|

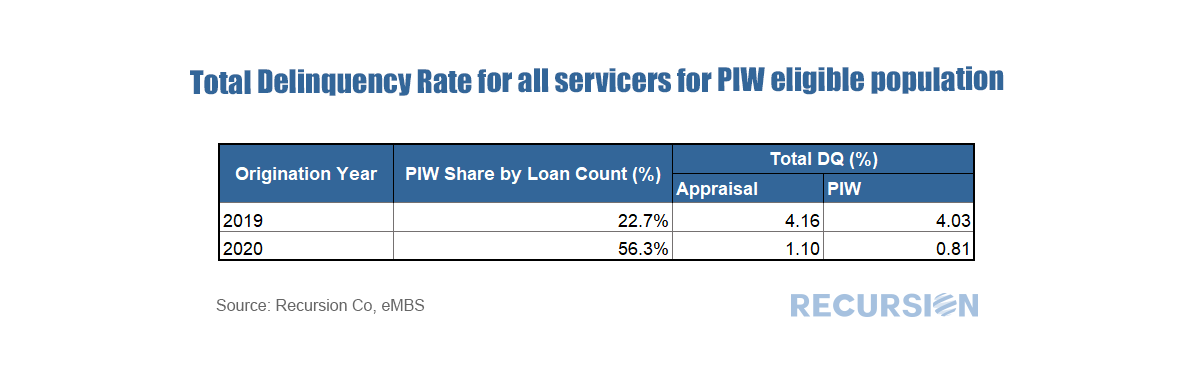

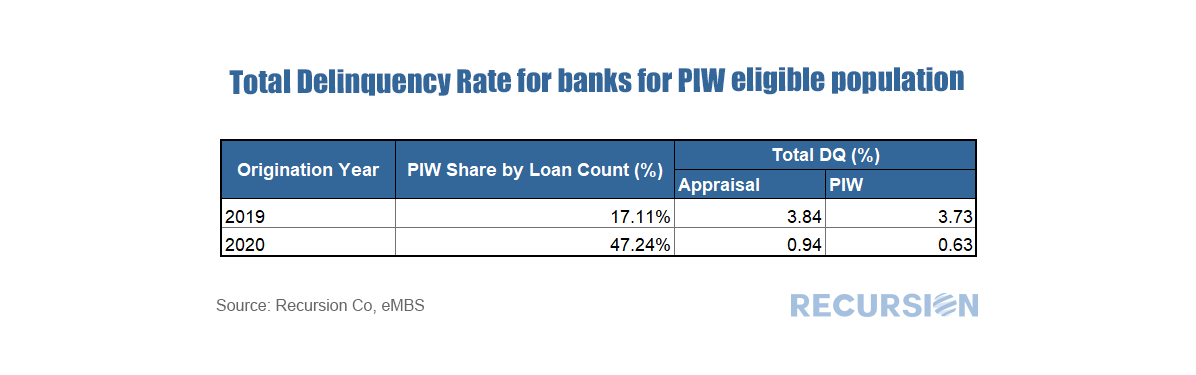

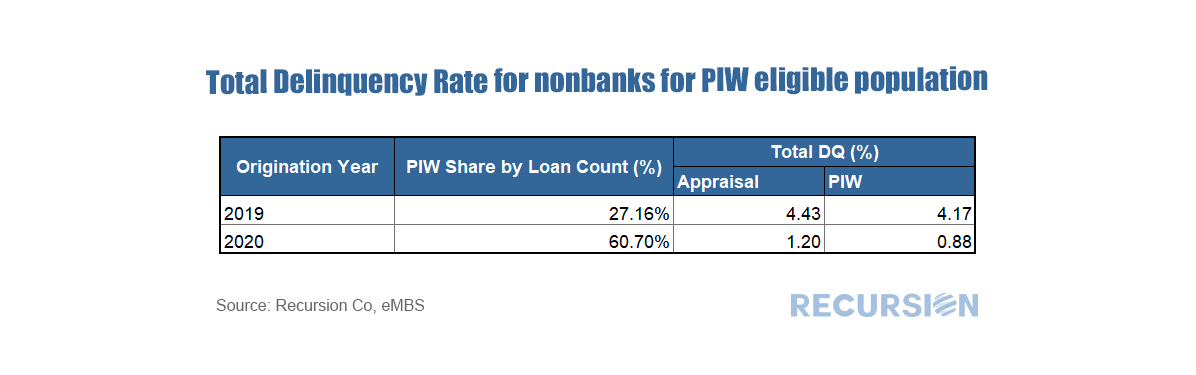

In a recent post, we discussed our comment letter to FHFA regarding policies and procedures related to property inspection wavers (PIWs)[1]. In that note we commented that one of the best ways to assess the impact of the program is to look at the performance of loans with appraisal waivers vs those eligible to obtain waivers but did not. At the time the note was posted (late February 2021) the loan-level data needed to perform such a calculation was not available, so we used a sample obtained from the reference loans in the pools used by the Fannie Mae Connecticut Avenue Security (CAS) Credit Risk Transfer (CRT) program. Earlier this month we obtained the loan level DQ data for the books of the GSEs as of the end of February 2021 so a more comprehensive analysis is now possible. As stated in the comment letter, the eligibility rules to obtain a PIW vary by product type and agency, so to obtain an apples-to-apples comparison we need to look at the performance of loans with waivers against those that are eligible to use them but did not, as opposed to all loans. Since waivers are generally a recent development, we look at performance for loans originated in 2019 and 2020. Several items jump out here. First, the share of loans using waivers is higher for those originated in 2020 than 2019. This is due both to increased usage of waivers when eligible over time, and also to a higher refinance share, where eligibility rules are less stringent, of mortgages originated in 2020 compared to 2019 due to lower interest rates in place last year. The second point is that total delinquency rates are modestly lower for loans that use waivers than those without. This is in line with the findings in our comment letter that lenders are more careful with respect to underwriting standards for loans that use waivers than those that do not. There are many ways to drill down further, but here we will look at the natural question of bank vs nonbank servicers. The additional point here is the increased usage of waivers on the part of nonbanks than banks. Delinquencies tend to be higher for nonbanks than banks, but in each category, total delinquency rates for loans with waivers are lower than those that use appraisals. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed