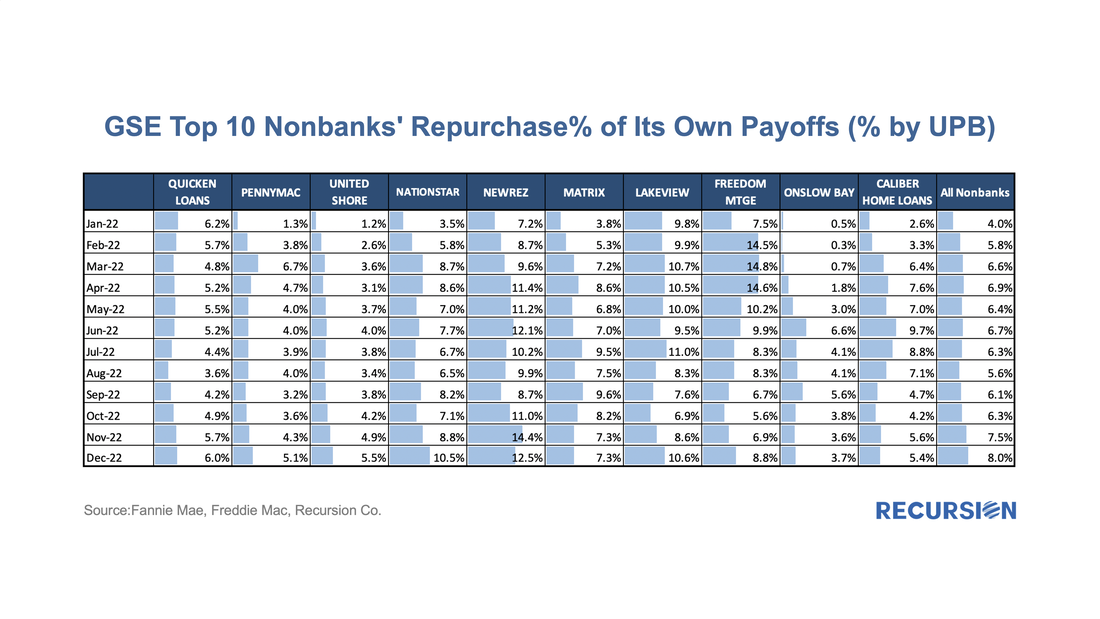

Growing concerns about a looming recession combined with increasing signs of distress in Government mortgage programs, particularly FHA, are leading many market participants to step up their focus on GSE buyouts. These found a recent peak last winter as forbearance programs unwound and have been in a generally declining trend since that time. To assess these trends, it would be advantageous to look into the makeup of the loans being purchased. To do so requires access to loan-level data. Within the loan-level data set, we can see which loans left the pool in a given month. However, loans leave pools for all kinds of reasons, and the question remains which of these are the result of the direction of Fannie Mae or Freddie Mac. While we don't see this directly, we can try to estimate this through a simple rule: we assume that any loan that disappears from a pool that is 60 days or more delinquent is an involuntary buyout. To test this rule, we computed this number and compared it to the pool-level metric. Here is the result for 2022: We have confidence that looking at a breakdown of the loan-level data gives us a reasonable picture of the GSE buydown landscape. To start, let's look at banks vs. nonbanks: While repurchase volumes have fallen, as a share of all payoffs, they have been rising. Since August 2022, the total share has risen about 2%, with the bank share rising by about 1.2% and the nonbank share by about 2.5%. It's then interesting to look at the dispersion among large lenders in each category. For banks: There is a great deal of dispersion between large institutions. In December, the banks with the greatest share of buyouts with their own prepayments were US Bank at about 8.3%. The lowest was JP Morgan, at 2.4%. For nonbanks: Here NewRez had the highest share in December at 12.5%, while Onslow Bay recorded the lowest share at 3.7%. This analysis opens up a whole new field of institutional-level analysis. Should delinquencies rise more substantially in 2023, this information would be very valuable in searching for relative value between mortgage pools. Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed