|

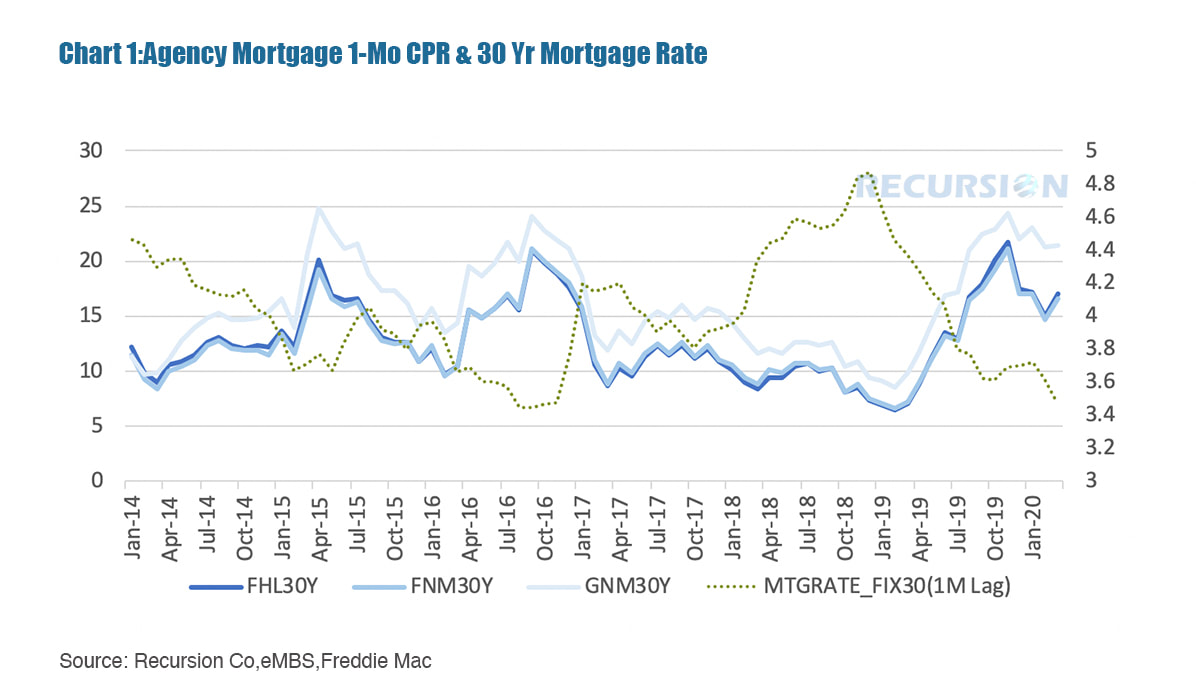

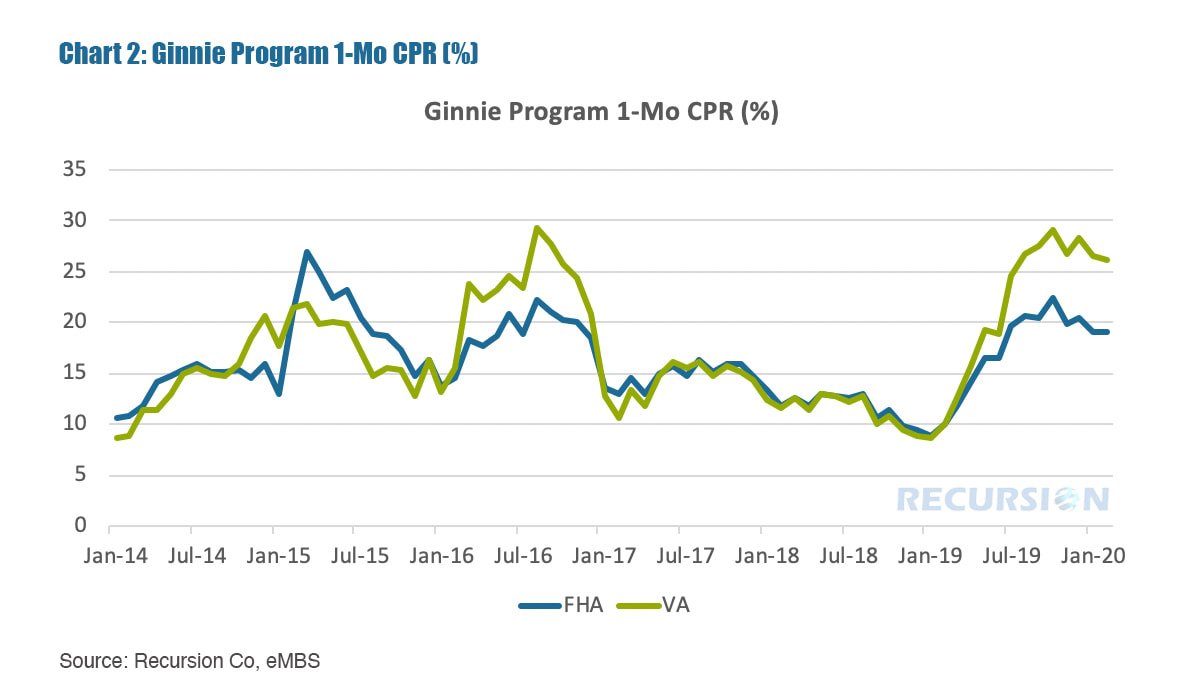

All issues have taken a back seat to the onset of the Covid-19 virus. Since this first arose in China at the end of 2019, concern has steadily mounted, leading to unprecedented dislocations in global financial markets. Markets are volatile to a great degree because of uncertainty, not just about the extent and severity of the virus, but also about its economic impact. The first wave of impact comes from plummeting interest rates. This impact actually acts as a stimulus to the economy as households refinance their mortgages, saving on their monthly payments. At the end of February, the 30-year fixed mortgage rate stood at 3.45%, a 3½ year low. As can be seen from the Chart 1 below, prepayment “speeds” as defined by 1-month CPR’s[1] reacted as expected, reaching to levels experienced during previous periods of low rates: This data is a very broad snapshot of what is transpiring in the mortgage market and may be attributed across many factors. For example, it’s notable that Ginnie Mae loans consistently prepay faster than those of the GSE’s (Fannie Mae and Freddie Mac). There are a number of reasons why this may be the case, but it’s natural to look into the structure of the securities for answers. In this case, the first place to look is at the performance of loans under different Government programs, the largest of which are Federal Housing Administration (FHA) and Veterans Administration (VA). Over the past four years, Chart 2 shows that VA Loans have paid off faster than FHA loans during periods of low interest rates, likely due to differences in program structure and borrower characteristics. More recently, rates have fallen to yet new lows, and we can expect refi activity to remain robust, although perhaps constrained by the limited capacity of underwriters to process loans. In that case, refis may not spike too much higher, but instead may persist at an elevated level for an extended period as the inventory of demand is worked through. Of course, the impact of the virus has distinctly negative implications as well. If the economy slows and unemployment increases, home sales and prices may suffer and deliquincies rise. It is too early to see these impacts yet, but in coming months we will closely monitor this situation and report on this. The unprecedented situation posed by the Covid-19 virus calls for the application of the most modern big data techniques to perform analyses that support informed decision making. If you would like to learn more about how your organization can gain access to these powerful tools, please contact [email protected]. [1] CPR stands for “Conditional Prepayment Rate”, the annualized rate of prepayments based on the recent performance of loans. The higher the number, the greater the stimulus to households.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed