|

On March 30, FHA released its Quarterly Report to Congress on FHA Single-Family Mutual Mortgage Insurance Fund Programs for Q4 2020[1]. The report shows that the MMI fund grew to $82.3 billion from $79.9 billion the prior quarter. However, the year-to-date actual net loss rate on claim activity of 35.2% is higher than the projection of 30.1% percent, as the portfolio-level serious delinquency rate increased in the quarter to 11.9%, from 11.6% percent last quarter. Consequently, Secretary Fudge in a statement indicated stated that “Given the current FHA delinquency crisis and our duty to manage risks and the overall health of the fund, we have no near-term plans to change FHA’s mortgage insurance premium pricing.”[2]

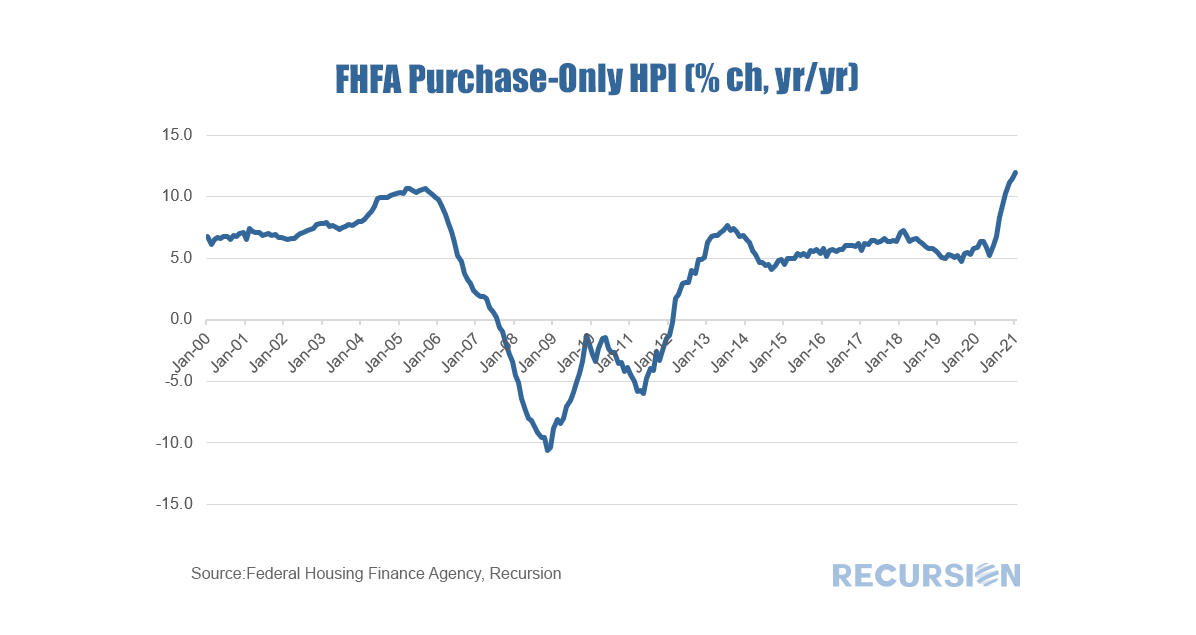

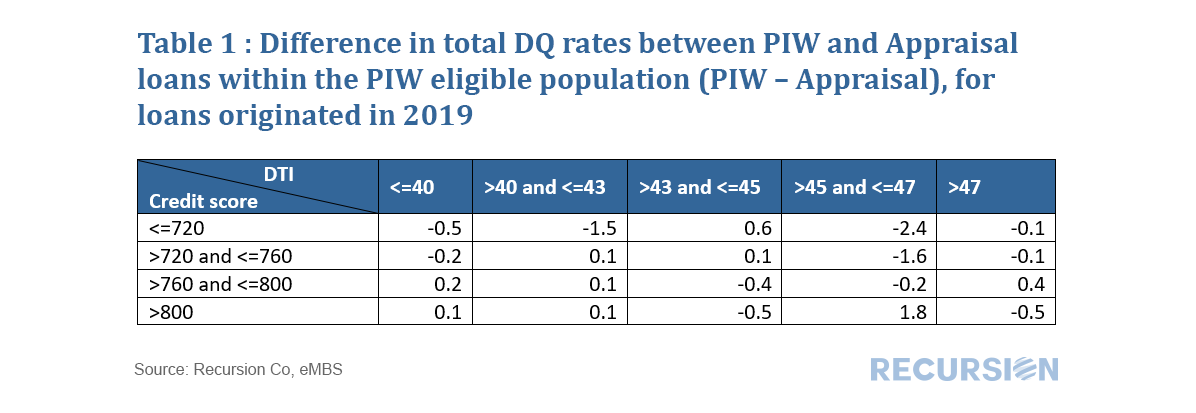

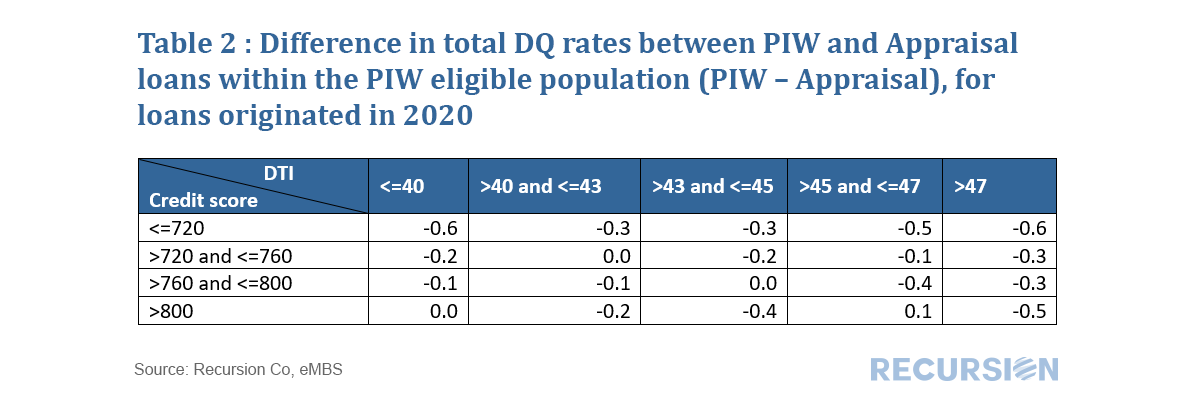

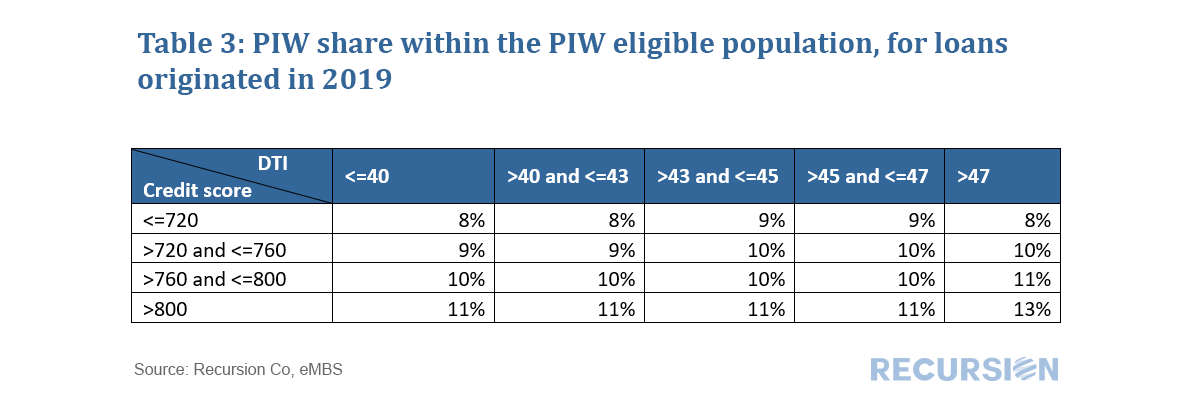

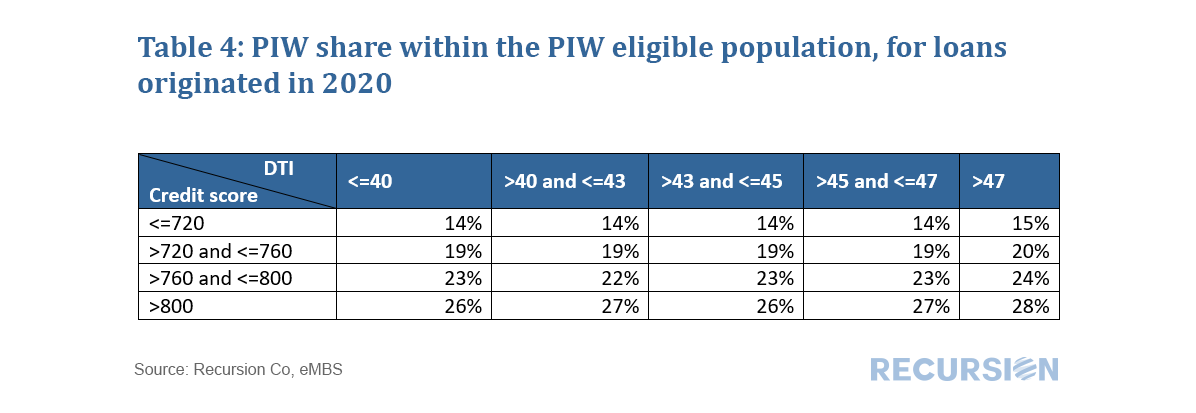

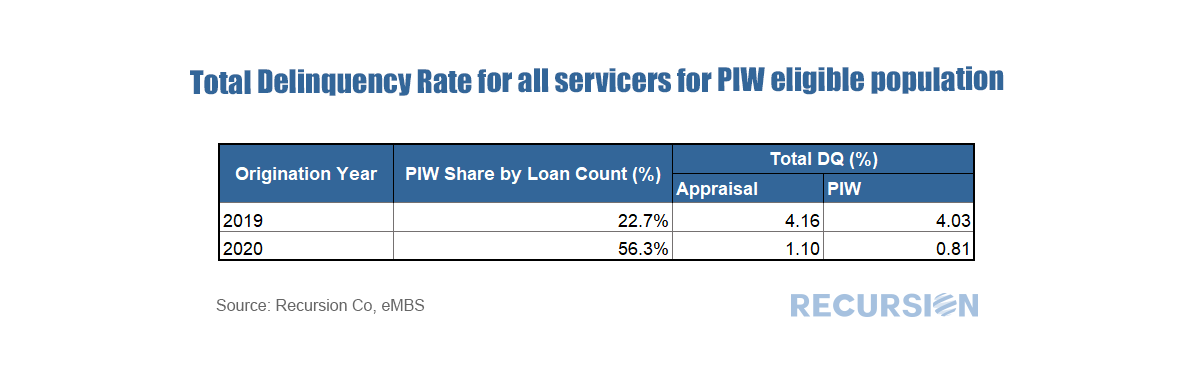

As we have noted previously, the Covid-19 crisis is very distinct from the Global Financial Crisis (GFC) insofar as while both periods experienced high delinquency rates, house prices now are soaring as opposed to collapsing in the earlier crisis. In a recent post, we discussed the relative performance of loans with property inspection waivers vs those with traditional appraisals that qualified for a waiver[1]. We commented that the observed out-performance of loans with waivers as measured by lower total delinquency rates (DQs) was likely influenced by relatively tighter lending standards (eg higher credit scores, lower DTI) for these loans compared to eligible loans that received a traditional waiver. A fully rigorous examination of this issue would be an extensive undertaking outside the scope of these brief posts. But let’s do a quick example as a demonstration of what our tools can produce along these lines. To make for an apple-to-apple comparison, below find two grids containing the difference between the total delinquency rates for purchase loans with PIWs compared to those that are eligible but obtain a traditional appraisal. The first is for loans originated in 2019 and the second is for those originated in 2020: We find that PIW’s are more extensively used in 2020 than in 2019. In addition, in 2019 the range of PIW takeup across cells was 8%-13%, while for 2020 it was 14%-28%. In both cases, takeup tends to rise with credit score. Lenders appear to be more willing to allow a waiver for borrowers with better credit. For 2019, there are a number of outliers, but there is no clear pattern across the grid. Many lenders were just beginning to implement their waiver programs that year. By 2020, PIWs became a standard part of the toolkit. For most of the center of the grid, loans with waivers very slightly outperform those eligible loans using appraisals. Bigger outperformance can be seen, however, along the edges, i.e. loans with credit scores less than 720, and DTIs greater than 47. It appears it is not the waiver itself that leads to outperformance, but likely that underwriters are more careful and pay more attention in general to these riskier classes of loans. Further work would look at performance across the largest servicers, and by state. Recursion has met the criteria set by the M/WBE Program at the New York City Department of Small Business Services to be certified as a Minority Women-Owned Business Enterprise (M/WBE).

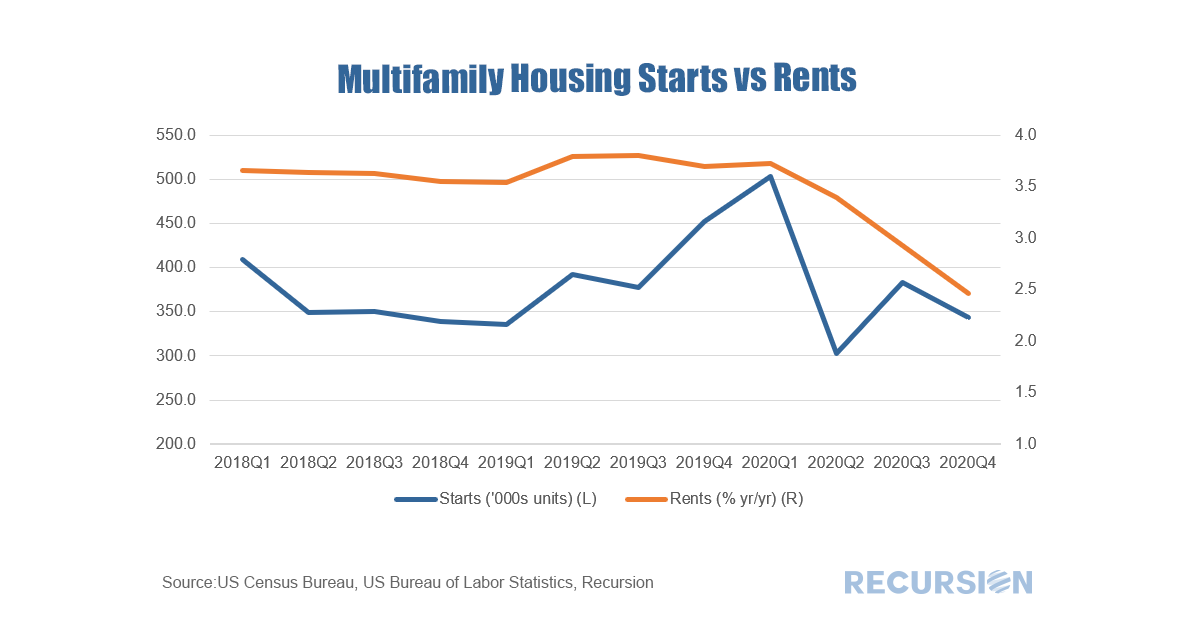

We have commented previously about housing and the “K-shaped Recovery”[1] in which home prices are booming but rent increases are decelerating. This dichotomy is highly unusual but reflects the flight of households out of dense urban environments due to the Covid-19 pandemic. With rents decelerating, it is not surprising that starts of new multifamily units have been in a trend decline over the past year.

In a recent post, we discussed our comment letter to FHFA regarding policies and procedures related to property inspection wavers (PIWs)[1]. In that note we commented that one of the best ways to assess the impact of the program is to look at the performance of loans with appraisal waivers vs those eligible to obtain waivers but did not. At the time the note was posted (late February 2021) the loan-level data needed to perform such a calculation was not available, so we used a sample obtained from the reference loans in the pools used by the Fannie Mae Connecticut Avenue Security (CAS) Credit Risk Transfer (CRT) program.

Earlier this month we obtained the loan level DQ data for the books of the GSEs as of the end of February 2021 so a more comprehensive analysis is now possible. As stated in the comment letter, the eligibility rules to obtain a PIW vary by product type and agency, so to obtain an apples-to-apples comparison we need to look at the performance of loans with waivers against those that are eligible to use them but did not, as opposed to all loans. Since waivers are generally a recent development, we look at performance for loans originated in 2019 and 2020. Debtwire cites Recursion Data within article on LoanDepot’s massive Ginnie Mae EBO activities3/17/2021

Debtwire quotes Recursion data showing a large uptick in LoanDepot’s Ginnie Mae portfolio over the month of February. In early reporting for March 2021, LoanDepot’s involuntary prepayment speed, or 1-month CDR, reached 20.6 percent.

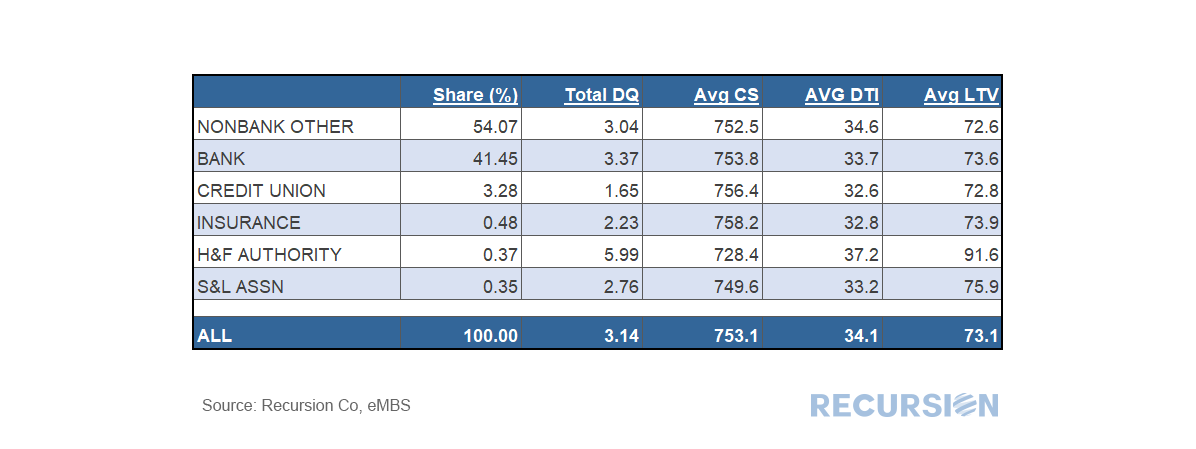

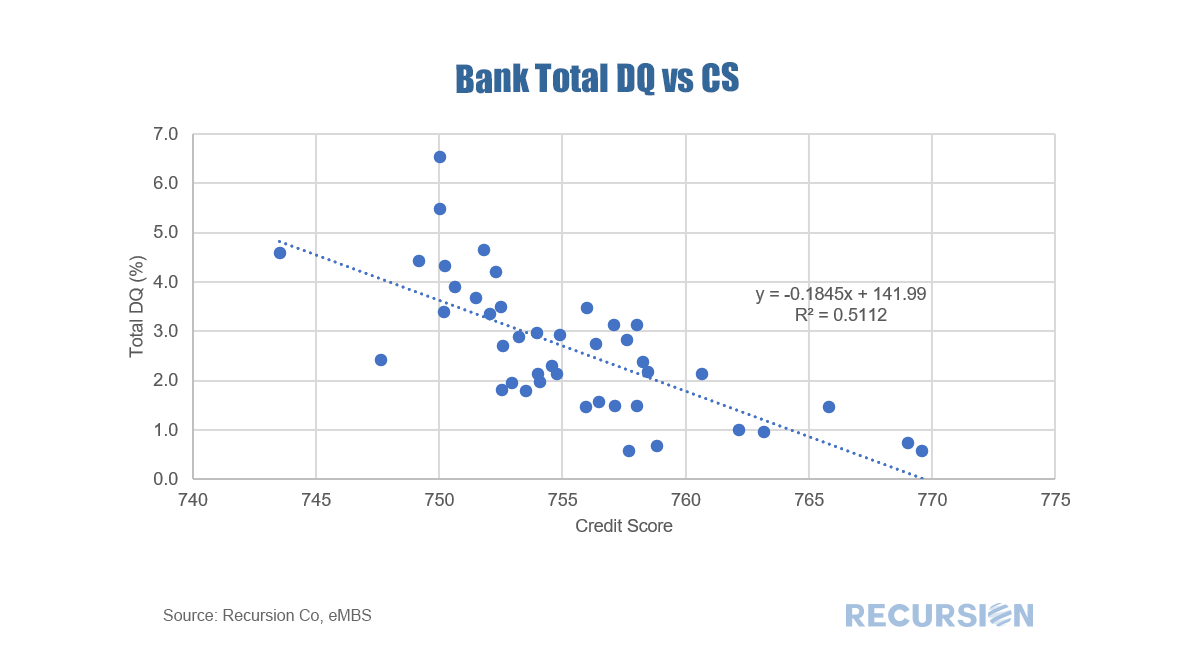

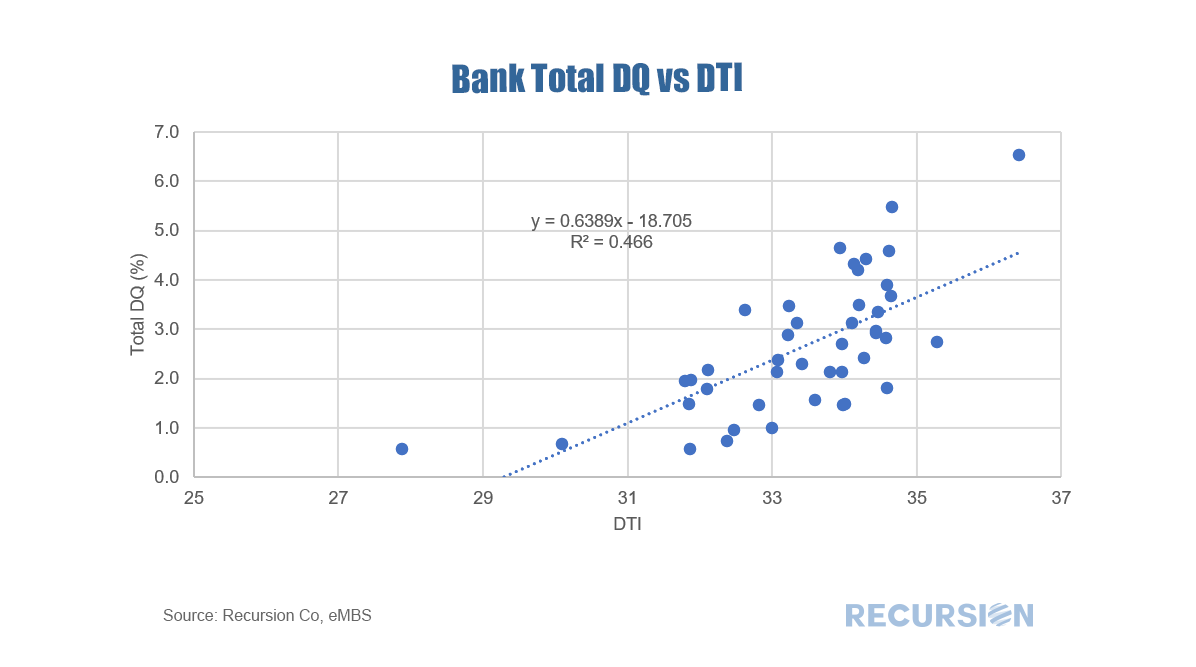

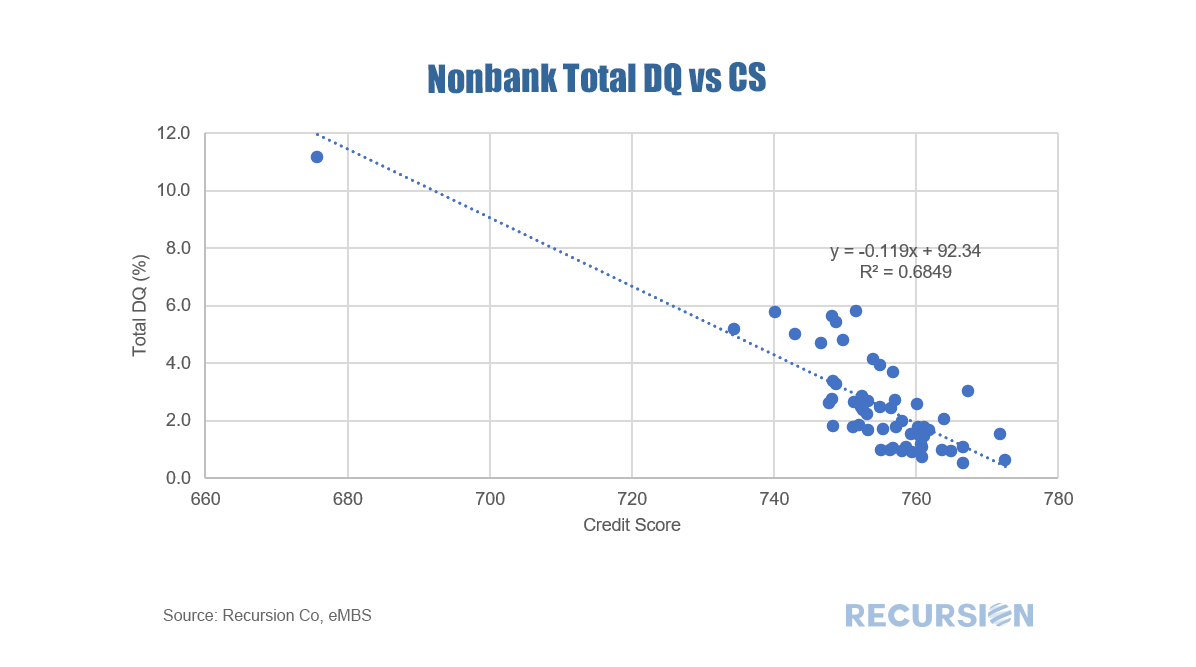

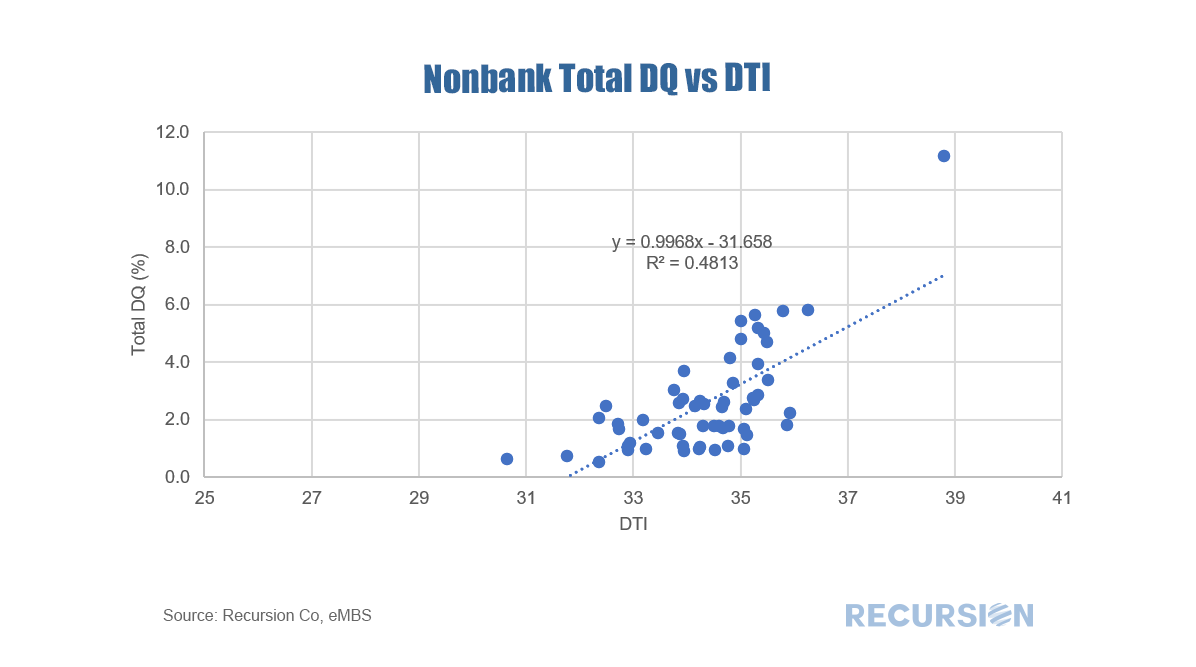

The release of loan-level dq data by the GSEs opens the door for much new analysis. In today’s blog we will look at servicer type. Below find a table of average DQ’s for each available type, along with average levels of underwriting characteristics: It’s interesting to note that banks tend to service loans with a modestly higher total DQ rate than the “Nonbank Other” category. The table also shows that banks have a tighter credit box with respect to credit score (higher) and DTI (lower) than nonbanks but have a more generous appetite for higher LTV loans. The data also presents financial analysts and strategists with a great deal of information about the performance of individual institutions. As an example, we look at the 100 largest servicers from the bank and “nonbank other” category (known as “nonbanks” from now on). There are 43 banks and 57 nonbanks in this group. The charts below plot total DQ’s vs credit score and DTI for each servicer type. Comparing different points or a single point vs trend lines can provide useful insights regarding the competitive landscape. Of course, these charts just scratch the surface of what is possible here.

Recursion in the News: Recursion Provides Comments to FHFA RFI on Appraisal-Waiver Policies3/10/2021

Recursion Co recently provided commentary in response to a Request for Information (RFI) regarding appraisal policies, practices, and processes. We comment on how big data technology can be applied to monitor the performance of loans where appraisals have been waived compared to a benchmark of eligible loans where traditional appraisals have been utilized. In addition, we provide a framework for analyzing how these tools can address issues such as the impact of new processes on fairness and the safety and soundness of the system of mortgage finance from such topics as environmental vulnerability.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed