|

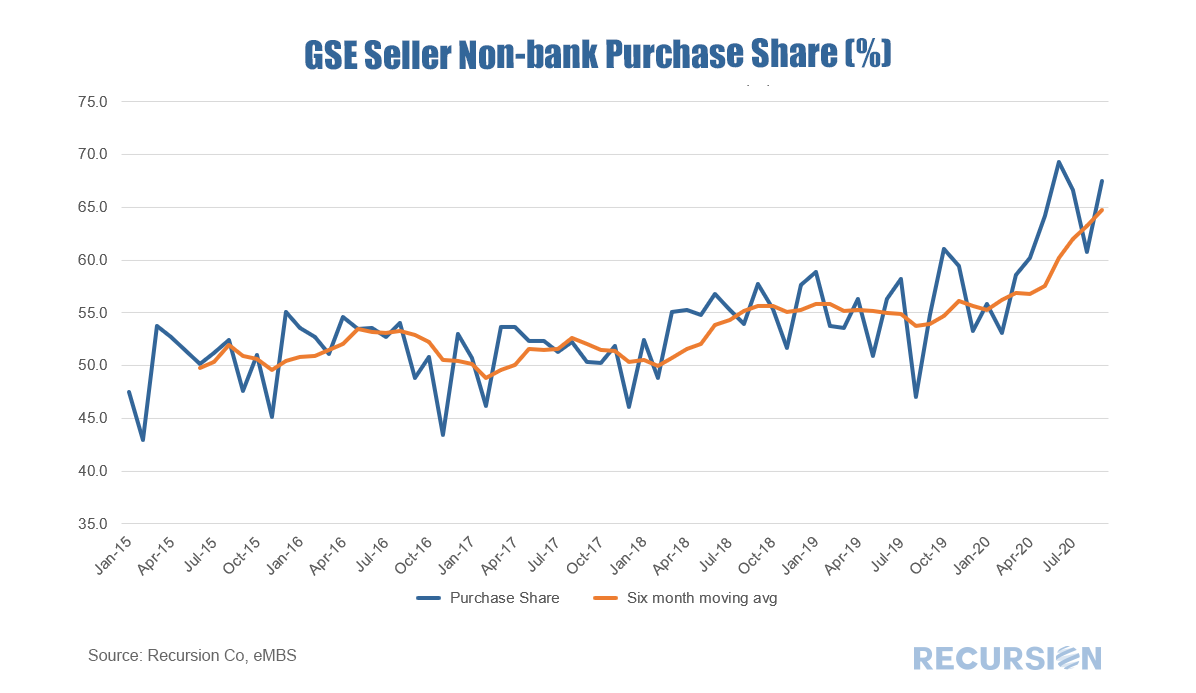

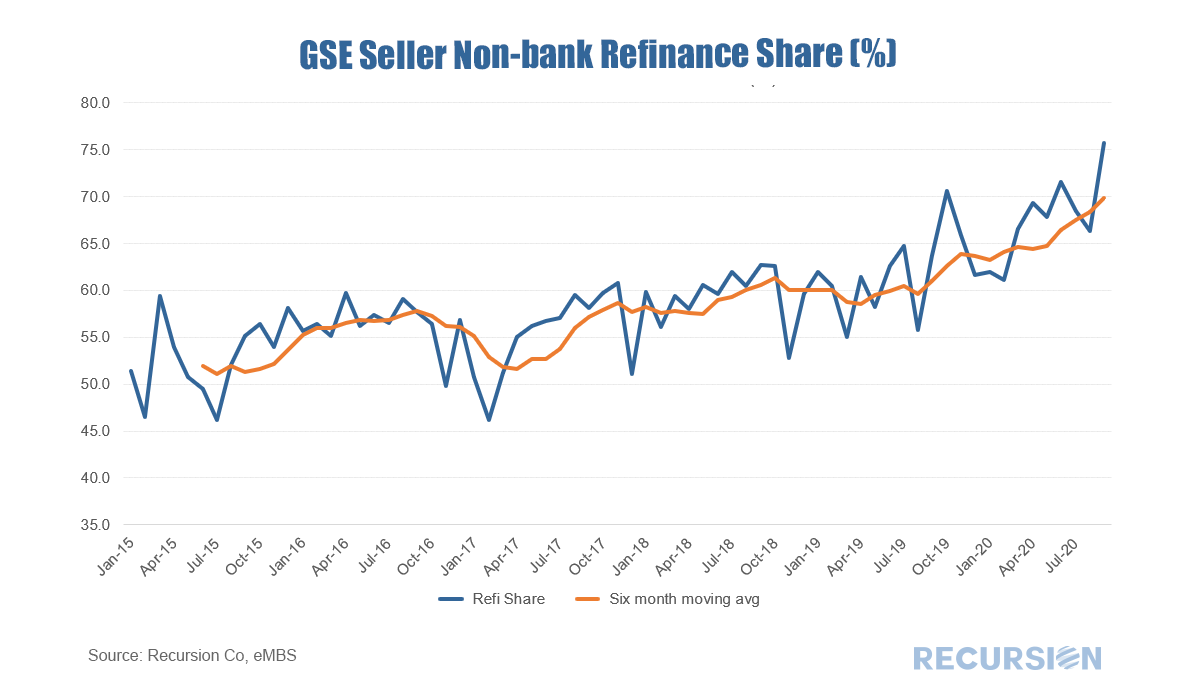

We have commented previously on the rising share of nonbank deliveries to the GSE’s in the wake of the Covid-19 crisis[1], but the data just released for the month of July shows this trend to be picking up at an astonishing pace. This time, let’s break the market up into two pieces: Purchase and Refi: While the data are volatile, trends can clearly be observed through the six-month moving average of the nonbank share. For the refinance market, the six-month average share for nonbanks in August stood 69.9%, up 5.7% from February. For the purchase market, the nonbank share was 64.8%, a bit less than the refi share, but this was up 8.5% from February. This was a larger share increase than had occurred over the entire prior five-year period! Received market wisdom has been that nonbanks have gained more share in the refinance space than purchase because purchase mortgages are more of a relationship product than refi. It turns out this advantage does not persist in a pandemic. More customers are willing to take the time to grow familiar with the superior online offerings provided in the nonbank mortgage space. The question facing us is will customers return to bank branches when the pandemic subsides? It seems reasonable to think that once customers grow familiar with the ease of online banking they are unlikely to go back. As such, bank branches seem destined to look like other empty storefronts in the retail sector. As we have stated before, mean reversion is not part of the new normal. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed