|

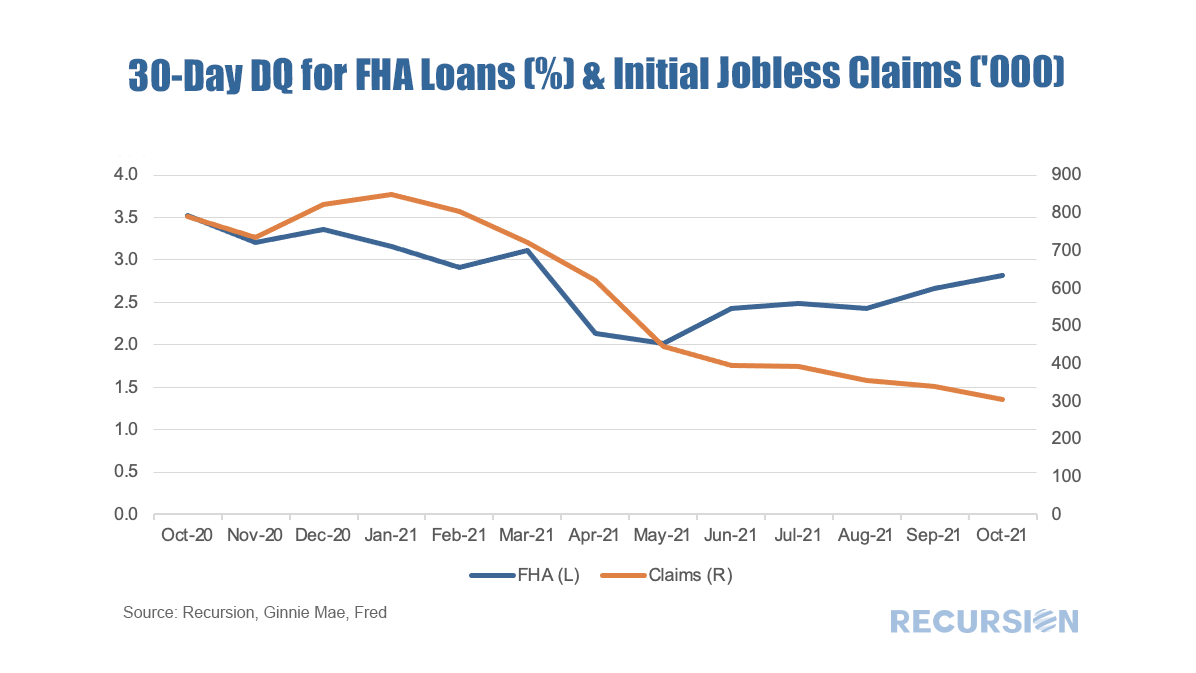

As policy interest rates continue to rise and economic activity begins to slow, attention in the mortgage market shifts towards concerns about the potential for borrower distress. We are early in this process as the labor market continues to add jobs, and there continue to be more job openings than people looking for work. Nonetheless, signs of strain begin to be seen, and it's worthwhile to point out early trends and consider implications.

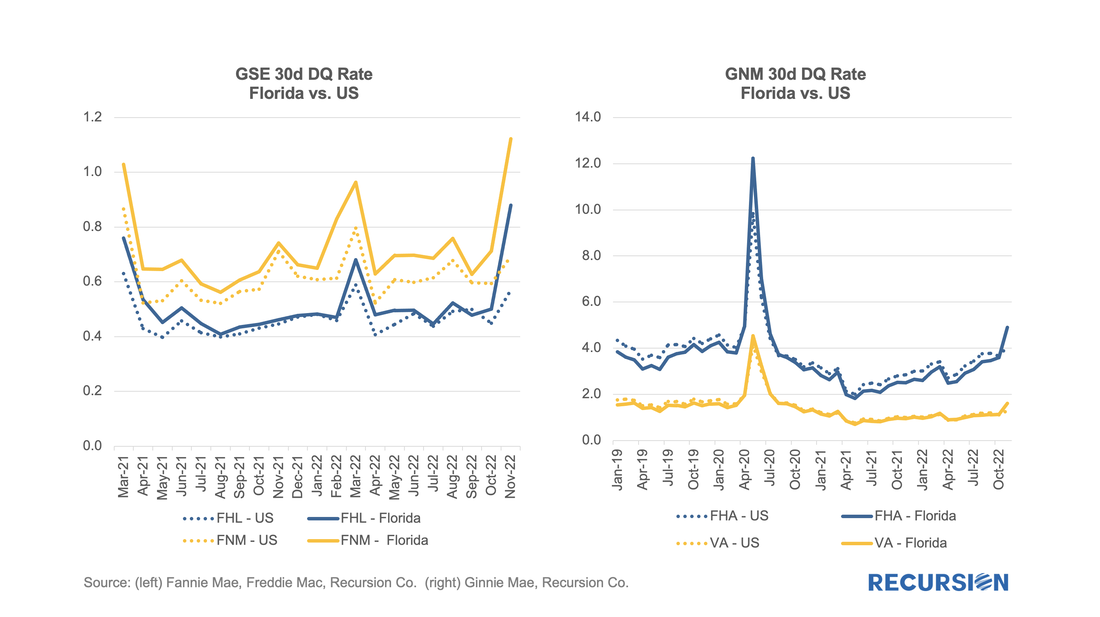

Notably, the impact of Hurricane Ian could be seen in the short-term delinquency data: Received wisdom in the mortgage market holds that distress in the mortgage market eases as the labor market improves. While there is certainly some justification for this view, in fact there are many factors that drive performance so the direct correlation with the jobs market does not always hold.

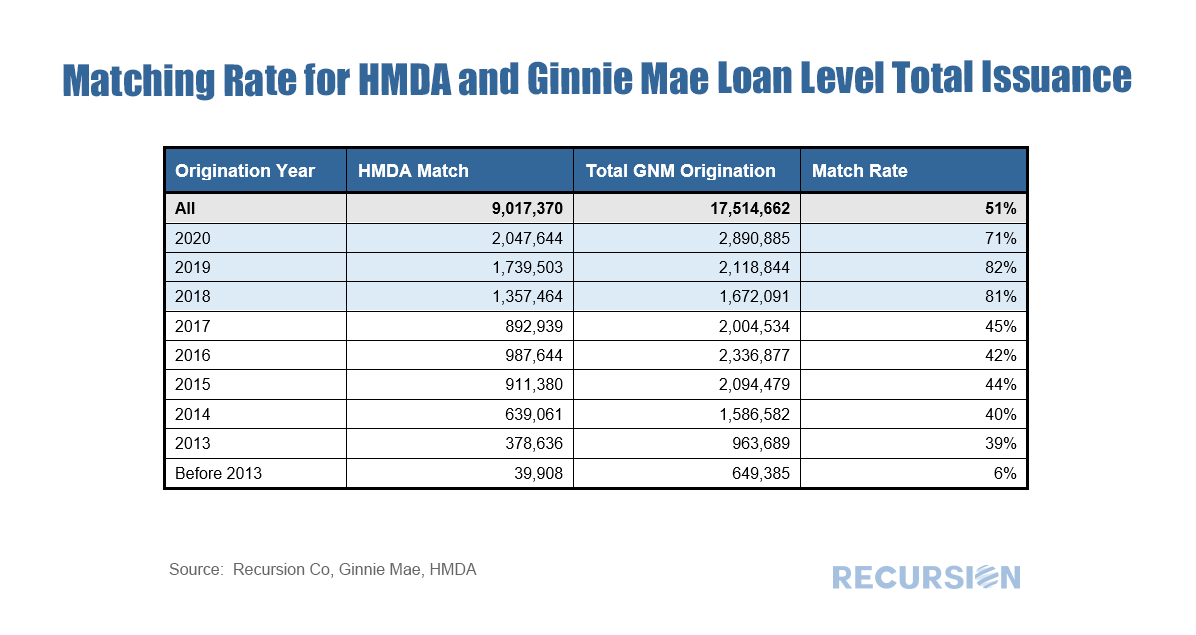

In a previous post, we mentioned the Recursion Matched data set[1], which uses a proprietary algorithm to match the loans provided in the monthly Agency loan tapes, with HMDA data. This allows for a broad analysis of loan performance (delinquency and prepayment rates) in terms of both underwriting standards (credit score, DTI, LTV) with demographic and household economic characteristics (income, race, gender, etc). We are always working to improve our algorithm, below find the match rates for Ginnie Mae loans over the 2013-2020 period. HMDA has released more characteristics in recent years, allowing for a greater matching rate.

On January 19, the Federal Housing Finance Agency (FHFA) issued a Request for Information (RFI) on “Climate and Natural Disaster Risk Management at the Regulated Entities”[1]. This RFI was issued as “A growing body of research is studying the risks that climate change and natural disasters pose to the stability of the economy, the financial system, the national housing finance markets, and FHFA’s regulated entities.” There are two main policy topics in which FHFA is seeking comment: 1. Identifying and Assessing Climate and Natural Disaster Risk

Recursion joined with a consortium of experts in this field, including the Lincoln Institute of Land Policy, the Roosevelt Institute, the Carbon-Free Buildings Program and the Vulnerable Communities Initiative Inc that submitted a comment letter to FHFA Director Calabria on April 19[2]. This letter spelled out a statement of principles that reflect Recursion’s mission of building “Data Democracy”, including:

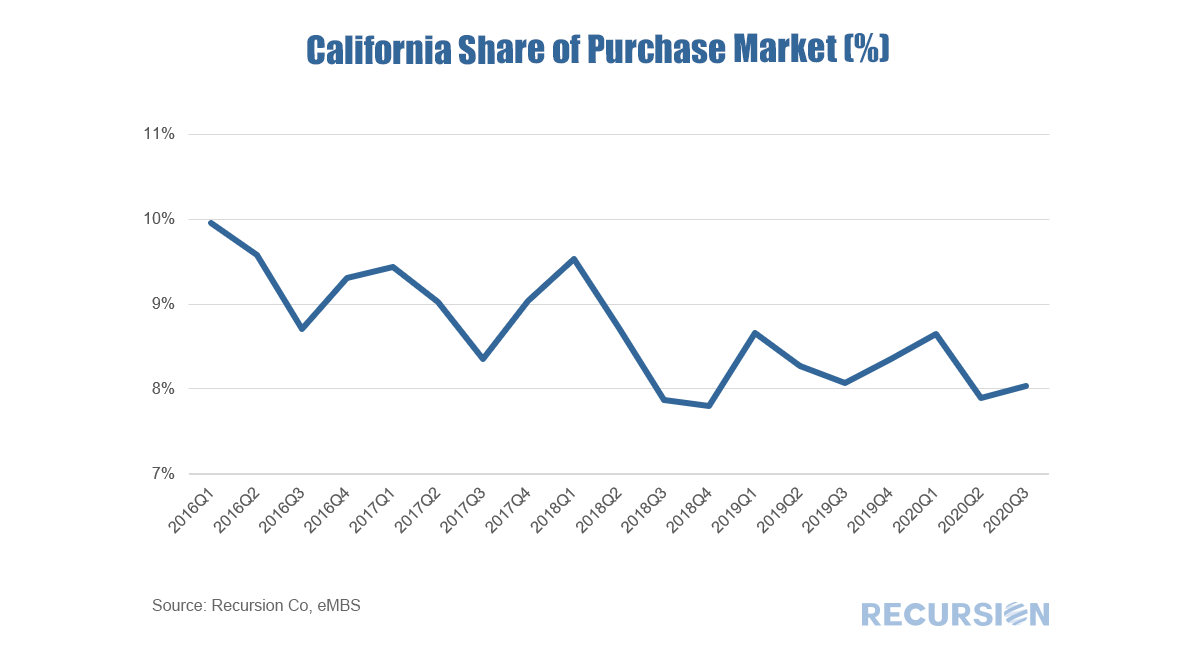

We are pleased to work with such distinguished colleagues on this important topic. One of our ongoing themes in this blog is that we are entering a period of unremitting structural change. We’ve noted previously that the combination of Covid-19 and technological innovation is leading to a surge in the nonbank share of purchase mortgages to the GSE’s[1]. Of course, there are others, notably climate change. As the technology leader among states and also the one suffering severe damage from wildfires, California is at the nexus of these transformations.

A survey conducted by the University of California at Berkeley in 2019 revealed that more than half of the residents of the state had given “some” or “serious” thought to leaving the state[2]. Has this in fact occurred? Such a desire may be offset by the traditional role of the state in attracting immigrants and young people looking for careers in technology and media. One way to look at this is to pull data for the count of new purchase mortgages sold to the GSEs in the state as a share of the US total: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed