|

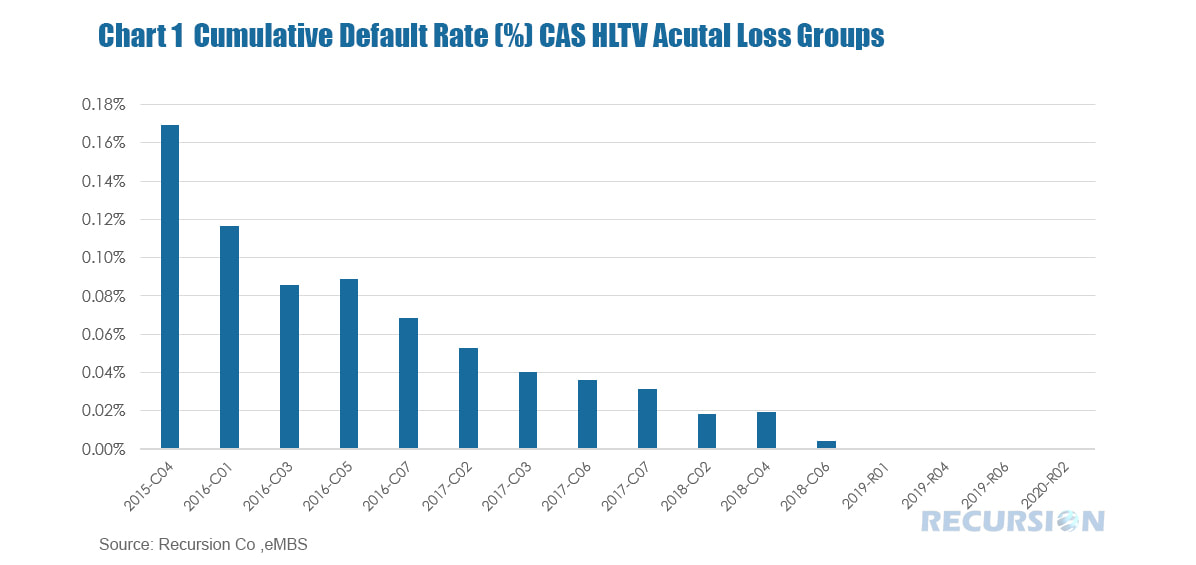

The Credit Risk Transfer (CRT) market was launched in 2013 by the GSE’s to help protect taxpayers from credit risk (risk of borrower nonpayment) by sharing mortgage losses with private investors. The market has grown substantially since that time, with the outstanding balance of reference loans reaching over $2 trillion at the end of 2019. Over this time, investors have largely been rewarded, as home prices have continued to rise and labor market conditions have been robust. Chart 1 shows these for the sixteen most recent high loan-to-value (LTV) Fannie Mae deals from their CRT program Connecticut Avenue Securities (CAS). 1. Cumulative Default Rate for CAS Securities

Preparing for the Delinquency Storm — Using Big Data to Track Portfolio Risk in the Mortgage Market3/27/2020

As US society goes deeper into “Shelter in Place” and “Social Distancing” to protect itself from the COVID-19 virus, jobs are being lost at a rapid pace. Jobless claims in the United States for the week ending March 21 came in at a record high 3.28 million. In turn, household finances are being stretched around the country. Fiscal stimulus and various debt forbearance plans can help to mitigate the damage, but families will have to make decisions about how to allocate scarce resources based on their own priorities.

Despite the challenges posed in the current environment, March is an “Achievement” month at Recursion! Congratulations to Tianci, our Financial Engineer, on achieving Amazon Web Services (AWS) Solutions Architect! And congratulations to Recursion Co. on renewing AWS Technology Partner status for another year! As an AWS Technology Partner, Recursion Co. integrates big data and AWS services, and provides proven and reliable solutions to our clients.

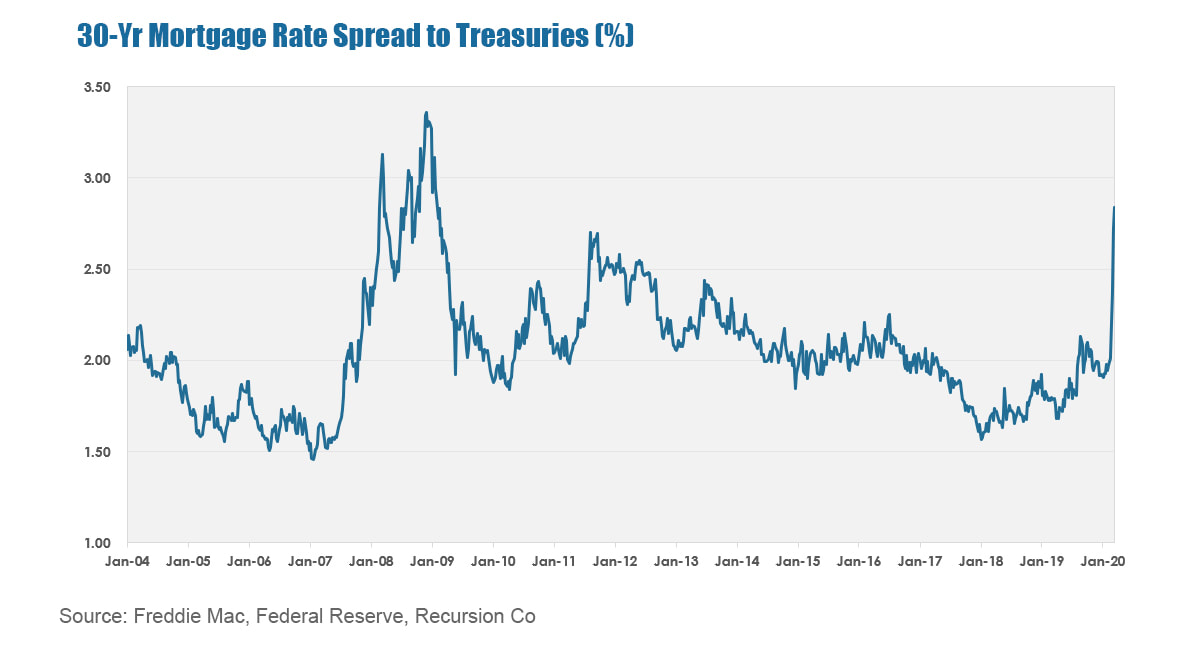

The onset of the COVID-19 virus has resulted in tremendous volatility in financial markets. The 10-year Treasury yield plunged from 1.9% at the beginning of 2020 to a record low near 0.5% in early March but has since rebounded to near 1.1% at present. The drop in Treasury yields has not been matched by a similar decline in mortgage rates. The 30-year fixed mortgage rate released by Freddie Mac on March 19 came in at 3.65%, just 0.07% below the level attained at the beginning of the year.

Chart 1* 【Debtwire】S&P/Case-Shiller Home Price Indices futures have been a lonely corner of activity for the CME Group over the past decade, perhaps as home values have been reliable gainers amid falling unemployment, growth in the number of households, and a dearth of available homes. Now, the abrupt shift in the US economic outlook might draw attention to the derivatives, according to one market maker.

All issues have taken a back seat to the onset of the Covid-19 virus. Since this first arose in China at the end of 2019, concern has steadily mounted, leading to unprecedented dislocations in global financial markets. Markets are volatile to a great degree because of uncertainty, not just about the extent and severity of the virus, but also about its economic impact.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed