|

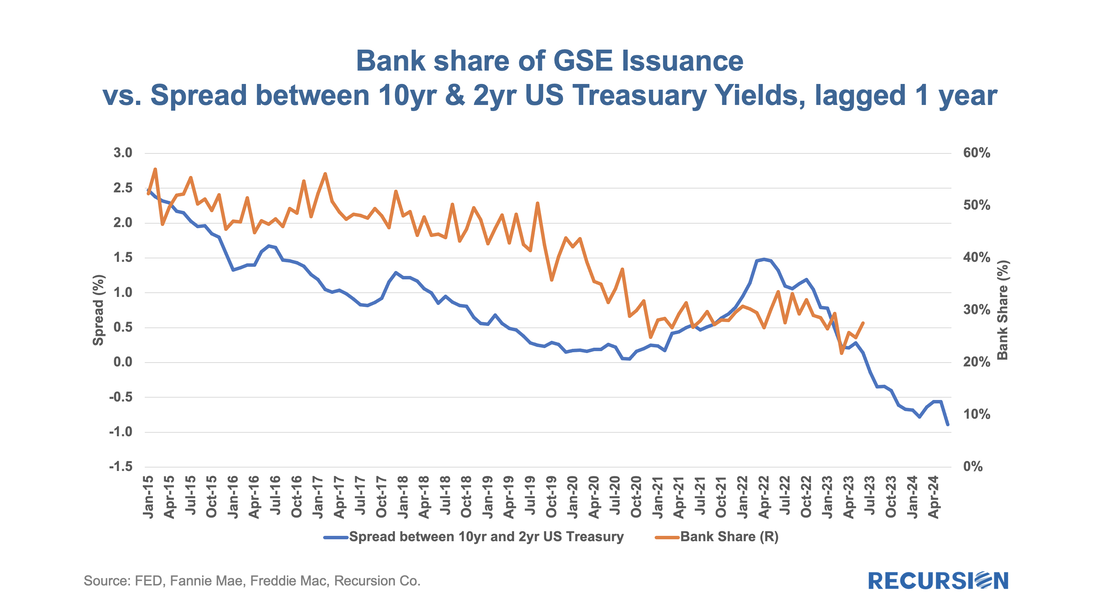

The value of research depends on the consumer. Traders look for actionable ideas to shore up their P/(L), policymakers look for insights into the impact of various regulatory changes, and risk managers look for potholes in the road ahead. The best research informs all of these constituencies by impacting the “big picture” thinking of all of these constituencies. We just got a fine example of the latter from a new paper by Camelia Minoiu of the Atlanta Federal Reserve, and Andres Schneider and Min Wei of the Federal Reserve Board, “Why Does the Yield Curve Predict GDP Growth? The Role of Banks.”[1] An old puzzle in economics is why Treasury Curve yield flattening is an excellent predictor of recessions. The authors conduct a comprehensive investigation into the role of banks in the relationship. A lower term premium, they argue, reduces profitability and the availability of credit. What does this have to do with the mortgage market? Mortgage credit is provided by both banks and nonbanks. Nonbanks, it may be argued, are monoline credit providers whose credit provision is less impacted by this factor. This leads us to the following chart: The debate around the driver of the bank share chart is often expressed in structural vs. cyclical factors. On the structural side, many argue that the nonbanks have benefitted over the last decade from a growing regulatory burden on banks, combined with an edge in technology adoption that cuts costs and attracts tech-savvy consumers. The cyclical argument is the trend in the curve slope as seen in the above chart. It seems there are some of both factors in play here. First, consider the year 2020. The bank share was negatively impacted by the yield curve flattening that occurred when the Fed was tightening interest rates the prior year. On the structural side, the onset of the pandemic chased borrowers out of bank branches onto their laptops and smartphones. The nonbanks were better positioned to take advantage of this shock. Second, the sharp Fed easing in 2020 steepened the yield curve, but the rebound in the bank share in 2021 was quite tepid, as customers got used to the technology and branches remained underutilized. Going forward, based on the chart above, the continued persistence of inflation keeping the yield curve flat implies that the role of banks in this market will become negligible over the next year or so. Is that our forecast? We don’t forecast, and a lot can happen in a year. But we also don’t rule it out. [1] Atlanta Federal Reserve Working Paper, forthcoming. A pdf of a draft can be found at the Social Science Research Network https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4493101#

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed