|

In a recent post[1], we discussed findings obtained with the recent release of 2021 HMDA data. Among other things, we looked at the share of mortgage originations by income group and product type. In this note, we look at the difference in lending patterns between the banks and nonbanks.

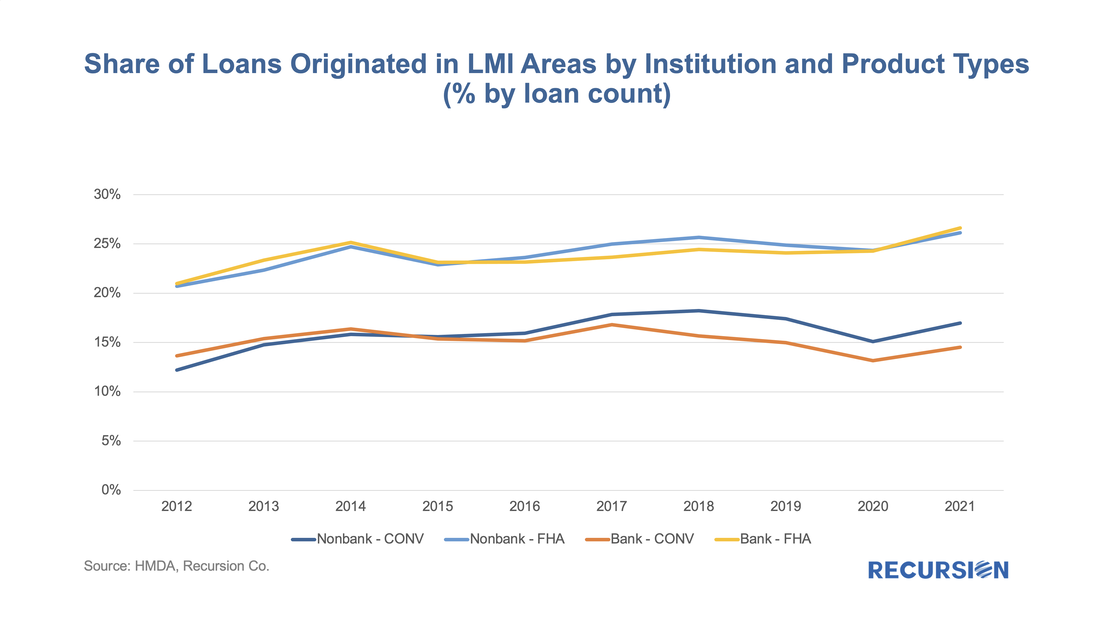

The incentive behind this approach is policy driven. There is a long history of measures taken to encourage lenders and builders to foster economic development in low-income areas via the housing market. For example, the Community Reinvestment Act (CRA) stipulates that a bank’s performance with regards to compliance of their regulatory requirements depends in part on: “the geographic distribution of loans—that is, the proportion of the bank's total loans made within its assessment area; how these loans are distributed among low-, moderate-, middle-, and upper income locations[2]” To assess this issue, we assign a flag to each of the census tracts designated by HUD as having a greater than 51% share of households with incomes in the Low-to-Moderate (LMI) range in the larger MSA the tract is part of[3], which are called LMI area by HUD, or “low income” tracts by FHFA. Below find a chart of the 10-year trend in the share of loans originated in this category by institution type for conventional and FHA loans: On Nov. 15, 2021, the U.S. Department of Housing and Urban Development (HUD) released its fiscal year 2021 report to Congress regarding the financial status of the Federal Housing Administration (FHA) Mutual Mortgage Insurance Fund. In the statement, HUD emphasized the critical role of FHA in the U.S. housing market and its mission of providing access to credit to expand first-time and low-and-moderate-income homeownership.

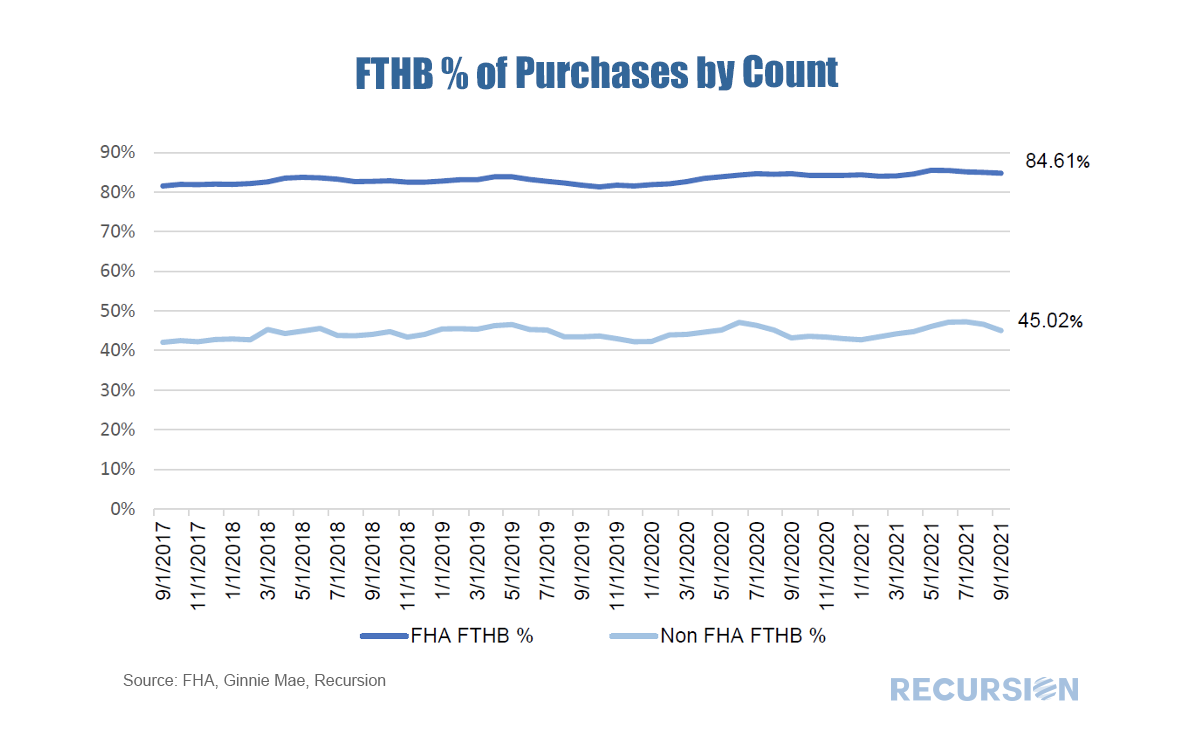

Recursion data was cited several times in the report, notably with regards to first-time homeownership, the share of loans originated under $70K, and the Agency share of total market output. Recursion is proud that HUD recognizes Recursion’s powerful analytic capabilities in supporting FHA’s “essential role in advancing homeownership”. As we accumulate more data at a fine local level, the opportunities to evaluate policies derived from insights into lender, borrower and supervisor behavior grow massively. Our recent post looking at the potential impact of FHFA’s new rate mod policy[1] is our most recent example of the application of digital tools in the policy space, but as noted previously[2], the new policy framework is designed to focus on wealth creation and housing sustainability at the local level.

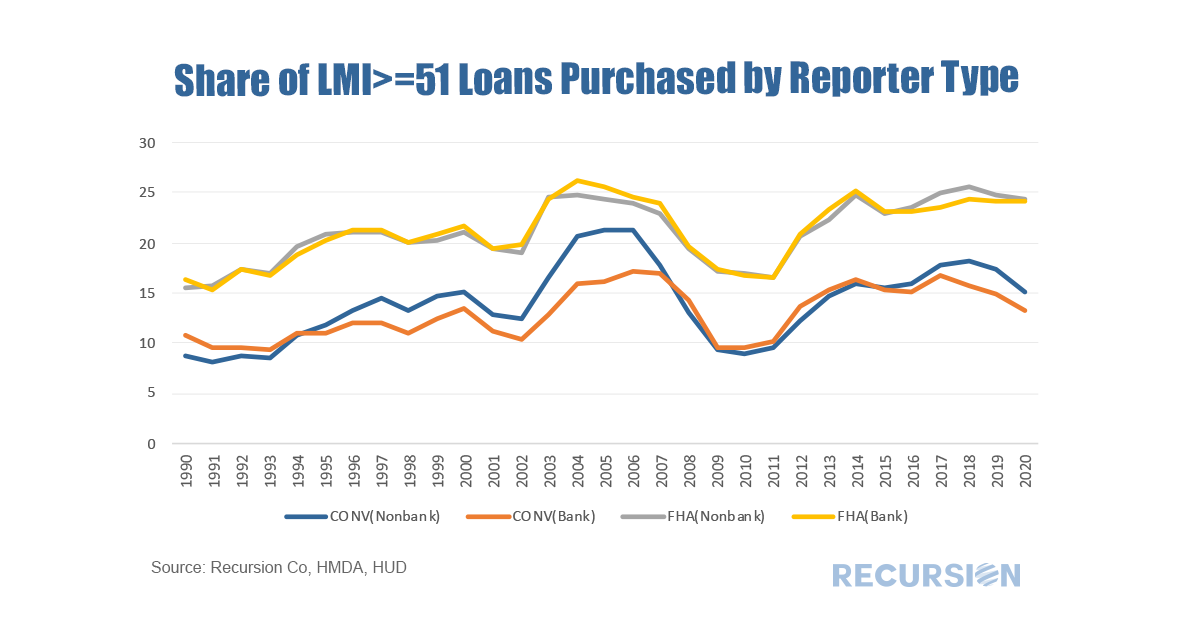

To look at this issue, we need to have data at hand that tells us which local areas have a preponderance of low-income borrowers on which we can overlay the HMDA data set, which reports census tract level indicators related to the policy issue at hand. It turns out that the income data can be found in the American Community Survey (ACS)[3]. A key facet of this survey is information regarding the share of every census tract where low and moderate income (LMI) people comprise less than or equal to 51% of the total population. This data is available through the HUD Exchange[4]. With that, we now have a robust tool for analysis. An immediate challenge in this regard is to come up with specific queries out of the myriad of possibilities that demonstrate their power. Below finds a chart that provides a big-picture view of lender behavior in LMI neighborhoods broken down between banks and nonbanks[5]. Specifically, we look at the trend in purchases from third-party originators of both FHA and conventional loans: As we head into 2021, an ongoing issue is the disposition of loans in forbearance. The Cares Act allows for borrowers negatively impacted by the Covid-19 pandemic to obtain forbearance up to 1 year[1]. This will begin to expire in Spring 2021, although an extension is possible as the new Administration takes over in January. A key point is that forbearance is not forgiveness. The mortgage agencies have provided options for borrowers who become current after forbearance, so they don’t have to make a lump-sum payment for missed principle and interest.

FHA has designated its policy regarding the disposition of suspended payment amounts as COVID-19 National Emergency Standalone Partial Claims[2](COVID Partial Claim). “The COVID Partial Claim puts all suspended mortgage payment amounts owed into a junior lien, which is only repaid when the homeowner sells the home, refinances the mortgage, or the mortgage is otherwise extinguished.” |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed