|

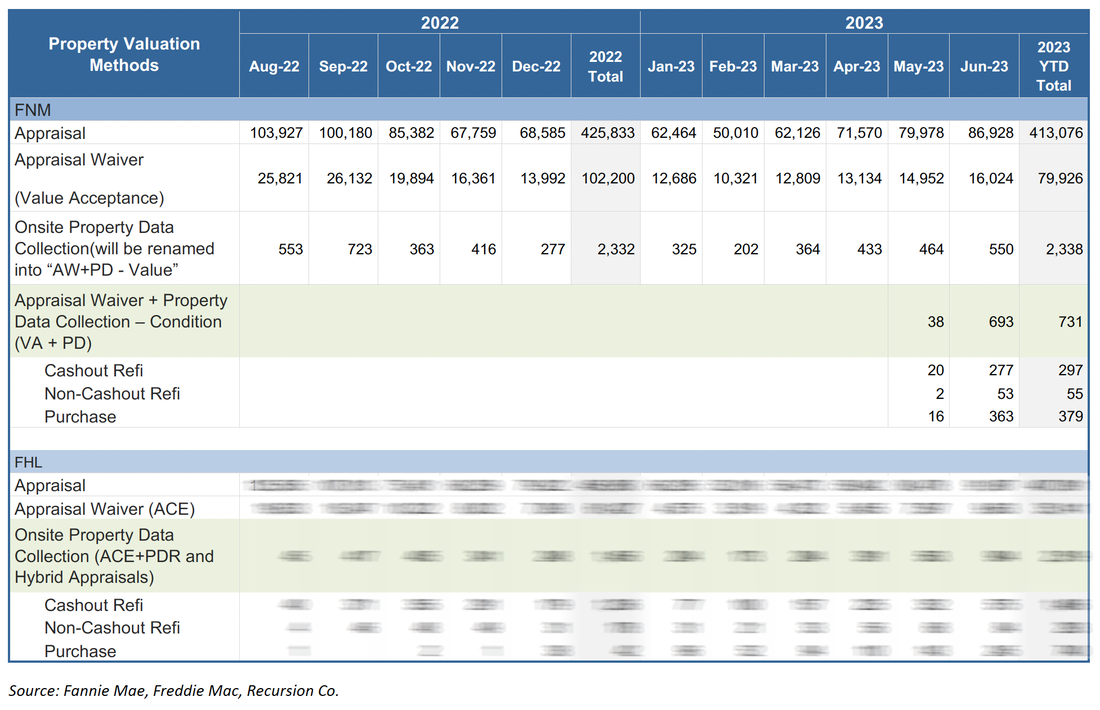

The last time we discussed the topic of appraisal waivers was at the end of 2022, when we looked at the impact of sharply higher interest rates on the use of this flexibility. Property valuation impact profitability of loan origination. Lenders can gain a significant advantage if they fully understand and choose from all the options in front of them. Given recent market developments, it is no doubt time to take another look at this topic, but structural change has come to this space, so it makes sense to discuss this first. Until last year we were in a binary appraisal/waiver world. One or zero. For some time, there have been discussions of various “modernization” programs somewhere in between, with valuations produced via a process that requires less information than that obtained from a full appraisal but not no information. To read the full article, please send an email to [email protected]

The value of research depends on the consumer. Traders look for actionable ideas to shore up their P/(L), policymakers look for insights into the impact of various regulatory changes, and risk managers look for potholes in the road ahead. The best research informs all of these constituencies by impacting the “big picture” thinking of all of these constituencies.

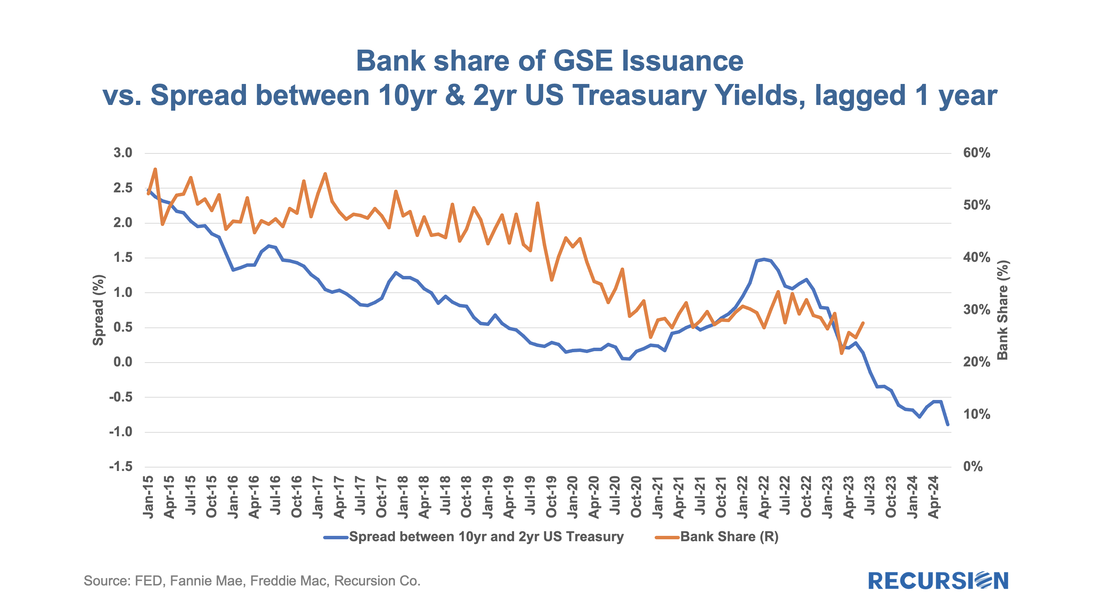

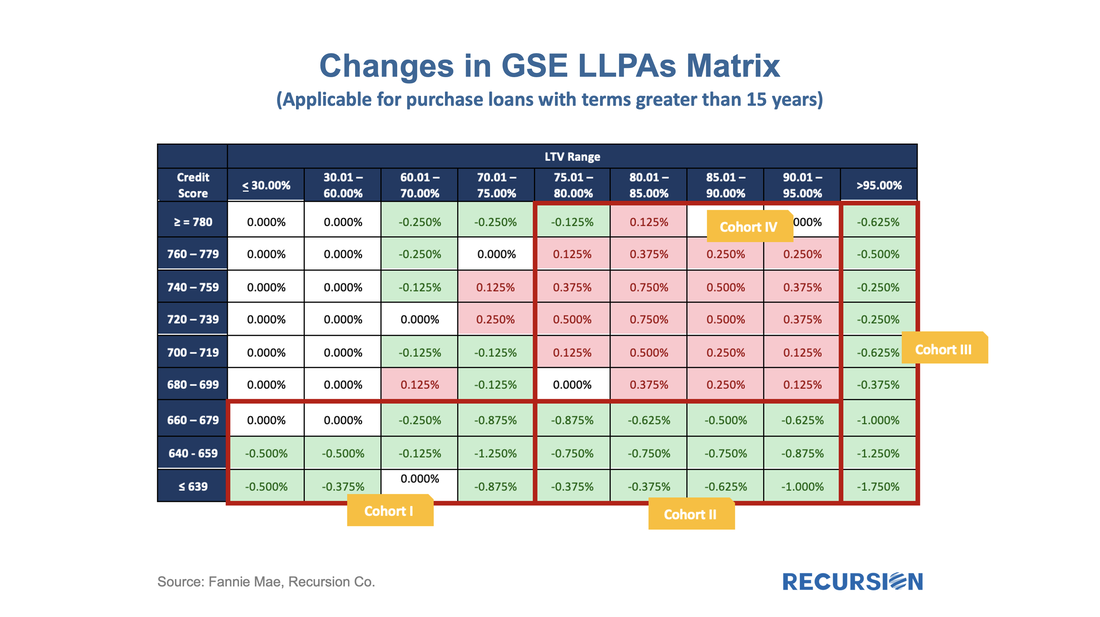

We just got a fine example of the latter from a new paper by Camelia Minoiu of the Atlanta Federal Reserve, and Andres Schneider and Min Wei of the Federal Reserve Board, “Why Does the Yield Curve Predict GDP Growth? The Role of Banks.”[1] An old puzzle in economics is why Treasury Curve yield flattening is an excellent predictor of recessions. The authors conduct a comprehensive investigation into the role of banks in the relationship. A lower term premium, they argue, reduces profitability and the availability of credit. What does this have to do with the mortgage market? Mortgage credit is provided by both banks and nonbanks. Nonbanks, it may be argued, are monoline credit providers whose credit provision is less impacted by this factor. This leads us to the following chart: Rising inflation and 30-year mortgage rates near 20-year highs of around 7%, coupled with historically high house prices, have sharply dampened housing demand in the US. This is particularly true for lower-income borrowers where household budgets are badly stretched. These developments have caught the attention of policymakers, who, in response, have taken it upon themselves to lower mortgage fees to partially compensate for these factors. This is an interesting moment in the formation of housing policy as we have two sets of changes taking effect close together in time. First, FHA announced on February 22, 2023, that it would cut its mortgage insurance premiums by 0.30% to 0.55% effective March 20. More recently, on March 22, GSEs implemented a rather complex set of changes in their upfront fee schedules, effective May 1: To read the full article, please send an email to [email protected]

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed