|

On Thursday July 21 the IMF-Recursion Global Housing Watch Webinar was launched with the episode “Are House Prices Headed for a Correction or Crash?”. Three noted economists, Mark Zandi from Moody’s Analytics, Julia Coronado from MacroPolicy Perspectives and Deniz Igan from the Bank for International Settlements presented their views, followed by group discussion moderated by Richard Koss at Recursion and IMF staff members. We found the discussion to be lively and informative and look forward to future episodes that provide a forum for the dissemination of expert views in this crucial sector of the global economy.

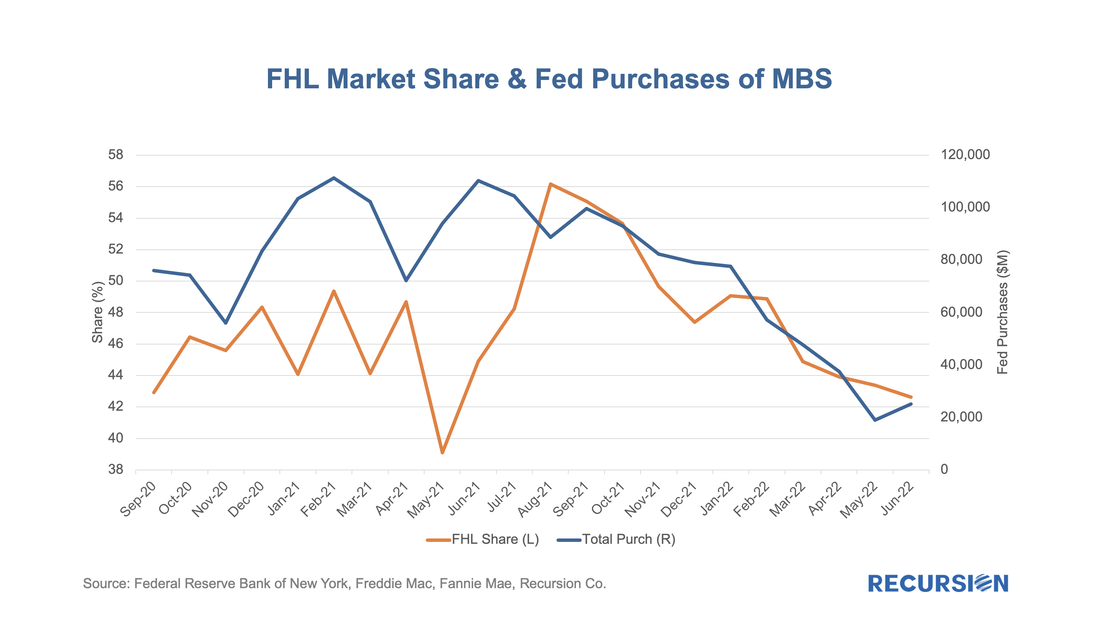

You can see the webinar here: Are House Prices Headed for a Correction or a Crash? (substack.com) With data in hand for the first half of 2022, it seems a good time to revisit the topic of the share of issuance between the two GSEs. This is also, at least implicitly, a hot topic in policy circles following the announcement on the part of the GSEs that they will be imposing a 50 bp fee on commingled Super and CMO pools starting on July 1[1]. Regular readers of our blog will recall how we pointed out that the Fed purchases of Super pools created an imbalance in favor of Freddie Mac loans that may have been a contributing factor to their rise in market share in 2020 and 2021[2].

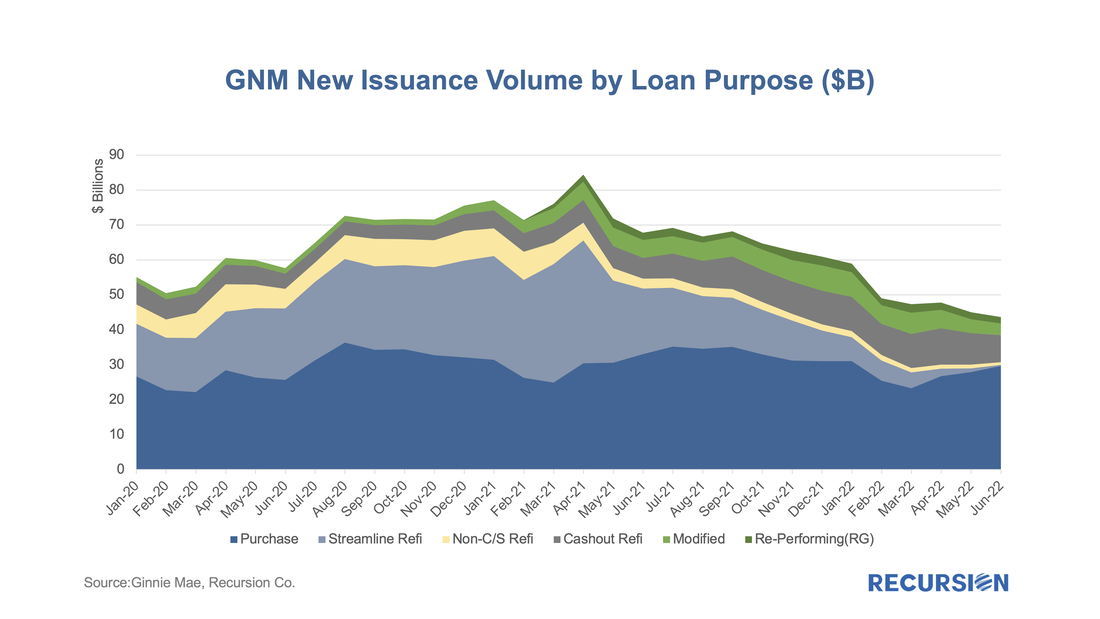

Interestingly, the Freddie Mac share of GSE purchase loans has fallen back. As shown in this chart, the FHL share of delivery peaked in August 2021 at 56%, while most recently it stood at 42%. With mortgage rates near 40-year highs, there has been a pronounced collapse in refinance activity reflected in agency loan originations:

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed