|

In a recent post, we noted that delinquency rates for two classes of FHA modified loans were rising faster than for the general population, namely reperforming (RG) and extended term (ET) loans[1]. In this post, we dig down into details to get a closer view of the behavior of lenders in these categories.

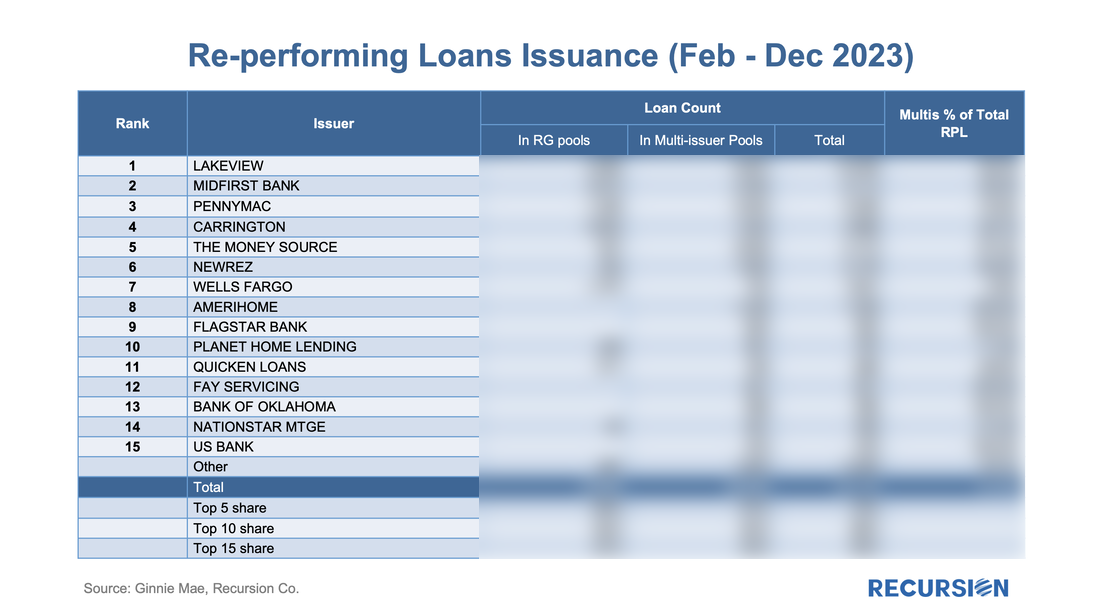

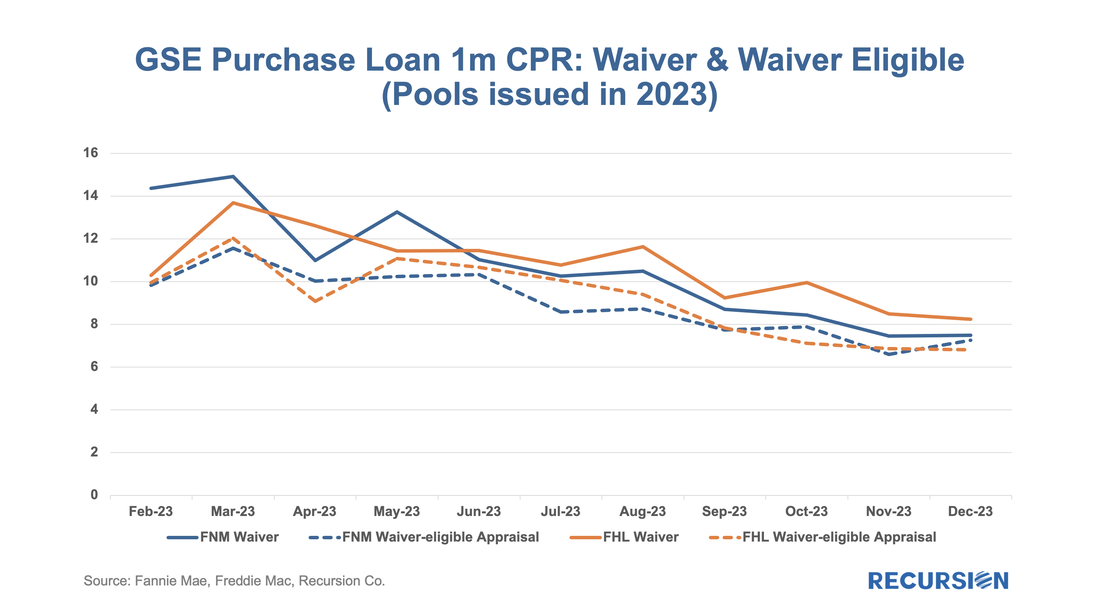

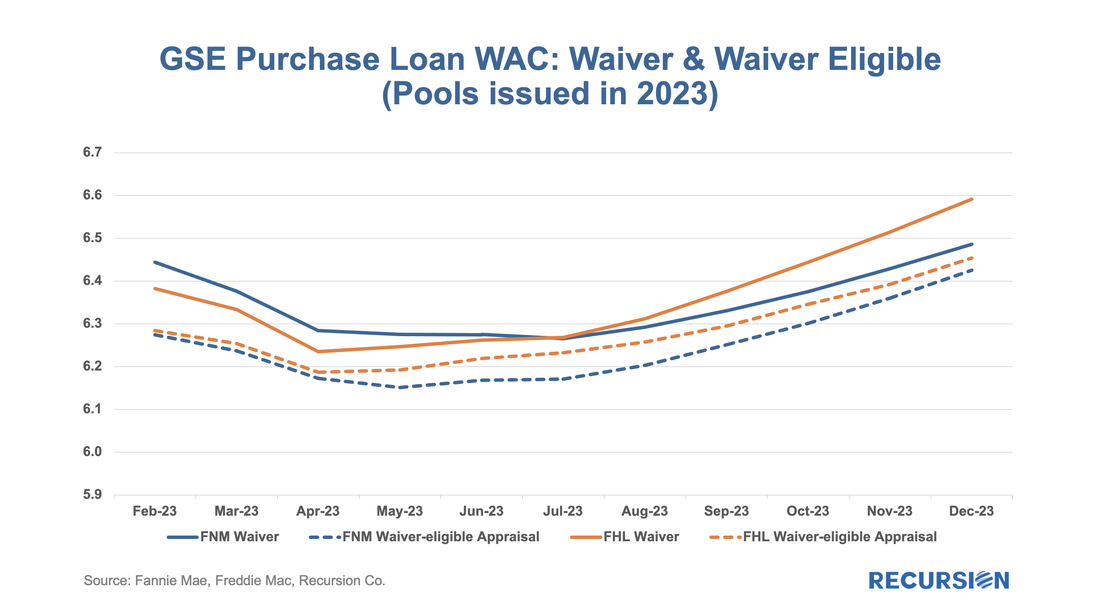

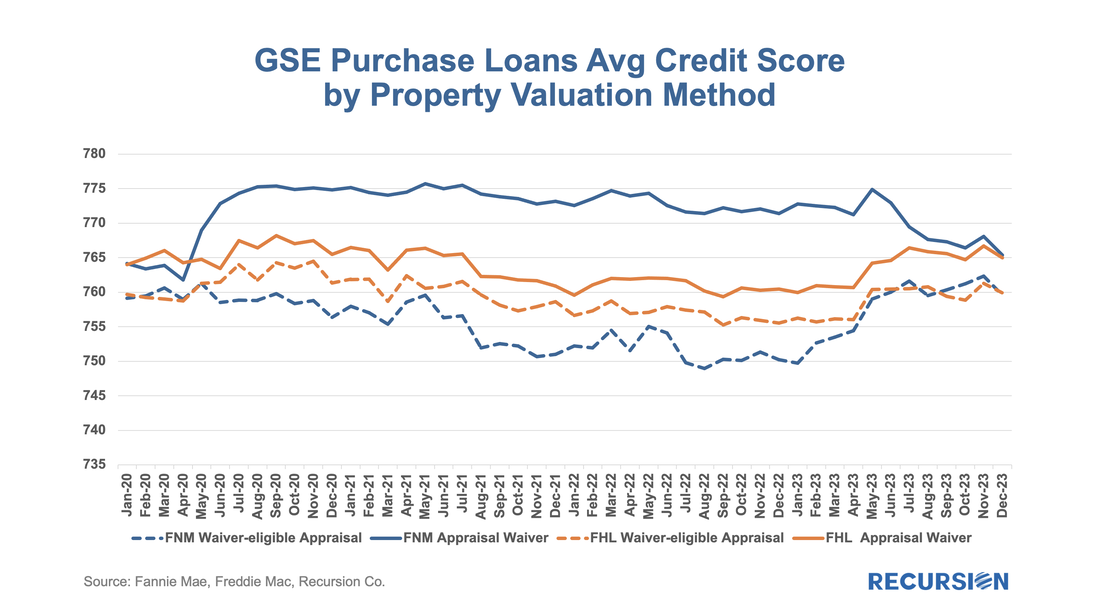

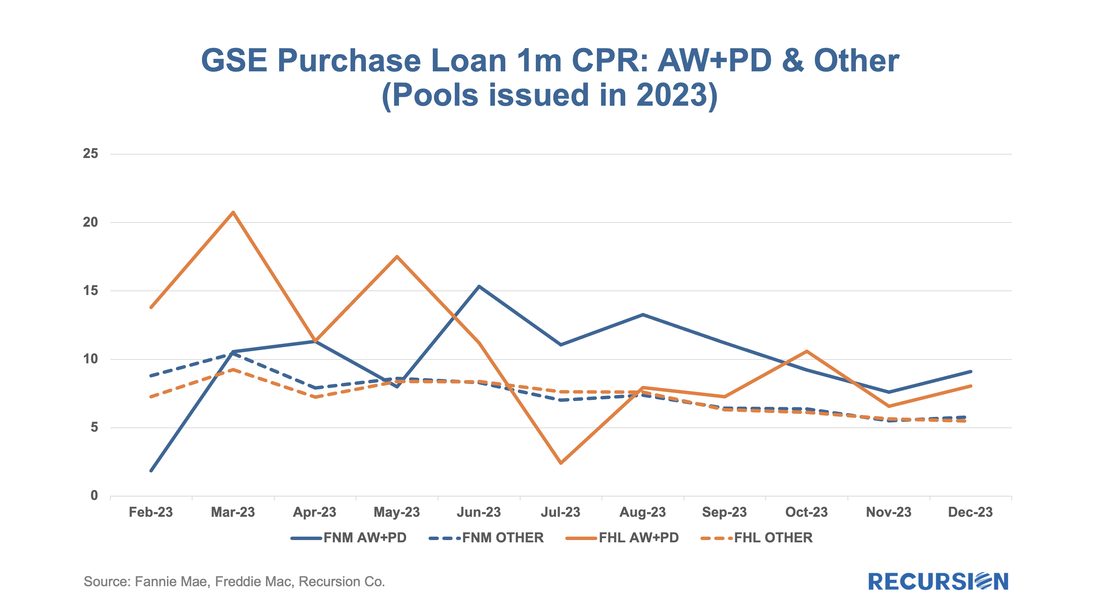

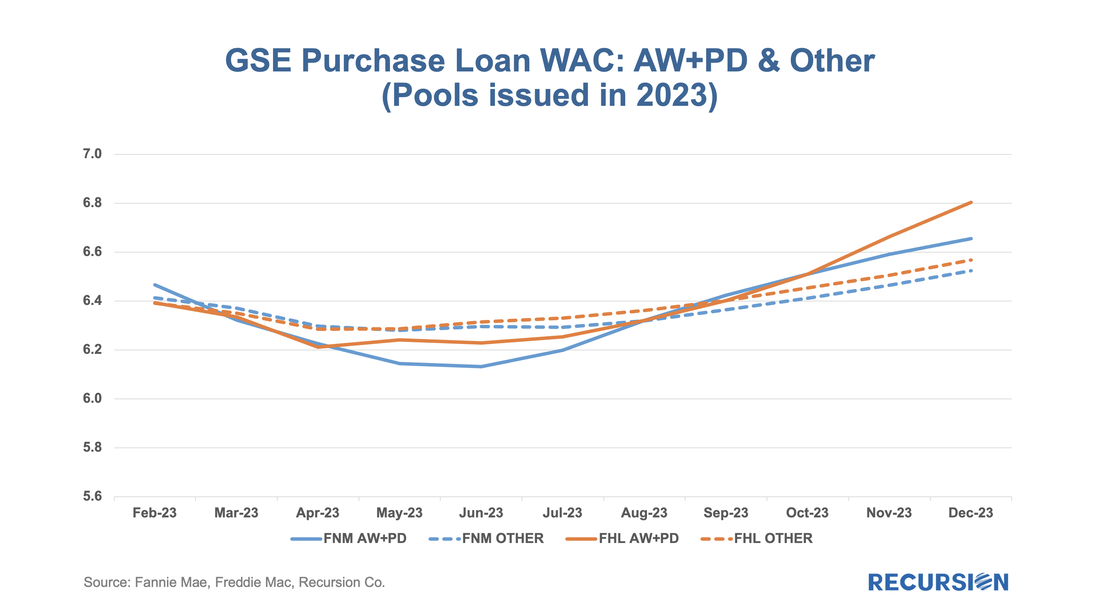

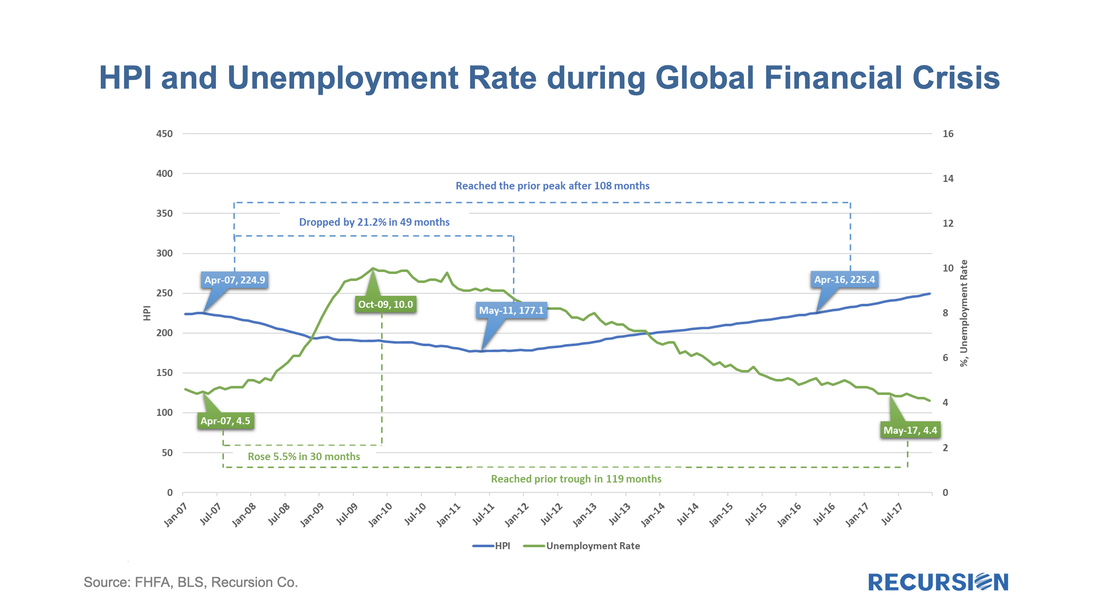

We start with RG loans. As noted in the previous blog, the program was launched in January 2021, allowing borrowers who had outstanding unpaid balances from the Covid period but six consecutive months of payments to roll the balances into a “partial claim” due when the loan is extinguished. At that time, a new “RG” custom pool category was formed to issue these mortgages. Starting in February 2023, the seasoning period was reduced from six to three months and these loans became eligible to be issued in Ginnie Mae multi-issuer pools. The share of these loans in multi-issuer pools reached over 2/3 at the end of 2023. Delinquency rates are modestly higher for RG loans in multi-issuer pools relative to RG pools even though they are relatively new. One topic that comes up is which servicers are most involved in this loan type and how much variation in behavior can be seen across these institutions. Below find the list of the top 15 institutions issuing RG loans and the distribution of each by pool type This is the third and (for now) final entry in our series of posts regarding appraisal modernization. The first describes the framework of data disclosures provided by the GSEs[1], while the second looks at differences in usage of the various programs between Fannie Mae and Freddie Mac and between banks and nonbanks[2]. In this note, we look at loan prepayment performance and the drivers behind it. Here we see 1-month CPRs and loan rates for purchase loans issued in 2023 with waivers and those eligible for waivers but did not obtain one: Those loans eligible for waivers but that obtain appraisals have lower loan rates and prepayment rates than loans with waivers, likely due to relatively reduced uncertainty surrounding valuation. Another key result that can be obtained from the chart is the more recent development whereby loans delivered to Freddie Mac with waivers have displayed persistently higher speeds than those delivered to Fannie Mae over the last six-month period. This corresponds with an increase in the pace of growth in FHL coupons compared to those of FNM over this period. It’s natural to ask if there are differences in loan characteristics that account for this gap. Below find the corresponding data for average credit scores across these categories: Over the past six months, FNM has loosened its credit standards for waivers as measured by credit scores relative to Freddie Mac. As this would tend to boost FNM coupons vs FHL, another explanation would seem to be required. We can speculate that FHL is discouraging waivers for its own risk-management purposes, but there is no verifiable support for this view. We can, however, see if this pattern persists in the newer appraisal types. The loan counts here are quite small, so it is not surprising to see a noisy CPR chart for these categories. On the other hand, the trend increase in FHL AW+PD loans relative to those of Fannie Mae can be seen, although it is a more recent development in this case. Our conclusion is there is enough distinction here to say that modelers and traders ought to keep an eye on collateral risk as an independent factor in their decisions. We kicked off 2024 with a post looking at the sensitivity of low-income borrowers to a slowdown in the economy[1]. We saw continued solid correlations between labor market conditions and jobless claims, particularly for low-income borrowers. At present, these all remain near historically low levels. However, we also saw growing distress in some categories of borrowers with modified loans. It seems that policymakers are going to great lengths to keep homeowners out of foreclosure. This effort falls directly out of the experience of the Global Financial Crisis, where six million households lost their homes while only one-quarter of these regained homeowner status afterwards[2]. This led to a persistent period of slow growth in the decade following the crisis, a situation that policymakers have become determined to avoid. Consequently, when the COVID-19 pandemic hit, policymakers were prepared with a policy of forbearance where households who were impacted by the disease were allowed to defer payments until their economic situation improved. The policy was extraordinarily effective. Unemployment and House Prices in Two Crises

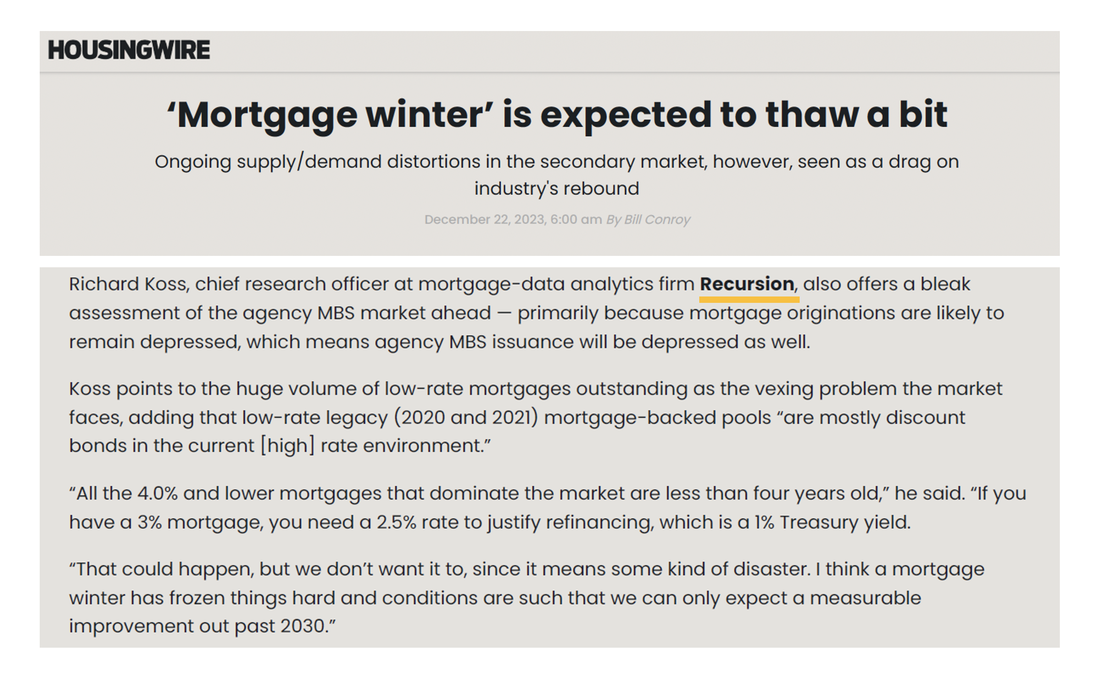

As part of its year-end market review, Housing Wire picked up Recursion’s theme of “Mortgage Winter”. On December 22, in an article entitled “‘Mortgage winter’ is expected to thaw a bit”, Recursion Chief Research Officer Richard Koss is extensively quoted. “Koss points to the huge volume of low-rate mortgages outstanding as the vexing problem the market faces. He said ‘I think a mortgage winter has frozen things hard and conditions are such that we can only expect a measurable improvement out past 2030.’ Recursion is proud to apply its advanced data and analytic tools to contribute to the ongoing dialogue about the market environment for the mortgage market.

Please reach out to [email protected] if you would like a copy of the article. In a January 5, 2024 article entitled “Agencies Seen Leading Multifamily Lending”, Commercial Mortgage Alert reported that “Last year, Fannie purchased $52.6 billion of multifamily loans, according to Recursion Co. Freddie purchased $41.1 billion through November.” Both figures are below the regulatory caps set by FHFA of $75 billion each. Recursion is proud to be the trusted data provider to the preeminent news outlets in the mortgage industry.

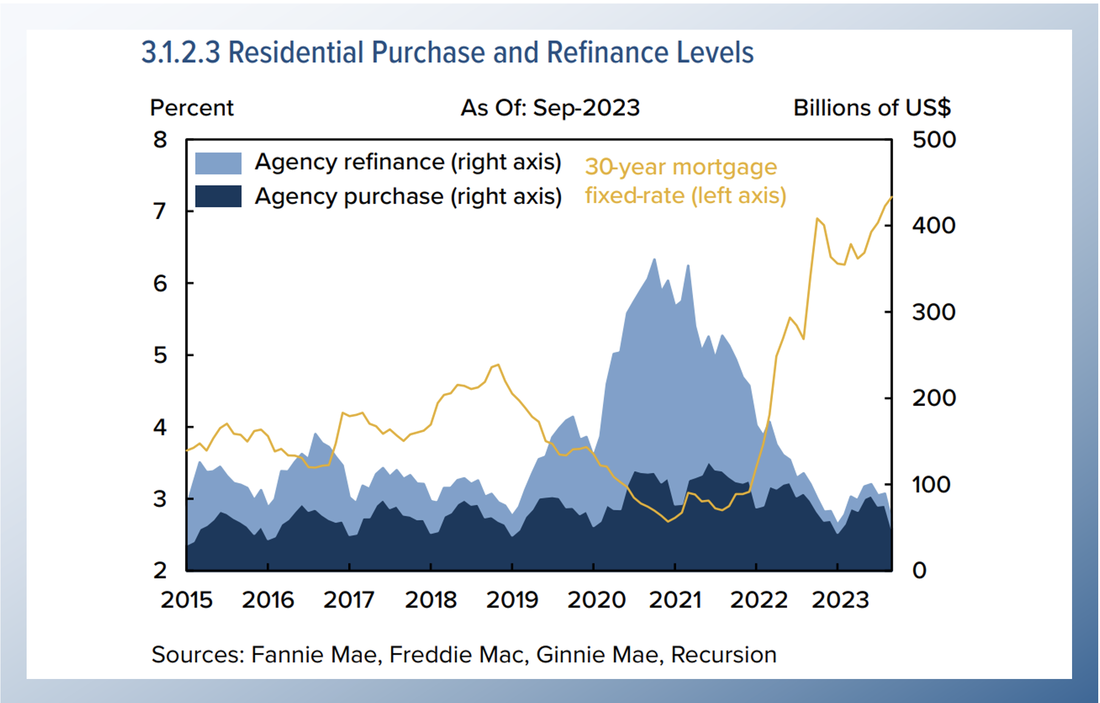

Please reach out to [email protected] if you would like a copy of the article. On December 15, 2023, the Financial Stability Oversight Counsel (FSOC) released its 2023 Annual Report. According to the Report: “The Council was established by the Dodd-Frank Act of 2010 and was charged with the collective responsibility to monitor and promote US financial stability. This annual report summarizes the Council’s assessment of current vulnerabilities across a variety of asset classes, institutions, activities and developments, and the 2023 activities of the Council and member agencies to reduce and respond to risks and lessen vulnerabilities facing the financial system.” In its discussion of the primary mortgage market, the Council states “High interest rates coupled with low inventory for sale led to fewer home sales and origination volume. (see figure 3.1.2.3) Recursion is pleased to be acknowledged by FSOC as a source for trusted data and analytical expertise.

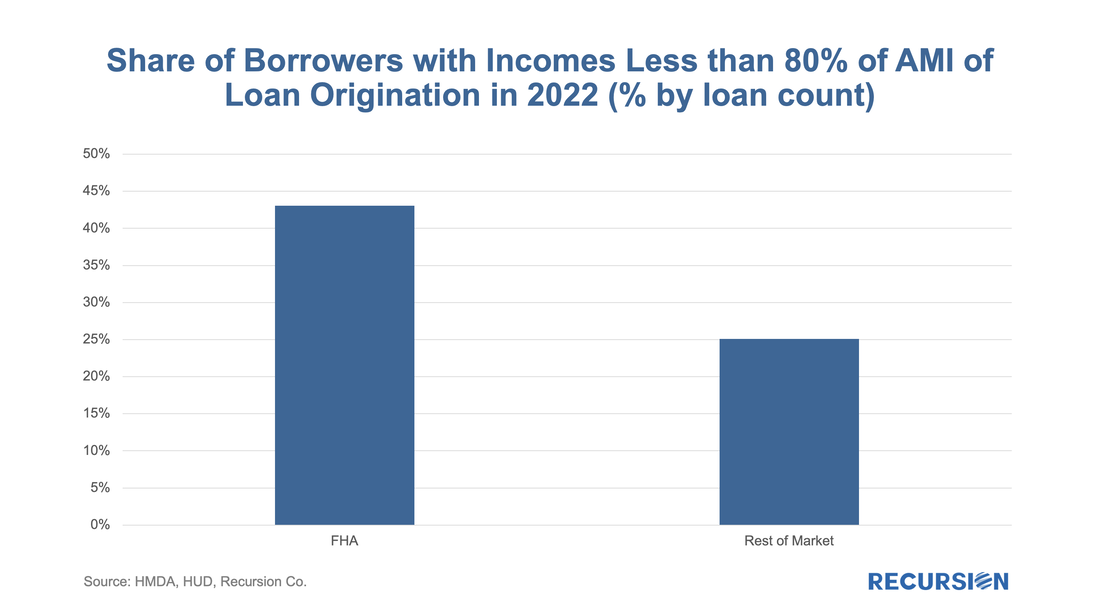

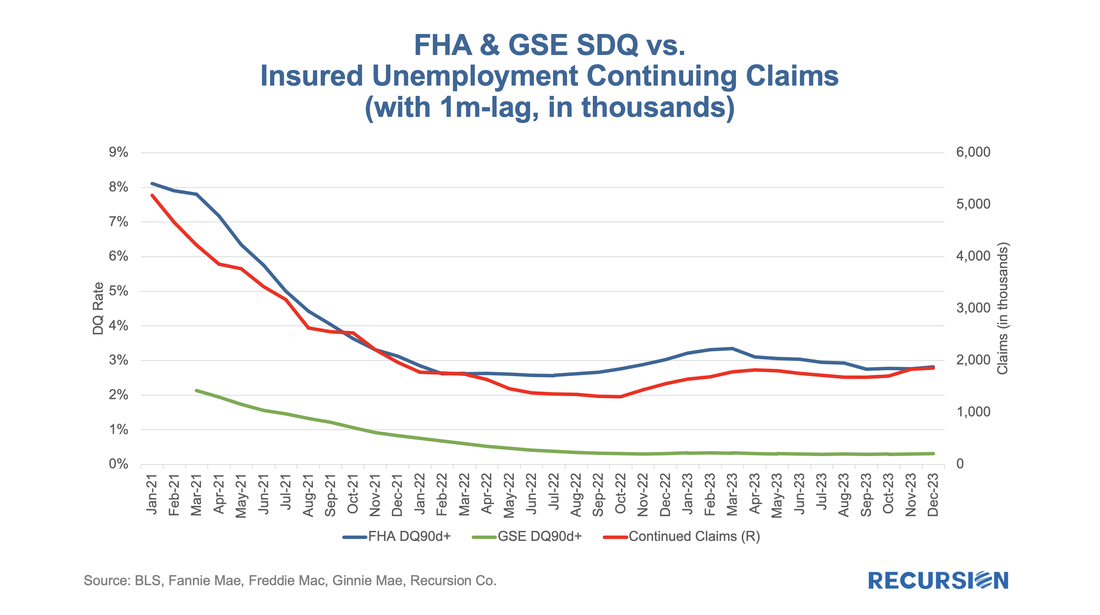

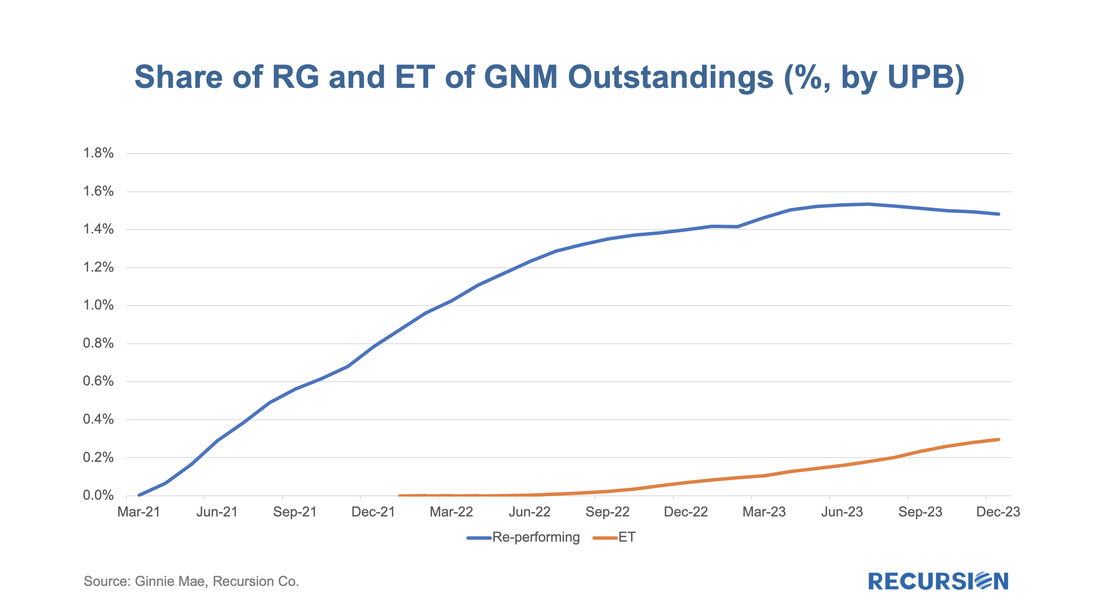

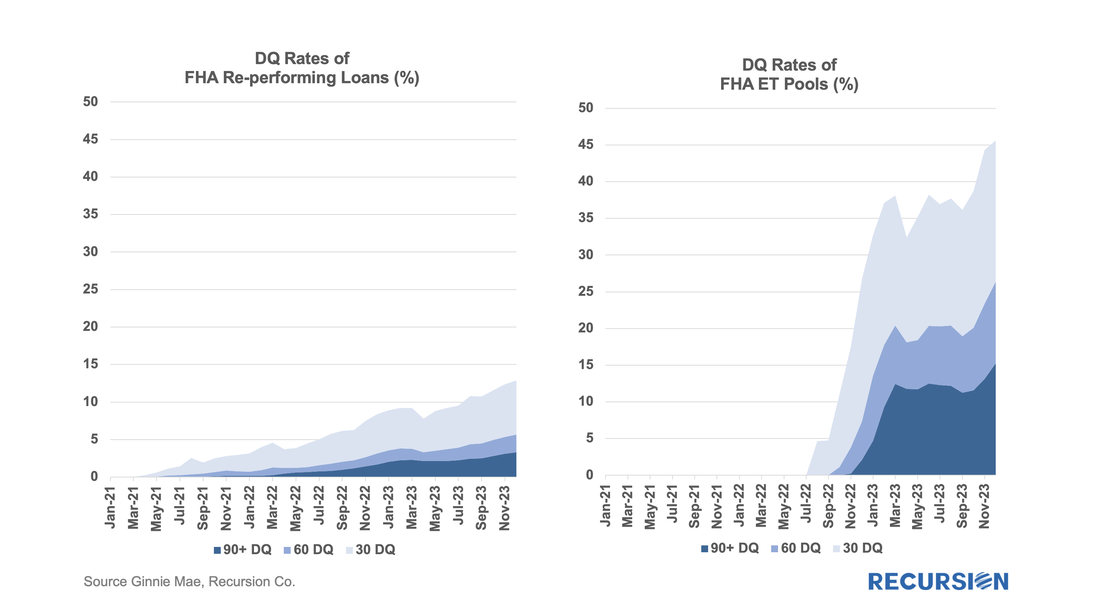

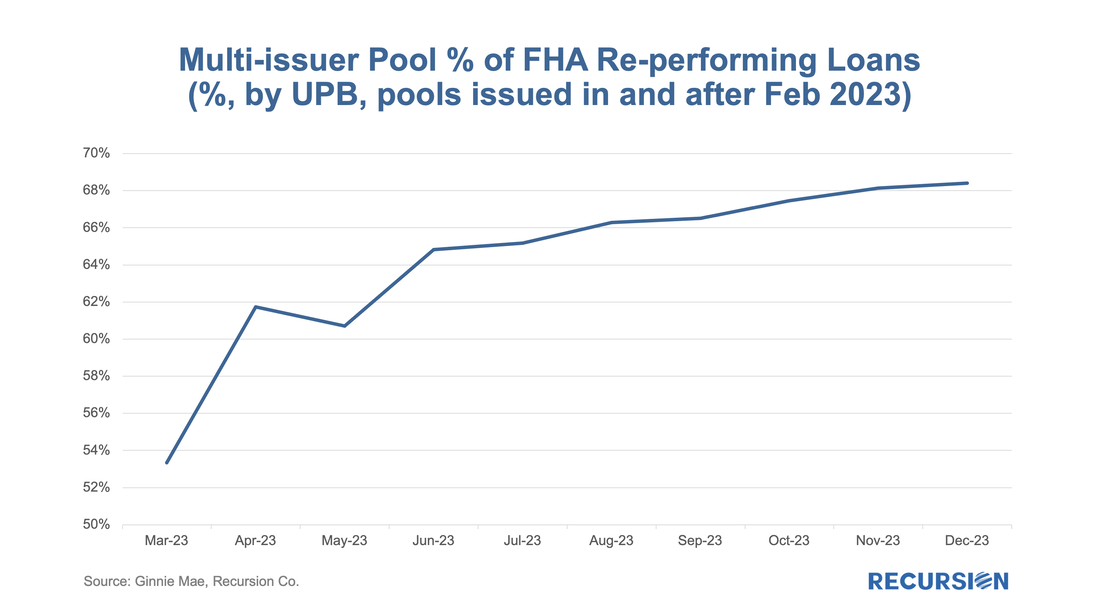

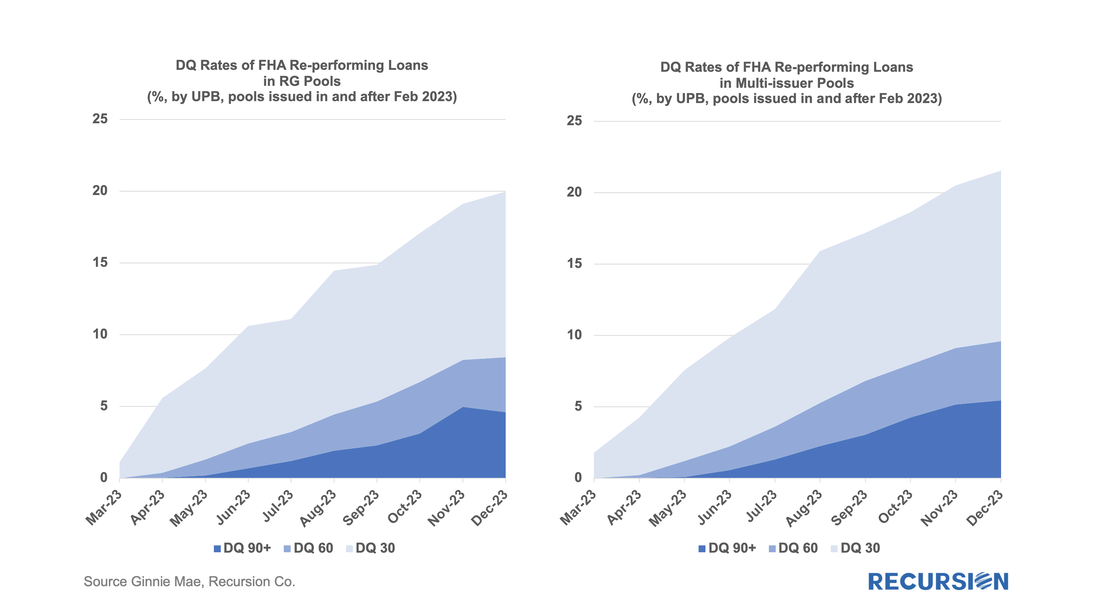

The year 2023 was remarkable in many ways, but a key characteristic was the resilience of the economy and labor markets to high and rising interest rates. At the start of the year, the consensus forecast called for sharply slower growth and rising unemployment. In reality, growth accelerated, and unemployment remained near historic lows. This has left analysts in a state of chaos regarding the outlook for 2024[1]. We leave forecasting to others, pausing to note that we find a high correlation between the confidence of forecasters, and forecast error. Instead, we pose a hypothetical question. What if the economy slows down and even experiences a modest recession? What would that mean for borrowers, particularly for those in low-income households? Our core Agency disclosure data is of somewhat limited usefulness here as we do not have borrower income as a disclosed characteristic. However, we can break the universe up by Agency, notably comparing FHA to conforming loans, as we know FHA borrowers are lower-income borrowers, as demonstrated by 2022 HMDA data: The distinction reported here allows us to perform a natural experiment whereby we compare the performance of FHA loans to those of other programs, in this case, the GSEs. To accomplish this, we look at the SDQ (90D+) rate for FHA and GSE loans vs a key fundamental: continuing jobless claims: Both FHA and conforming loans are sensitive to the state of the labor market, but the connection is much tighter for low-income FHA borrowers. It seems reasonable to think that the same relationship would hold should the labor market deteriorate, and continuing claims rise. But there is more. FHA, in recent years, has implemented programs for highly vulnerable borrowers to keep them in their homes. The first of these is “reperforming mortgages,” where borrowers who have fallen behind on their payments after leaving forbearance but have subsequently made payments for six consecutive months may take the missed payments as a “partial claim” due when the mortgage is extinguished[2]. This has superior credit considerations for the borrower compared with a modification. When the program was launched in January 2021 these loans could only be securitized in new “RG pools”. Since February 2023, the seasoning repooling requirement was shortened to three months from six months, and these loans are eligible for issuance in Ginnie Mae multi-issuer pools[3]. Another program is “Extended Term Mortgages”. These are loans with a modification that extends their maturity to at least 361 months and not more than 480 months. This program was launched in February 2023, and these loans are securitized only into “ET pools”. It is natural to ask about the performance of these categories of loans as they relate to particularly vulnerable borrowers. While these are not particularly large programs, it’s interesting to note that the share of RG loans out of total outstandings peaked earlier this year while the ET share continued to rise. And below find the performance statistics for these categories of loans: The DQs for the RG loans are modestly higher than those for the overall FHA program, while those for the ET pools are dramatically higher. Given the current strong state of the economy, we conclude that there are market segments that will experience distress should labor market conditions become less tight. Many questions remain. First, we have the issue of the performance of RG loans by pool type since these can now be securitized into either RG or GNM multi-issuer pools. Interestingly, over the last nine months, the split has grown from just over 50/50 multis/RG pools to about 68/32. Here are the performance statistics for each type: It is noticed that DQs for loans distributed to multi-issuer pools have recently been performing somewhat worse than those in RG pools. There is a temptation to think that the loans in multi-issuer pools can only be tracked at the loan level with advanced data technologies. A natural question would be whether issuers have different strategies for allocating re-performance mortgages in RG prefix pools or multi-issuer pools. And then there is the issue of the large spike in DQs for ET pools. Again, further work on the issuer level will shed light on the driver of the deteriorating performance. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed