|

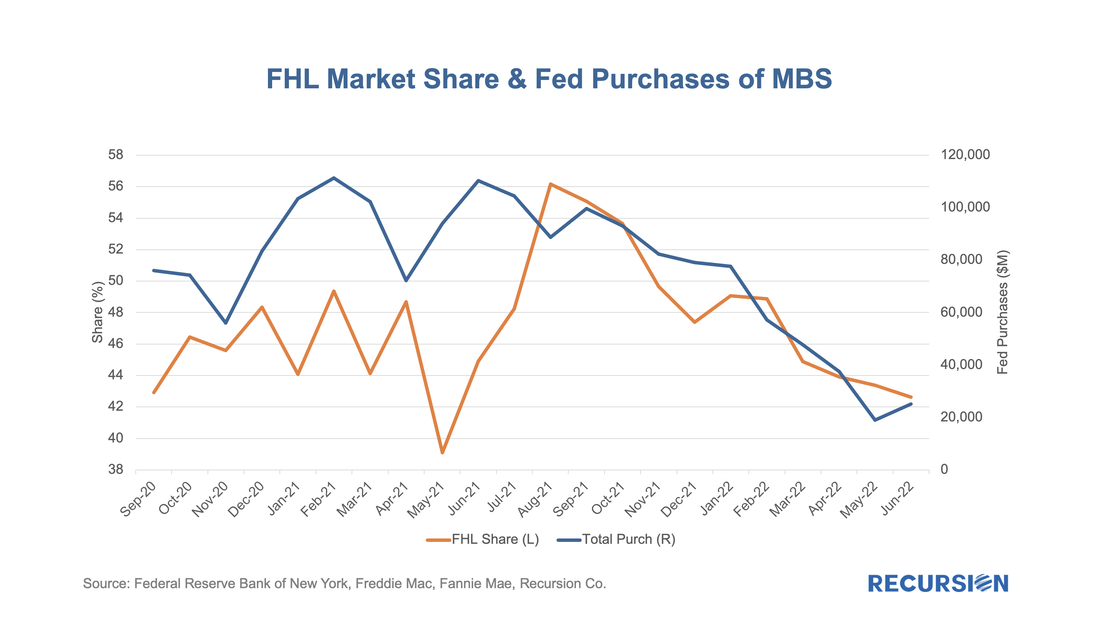

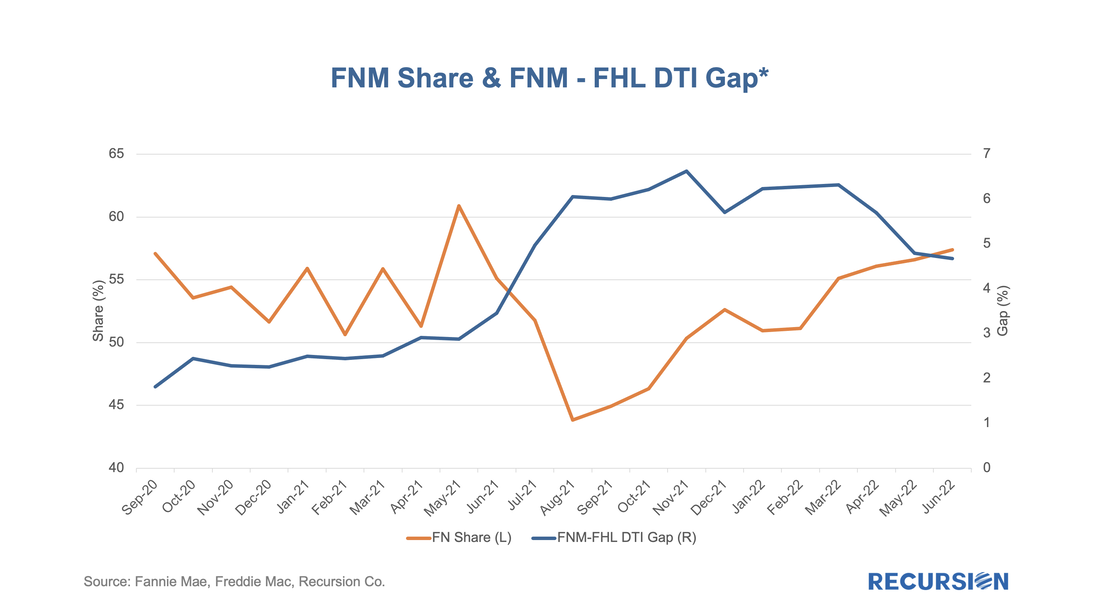

With data in hand for the first half of 2022, it seems a good time to revisit the topic of the share of issuance between the two GSEs. This is also, at least implicitly, a hot topic in policy circles following the announcement on the part of the GSEs that they will be imposing a 50 bp fee on commingled Super and CMO pools starting on July 1[1]. Regular readers of our blog will recall how we pointed out that the Fed purchases of Super pools created an imbalance in favor of Freddie Mac loans that may have been a contributing factor to their rise in market share in 2020 and 2021[2]. Interestingly, the Freddie Mac share of GSE purchase loans has fallen back. As shown in this chart, the FHL share of delivery peaked in August 2021 at 56%, while most recently it stood at 42%. We believe there are two main drivers of this change:

* DTI Gap = Share of purchase loans delivered to Fannie Mae with DTI greater than 45 minus the share of purchase loans delivered to Freddie Mac with DTI greater than 45. We expect that by imposing the 50bp fee for commingled securities, Fannie Mae will no longer suffer from a biased balance of official purchases should the Fed decide to reinstate its MBS QE program. However, market participants have expressed concerns that this fee will undermine UMBS. Will the fee last? We will see. The dynamics here are very complex, but the main takeaway here is that it is essential for market participants who wish to understand broad market trends and policy impacts on these to have access to powerful tools and big data. [1]See https://capitalmarkets.fanniemae.com/mortgage-backed-securities/new-fee-structure-certain-structured transactions#:~:text=A%20fee%20of%2050%20basis,Fannie%20Mae%20in%20the%20past. and https://capitalmarkets.freddiemac.com/mbs/docs/f411news.pdf [2] https://www.recursionco.com/blog/unpacking-qe Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed