|

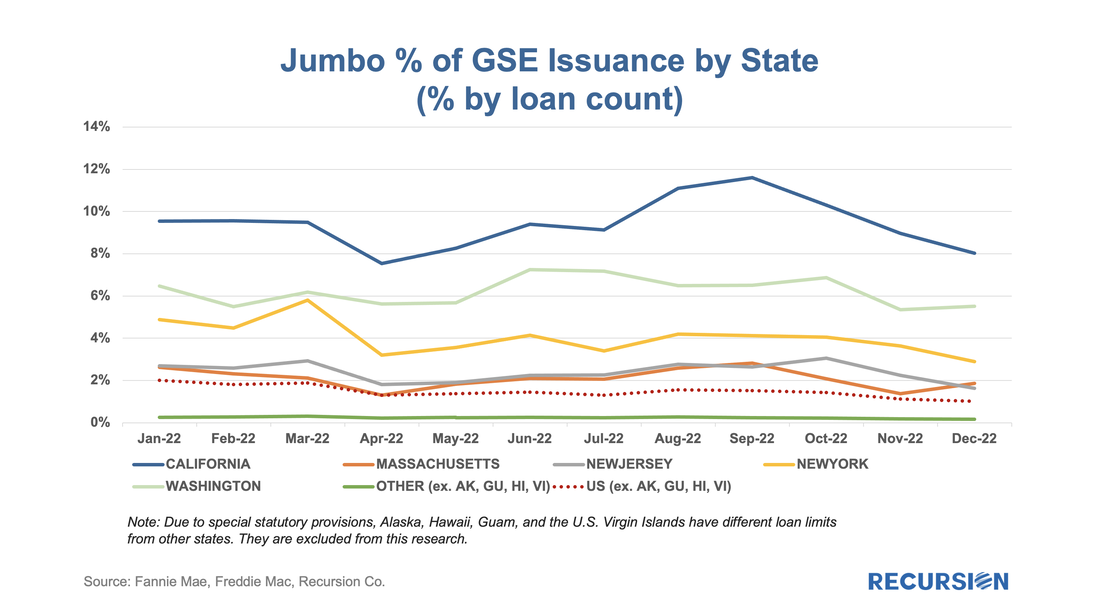

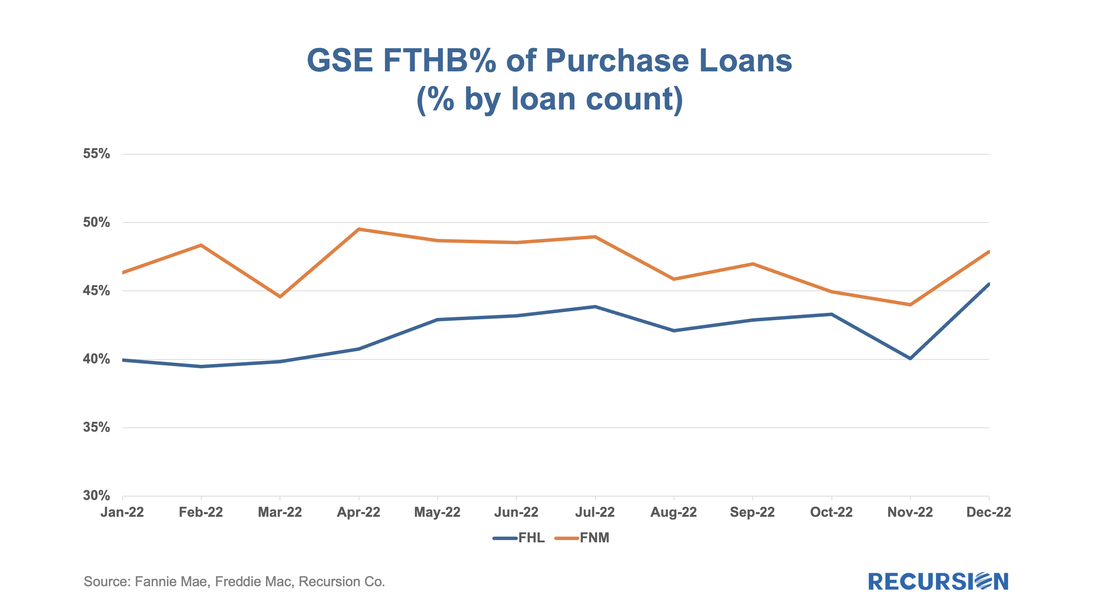

Last week’s announcement by FHFA of elaborate changes in the GSE’s upfront fee matrixes to be implemented in May[1] reminded us that this is just the latest in a series of announcements made by the housing regulator over the past year. Just over a year ago, FHFA announced fee hikes for second homes and high balance loans.[2] At the time, we looked at the impact of the second home fee hike on the market through the lens of the relative impact compared to investor properties, which did not experience such an increase. To complete the picture, here is a chart for high-balance loans: The expected pattern of a jump in the share of deliveries ahead of the fee hike, followed by a subsequent decline, can be seen to various degrees across geographies. It’s important to note that a decrease in the share of loans delivered does not necessarily imply a decrease in the same share of loan production, or at least not to the same degree. In particular, the rise in the fee may incentivize lenders to keep these loans, which tend to perform well, in their portfolios. We can’t tell this now, but we may be able to shed some light on this question when 2022 HMDA data comes out in the next few months, and we can see the properties of loans held on balance sheets. More recently, in October, FHFA announced cuts in fees starting December 1, 2022, for a number of loan types, notably for first-time homebuyers with AMIs at or below 100 in most areas, except those in high-cost areas where the cutoff is 120 or below[3]. At this point, we have no information on incomes, so we look at all FTHB: The impact here is very clear: the fee decline was preceded by a decline in FTHB share, which subsequently rebounded. As a final aside, we push this chart back to the start of 2022 to point out the peculiar disparity of changes in first-time homebuyer share between the two Enterprises when the second home tax hike was implemented last May. In the case of Fannie Mae, the share dipped but then rose, apparently as second home buyers jumped into the market and then pulled back. There is no such pattern at all in the Freddie Mac data, however. There are always more questions to explore. [1] FHFA Announces Updates to the Enterprises’ Single-Family Pricing Framework | Federal Housing Finance Agency [2] https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Announces-Targeted-Increases-to-Enterprise-Pricing-Framework.aspx [3] https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Announces-Targeted-Pricing-Changes-to-Enterprise-Pricing-Framework.aspx Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed