|

An article published in Commercial Mortgage Alert on June 9 stated that:“Fannie Mae will no longer offer 35-year amortization schedules on loans financing market-rate multifamily properties.”

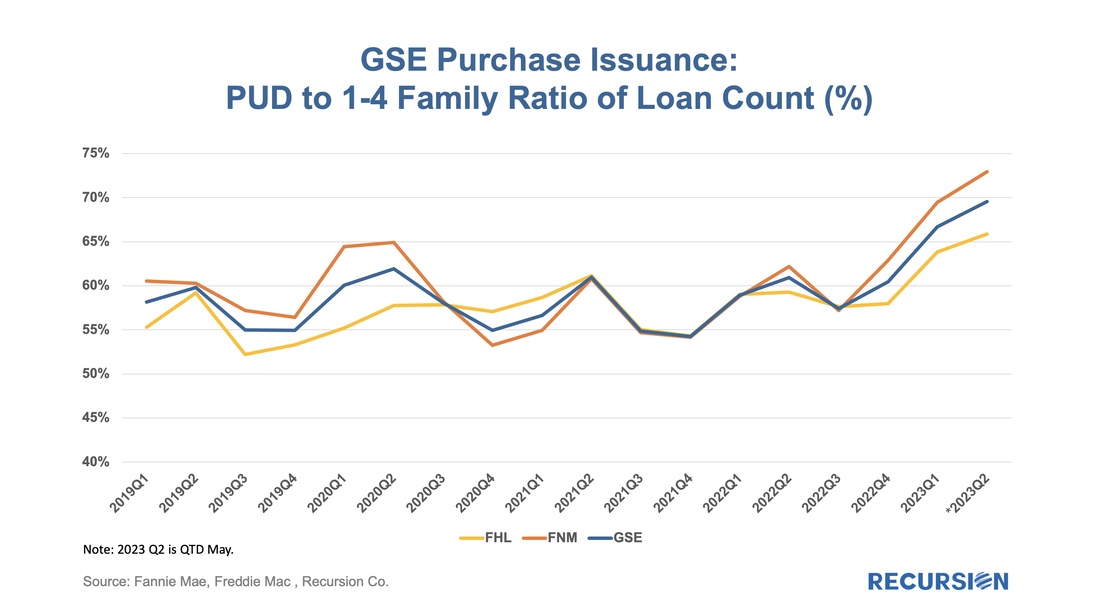

They went on to state:“Loans with 35-year amortization schedules accounted for 26.5% of Fannie multifamily loans in May, the highest portion on record and up from 6.1% in the same month a year ago, according to data from Recursion Co., which has amortization data dating to 2016. The research firm also reported that Fannie notched $4.25 billion of multifamily business in May, down 14% from last year.” The new policy takes effect on June 12. Loans with 35-year schedules providing support to affordable projects will continue to be offered. Recursion is pleased to be the preferred source for mortgage data and analytics for key information providers in the mortgage market. On June 20th, MSCI Executive Director Yihai Yu published a report “Agency MBS Are Going Social”[1], describing the data disclosed by the GSEs in the social data space. He goes on to describe how the release of this data enhances their prepayment models. We are pleased to see that they cite Recursion data in their efforts. Recursion is devoted to providing its clients with cutting-edge analytic tools to access timely and clean mortgage data at a deep level of detail conduct research of great benefit to all the participants in the mortgage market. As famous investor Warren Buffett once stated, “Only when the tide goes out do you learn who has been swimming naked.” Well, it turns out that only in a declining market can you see which segments are resilient. In this case, we will look at Planned Unit Developments or PUD’s. A PUD is a planned neighborhood, generally consisting of a group of single-family homes that are bound together by a Homeowners Association (HOA). In this manner, it is like a condo, with the significant difference that the property is usually a stand-alone structure that the buyer owns along with the lot on which it is located. Details about eligibility can be found in Fannie Mae’s selling guide[1].

Below finds the ratio of purchase mortgage deliveries from PUDs to those of 1-4 unit conventional loans: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed