|

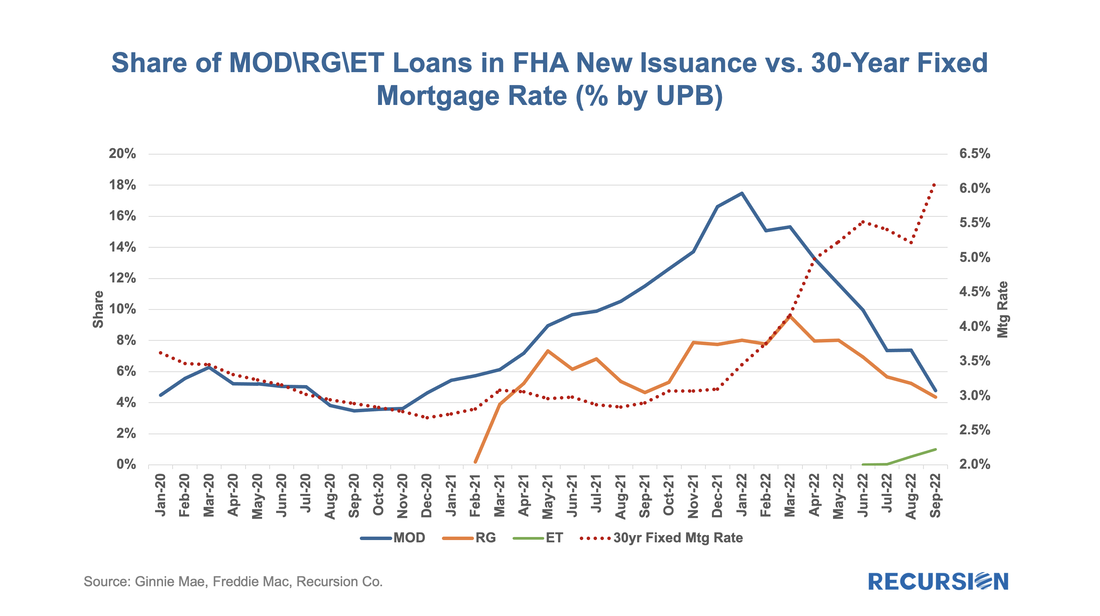

In previous posts, we discussed the trends in Ginnie Mae MBS issuance by loan purpose.[1] Recall that the decision to buy a loan out of a Ginnie pool rests with the servicer. As such, this decision is dependent in part on environmental factors that impact the profitability of this action, notably the interest rate. As loans get bought out at par, there is a greater incentive to purchase loans out of pools and get them into reperforming status when rates are low than when they are high. This relationship can be clearly seen in the following graphs:

A recent Housing Wire article entitled “Specter of the S&L crisis haunts today’s mortgage market” discusses the similarities of the current environment with the tumultuous period of the 1980’s. At that time 747 of these institutions were closed accounting for almost $500 billion in mortgages. At the present time similar pressures are building for independent mortgage banks (IMB’s, which are nonbanks). Many of these institutions failed to heed the historic example and Richard was quoted as saying “Many (IMBs) expanded operations during an unsustainable refi boom…” As the brewing economic storm becomes more apparent it’s essential that financial institutions have at their disposal both cutting edge data and analytic tools, as well as the expertise of experienced analysts. Recursion is uniquely situated to provide such services at affordable price points.

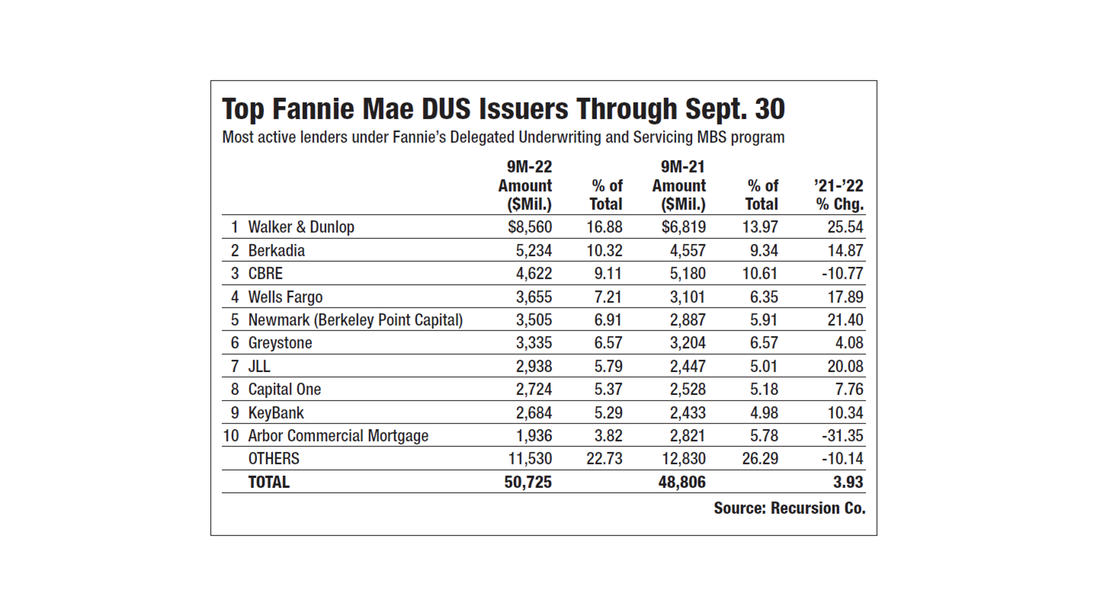

If you would like a copy of the article, please reach out to [email protected]. Commercial Mortgage Alert recently cited Recursion multifamily data in an article about issuance trends in this asset class. “Fannie purchased $6.5 billion of multifamily loans last month through its delegated underwriting and servicing, or DUS, model, according to data from Recursion Co. That compares with $4.93 billion of such purchases in August and $4.51 billion in July.” CMA also published a list of the top 10 issuers of Fannie Mae DUS loans YTD September. Recursion recognizes the importance of the rental market in an environment of extreme unaffordability and is the premier provider of Agency data and analytics in this sector.

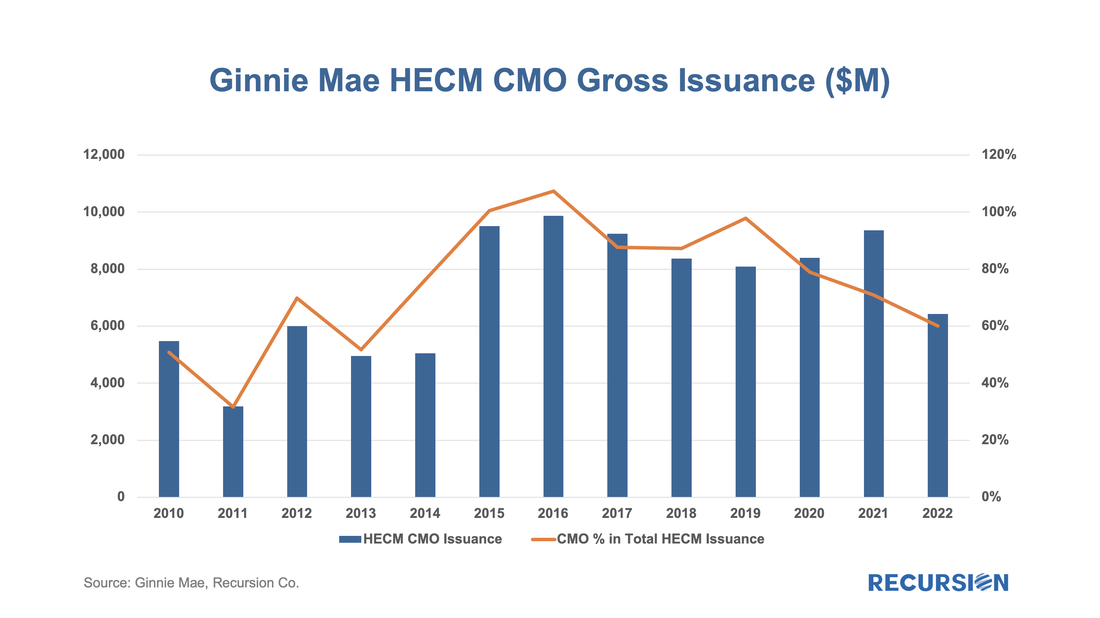

For more information, please reach out to [email protected]. Following the recent publication report of our CMO league tables[1], our next look at the structured mortgage product market is with HECMs. This is a very specialized product, but it offers distinct investment opportunities for investors to benefit from fundamental analysis of the unique characteristics of these "reverse mortgages". As the number of outstanding loans in this class is very much less than that of "forward" mortgages, it stands to reason that many HECMs would be packaged into CMOs to enhance diversification, and indeed that is the case:

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed