|

For the first time in a while, second liens have come to the forefront of mortgage industry conversation. To a large degree, this is natural because of the unprecedented rise in home prices that we have experienced since the Covid shock. These seconds can be so-called “piggyback” loans that are used to keep the first lien under the conforming loan limit at origination, or they may be “closed seconds” that are used by consumers to extract equity from gains in home price valuations. This product may be superior to the other traditional form of equity extraction, cash-out refinancings, as this vehicle requires that the entirety of the original mortgage be refinanced, not just the extraction amount, often from a much lower level. Finally, while not strictly a loan, Home Equity Lines of Credit (HELOCs) are also popular for this purpose.

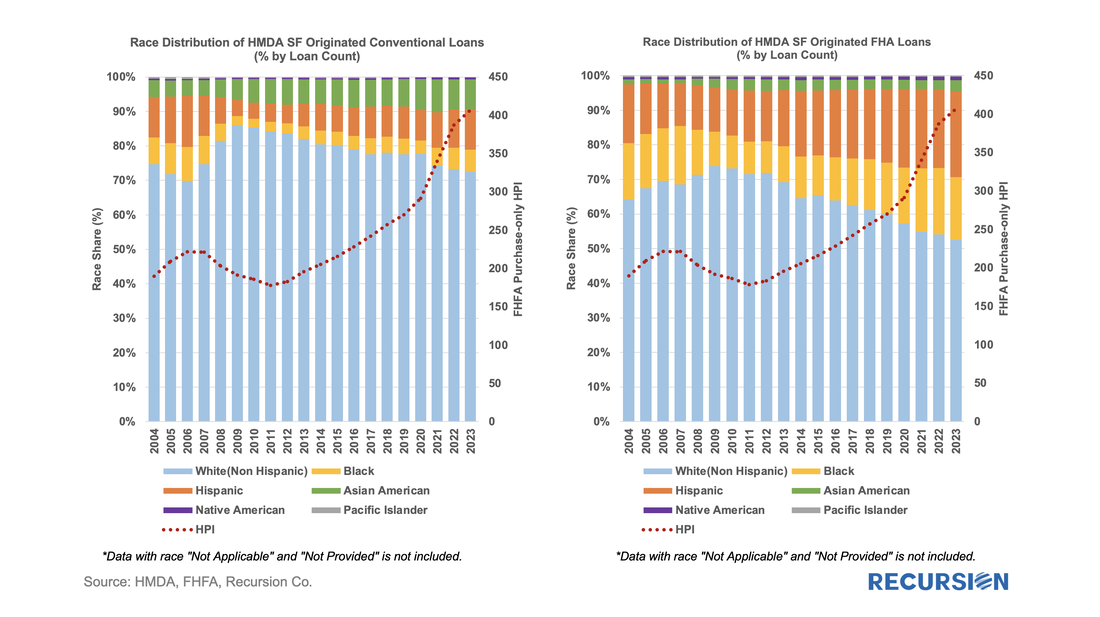

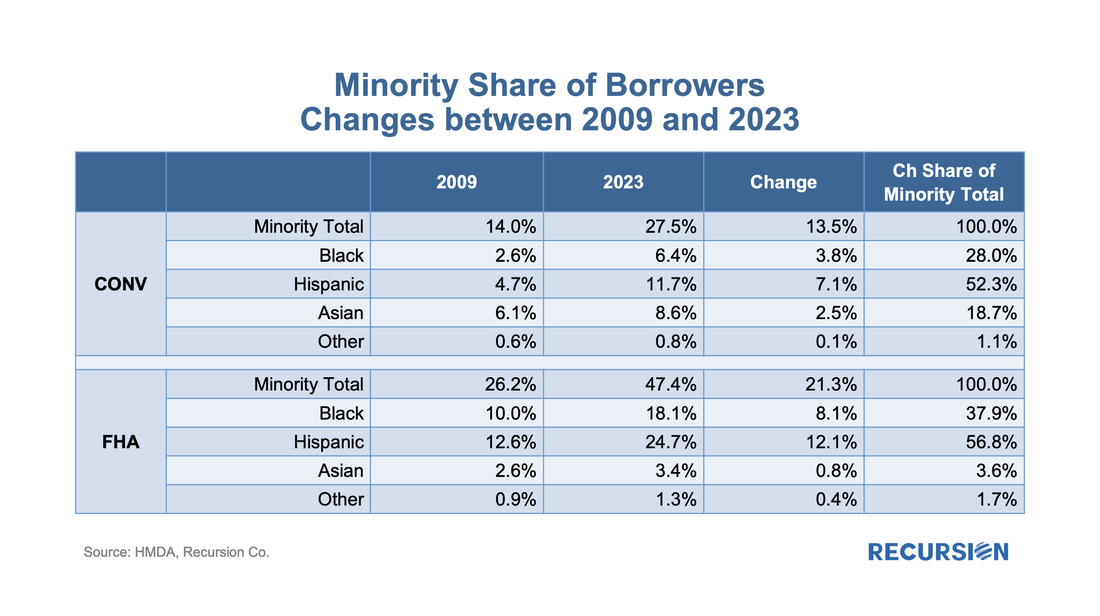

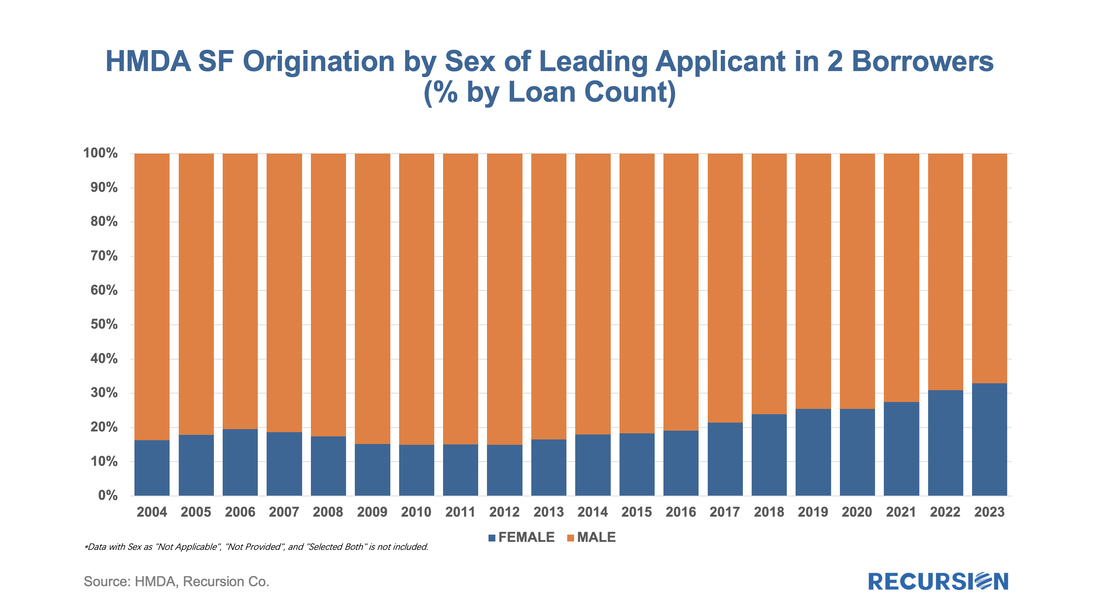

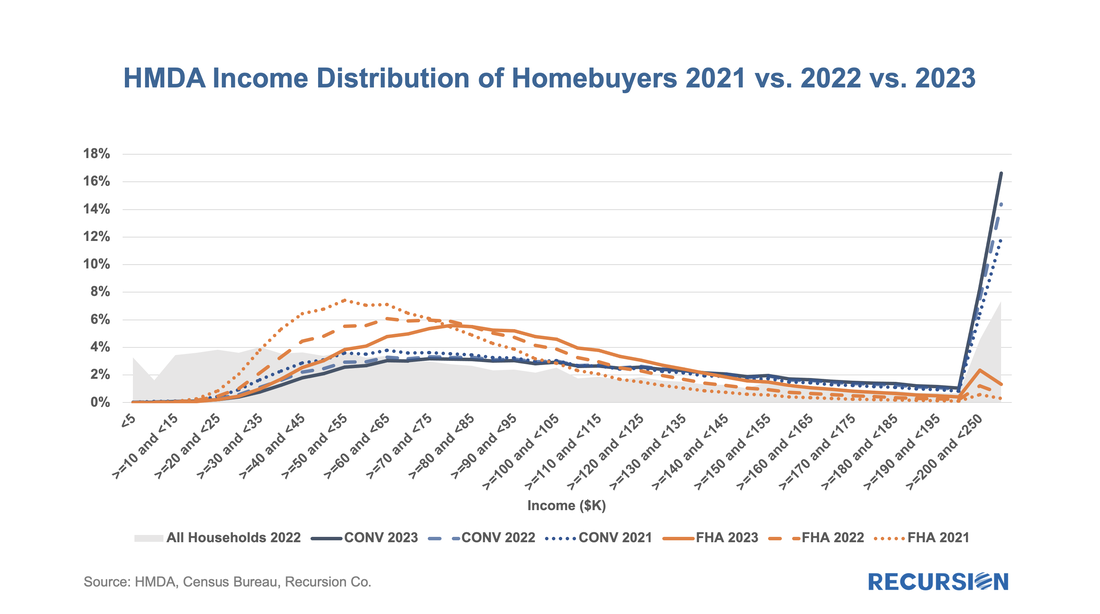

Below find the share of second liens, by both loan count and by the original loan amount from HMDA[1]: In a recent post, we summarized the main market indicators from 2023 HMDA[1]. Besides offering a wider view of the mortgage market than contained in the Agency disclosures, HMDA contains a wealth of information about borrower characteristics, harking back to its original purpose of ensuring credit availability across populations. This note provides a look at some of the most-followed characteristics. We start with the race of the borrower. This type of analysis is rather nuanced as HMDA allows for information for up to two borrowers per loan file, with demographic information available for both. The chart below shows the distribution of new conventional and FHA mortgages by the race of the first race category reported by the first borrower only. A few salient points can be immediately inferred. First, we can see that the minority share of mortgage recipients has risen steadily over the past 14 years for both loan types. FHA continues to have a higher minority share than conventional, with minority borrowers accounting for almost half (47%) of new loans last year. That said, the share of minority borrowers obtaining conventional loans almost doubled over the 2009-2023 period to 28%, slightly below the 30% peak attained in 2006. In terms of breakdowns by race, the increase in the share of loans going to Hispanic borrowers led minority in both the conforming and FHA markets. Asian borrowers remain more significant to conventional than to FHA. There are many factors that account for these trends, including population growth in each category, policy measures taken to support minority ownership, and overall market conditions. It’s interesting to note that there is a distinct correlation between minority share and house prices in both programs. In the mid-2000, this ended badly as a disproportionate share of minority borrowers were trapped in toxic loans that led to foreclosures when the market collapsed. These concerns do not automatically carry over to the present as credit conditions are much more conservative, and policy is designed to keep distressed borrowers in their homes to the greatest extent possible. Next, we turn to gender. Here is the share of two-borrower loans where the lead borrower identifies as female: In 2023, the female share rose for the 10th time in 11 years, more than doubling from 14.9% in 2012 to 32.9% last year. HMDA also contains borrower income information, but a detailed analysis awaits the arrival of MSA-level median income data from HUD, which should be out sometime mid-year about when the final version of 2023 HMDA is released. For now, we can look at the distribution of loans by income bucket for the past three years: For both conventional and FHA loans, we have witnessed an increase in the weight of the distribution at the right tail, at the expense of the hump in middle-income brackets. This is particularly true for conforming loans where the share of incomes in the greater than or equal to $250 bucket jumped from 11.9% in 2021 to 16.6% in 2023. In the next blog, we will look at manufactured housing, a topic receiving increased policy scrutiny in the current era of unaffordable housing. This rich and robust dataset can accomplish much more. Feel free to contact us with specific questions. The preliminary HMDA data came out last week, and we have it fully processed and available on our Recursion HMDA Analyzer. While always notable, this release has been particularly eagerly awaited as it represents the first complete view of market conditions in “Mortgage Winter”, the extraordinary period of sustained high house prices and mortgage rates.

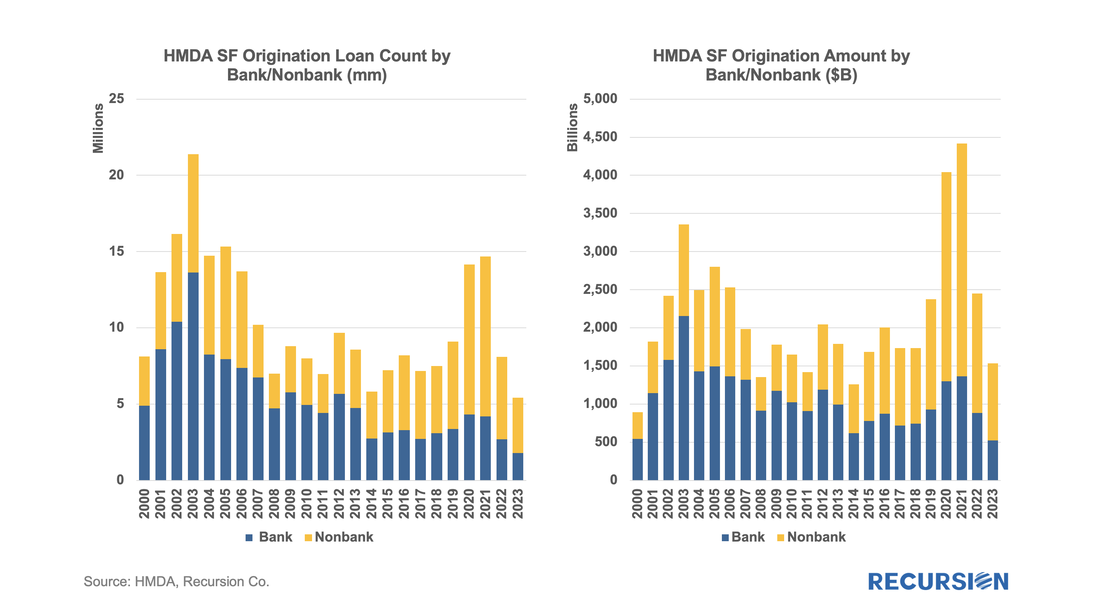

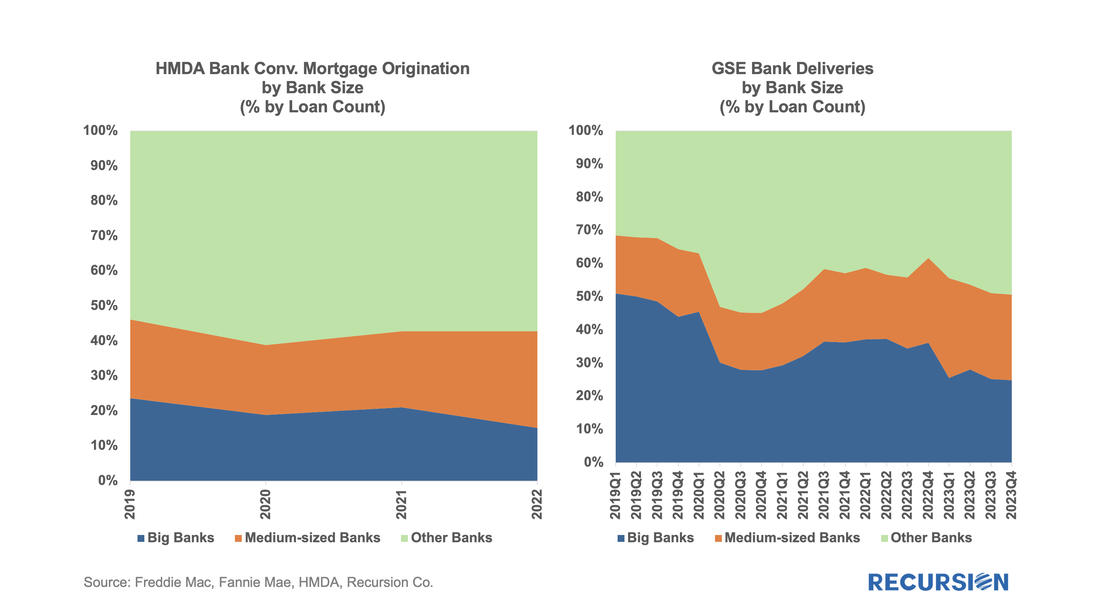

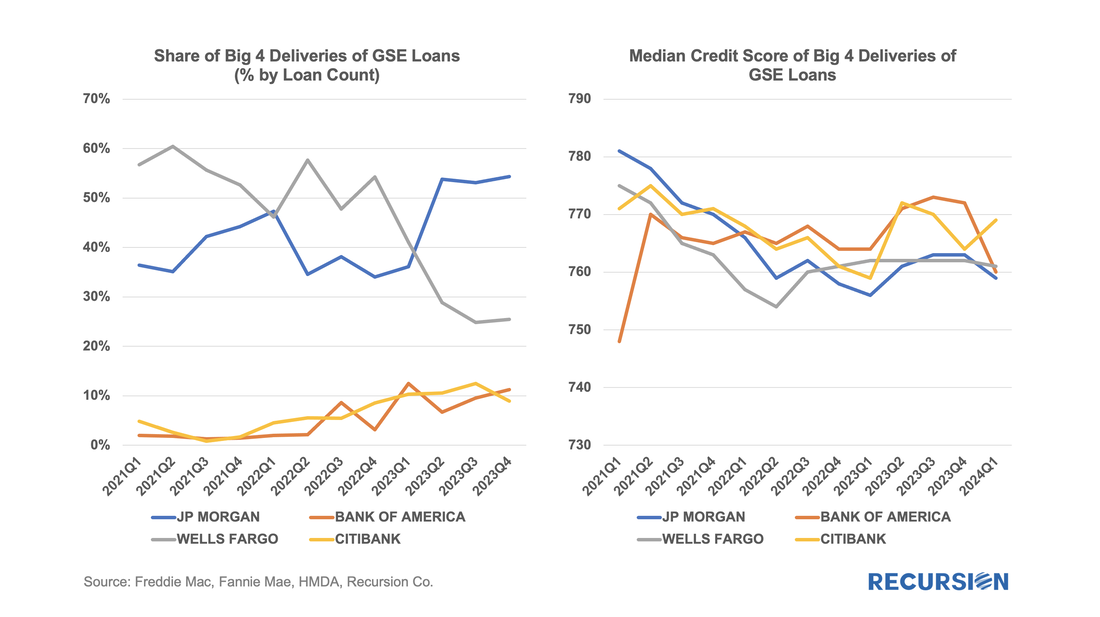

Not surprisingly, volumes are down compared to 2022, more so for balances than loan counts: In a recent post, we discussed the impact of the COVID-19 pandemic on the mortgage market[1]. We noted that there has been a trend toward higher median credit scores in Agency mortgage deliveries since 2020 due to policy stimulus and asset price appreciation. In addition, there was a jump in median bank credit scores in early 2022, accompanied by a drop in the bank share relative to nonbanks of about 5%. This is not negligible, and the share decline has persisted over the past year. We attribute this to the shock of the collapse of four banks, notably Silicon Valley Bank (SVB), during this time. A more thorough assessment of the impact the bank shock had on the mortgage market requires access to the financial statements of a range of banks. This data is available via the Bank Call Reports. Data are released quarterly by the FDIC and made available through the FFIEC[2] with trends discussed in the FDIC Quarterly[3]. This note is meant to be a technical description of the data infrastructure we have built to support this sort of analysis by tying together mortgage production data with bank financial information from the Call Reports. The Recursion Call Report Analyzer The Call Report data is readily accessible, and we like many others have for some time pulled data down for individual institutions for use in various studies. If you want to look at the whole system, however, we are looking at well over 3,800 datapoints covering some 4,600 institutions. This is not big data like the Agency loan level disclosures or HMDA data, however, normalization of the dataset takes considerable subject expertise, as banks report different forms with different datapoints. Since we are interested in applications to the mortgage market, we start by linking institution names to the consistent naming database we have built in the Agency mortgage space. That allows us to make quick inferences into the mortgage world from bank shocks. In next step, we designed a front-end system (the Analyzer) that allows users to pull down data for designated characteristics for subsets of banks using a graphic interface without programming. To demonstrate the application of this tool, we look at some aggregate figures with a breakdown for the Big 4 Banks: JP Morgan, Wells Fargo, Citi and Bank of America. These banks were not the source of the turmoil last Spring but are of general interest. The Overall Bank Picture First, we break down the banks into three buckets: large (assets over $1 trillion), medium ($100 billion to $1 trillion), and small (under $100 billion) using the total assets of them obtained from Bank Call Reports. Then we analyze them through the origination data from two traditional Recursion tools, HMDA Analyzer and Cohort Analyzer (for agency loan level disclosure). Below find charts of the distributions from each source for conforming mortgages by loan count back to 2019: Note that the HMDA data ends in 2022 as 2023 HMDA has not been released yet. In both cases, we see a trend decline in the share of the Big 4 banks. There are a couple of observations that are notable here. First, the share of mortgage activity of the Big 4 institutions with regard to mortgage activity is in decline. (Originations by 9% from 2019 to 2022, deliveries by 22% from 2019 to 2023). It seems that the bulk of declines in the bank share of deliveries in 2023, cited in the earlier note, was concentrated in bigger banks.

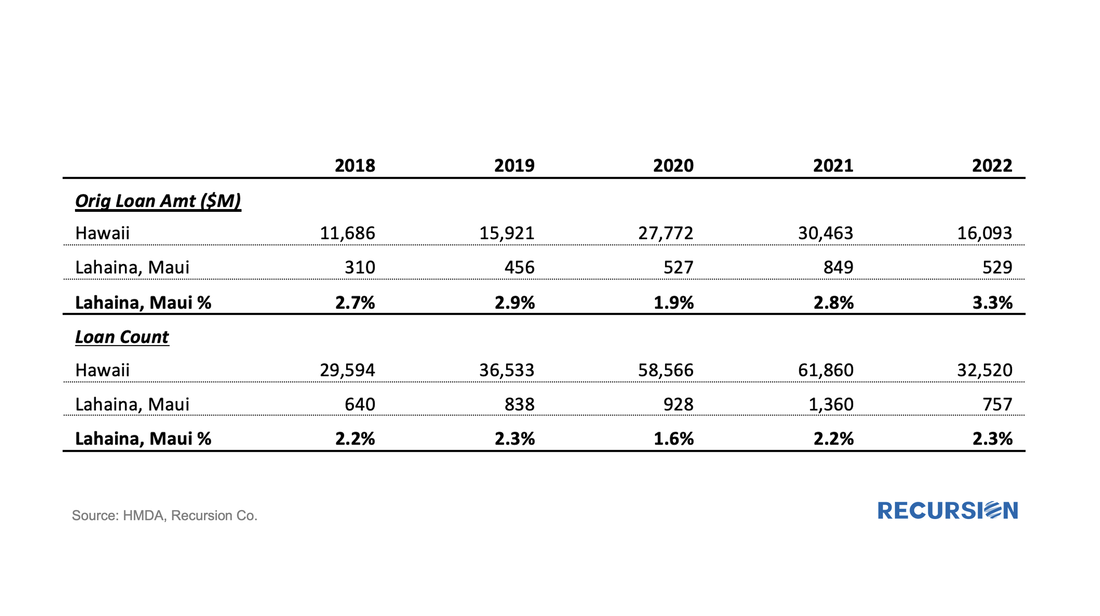

Below find a table of the share of deliveries of the Big 4 Banks along with the median credit score quarterly since 2021: We get a lot of requests at Recursion, the bulk of which never make it to these posts, but one that struck home recently was from a regulator who asked what we know about Lahaina. Given the scope of this tragedy, we thought it worth the effort to talk about what we do and don’t have. Specific to that location, the answer is relatively limited. The Agency disclosure data is provided at the state level. The population of Lahaina was 12,700 as of the 2020 Census, out of a population of the Island (County) of Maui of 164,000 and 1.4 million for the state of Hawaii overall. So, this level of detail seems unlikely to be sufficiently granular to provide a basis for analysis. However, it seems we can take a bottom-up approach that may yield something of value. This would be based on the HMDA data.

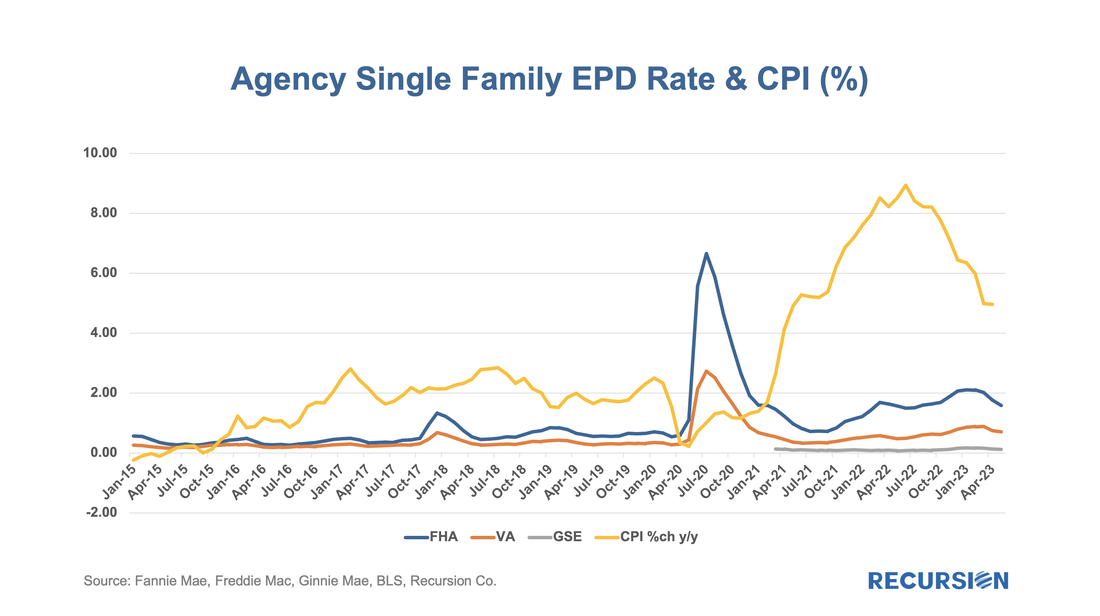

HMDA data has the advantage of granularity down to the census tract level. Out of over 84,000 Census Tracts, we can identify 6 for Lahaina. We can then pull-down originations from HMDA: The release of the Agency performance data in early May provided confirmation that the dip in Early Payment Defaults[1] we have witnessed over the last three months ended a 16-month long uptrend in this statistic for FHA loans. A similar but far more muted pattern can be seen for VA and conventional mortgages. In a previous post, we speculated that the uptrend was correlated with the higher inflationary trend observed since early 2021[2]. Below please find an update of the chart:

In a previous note, we looked at mortgage trends derived from the recent release of 2022 HMDA data[1]. Of course, HMDA is a prime data source for analysts and policymakers who seek to understand how social and economic trends interact. The most discussed issue is the distribution of originations by race. Below find a bar chart for the share of originations by race annually from 2004-2022 by loan count:

The cherry blossoms are blooming, which means it’s time for the HMDA preliminary data set to be released. The dataset provides a social underpinning to the nation’s mortgage market and enhances our understanding of the behavior of borrowers and lenders. The 2022 dataset has been particularly eagerly awaited, as we get our view on the new world of high inflation and mortgage rates for the first time in decades. We start with origination volumes and get not just confirmation of the onset of mortgage winter, but some breakdown of its characteristics.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed