|

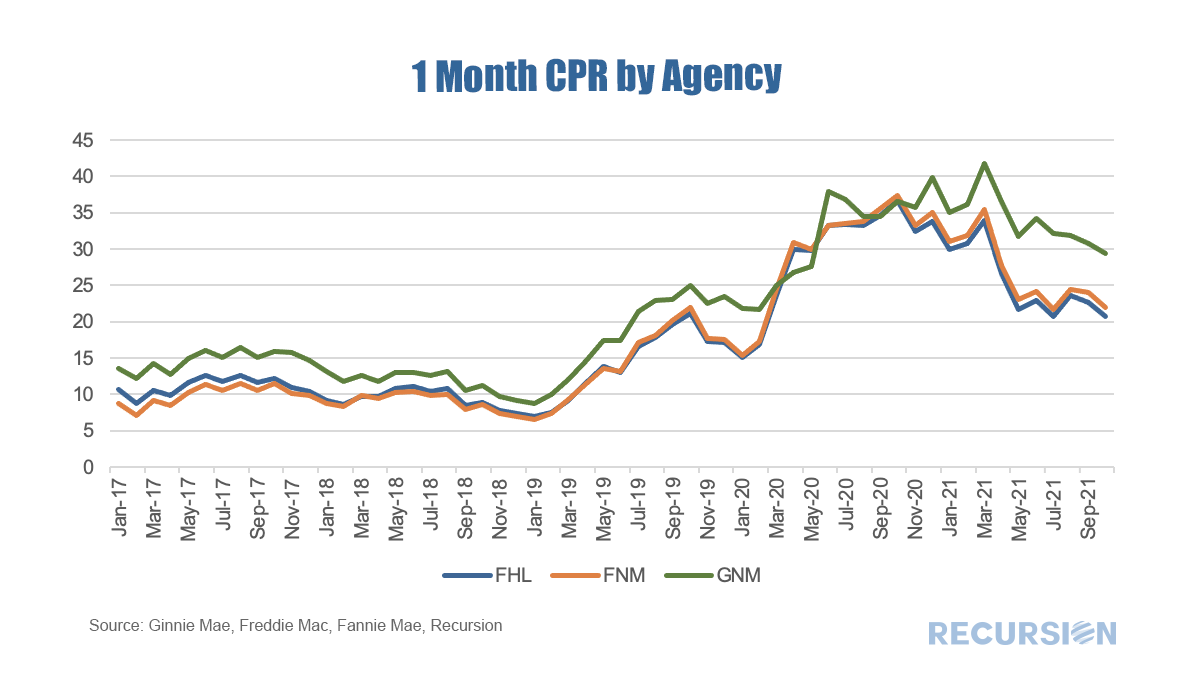

Over the past six months, prepayment speeds of Ginnie Mae securities have notably widened against those of the GSEs.

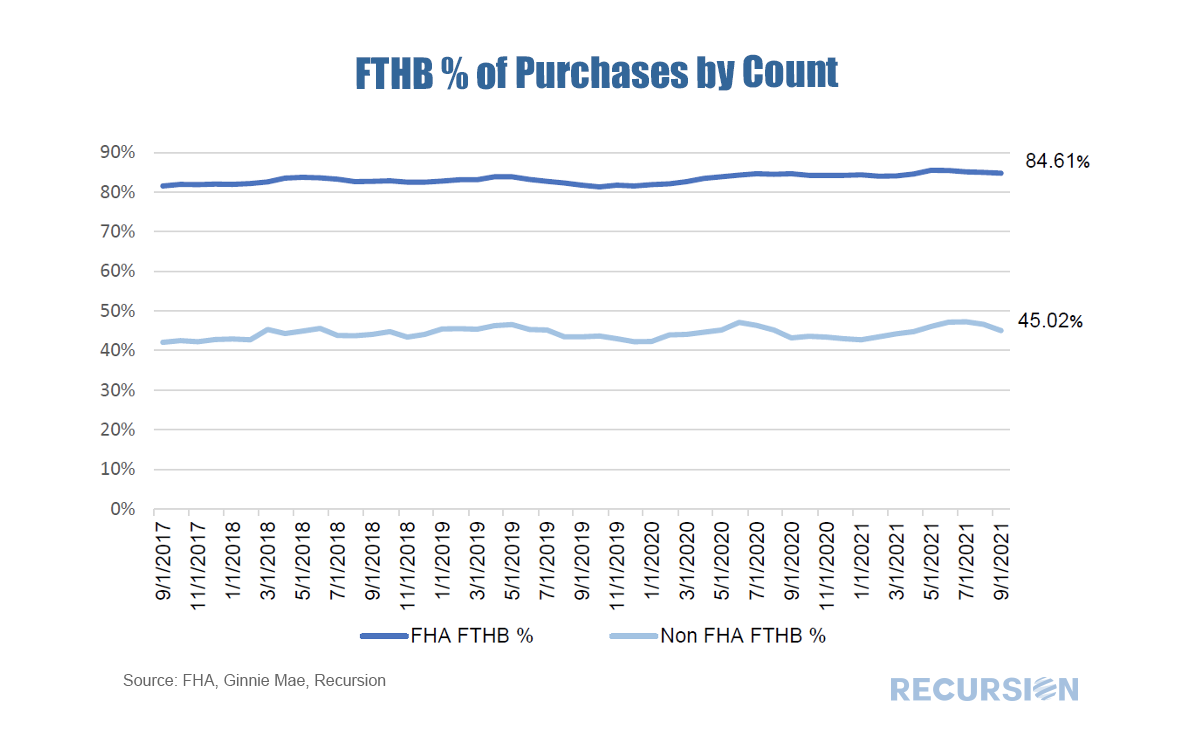

On Nov. 15, 2021, the U.S. Department of Housing and Urban Development (HUD) released its fiscal year 2021 report to Congress regarding the financial status of the Federal Housing Administration (FHA) Mutual Mortgage Insurance Fund. In the statement, HUD emphasized the critical role of FHA in the U.S. housing market and its mission of providing access to credit to expand first-time and low-and-moderate-income homeownership.

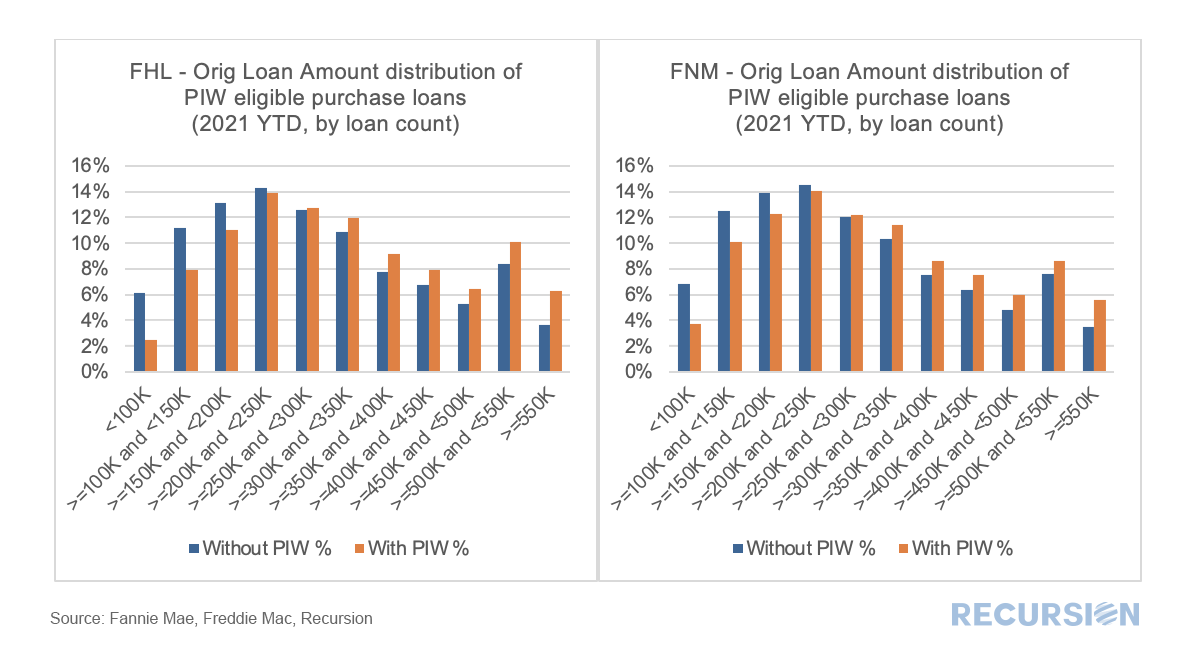

Recursion data was cited several times in the report, notably with regards to first-time homeownership, the share of loans originated under $70K, and the Agency share of total market output. Recursion is proud that HUD recognizes Recursion’s powerful analytic capabilities in supporting FHA’s “essential role in advancing homeownership”. As we have noted many times, one of the best features of loan-level analysis is the ability to segment the mortgage market into components that allow for a deepening of understanding of the behavior of the various market players. In this note we look at two groups: borrowers who get an appraisal and those who are eligible to get one but do not.

In previous posts we pointed out that analysis of the performance characteristics of mortgages with and without appraisal waivers cannot be accomplished by looking at loans with waives vs those without as many loans without waives are ineligible to obtain them. A robust analysis can only be conducted by looking at loans with waivers against loans that are qualified to get one. The qualification characteristics can be complex, but the main factor is LTV, which differs by loan purpose.[1] The question that naturally arises is why do some eligible borrowers not obtain a waiver when doing so would save money on the transaction? To address this issue, we look at the distribution of loan sizes for purchase loans with waivers vs those without them that are eligible. Here is the pattern of loans delivered to the GSEs YTD October 2021 by Agency: New York, NY Nov.3rd 2021 --- New York based FinTech company Recursion is teaming up with Fordham University’s Center for Research in Contemporary Finance to work on ESG aspects of mortgage market.

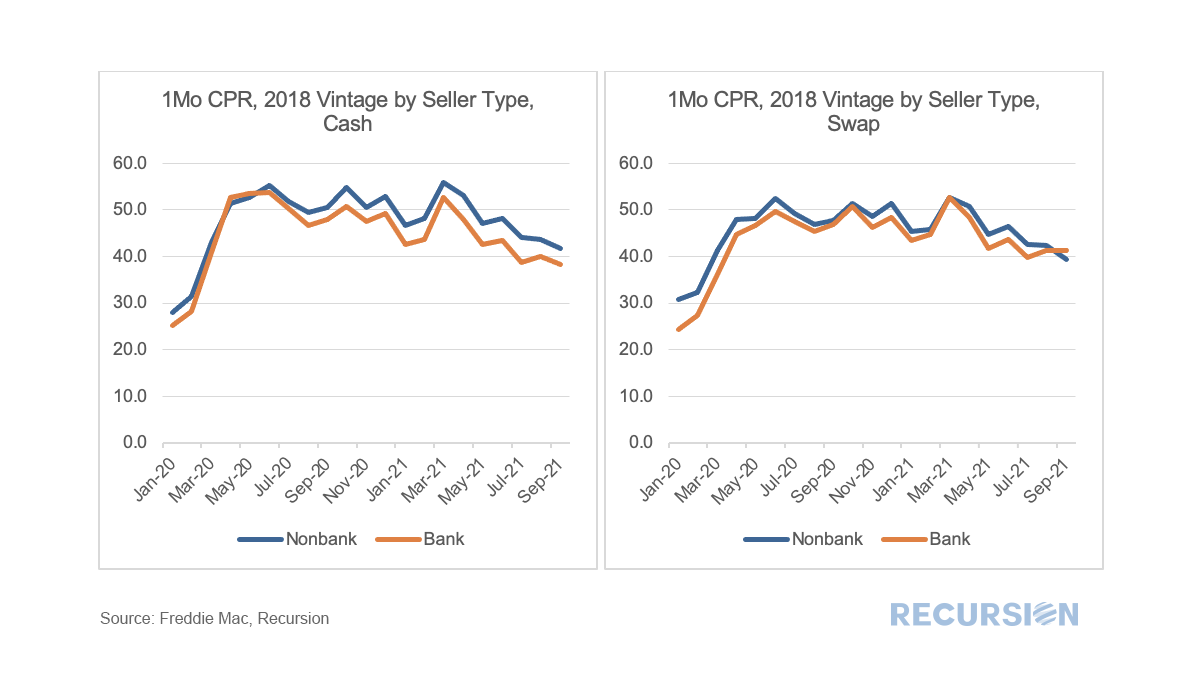

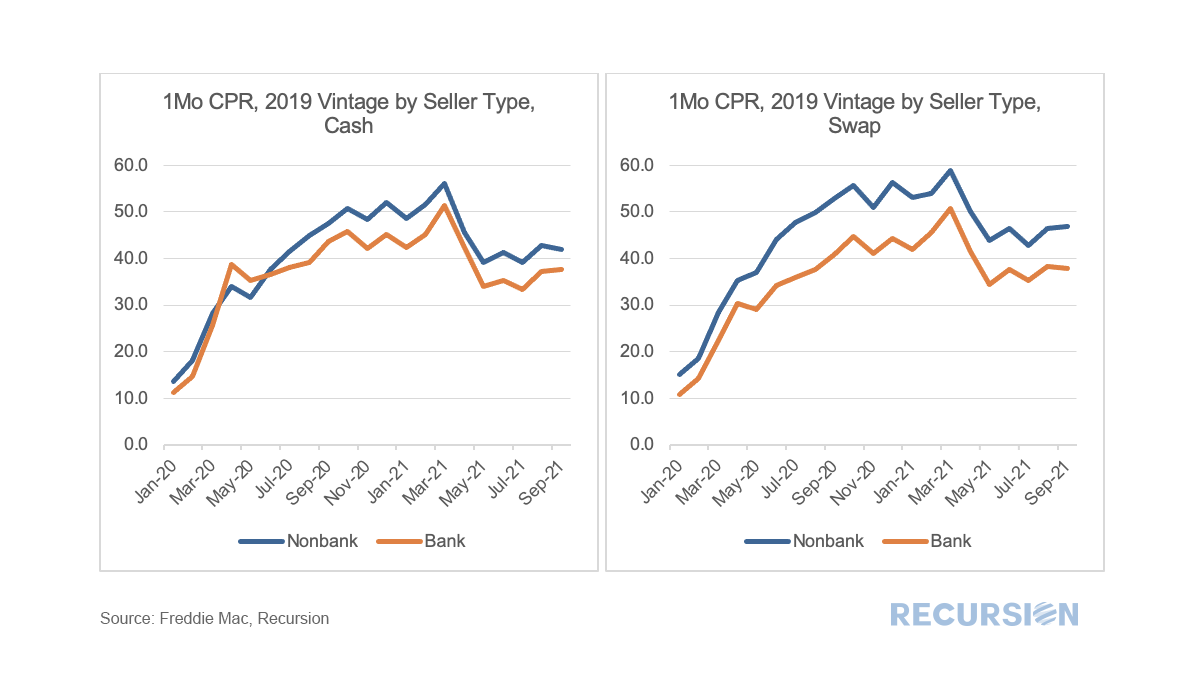

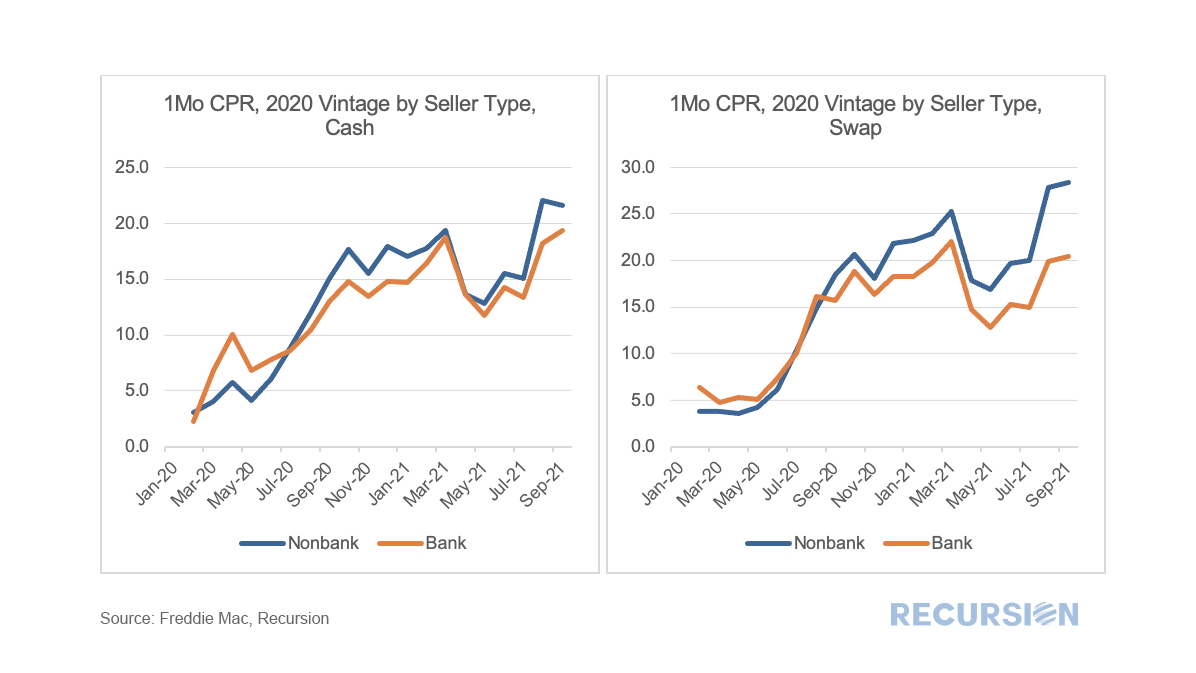

The group will utilize Recursion’s cutting edge big data tool, HMDA analyzer, that is based on HMDA data released by CFPB and FFIEC from 1990 to 2020 consisting of more than 600mm mortgage applications, originations, and purchases that is widely used to evaluable affordable housing policies in the US. Recursion also recently introduced FHFA’s newly released fair lending dataset, such as low-income areas, minority tracts, disaster areas and rural areas to HMDA analyzer. In a recent post[1], we looked at the share of the use of the cash window for bank and nonbank sellers. We found a reversal in the long-term upward trend in this share this year, correlated with the imposition of FHFA imposed lender-level caps on the use of the cash window. We next turn to performance.

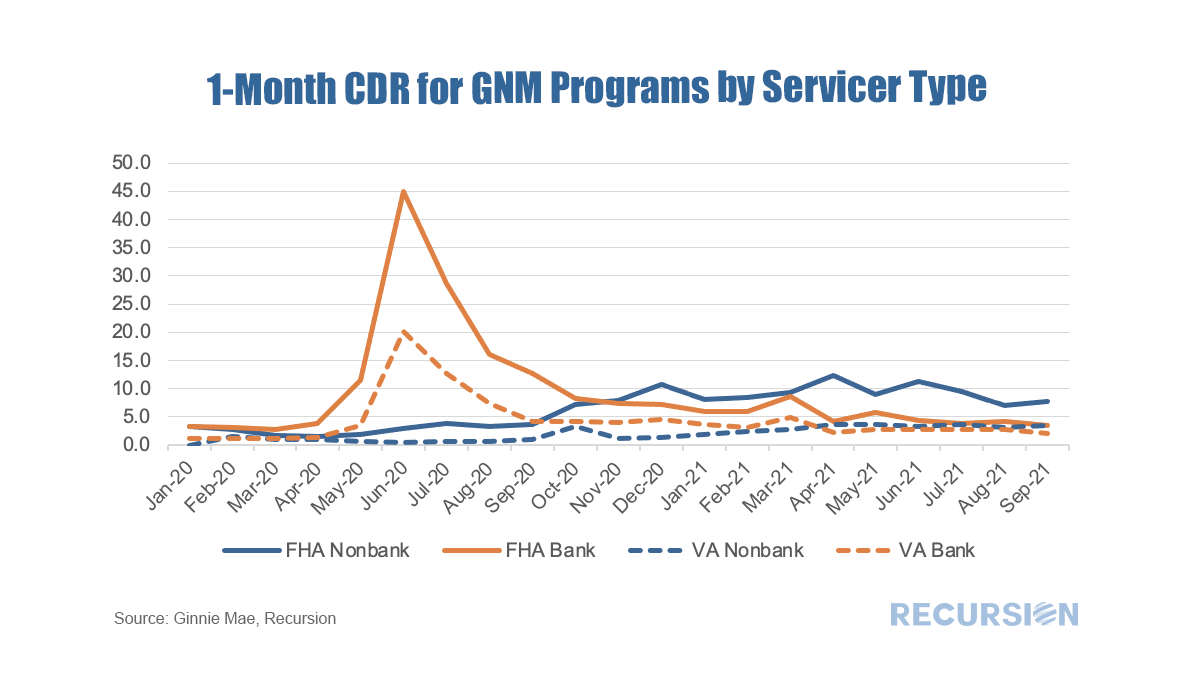

We look below at prepayment speeds for the 2018, 2019 and 2020 cohorts broken down by bank and nonbank sellers. As we approach year-end and the beginning of the process of phasing out forbearance programs, the natural question market participants are asking is which indicators should they be watching to gain a sense of the mortgage landscape in 2022. Along these lines, there is a significant difference between the Ginnie Mae programs and the GSE’s. In particular, for conforming loans, it is the Agencies themselves that buy nonperforming loans out of pools, while for FHA and VA, this function is performed by servicers. As the timeframe for buyouts on the part of the GSE’s was extended to 24 months earlier this year, we won’t see much activity prior to April 2022 on this front[1]. So in this post, we focus on the Ginnie Mae programs.

As we have written previously, it is challenging to follow the path of a loan once it has been purchased out of a pool. At the aggregate level, we can view the activity of individual lenders using the FHA Neighborhood Watch data[2]. In terms of the process, a nonperforming loan is bought out of a pool, and one of three actions can be taken. First, the borrower can be taken into foreclosure. Second, the borrower can become current and roll the unpaid balance into a second lien, in a process known as a partial claim. Third, the borrower can accept a loan modification. In terms of the scale of buyouts, after an early spurt of activity in 2020 on the part of some parties, notably banks, the involuntary prepayment rate, measured by CDR(constant default rate), has settled down in recent months. FHA nonbank servicers have been more active in this space than other categories over the past year. As forbearance plans begin to expire towards the end of the year, these numbers may start to rise. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed