|

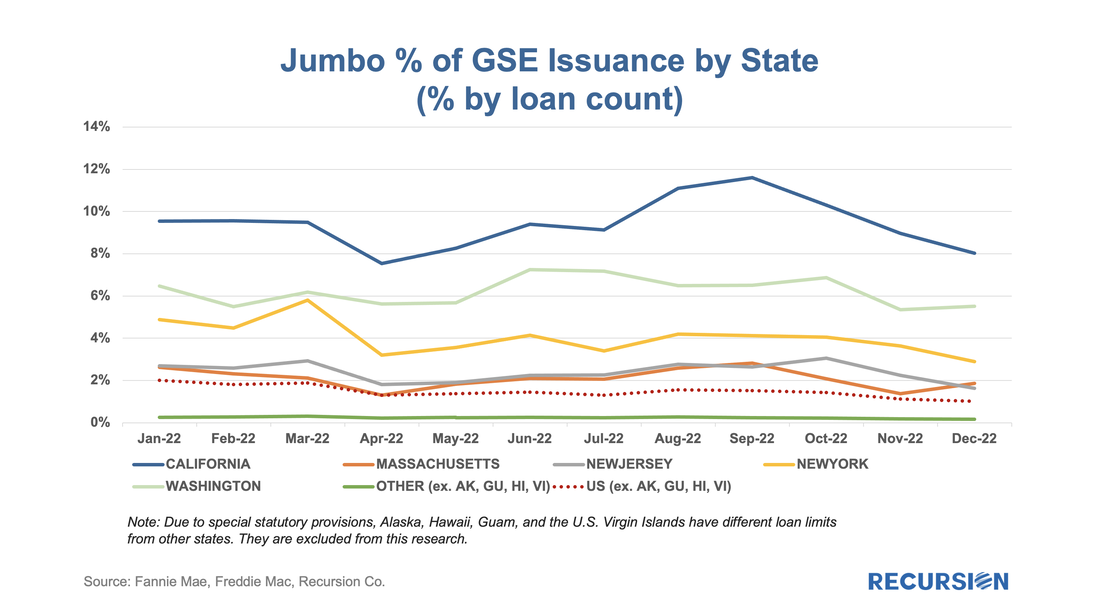

Last week’s announcement by FHFA of elaborate changes in the GSE’s upfront fee matrixes to be implemented in May[1] reminded us that this is just the latest in a series of announcements made by the housing regulator over the past year. Just over a year ago, FHFA announced fee hikes for second homes and high balance loans.[2] At the time, we looked at the impact of the second home fee hike on the market through the lens of the relative impact compared to investor properties, which did not experience such an increase. To complete the picture, here is a chart for high-balance loans:

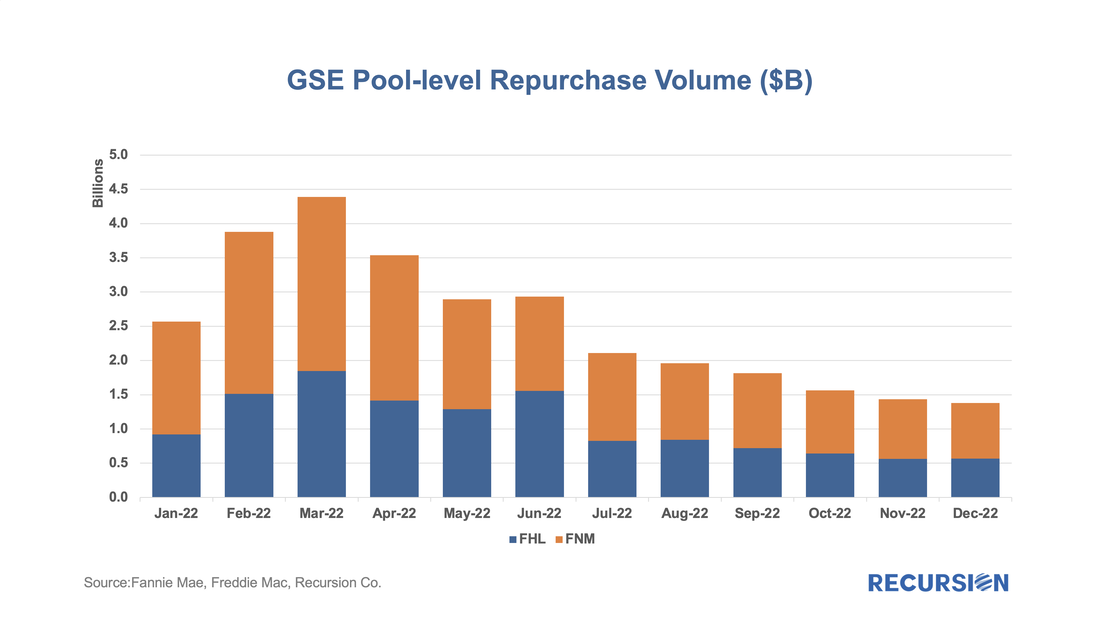

Growing concerns about a looming recession combined with increasing signs of distress in Government mortgage programs, particularly FHA, are leading many market participants to step up their focus on GSE buyouts. These found a recent peak last winter as forbearance programs unwound and have been in a generally declining trend since that time.

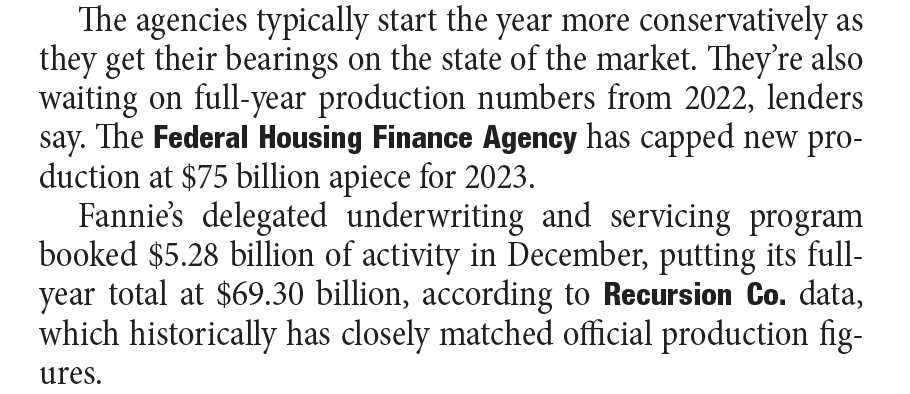

Recursion Data Cited in Commercial Mortgage Alert story on Fannie, Freddie Tighten Loan Terms1/19/2023

According to a recent Commercial Mortgage Alert article Fannie and Freddie have become more conservative with credit exceptions and maximum proceeds. Compared to the lower debt-service coverage ratios and longer amortization schedules observed in the previous year, “Fannie’s delegated underwriting and servicing program booked $5.28 billion of activity in December, putting its full-year total at $69.30 billion, according to Recursion Co. data”, below the $75 billion cap set by Federal Housing Finance Agency. In the article, Recursion Co. was described as a data source “which historically has closely matched official production figures.” We are proud to be cited as the leading provider of servicer data to the mortgage market. This data is used by investors, mortgage traders and the servicers themselves to obtain an accurate overview of the servicing landscape. Recursion data and analytics provide essential insights and productivity enhancements essential to thriving in a challenging environment.

The article can be found on the Commercial Mortgage Alert website (paywall). If you would like a copy of the article, please reach out to [email protected]. In a recent post[1], we spoke about how the current market environment of high interest and home prices is leading to downward pressure on both supply and demand in the housing market, a situation we call "Mortgage Winter". While this environment is unlikely to result in a severe recession such as the Global Financial Crisis, there is the potential for broad fallout associated with distress in the lender and broker markets.

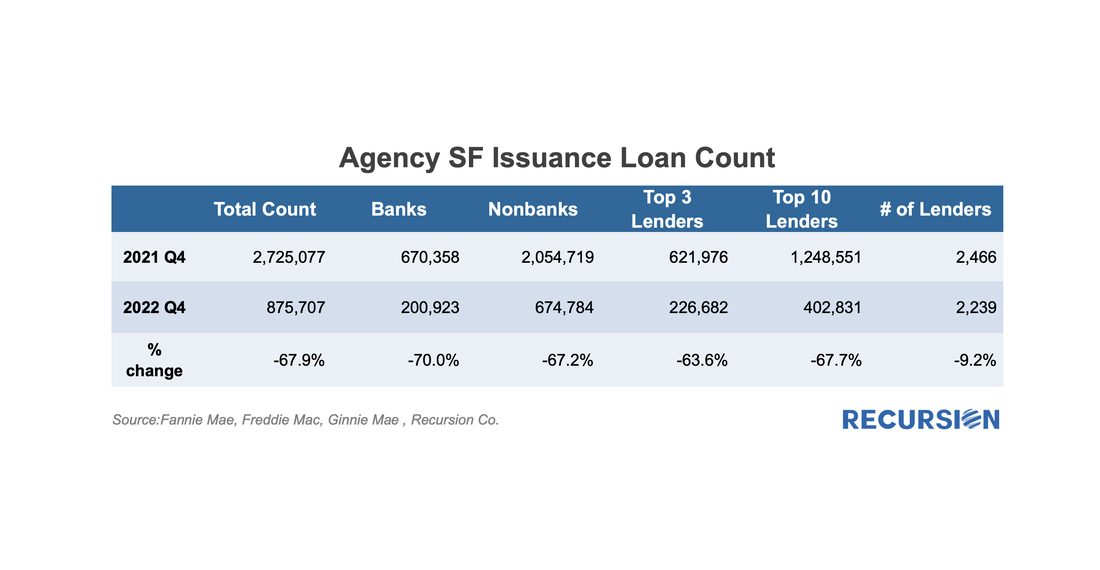

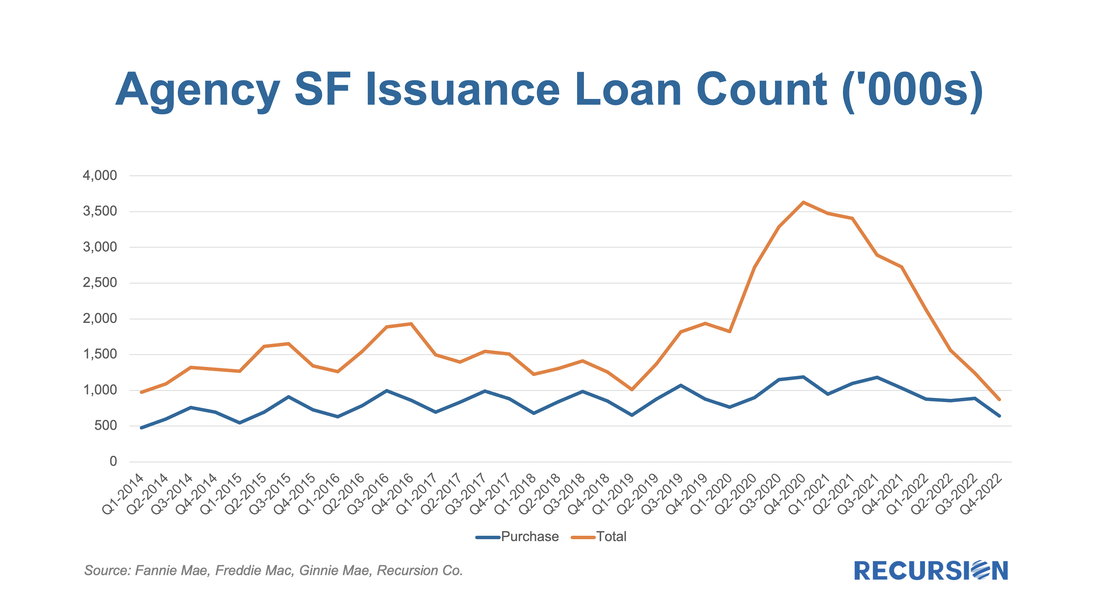

First, we look at the originations. The count of loans that were delivered to the three agencies dropped by 68% from Q4 2021 to Q4 2022: With 2022 at a close, we can begin to assess the impact of the extraordinary shocks of the past few years on the mortgage market landscape. The boom-bust nature of the housing market since the onset of the Covid-19 pandemic has resulted in an unprecedented degree of uncertainty about the outlook. Most commentary in this regard is understandably focused on home prices, but in the end, real estate is a transactional business, and we focus on that market aspect here:

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed