|

In a recent post, we discussed the attributes of manufactured housing data that came with the final 2021 HMDA release in July[1], which were not available in the preliminary release. Another important data point from this final release is the conforming flag, identifying which loans satisfy the requirements for delivery to Fannie Mae and Freddie Mac. Obviously, any loan sold to a GSE is conforming, so its main use is to enable analysts to examine these loans which are held on bank balance sheets.

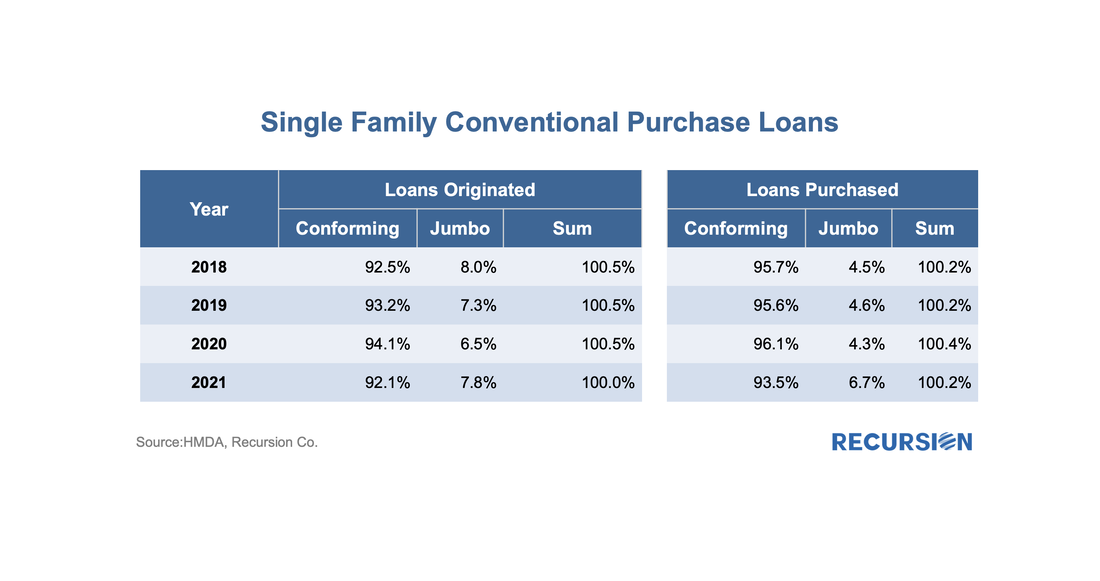

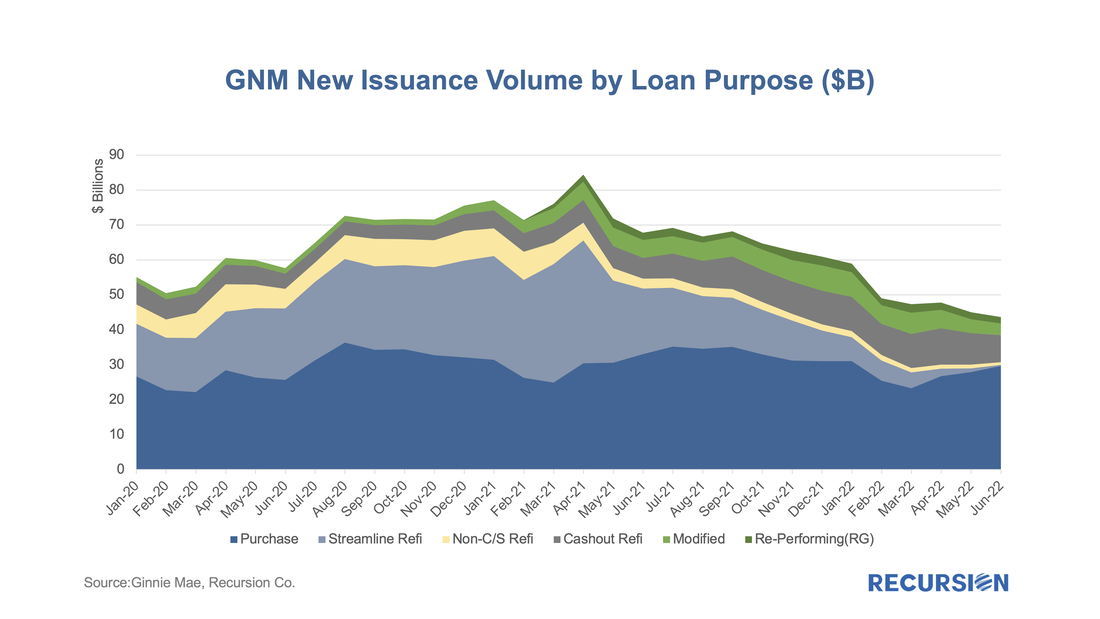

The lag between the preliminary and final releases of HMDA data can be four months or longer, so it would be useful to be able to identify these loans right after the preliminary release. One way to approach this is to flag non-government loans with balances above the conforming limits as “jumbo”. How does Recursion’s “Jumbo” flag compared with HMDA’s Conforming flag? If the information is perfect, “Jumbo” loans should be all the loans that are not “Conforming”. However, the exact original balance of a mortgage is not provided by HMDA to protect privacy. For those loans close to the conforming boundary, our program can misjudge which category to assign. Given all that, going back to 2018, there is still a very strong negative connection between the two measures: With mortgage rates near 40-year highs, there has been a pronounced collapse in refinance activity reflected in agency loan originations:

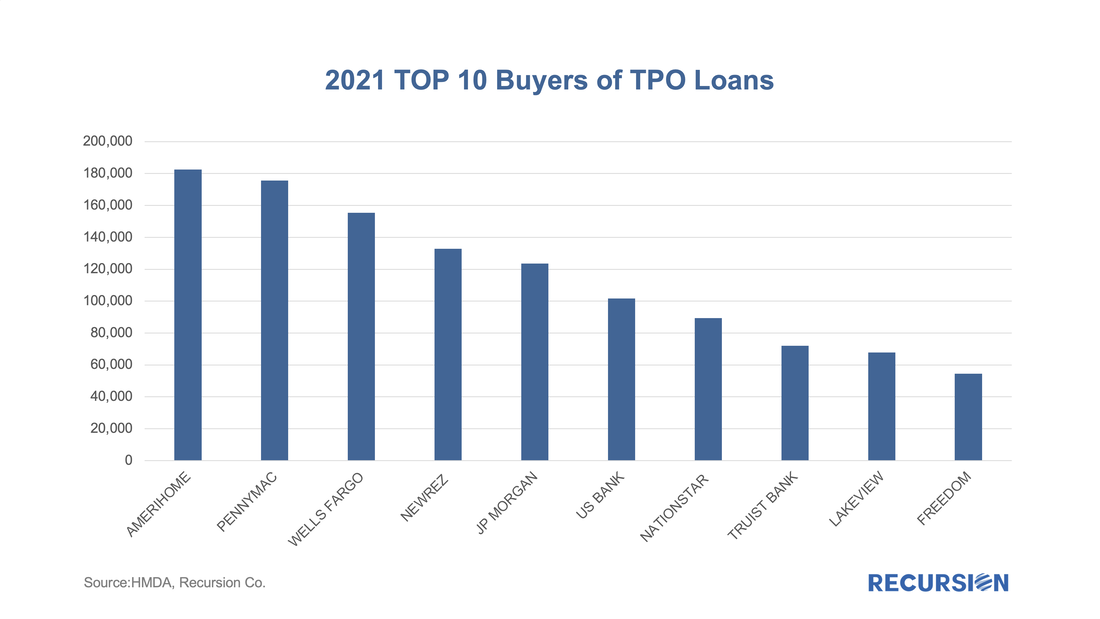

Usually, when we talk about financial institutions in our posts, we focus on sellers and/or servicers as we have a clear view from the Agency disclosures. An interesting distinction in this regard is to break down originations between those sourced through a retail channel within the lending institutions and those purchased from other lenders, known as third-party originations (TPOs). We are often asked the question in the case of TPO lending, where only sponsors of the mortgages are reported, who are the originators? This information is not reported in the agency loan-level disclosure. We can supplement this information by examining originators in the HMDA data by observing the fact a TPO (correspondent or broker) loan is often reported twice, one record reported by the originator and another reported by the sponsor. At Recursion, we conducted an exercise by matching the pairs together, and we were able to identify the counterparty pairs for about 50% of the mortgages marked as “purchased”, and also made this revealing data point to our HMDA Analyzer users.

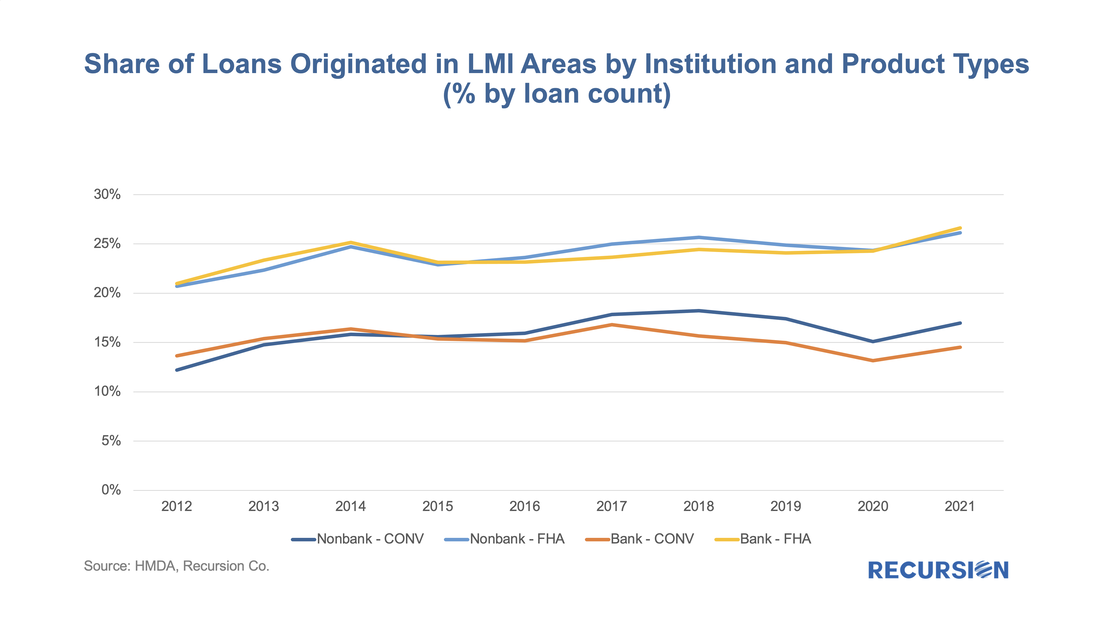

According to the 2021 HMDA preliminary release, about 2.65 million loans were purchased from other lenders that year, about 18% of all originations. Roughly half of these purchases were made by 10 institutions: In a recent post[1], we discussed findings obtained with the recent release of 2021 HMDA data. Among other things, we looked at the share of mortgage originations by income group and product type. In this note, we look at the difference in lending patterns between the banks and nonbanks.

The incentive behind this approach is policy driven. There is a long history of measures taken to encourage lenders and builders to foster economic development in low-income areas via the housing market. For example, the Community Reinvestment Act (CRA) stipulates that a bank’s performance with regards to compliance of their regulatory requirements depends in part on: “the geographic distribution of loans—that is, the proportion of the bank's total loans made within its assessment area; how these loans are distributed among low-, moderate-, middle-, and upper income locations[2]” To assess this issue, we assign a flag to each of the census tracts designated by HUD as having a greater than 51% share of households with incomes in the Low-to-Moderate (LMI) range in the larger MSA the tract is part of[3], which are called LMI area by HUD, or “low income” tracts by FHFA. Below find a chart of the 10-year trend in the share of loans originated in this category by institution type for conventional and FHA loans: On March 24, the CFPB released HMDA data for 2021[1], with results obtained from 4,316 reporters, little changed from 4,472 reporters in 2020, but well below the 5,505 respondents reached in 2019[2]. There are yet more companies are expected to report to 2021 HMDA. However, our experience from previous year indicates little change in big picture when reporting is finalized. The drop reported in the number of reporters in 2020 vs 2019 is largely due to a reduction in the number of loans that a bank needed to underwrite, requiring a report to be filed starting in 2020.

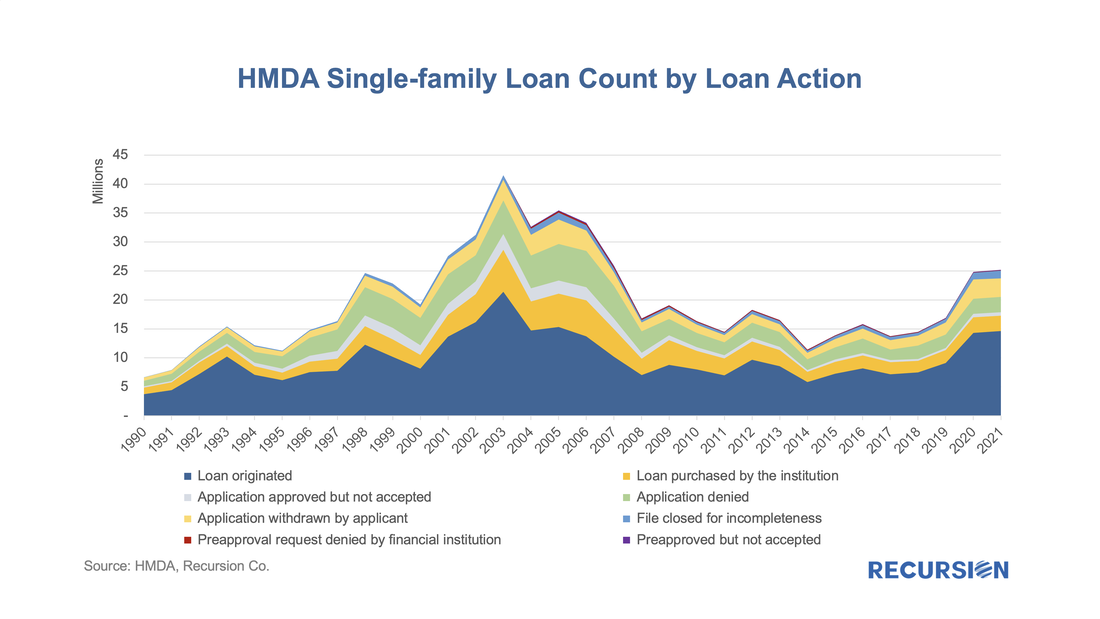

This data is used for market sizing by regulators and market participants, but it also represents a treasure trove of information regarding lender and consumer behavior across a wide variety of economic and market regimes. 2021 was notable for being the second year of the Covid-19 pandemic, which is associated with expansive monetary and fiscal policies and surging house prices. This report will briefly assess trends across a variety of topics. Market Activity After surging by 47% in 2020 to 24.8 million from 2019, the number of loan activities reported in 2021 HMDA ticked up by just 2% to 25.2 million, almost 40% below the record high 41.5 million attained in 2003. Similarly, the number of loans originated reported in 2020 jumped by 57% from the prior year to 14.2 million, while in 2021 the figure rose by only 3% to 14.6 million, down by about one-third from the 2003 peak of 21.4 million. New York, NY Nov.3rd 2021 --- New York based FinTech company Recursion is teaming up with Fordham University’s Center for Research in Contemporary Finance to work on ESG aspects of mortgage market.

The group will utilize Recursion’s cutting edge big data tool, HMDA analyzer, that is based on HMDA data released by CFPB and FFIEC from 1990 to 2020 consisting of more than 600mm mortgage applications, originations, and purchases that is widely used to evaluable affordable housing policies in the US. Recursion also recently introduced FHFA’s newly released fair lending dataset, such as low-income areas, minority tracts, disaster areas and rural areas to HMDA analyzer. Recursion is teaming up with Lincoln Institute of Land Policy and Rice University to work on the Underserved Mortgage Markets Coalition project and the Social Policy Analysis Capstone Course (“SOPA”).

With affordable housing for Low-Moderate Income (LMI) households at the top of the policy agenda, we take a look at loan data for manufactured housing (MH). In a recent report, the CFPB provided a comprehensive survey of this market based on enhancements to the HMDA data first made available in 2018[1]. These include data on

Secured property type:

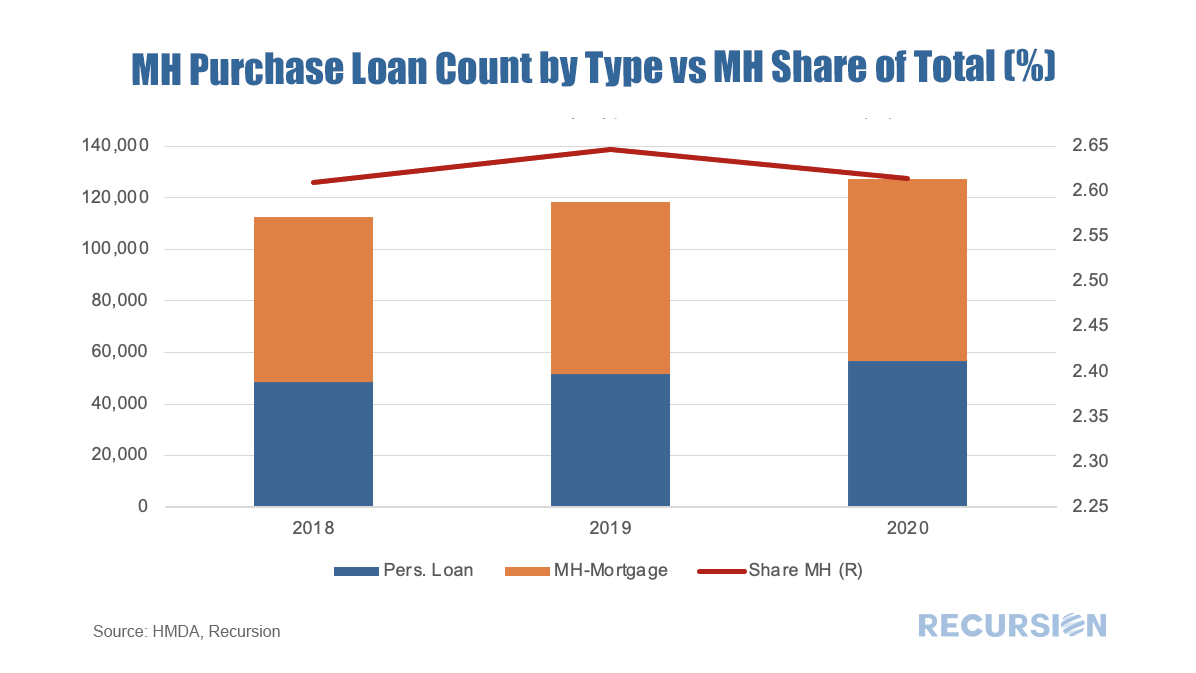

In their survey, the CFPB looked deeply into the data for 2019. In this note, we update some of their work with 2020 HMDA data. This is important because of the onset of Covid-19 that year. The site-built market performed strongly, but this cannot necessarily be presumed to carry over to MH as Covid is a supply shock, impacting labor markets and supply chains. Another innovation in this note is that rather than looking at this market by state the way the CFPB does, as a policy guide we look at it bifurcated between rural and nonrural MSAs. Below finds a chart of the progression of single-family manufactured housing origination volumes for personal loans (securitized by chattel) and mortgages (securitized by real property) from 2018-2020, along with the share of all single-family manufactured housing loans (personal loans plus mortgages) of the total single-family mortgages including those for site-built homes. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed