|

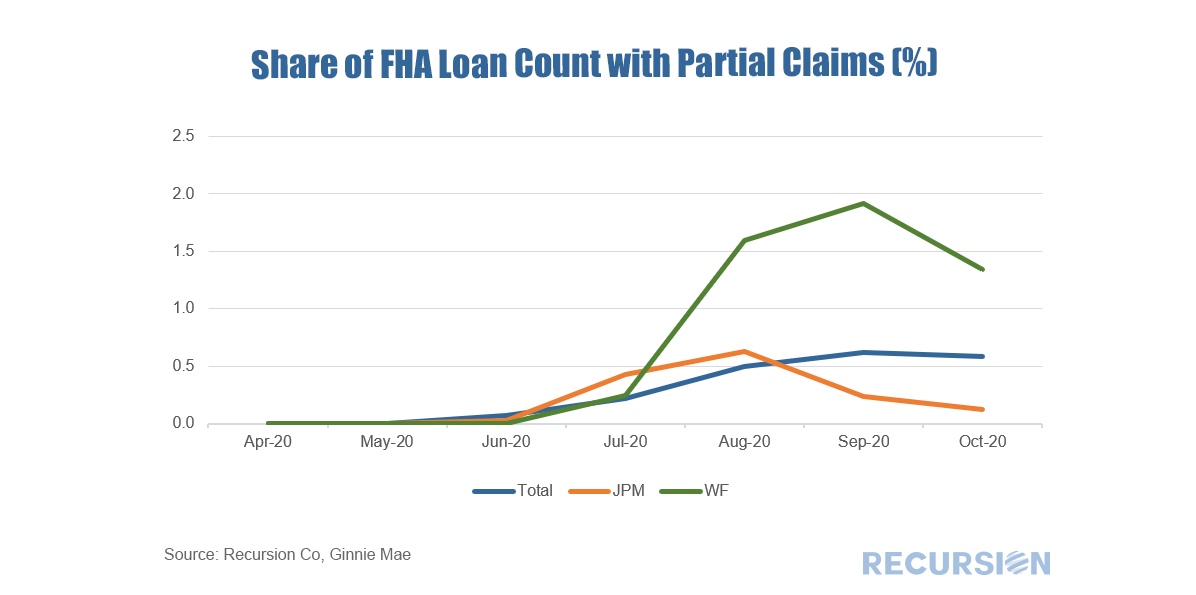

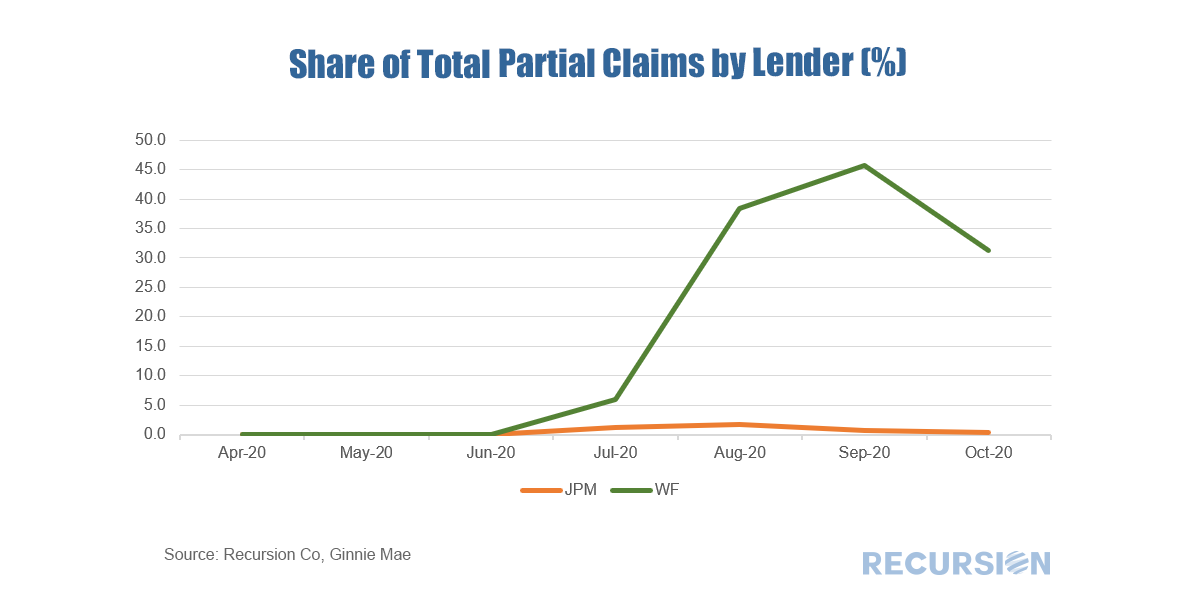

As we head into 2021, an ongoing issue is the disposition of loans in forbearance. The Cares Act allows for borrowers negatively impacted by the Covid-19 pandemic to obtain forbearance up to 1 year[1]. This will begin to expire in Spring 2021, although an extension is possible as the new Administration takes over in January. A key point is that forbearance is not forgiveness. The mortgage agencies have provided options for borrowers who become current after forbearance, so they don’t have to make a lump-sum payment for missed principle and interest. FHA has designated its policy regarding the disposition of suspended payment amounts as COVID-19 National Emergency Standalone Partial Claims[2](COVID Partial Claim). “The COVID Partial Claim puts all suspended mortgage payment amounts owed into a junior lien, which is only repaid when the homeowner sells the home, refinances the mortgage, or the mortgage is otherwise extinguished.” Borrowers who were current prior to the onset of the pandemic are eligible for the COVID Partial Claim, contingent on the availability of income to resume payments. For loans not eligible for the COVID Partial Claim, COVID Loan Mods and combination Mod/Partial Claim options are available. Failing these two options because of the lack of income, the remedies available to borrowers are short sales or foreclosure. According to its recently released Mutual Mortgage Insurance Fund Annual Report for FY 2020[3], FHA indicated that about 40% of seriously delinquent borrowers are eligible for the COVID Partial Claim. In 1998, HUD instituted the Neighborhood Watch[4], designed to provide “reporting and analysis capabilities for tracking the performance of loans originated, underwritten, and serviced by FHA-approved lending institutions.” There is a wealth of information contained here, including the total number of loans in the FHA portfolio, the number of Partial Claims, and similar data for all FHA servicers, including Wells Fargo and JP Morgan. The charts below show the share of Partial Claims in the books of the two servicers and the total, as well as the share of all Partial Claims by the two servicers. It should be noted that the loans in this data set are all the nearly 8 million FHA loans, while the loan-level data from our eMBS data sets consist only of loans in MBS pools. Thus far, the number of Partial Claims is overall quite limited, amounting to just a bit more than 0.5% of total FHA loans. There are substantial differences between servicers however, reflecting alternative strategies regarding the disposition of loans in their respective books. For example, Wells Fargo alone accounted for almost half of all FHA loans with Partial Claims in September. Once the forbearance period begins to run off, more widespread use of this program will be observed, creating a robust basis for research regarding how different classes of institutions deal with this issue. [1] https://www.consumerfinance.gov/coronavirus/mortgage-and-housing-assistance/mortgage-relief/

[2] https://www.hud.gov/press/press_releases_media_advisories/HUD_No_20_176#:~:text=The%20COVID%2D19%20National%20Emergency,the%20mortgage%20is%20otherwise%20extinguished. [3] https://www.hud.gov/sites/dfiles/Housing/documents/2020FHAAnnualReportMMIFund.pdf, p. 69 [4] https://www.hud.gov/program_offices/housing/sfh/lender/nw_home |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed