|

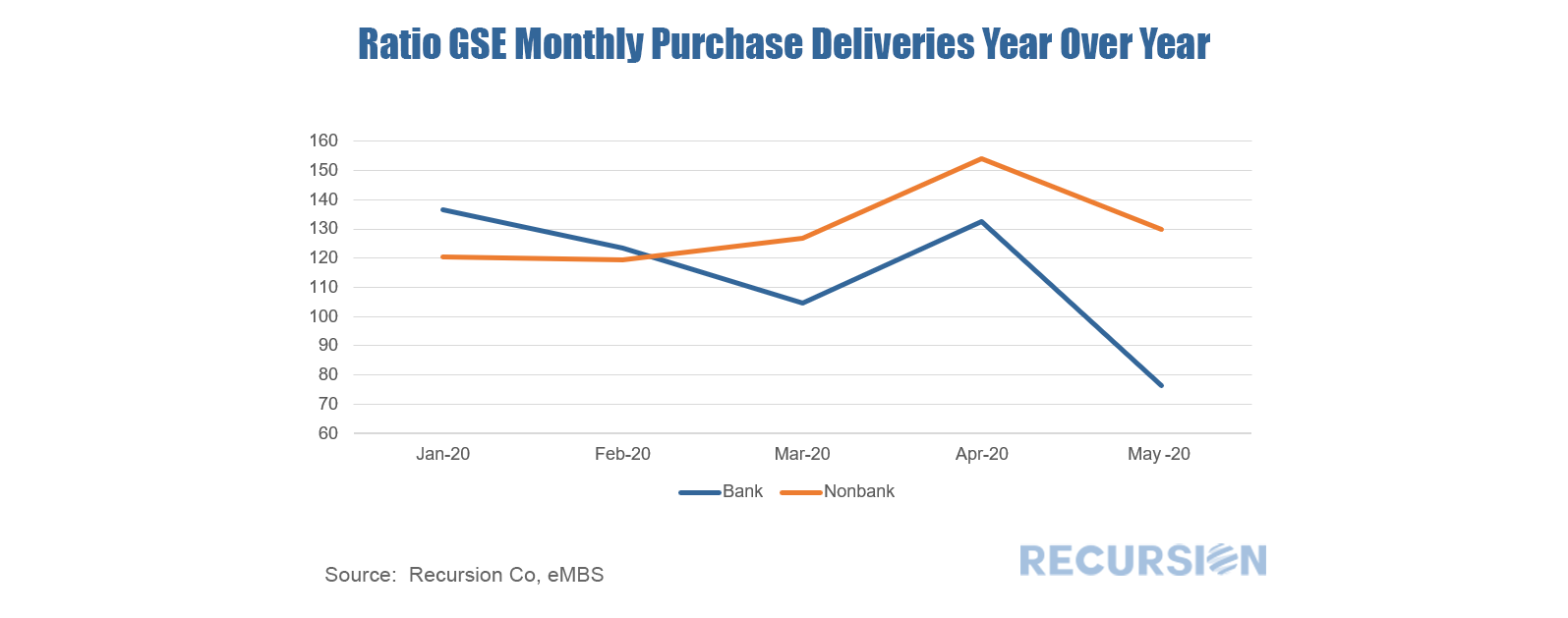

With the release of the GSE delivery data for May late last week we can start to see the impact of the Covid-19 crisis on the spectrum of loans delivered to Freddie Mac and Fannie Mae. First, deliveries of purchase mortgages have so far held up, with May deliveries up 3.5% from a year earlier. The notable development, however is the discrepancy between bank and nonbank deliveries, with Nonbank lenders in May delivering 30% more loans compared to a year earlier, while banks delivered 24% less. In general, mortgage production has held up because mortgage rates are at record lows in the face of the economic crisis. The question is why they hold up better for nonbanks than banks. The bank data are more complicated to analyze than nonbank because banks have the option of holding loans on their balance sheets so a decline in deliveries may be due to an increase in loans retained rather than a drop in originations. Such a decline seems unlikely at present because banks have an incentive to sell loans that might go into forbearance because the two agencies charge the lenders substantially for such purchases[1]. We have commented previously that banks are reducing loan balances but adding MBS to their balance sheets to reduce these risks[2]. Another possibility is that banks are tightening lending standards due to concerns about rep and warrant issues if loans become delinquent. It is also possible that the virus has accelerated the trend to fintech lending, much like it has online shopping. There leaves many paths to investigate in future posts. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed