|

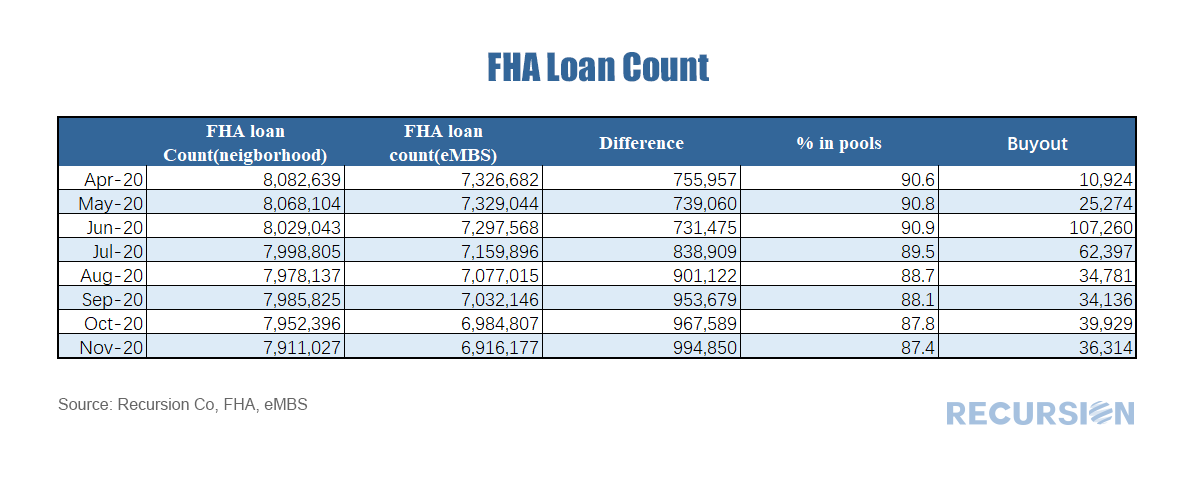

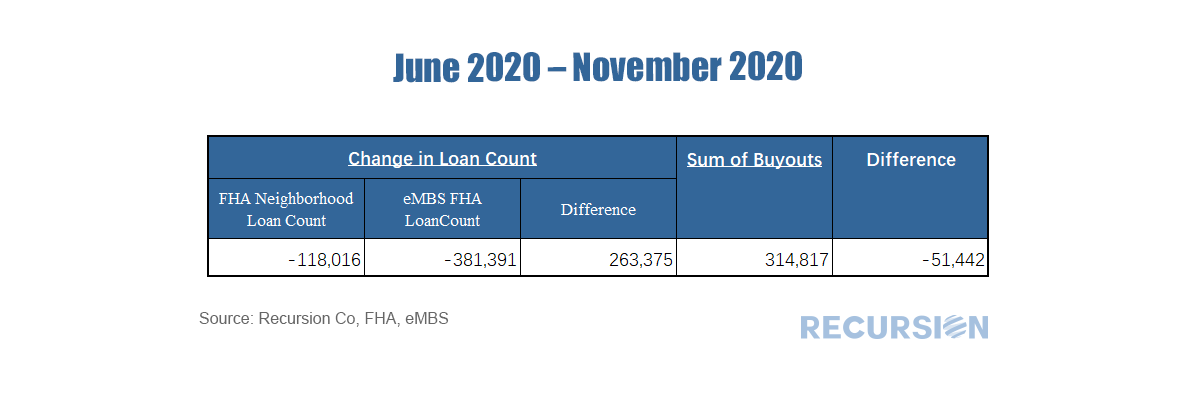

So once again we look at the theme of 2021 as a transition year. A lot of the year will be spent peering at the data to tease out emerging trends as we head towards the new normal. The discernment of new trends requires the use of new data, and new tools. We have recently brought into the Recursion data set FHA Neighborhood Watch data, which was discussed previously in the context of partial claims[1]. These are the suspended mortgage payments for loans in forbearance that are rolled into a second lien, repaid only when the loan is extinguished. This is particularly useful for tracking the financial burden of forbearance by servicer. To accomplish this in a comprehensive manner, FHA releases this data for all endorsed loans. Using this data, we can examine trends in all loans vs those securitized in Ginnie Mae pools. Our data for the FHA Neighborhood Watch extends back only to April 2020, but the last eight months have been an interesting period in mortgage markets. As of November 2020, there were 7.9 million loans in the FHA Neighborhood Watch database, while there were 6.9 million securitized in Ginnie Mae pools, reported by eMBS, a gap of 1 million loans. Since loans may be held by servicers or on bank balance sheets, it’s not surprising that the number of loans in pools falls short of the total. What is interesting here is that the gap of 1 million loans in November has grown steadily since June[2]. Why is that? Well, there are many factors behind financial institutions’ decisions to hold or securitize loans, but what has been particularly interesting since last June is the growing number of buyouts of loans from pools associated with delinquencies stemming from the Covid-19 pandemic[3]. Between June and November of 2020, the number of loans in the FHA Neighborhood Watch data base fell by 118K while the number of loans in Ginnie pools fell by 382K, 263K more than the drop in the total. Over that same period, 315K loans were bought out of pools, accounting for 51.4K more than the total discrepancy in loan growth between the two sources. The remaining difference may be explained as resecuritization of loans previously bought out of pools, although other explanations are possible. [1] https://www.recursionco.com/blog/partial-claims

[2] We commented previously that the declining share of FHA loans in the mortgage market is related to a growing share of FHA loans that refinance into conventional loans. https://www.recursionco.com/blog/the-fha-refi-share [3] The large jump in buyouts last June is related to changes in Ginnie Mae pooling regulations. https://www.recursionco.com/blog/the-great-prepay |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed