|

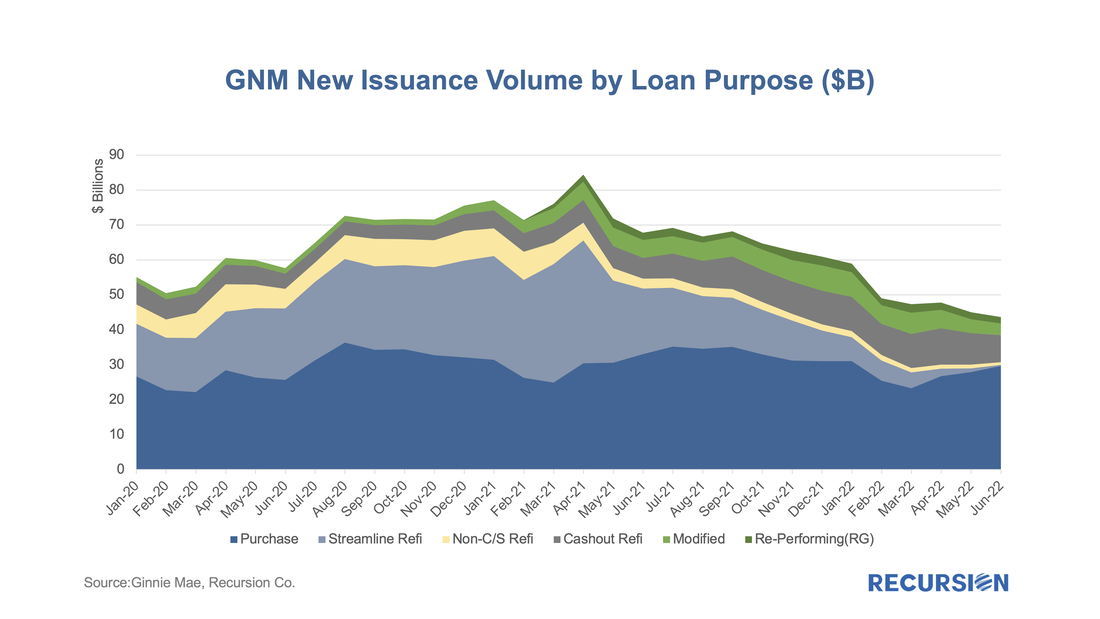

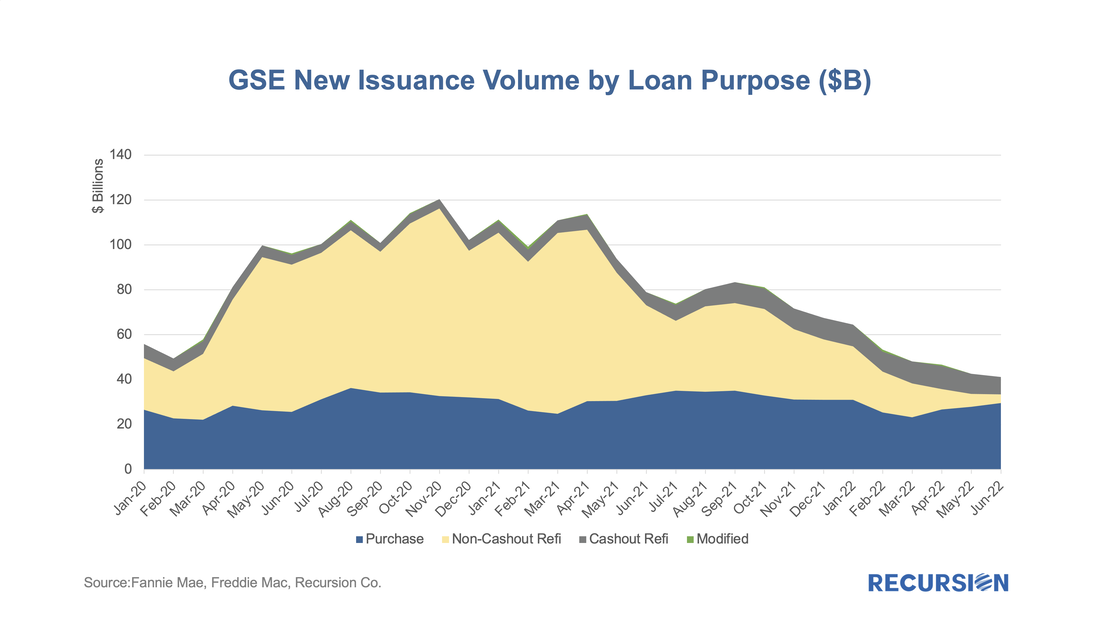

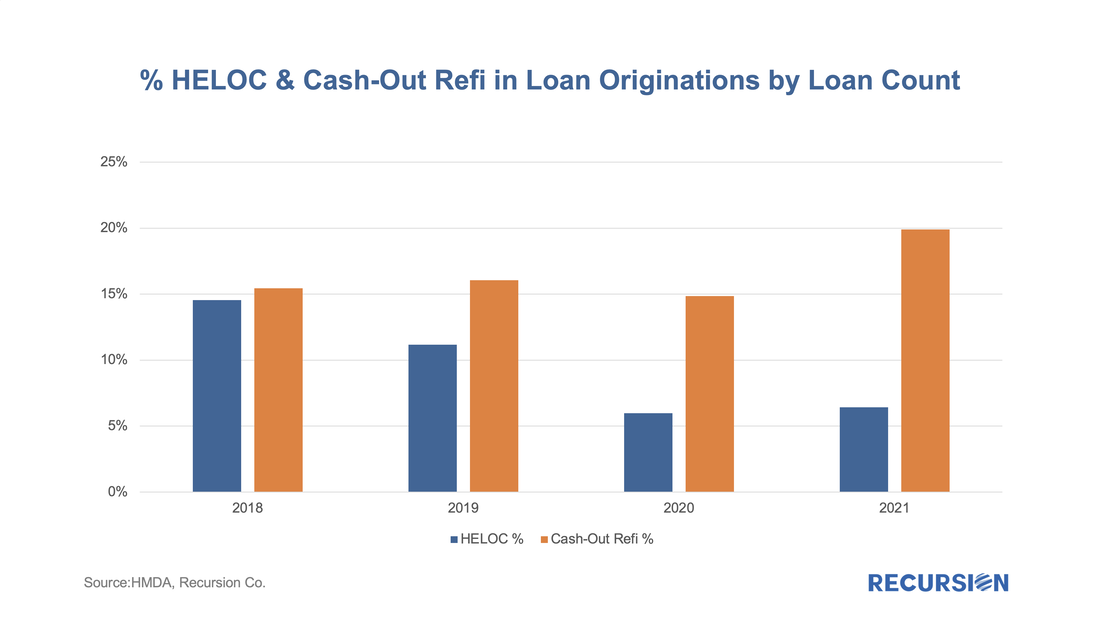

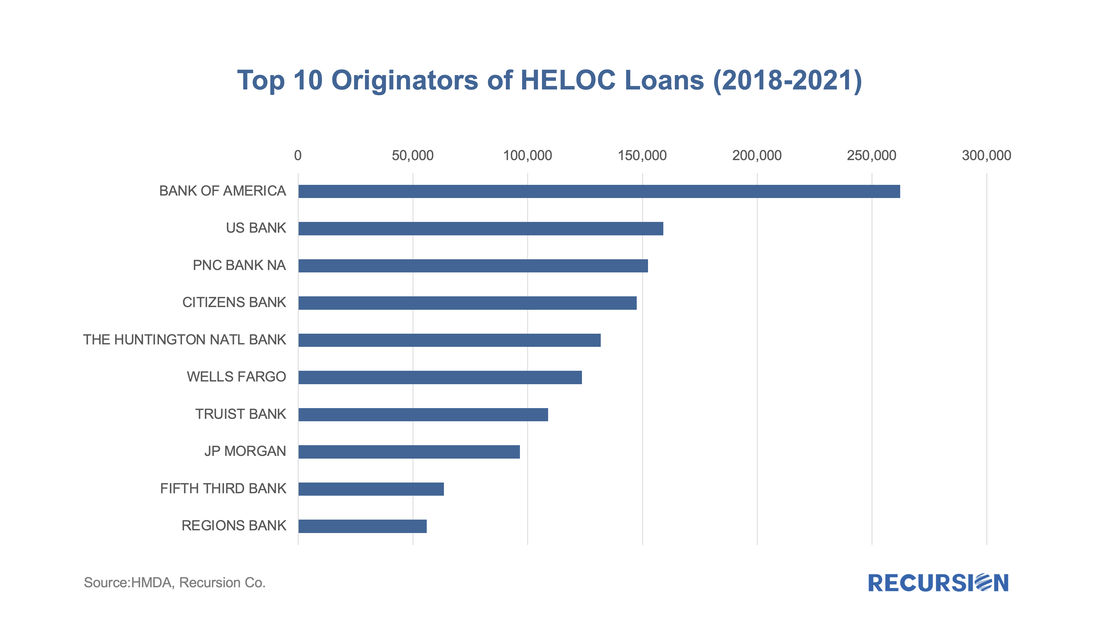

With mortgage rates near 40-year highs, there has been a pronounced collapse in refinance activity reflected in agency loan originations: Two other categories have held up, however, namely purchase mortgages and cashout refis. Cashouts are used by borrowers as a way to tap home equity to generate cash for other purposes. Rising interest rates are problematic to such borrowers insofar as the entire mortgage balance remaining after cash is taken out must be refinanced, potentially leading to higher monthly payments. So far, it doesn’t seem like this behavior has been deterred to any significant degree. This may be because homeowners who need cash may find the cashout refi is an economically superior way to generate this compared to alternatives. A key alternative to a cashout refi is a Home Equity Line of Credit (HELOC), especially in the rising mortgage rate environment. It’s different from a loan insofar as you can draw it down over time when needed, as opposed to getting a slug of cash as is the case with a cashout refi. Another key difference is that the deductibility of HELOC interest payments is limited to funds spent on home improvement. The benefit in a rising rate environment is that the rate on your current mortgage remains unchanged. HELOC interest rates are generally above those of mortgage rates as investors who hold them fall behind the owners of first-lien mortgages in terms of payment priority for distressed borrowers. HELOCs cannot be delivered to the Agencies, so are not part of the monthly disclosures we receive. However, on an annual basis, the HMDA data contains a HELOC flag that allows us to document activity in this area. Given the complexity of the HELOC in terms of calculating a UPB, we look at the total share of all single-family mortgage originations for HELOCs and Cashouts based on loan count: As interest rates fell from 2018-2020, the share of all mortgages that were cashout refis stayed relatively stable at about 15% of the total. However, the share of HELOCs dropped by about two-thirds. In 2021, however, the share of cashouts soared, incentivized by surging house prices and historical low mortgage rate. This factor led to a very modest increase in the HELOC share. The unusual combination of surging interest rates and home prices makes the outlook for these product types very uncertain, but from what we can see in the cashout share of mortgage deliveries to the agencies so far in 2022, it is too early to say that this is no longer the dominant product for homeowners looking to raise cash. On a final note, a key distinction between the markets for cashout refis and HELOCs is purely a bank product while both banks and nonbanks provide cashout refis. This is because the agencies do not securitize HELOCs, so that underwriters keep them on their balance sheets. Having the HELOC data reported in HMDA provides a wealth of information on this market. For example, we have data by bank. Here are the top 10 underwriters by loan count, cumulative over 2018-2021: Much more can be done in this space. The Recursion Analyzers are handy tools to conduct such research.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed